Prosperity Partners Blog

Does a Republican Sweep Matter for Investors?

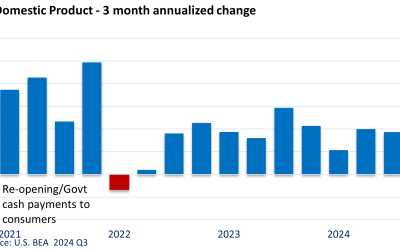

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

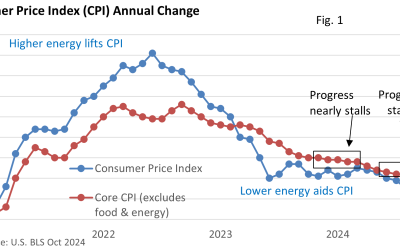

Inflation—Not Back to Target, Not Enough to Derail a December Rate Cut

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

A Drama-Free Fed Meeting, Press Conference* and the Election

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

A Robust GDP and Muddy Jobs Report

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

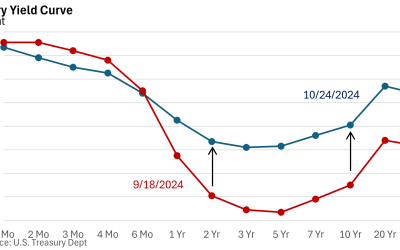

The Interest Rate Paradox

The U.S. Bureau of Labor Statistics reported that the economy added a whopping 254,000 jobs in September, about 100,000 more than economists surveyed by Bloomberg had projected. The unemployment rate, expected to hold steady at 4.2%, slipped to 4.1%.

Happy Birthday

The U.S. Bureau of Labor Statistics reported that the economy added a whopping 254,000 jobs in September, about 100,000 more than economists surveyed by Bloomberg had projected. The unemployment rate, expected to hold steady at 4.2%, slipped to 4.1%.

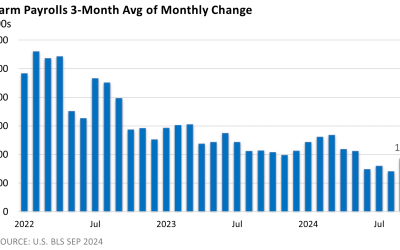

Job Growth Blows Past Expectations

The U.S. Bureau of Labor Statistics reported that the economy added a whopping 254,000 jobs in September, about 100,000 more than economists surveyed by Bloomberg had projected. The unemployment rate, expected to hold steady at 4.2%, slipped to 4.1%.

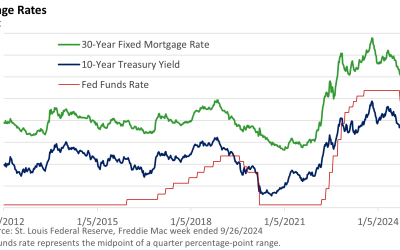

A Fed Rate Cut and Your Mortgage Rate

A recent online advertisement from a major bank read, “The Fed just lowered interest rates. Could refinancing save you money?” There is an implicit assumption in the ad that the Fed’s half-percentage point rate reduction brought about a significant drop in mortgage rates shortly following the decision.

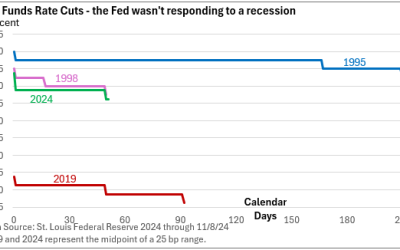

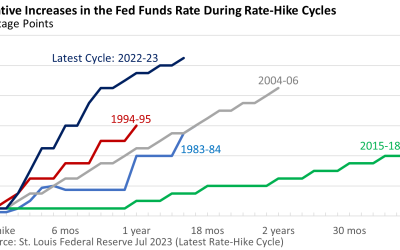

Boom – Fed Opts for 50

On Wednesday, the Federal Reserve announced a 50-basis point (bp, 1 bp = 0.01%) rate cut for the fed funds rate to 4.75 – 5.00%, its first reduction since 2020. The announcement marks the end of the most aggressive rate-hike cycle since 1980 when the Fed funds rate rose a whopping 11 percentage points (1,100 bps) in just 6 months.

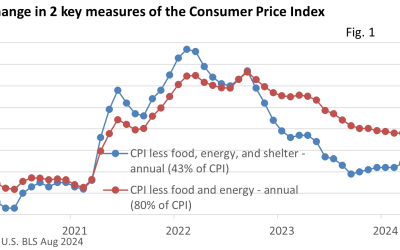

A Green Light for the Fed – in Three Graphs

All indications point to a rate cut by the Federal Reserve this week. What’s behind the Fed’s rationale? Let’s look at three key metrics. Aided by lower gasoline prices and stable prices for consumer goods, the rate of inflation has slowed dramatically.

August Melt-Up Follows Brief Meltdown

Market pullbacks are to be expected. They are incorporated into the financial plan. But like an unexpected traffic jam, they are exceedingly difficult to predict. Early August was one such event. The turbulence began at the end of July in the wake of seemingly minor news—the U.S. BLS reported another rise in the unemployment rate, which forced some investors to re-evaluate their view of a recession.

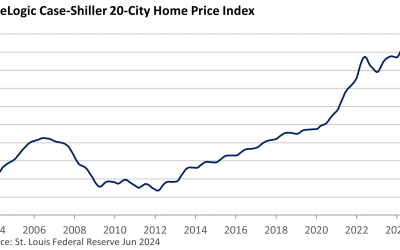

Then and Now

Overbuilding, speculation, and easy access to credit encouraged a housing boom and a bust in the 2000s. Sales cratered later in the decade, and along with it, prices tumbled. Today, housing sales have plummeted once again.