Weekly Market Commentary

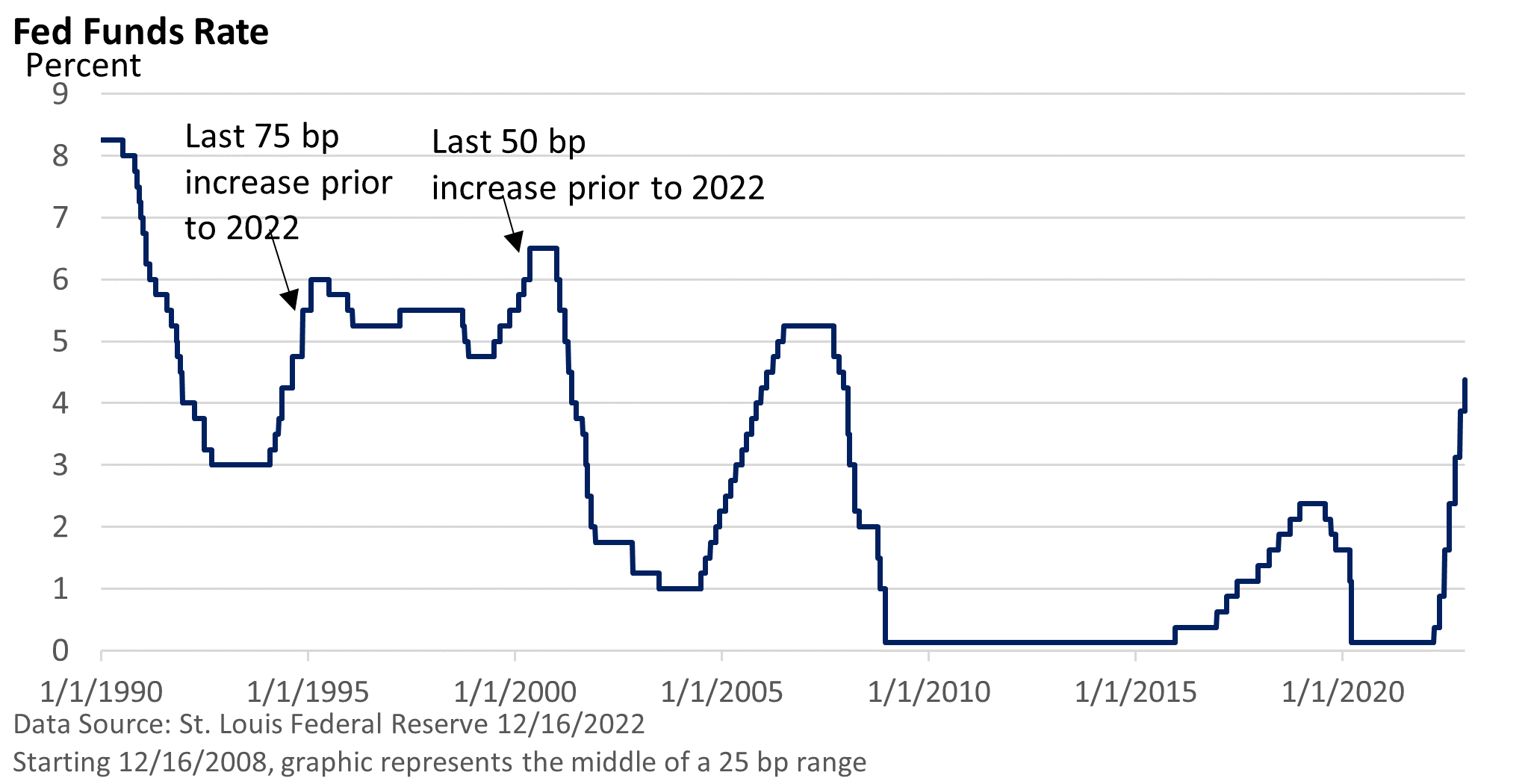

After four-straight 75 basis-point (bp, 1 bp = 0.01%) rate increases, the Federal Reserve downshifted and boosted its key rate, the fed funds rate, by 50 bp last week to 4.25 – 4.50%. But it didn’t muddy its hard-hitting anti-inflation rhetoric.

Since 75 bp rate hikes are probably behind us, Fed Chief Powell took great pains to distance the Fed from the idea that it might be considering a policy shift.

Powell said rates are still not high enough. “We’ll need to stay there (at a yet-to-be-determined peak) until we’re really confident that inflation is coming down in a sustained way. And we think that will be some time.”

That wasn’t pivot language. It wasn’t pivot lite. It wasn’t even a pivot with a small ‘p.’

The continued tough stance came despite the second-straight monthly inflation reading that came in less than expected.

A day before the Fed’s decision, the Consumer Price Index rose 0.1% in November, the U.S. Bureau of Labor Statistics reported. Excluding food and energy, the core CPI rose 0.2%.

It’s welcome, and it’s encouraging, but two months isn’t exactly a convincing trend, in the Fed’s eyes.

Moreover, the Fed lifted its end-of-2023 fed funds projection from 4.50 – 4.75% to 5.00 – 5.25%. It’s another upward drift that caught the attention of investors.

Take the projected level next year with a couple of grains of salt. At this time last year, the Fed expected a fed funds rate of 0.75 – 1.00% by the end of 2022. That’s quite a miss.

Nonetheless, the heavy lifting is probably behind us. Still, the Fed made sure it balanced a smaller rate hike with a stern message, lest short-term traders get too complacent, and the public loses faith in the Fed’s commitment to price stability.

Short-term traders, who have made a series of bets this year that the Fed would pivot, were once again disappointed.