Weekly Market Commentary

Can there be too much hiring? Can job growth be too fast? It seems like an odd question. But following a better-than-expected jobs report on Friday and the initial negative reaction (shares pared losses and finished mixed), the question is worth exploring.

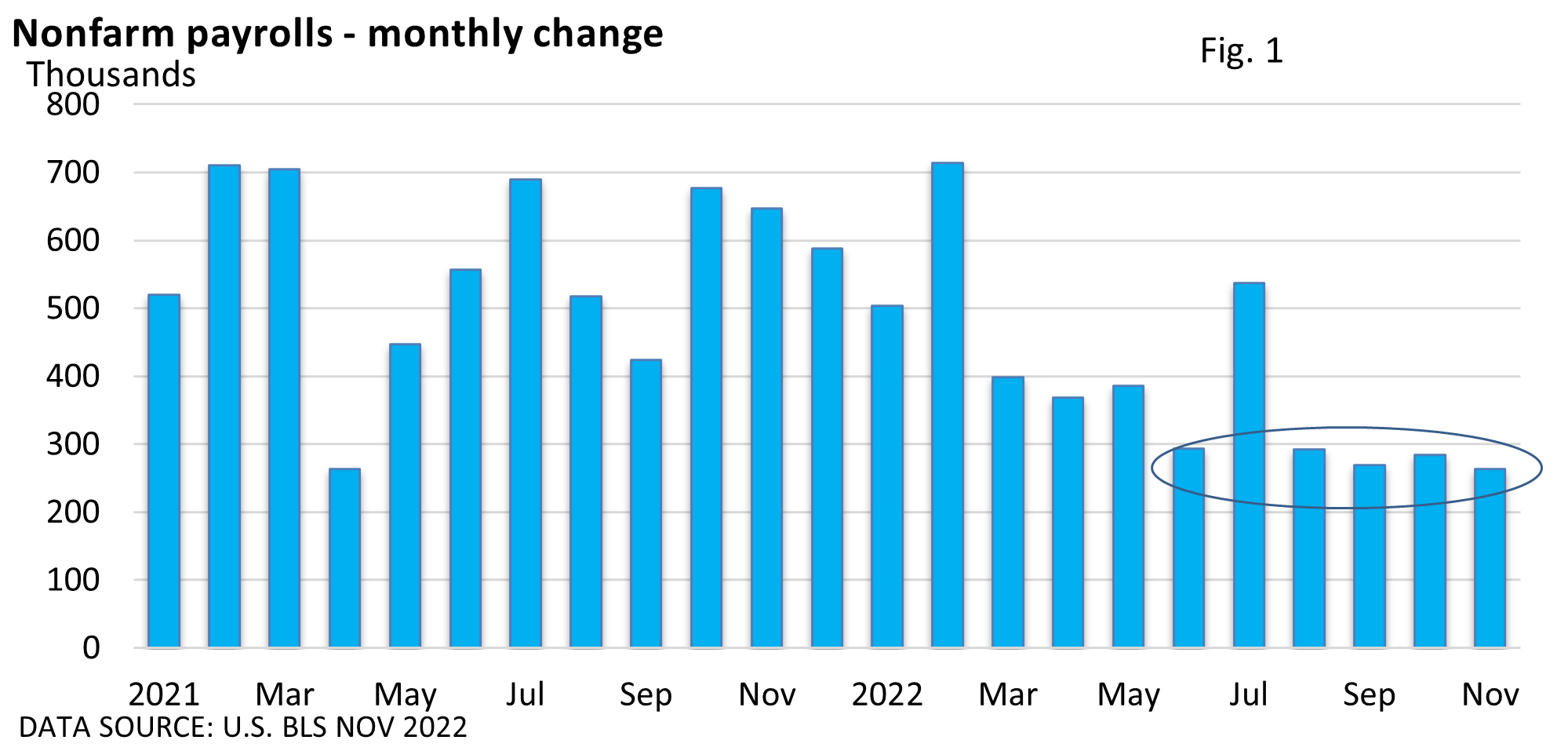

The U.S. Bureau of Labor Statistics reported nonfarm payrolls rose 263,000 in November, beating the CNBC consensus estimate of 200,000. The unemployment rate remained at 3.7%.

The trend in Figure 1 illustrates a moderation in job growth, but nothing concerning.

Five of the last six months have held in a narrow but historically solid range of 263,000 to 293,000. Investors initially reacted negatively to the report, and it seems fair to inquire why analysts had expected a big slowdown in November. Layoffs aren’t up, and job openings remain high.

So, why the sour mood? Sometimes the interest of Wall Street (investors) lines up with those of Main Street, but not always.

Main Street is benefiting from the labor shortage and upbeat job growth, as both are helping to support wages.

But Wall Street contends that robust hiring and fast wage gains add to inflation. You see, interest rates have skyrocketed this year in response to high inflation.

Wage growth that is too fast usually forces businesses to raise prices since labor costs are among the biggest expenses for most firms.

And, if inflation remains sticky, we’re likely to see rates continue to rise and remain at a higher level for a longer period. That creates added headwinds for stocks.

There will come a time when job growth slows. Several economic indicators suggest that a recession may be unavoidable next year. Historically, economic weakness sends the jobless rate higher and slows wage hikes.

The Fed’s goal, however, is to gently slow the economy and bring down the rate of inflation. It’s a very narrow path and may not be achievable. Next year, we may be having a different conversation, but today’s prevailing themes continue to be interest rates and inflation.