Weekly Market Commentary

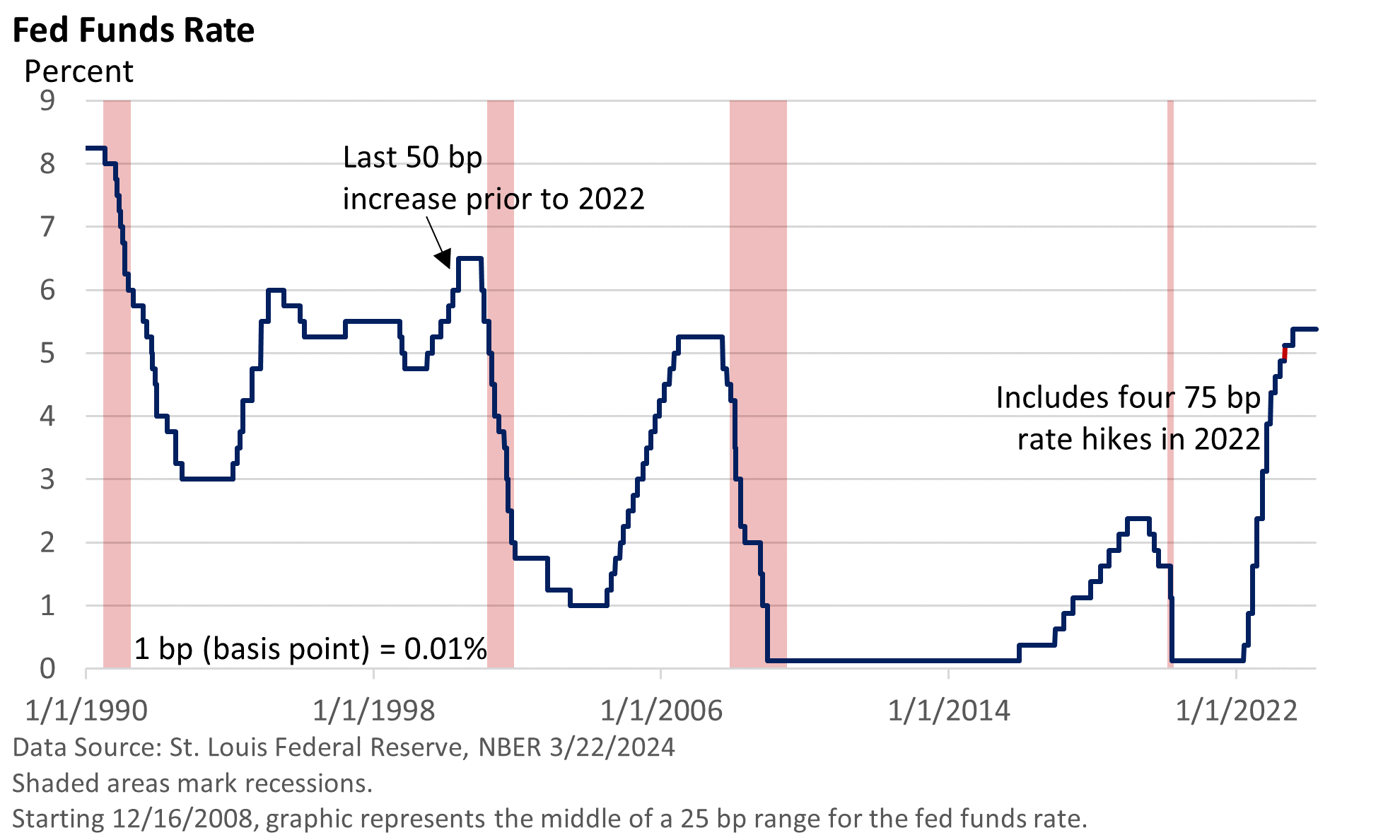

The Federal Reserve held its benchmark rate, the fed funds rate, at 5.25 – 5.50% last week. That wasn’t a surprise.

Let’s look at three important takeaways from the meeting that drove the Dow, the S&P 500 Index, and the Nasdaq to new closing highs on Wednesday and Thursday (MarketWatch data).

- Despite disappointing inflation numbers in January and February, the Fed’s Summary of Economic Projections still foresees three rate cuts this year—75 basis points in total rate reductions. That’s unchanged from December’s projections.

Given still elevated inflation, why not emphasize ‘patience’ on rate cuts?

- Well, while he wasn’t dismissive of the disappointing inflation numbers at the top of the year, Fed Chief Jerome Powell said in his press conference, “There’s reasonable seasonal effects there.” In other words, he’s suggesting that price hikes were tied to the calendar.

- If strong job growth continues, it won’t discourage the Fed from reducing interest rates. So, if nonfarm payroll growth continues to impress, it shouldn’t delay the Fed’s expected timetable on rate reductions.

What might finally trigger what appears to be an expected series of rate cuts later this year? The Fed is looking for “greater confidence that inflation is moving sustainably toward 2 percent.”

As Powell defined it at his press conference, Fed officials are looking for “data that confirm the kind of lower (inflation} readings that we had last year.”

Cheered on by the Fed’s relatively dovish stance, investors pushed shares to new highs last week as Powell appears to be greenlighting a rate cut, possibly by June.