Weekly Market Commentary

The latest employment numbers from the U.S. Bureau of Labor Statistics (BLS) point to a robust job market.

On Friday, the U.S. BLS reported that nonfarm payrolls rose 303,000 in March, well ahead of expectations. It’s not simply March; growth has been above 250,000 for four months running. Meanwhile, the unemployment rate fell to 3.8% in March from 3.9% in February.

So far, Fed rate hikes in 2022 and 2023 appear to have done little to dampen economic activity.

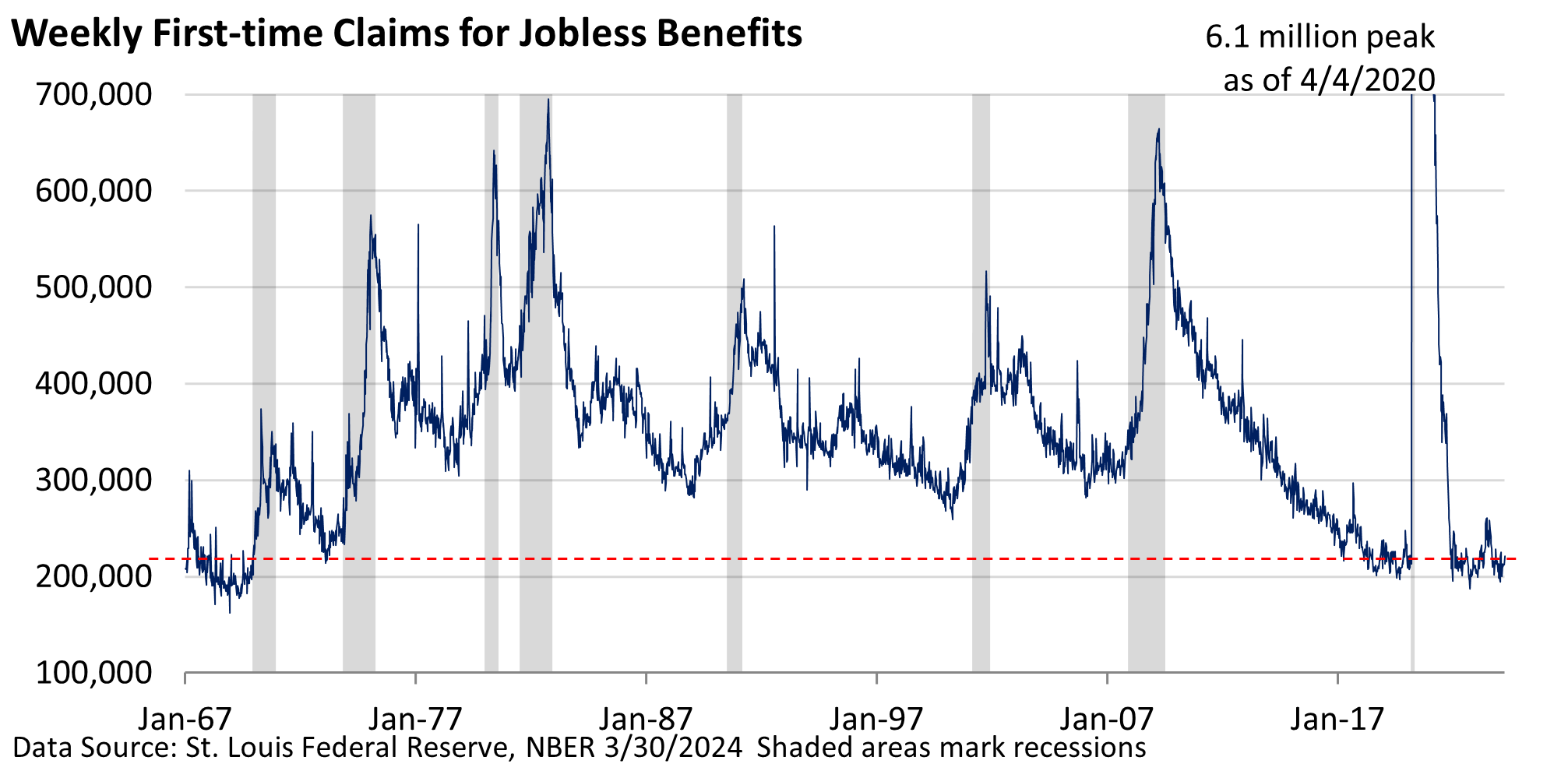

Despite numerous headlines of tech sector layoffs, not many laid-off workers are filing for unemployment benefits.

Though the population is much larger today, claims are hovering near a level not seen since the early 1970s.

What does this tell us? Most firms want to retain workers. If sales flounder, employers lay off staff, and first-time claims for benefits rise. That’s not happening today.

And it’s not simply upbeat job growth or low layoffs, job openings remain elevated, too, and have stabilized at an elevated level over the last eight months.

Weekly Market Commentary

The latest employment numbers from the U.S. Bureau of Labor Statistics (BLS) point to a robust job market.

On Friday, the U.S. BLS reported that nonfarm payrolls rose 303,000 in March, well ahead of expectations. It’s not simply March; growth has been above 250,000 for four months running. Meanwhile, the unemployment rate fell to 3.8% in March from 3.9% in February.

So far, Fed rate hikes in 2022 and 2023 appear to have done little to dampen economic activity.

Despite numerous headlines of tech sector layoffs, not many laid-off workers are filing for unemployment benefits.

Though the population is much larger today, claims are hovering near a level not seen since the early 1970s.