Overbuilding, speculation, and easy access to credit encouraged a housing boom and a bust in the 2000s. Sales cratered later in the decade, and along with it, prices tumbled.

Today, housing sales have plummeted once again. According to the National Association of Realtors (NAR), sales of existing homes, which account for about 85% of all housing sales (NAR and Census Bureau data), are languishing near 2008 levels.

Existing home sales are down about 38% from early 2022, according to the NAR.

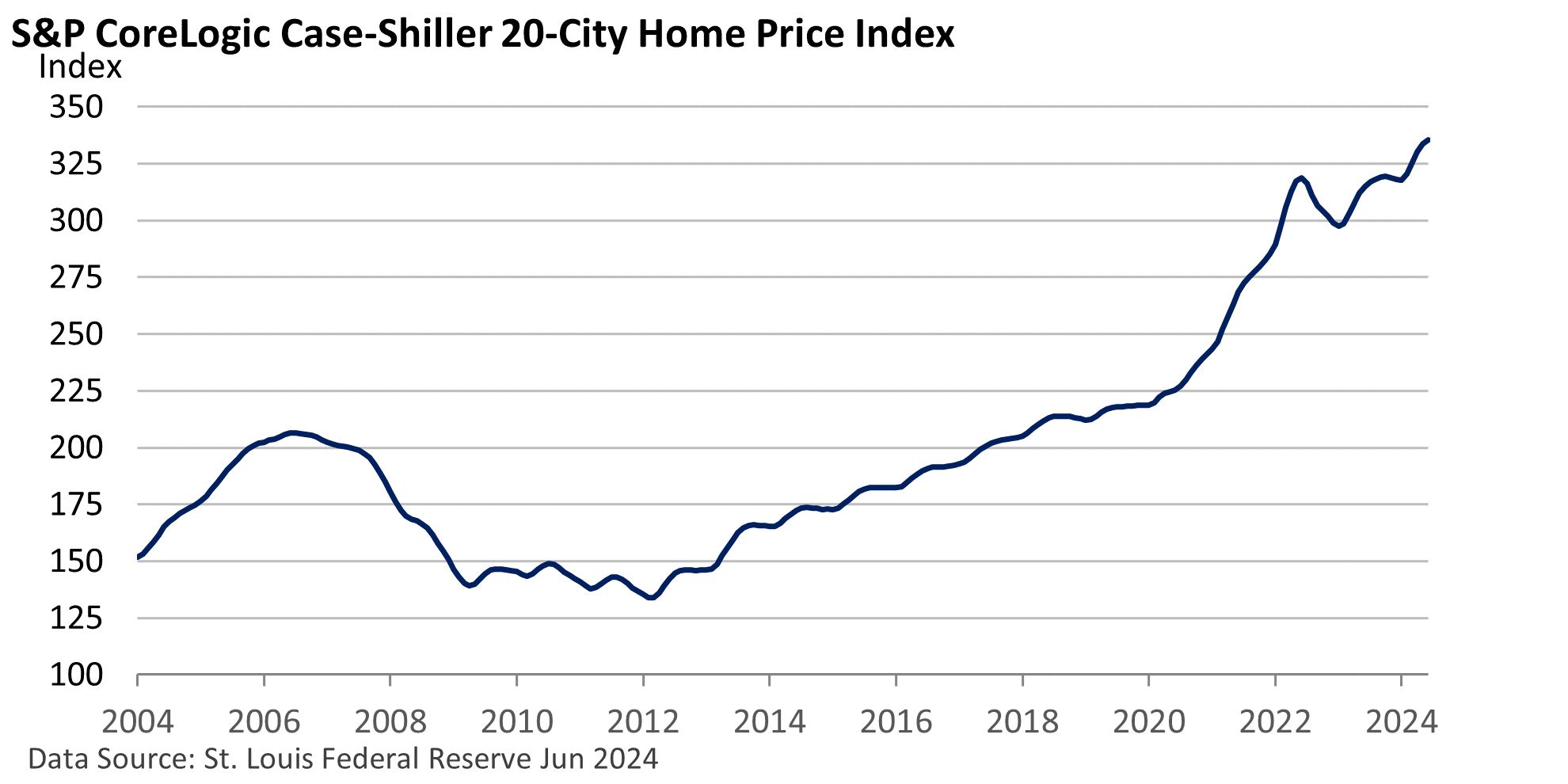

Yet, prices just hit a record high, per the S&P CoreLogic Case-Shiller 20-City Home Price Index. It’s counterintuitive.

The sharp drop in sales would be expected to create a buyers’ market and lower prices, as would-be sellers are forced to slash prices amid a glut of homes for sale. But that hasn’t happened.

Let’s review some of today’s key differences that have kept prices elevated and pushed the index to an all-time high in June (the latest report that is available).

But first, let’s acknowledge that prices vary by location, city, and zip code. While prices are up overall, some locales are seeing declines. But not to the extent of what was happening in 2008, when some underwater homeowners simply walked away from their houses, adding supply to an already glutted market.

Lending standards are much better today. Many buy with significant equity and aren’t willing to hand their keys to the bank if prices dip modestly. More importantly, homeowners who would like to sell are trapped by what might be called “the golden handcuffs.”

Many refinanced around 3% a few years ago. Today, rates are much higher, and those who would like to move are unwilling to trade in their low-interest loan for today’s rates.

Consequently, the NAR has repeatedly stated that inventories for sale are low by historical standards, and the lid on supply more than balances out the big drop in sales.

Eventually, life’s circumstances may encourage more homeowners to list. A drop in mortgage rates could do the same, unlocking supply, even as it may bring buyers, who are now sidelined by high prices and high mortgage rates, into the market. For now, prices remain high.