Prosperity Partners Blog

Heavy Data Week Offers Mixed Picture

Last week was packed with economic developments, as reports poured in from all directions. We saw the release of second-quarter Gross Domestic Product (GDP) figures, the broadest measure of goods and services produced, alongside the July jobs report.

One Big Beautiful Bill and You

Signed into law on July 4, the One Big Beautiful Bill (OBBB) Act introduces sweeping changes into the tax code that could influence how you plan for and pay your taxes. Given the depth and complexity of the new law, our review is not all-encompassing. But we’ll touch on some of the key provisions.

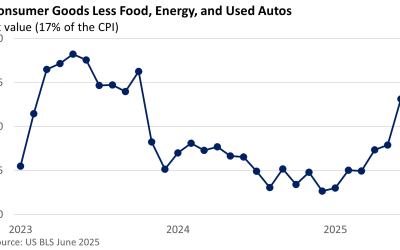

Tariffs Begin to Bite

At first glance, June’s Consumer Price Index (CPI) was reassuring. The US Bureau of Labor Statistics reported that the CPI rose 0.3% in June as expected, while the core CPI, which excludes food and energy, rose a smaller-than-forecast 0.2%, per the Wall Street Journal.

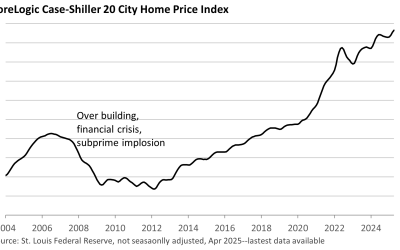

Inside the Front Door of the Housing Market

Home sales have fallen sharply over the last three years, with sales near the levels we last saw in 2008, according to the National Association of Realtors. Yet, unlike in 2008, housing prices haven’t collapsed this time around.

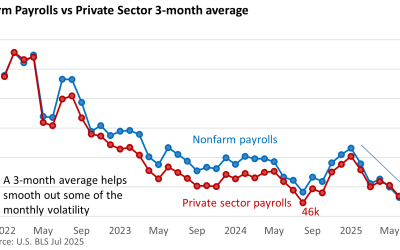

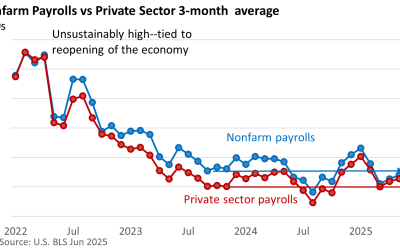

A Quirky Jobs Report

The US Bureau of Labor Statistics reported that nonfarm payrolls rose 147,000 in June, topping the forecast of 110,000 (Wall Street Journal), while the unemployment rate fell to 4.1% in June from 4.2% in May. Private sector jobs rose a more muted 74,000.

9 Interesting Facts about the Declaration of Independence

As we get set to mark the 249th anniversary of the signing of the Declaration of Independence, it’s the perfect time to reflect on some fascinating details behind this iconic American document. Here are nine interesting facts to explore and enjoy!

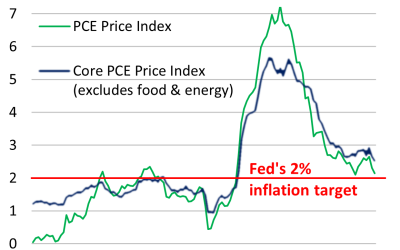

The Fed Hits Snooze on Policy Moves

It came as no surprise that the Federal Reserve maintained its benchmark rate—the fed funds rate—at 4.25% to 4.50% during last Wednesday’s meeting. Despite the moderation in the rate of inflation, central bankers didn’t hint at any near-term cut in interest rates.

Tariffs MIA in Latest CPI; Renewed Geopolitical Instability

Inflation remained mild in May, showing little upward pressure. According to last week’s report from the US Bureau of Labor Statistics, the Consumer Price Index (CPI) rose just 0.1% for the month, while the annual rate settled at 2.4%.

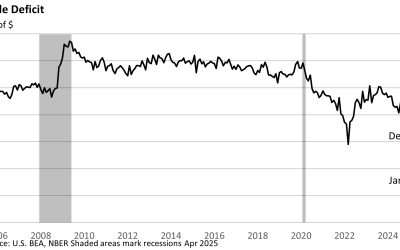

Trade Deficit Cut in Half

April exports rose $8.3 billion to a record $289.4 billion. April imports fell $68.4 billion to $351.0 billion. The decline in imports included a $33.0 billion drop in consumer goods, $8.3 billion in automobiles and auto parts, and $23.3 billion in industrial supplies.

From Wallets to Wall Street: Why We Hate Inflation

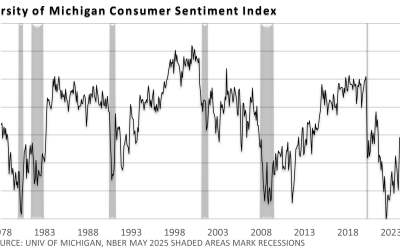

On Friday, the University of Michigan reported that the Consumer Sentiment Index for the U.S. fell to the second-lowest reading on record, with the mid-May level falling to 50.8 from April’s 52.2. “Tariffs were spontaneously mentioned by nearly three-quarters of consumers, up from almost 60% in April; uncertainty over trade policy continues to dominate consumers’ thinking about the economy,” the Director of the Survey said.

US Exceptionalism

On Friday, the University of Michigan reported that the Consumer Sentiment Index for the U.S. fell to the second-lowest reading on record, with the mid-May level falling to 50.8 from April’s 52.2. “Tariffs were spontaneously mentioned by nearly three-quarters of consumers, up from almost 60% in April; uncertainty over trade policy continues to dominate consumers’ thinking about the economy,” the Director of the Survey said.

Debbie Downer

On Friday, the University of Michigan reported that the Consumer Sentiment Index for the U.S. fell to the second-lowest reading on record, with the mid-May level falling to 50.8 from April’s 52.2. “Tariffs were spontaneously mentioned by nearly three-quarters of consumers, up from almost 60% in April; uncertainty over trade policy continues to dominate consumers’ thinking about the economy,” the Director of the Survey said.