Weekly Market Commentary

Mortgage rates soared last year, rising from nearly 3% for a 30-year fixed-rate mortgage to as high as 7.08%, according to Freddie Mac’s weekly mortgage survey.

Predictably, housing sales fell sharply last year, and there were plenty of forecasts predicting a significant drop in home prices.

But something curious and interesting happened. Not only did prices not collapse as they did in the late 2000s, but home prices have recently moved higher.

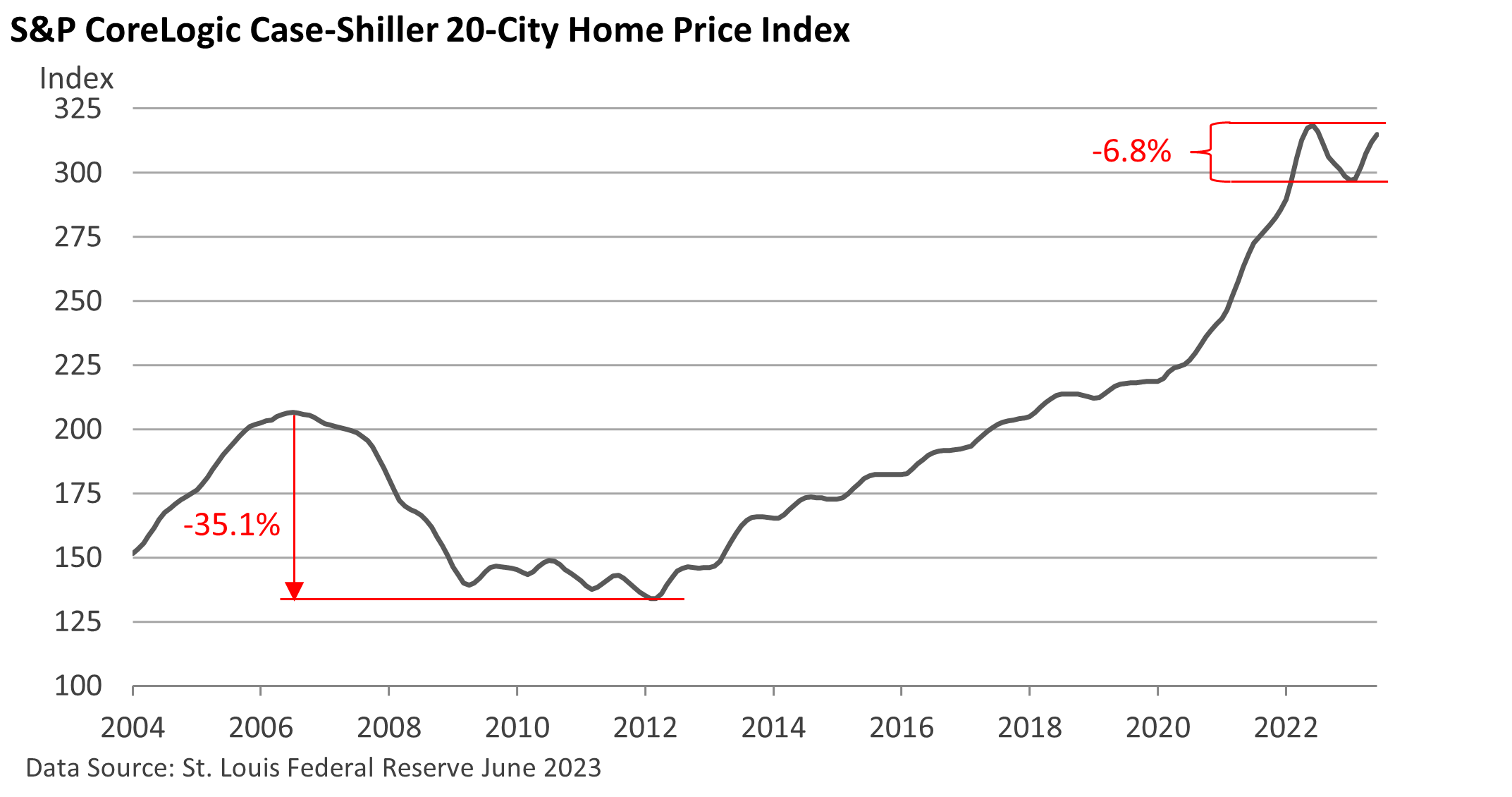

Take a moment to review the graphic below. The S&P CoreLogic Case-Shiller 20-City Home Price Index measures housing prices in 20 large metropolitan areas.

Between June 2022 and January 2023, the index declined a modest 6.8%. Since the beginning of the year, prices have turned around.

Why didn’t prices fall further? Why have prices recently rebounded, even as mortgage rates remain high?

There aren’t enough homes for sale, according to the National Association of Realtors. Homeowners who refinanced at record-low rates are staying put rather than buying a new home and saddling themselves with an expensive mortgage.

In addition, much better underwriting standards that followed the financial crisis have helped keep foreclosures low, which also limits the supply.

Mortgage rates did approach 6% earlier in the year, helping to support prices and limit the decline in sales, but rates are back above 7%, according to Freddie Mac.

That may slow sales in what is typically a seasonally slow fall period. But a sharp drop in housing prices this year has yet to materialize.