Prosperity Partners Blog

Buyer’s Market – With Strings Attached

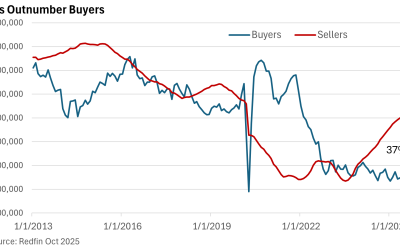

Redfin reported last week that sellers are grappling with the strongest buyer’s market since the real estate brokerage firm began compiling records back in 2013. Sellers now outnumber buyers by 37%.

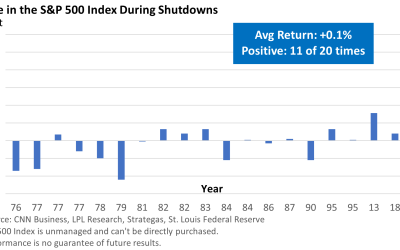

Investors Unfazed by Shutdown

The government shutdown lasted from October 1 to November 12. It was the longest on record. During that period, the S&P 500 rose from 6,688.46 (September 30) to 6,850.92 (November 12), or an advance of 2.4%. As we’ve noted in prior shutdowns, investors typically ignore political drama.

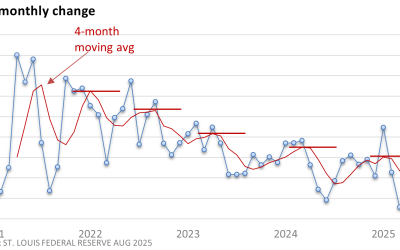

The Job Market’s Missing Pulse

The government shutdown has been and will always be prominently featured in the 24-hour news cycle. Travelers are feeling it, furloughed federal employees wonder when they will receive their next paycheck, and even the housing market is affected as some buyers are left in limbo.

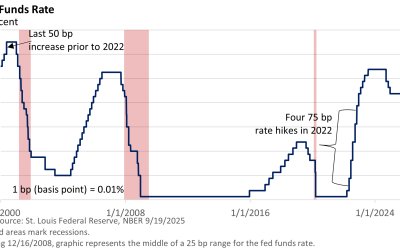

One Cut, Two Cut: The Fed’s Delicate Balancing Act

The Federal Reserve delivered a widely expected 25-basis-point rate cut (bp, 1 bp = 0.01%), but Fed Chief Jay Powell tempered market enthusiasm by signaling that a December cut is far from certain.

All That Glitters is Gold

On October 12, 2022, the S&P 500 Index hit a cyclical low. In hindsight, that marked the end of the 2022 bear market. Fast forward three years, and the current bull market has now been running for three years.

A Three-Year Anniversary

On October 12, 2022, the S&P 500 Index hit a cyclical low. In hindsight, that marked the end of the 2022 bear market. Fast forward three years, and the current bull market has now been running for three years.

Government Shutdowns: Why Investors Rarely Care

Historically, US government shutdowns have had minimal impact on the stock market. Let’s review the graphic below. Since 1976, government shutdowns of varying lengths have had little effect on stocks, as measured by the S&P 500 Index.

Reductions in Interest Rates and Market Response – Historical Review

A couple of weeks ago, the Federal Reserve cut its key rate, the fed funds rate, by a quarter-percentage point to 4.00-4.25%. It’s the first rate cut since last December. So, is this one and done, or will there be a series of rate reductions? A speech delivered last week by Fed Chief Powell wasn’t overly dovish, but the Fed meets two more times this year, and Powell left the door open to at least one more rate cut in 2025.

The Fed Delivers a Long-Awaited Rate Cut

To virtually no one’s surprise, the Federal Reserve slashed the target on its key interest rate—the fed funds rate—at the conclusion of its meeting on Wednesday. The only question regarding the decision was whether the Fed would cut by a quarter point (25 basis points [bp]; 1 bp = 0.01%) or 50 bp. They opted for 25 bp and a new range of 4.00-4.25%.

Last CPI Tees Up Fed Rate Cut

The only thing that might have been standing in the way between the Federal Reserve and a rate cut this week was last Thursday’s release of the Consumer Price Index (CPI). While the inflation figures weren’t particularly soft, August’s data didn’t reflect a sharp rise in prices either, all but guaranteeing that the Fed will move at Wednesday’s meeting.

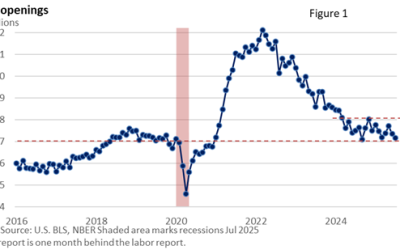

No Hire, No Fire Economy

For starters, the title is a simplified five-word summary of the labor market. Recall that last week, we explored the low level of layoffs. This week, we shift the focus to hiring trends. But first, let’s take a closer look at the numbers from the latest jobs report.

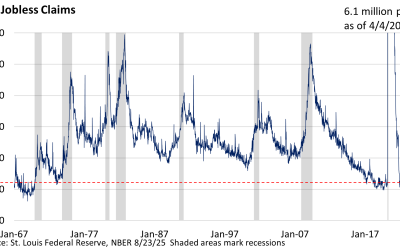

Initial Claims and Economic Signals: What Investors Watch

Initial claims for unemployment insurance measure the number of people filing for unemployment benefits for the first time. The data is released weekly, making it one of the most up-to-date indicators of labor market conditions. It is a key economic indicator because it offers a real-time snapshot of the health of the labor market.