Weekly Market Commentary

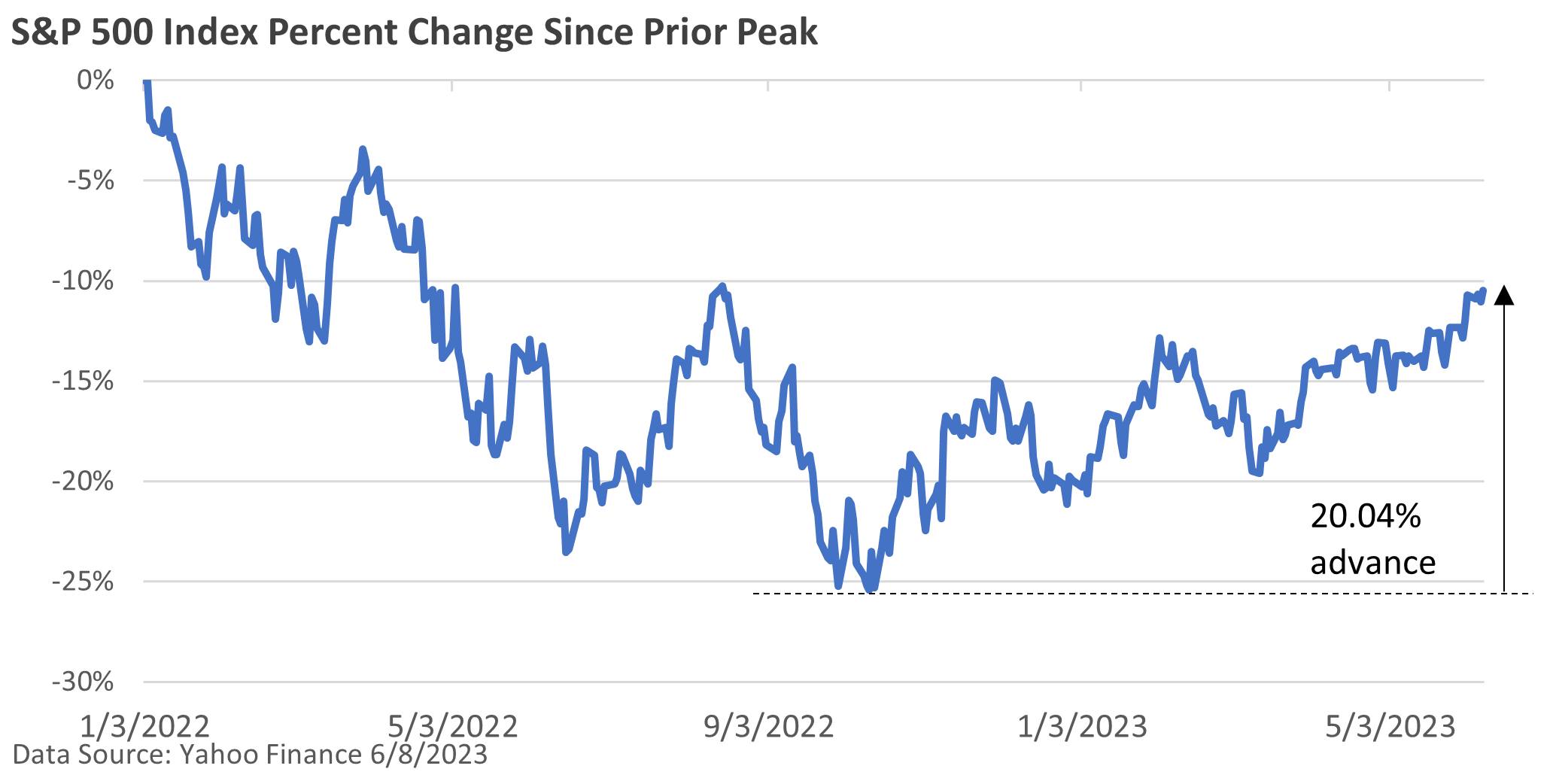

The S&P 500 Index, which tracks 500 large publicly traded companies, entered a new bull market last Thursday, according to the general definition of a 20% rise from the most recent low.

Let’s review some key mileposts. The index hit an all-time high of 4,797 on January 3, 2022. It proceeded to decline 25.4% to the most recent low of 3,577 on October 12th. A bear market is typically defined as a 20% or greater drop from the closing peak to the closing trough.

Since its most recent bottom, the index has rallied 20.04% to close at 4,294 on June 8th. Predicting short-term market fluctuations is nearly impossible, but the recent surge serves as a reminder that no one rings a bell when the market is about to rebound.

In order to eclipse the previous all-time high, the S&P 500 would need another 11.7% advance from June 8th’s close.

Climbing a Wall of Worry

There has been a multitude of concerns, including a much-advertised recession, persistent inflation, rising interest rates, regional bank failures, and the ongoing war in Ukraine.

But we’ve yet to slip into a recession, rate hikes have slowed significantly, and the banking crisis and war in Ukraine, which has caused immense human suffering, are off the front burner.

According to the Wall Street Journal and Barron’s, the recent market rally has been unbalanced and primarily driven by a handful of giant tech companies. This trend is evident in the impressive growth of the Nasdaq Composite, while the Dow has lagged.

Although the Dow comprises only 30 major corporations, it currently serves as a more accurate reflection of the broader market.

What’s fueling the Nasdaq? A more gradual progression of rate hikes has helped. But a crucial factor that has propelled the triumph of several prominent tech companies is the soaring interest in businesses that aim to capitalize on artificial intelligence.

The laggards are running into resistance amid a still-high degree of economic uncertainty.