Weekly Market Commentary

Much has been made of the remarkable resilience of the American economy. Forecasters who confidently called for a recession in 2023 got it wrong. So far this year, the economy is generating new jobs, and the U.S. economy has yet to falter.

Notably, Barron’s pointed out, “The people in the know are often mistaken, sometimes spectacularly.” In most cases, they fail to foresee an impending recession.

Economic forecasting is an imperfect science. Economic models are quite complex, but each cycle has its own unique characteristics, which are typically confirmed in hindsight. Are there signs the economy is finally slowing down?

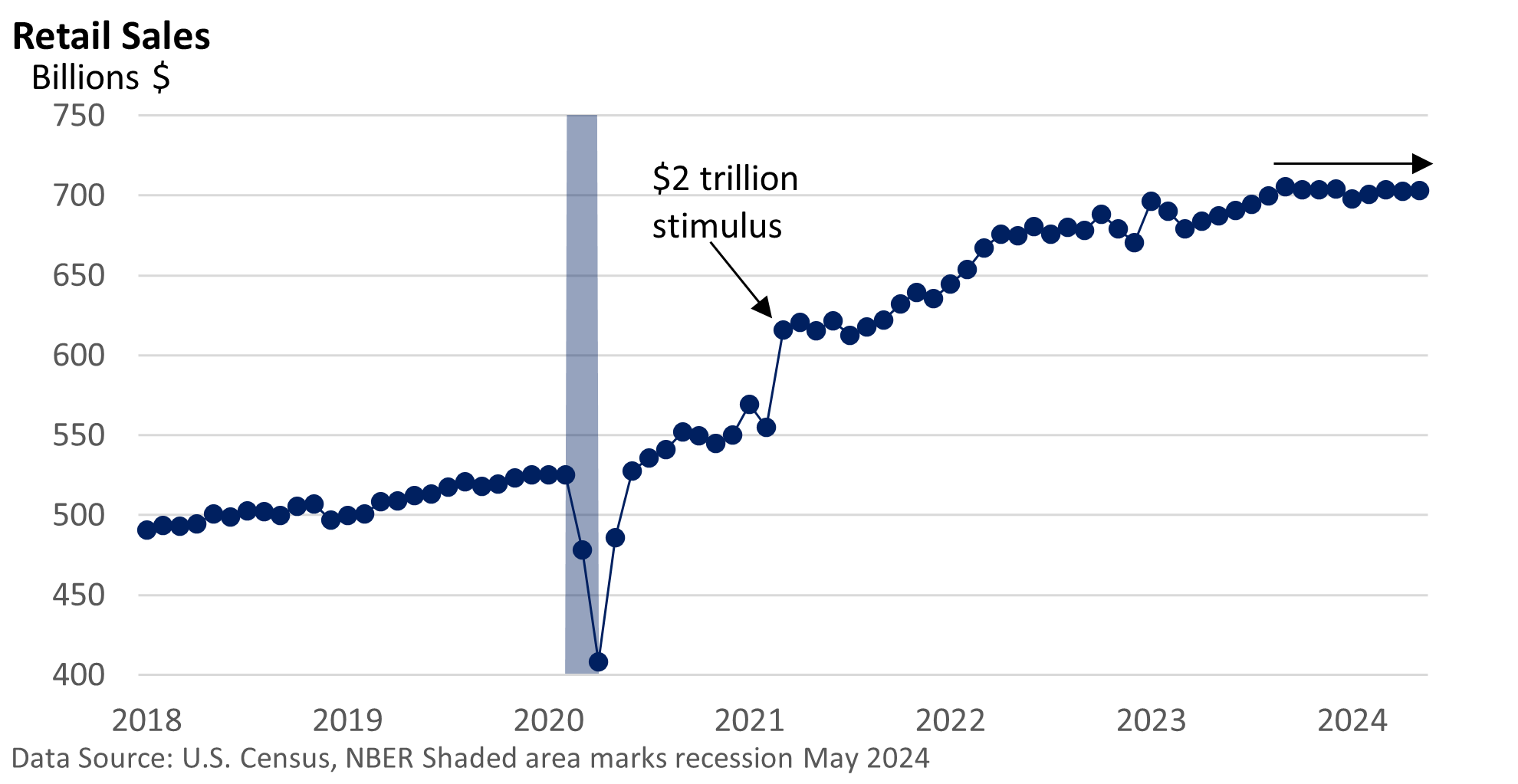

Last week, the U.S. Census Bureau released its monthly report on May retail sales. A review of the data suggests that consumers may have reached their spending limit.

The retail sales report offers us a peek at what consumers (you and I) are spending on goods such as autos, furniture, electronics, groceries, restaurants, sporting goods, and clothing. It does not include services such as leisure, entertainment, concerts, utilities, and hotels.

The graphic below illustrates that sales plateaued last September.

The report is important as retail sales make up about 30% of U.S. economic activity. When services are included, this number increases to just under 70% (according to St. Louis Federal Reserve data).

Yet, the latest from the Atlanta Federal Reserve signals that economic growth isn’t slowing. Its GDPNow model, which incorporates economic reports that directly impact Gross Domestic Product (GDP) in real-time, is tracking at 3.0% in Q2 (through June 18). That’s an impressive pace.

Q2 GDPNow includes April’s economic reports and most of the major May reports.

Is the economy about to flounder? Though it is difficult to provide a precise answer as the data are inconclusive and mixed, a lack of fuel from the consumer could take some wind out of the economic sails.