Weekly Market Commentary

Recession talk earlier this year and a belief that the Federal Reserve was nearly finished hiking interest rates kept a lid on longer-term Treasury yields. That’s changed.

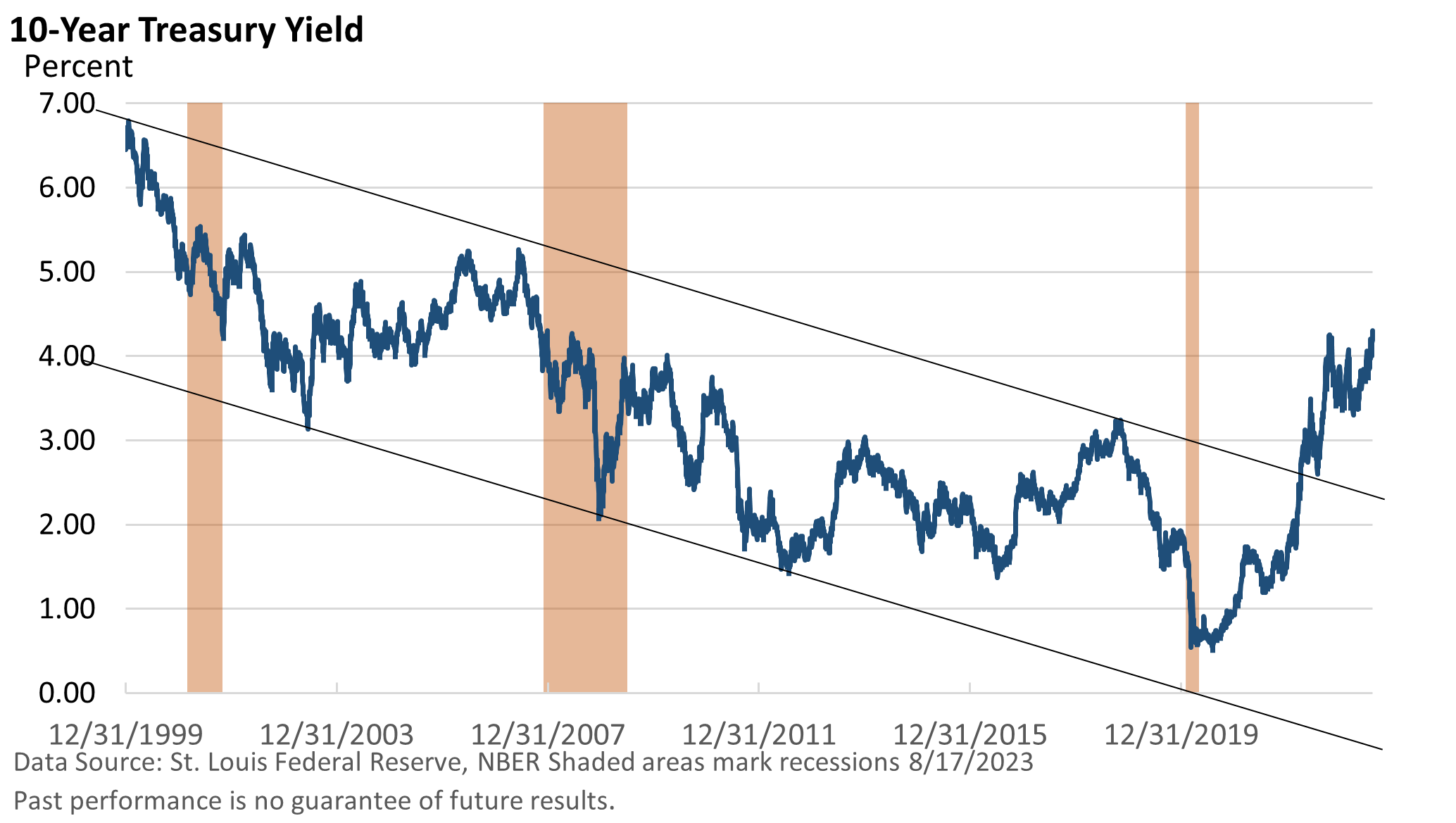

Last Thursday, the 10-year Treasury yield closed at 4.30%, according to the U.S. Treasury. It was the highest close since late 2007 (St. Louis Federal Reserve Treasury data).

As the graphic illustrates, the long-term trend has shifted. But why have yields recently lurched higher?

To begin with, the Treasury Department is ramping up debt issuance. In late July, the Treasury revised its net borrowing estimate for the third quarter to $1 trillion, significantly higher than the $733 billion projected in early May, according to Bloomberg News.

Meanwhile, the Federal Reserve has not only stopped buying long-term Treasury bonds, it is letting some of its long-term Treasuries roll off its balance sheet when the bonds mature rather than replacing them.

In other words, all else equal, a greater supply of bonds and fewer buyers puts downward pressure on Treasury bond prices (bonds and yields move in the opposite direction).

Next, economic growth jumped in July, contrary to what most analysts had expected. It’s early in the quarter, but the Atlanta Fed’s GDPNow model, which estimates GDP growth throughout the quarter, tracks Q3 GDP at an astounding 5.8% annualized pace (as of August 16).

Even if the model is one or two percentage points too high, 3.8 – 4.8% growth is still impressive.

Faster growth may not only put upward pressure on inflation, it may also encourage the Federal Reserve to accelerate the pace of rate hikes. If not, the bond market may try to do the Fed’s job for it, driving yields higher.

Of course, that’s not a foregone conclusion. Economic data can be lumpy—fast one month and slower the next.

To some extent, however, the rise in yields has encouraged a modest pullback in stocks.