Weekly Market Commentary

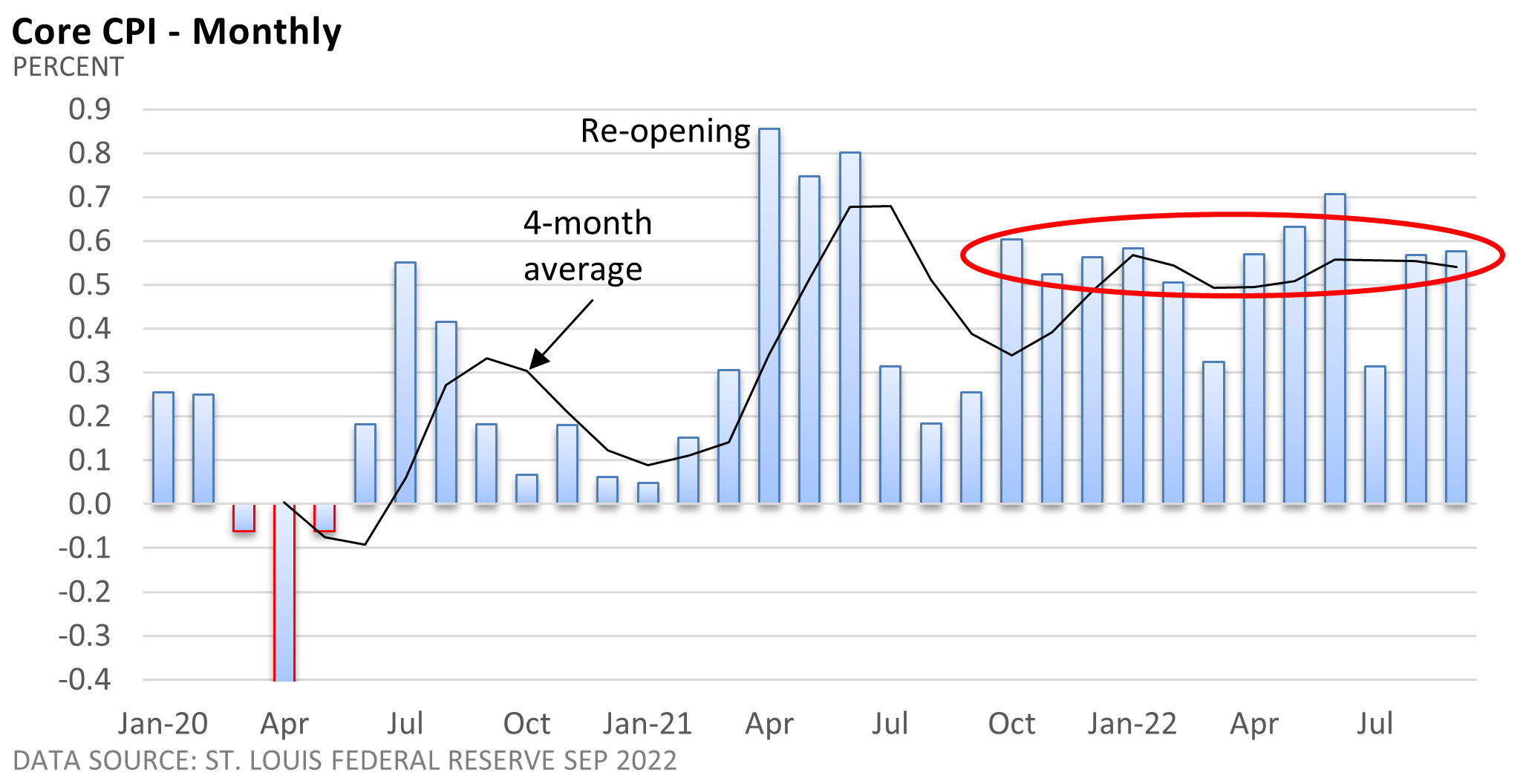

The release of the September Consumer Price Index (CPI) offered more sobering news, as inflation continues to run hot. The U.S. Bureau of Labor Statistics (BLS) reported the CPI for September rose 0.4% versus August. The core CPI, which excludes food and energy, rose 0.6%

Economists had forecast a 0.3% and 0.4% increase, respectively, according to DJ Newswires.

Food and energy are important components of the cost of living. Recently, gasoline prices have fallen, but CPI data continue to reflect sharp gains for food.

If we strip out food and energy, the core rate of inflation has been steady over the last 12 months—no signs of a peak, just a long plateau.

The Fed is letting bonds bought in the pandemic run off its balance sheet, while the disappointing CPI almost guarantees another 75-basis point (bp, 1 bp = 0.01%) rate hike at the Fed’s November 2 meeting, unless the sharp rate hikes spark unwanted financial instability.

We haven’t seen that at home, but the U.K. has recently experienced financial turbulence.

Low U.K. government bond yields during the 2010s encouraged U.K. pension funds to adopt more aggressive strategies to boost returns.

But as yields have risen this year and bond prices have fallen (bonds and yields move in opposite direction), the value of these complex strategies fell, forcing pension funds to sell government bonds to raise cash.

Forced selling pushed bond prices even lower, forcing additional sales—a so-called doom loop—until the Bank of England intervened to buy government bonds.

It’s hard to know what might be lurking under the surface, but it’s unlikely we are in immediate danger of something ‘breaking’ in the U.S., which could force a U-turn in Fed policy.

Fed officials have signaled they will eventually slow the pace of increases and assess the effects of current policy on the economy and inflation. For now, the Fed continues to take a hardline on inflation, as it plays catch up after failing to raise rates last year.