Weekly Market Commentary

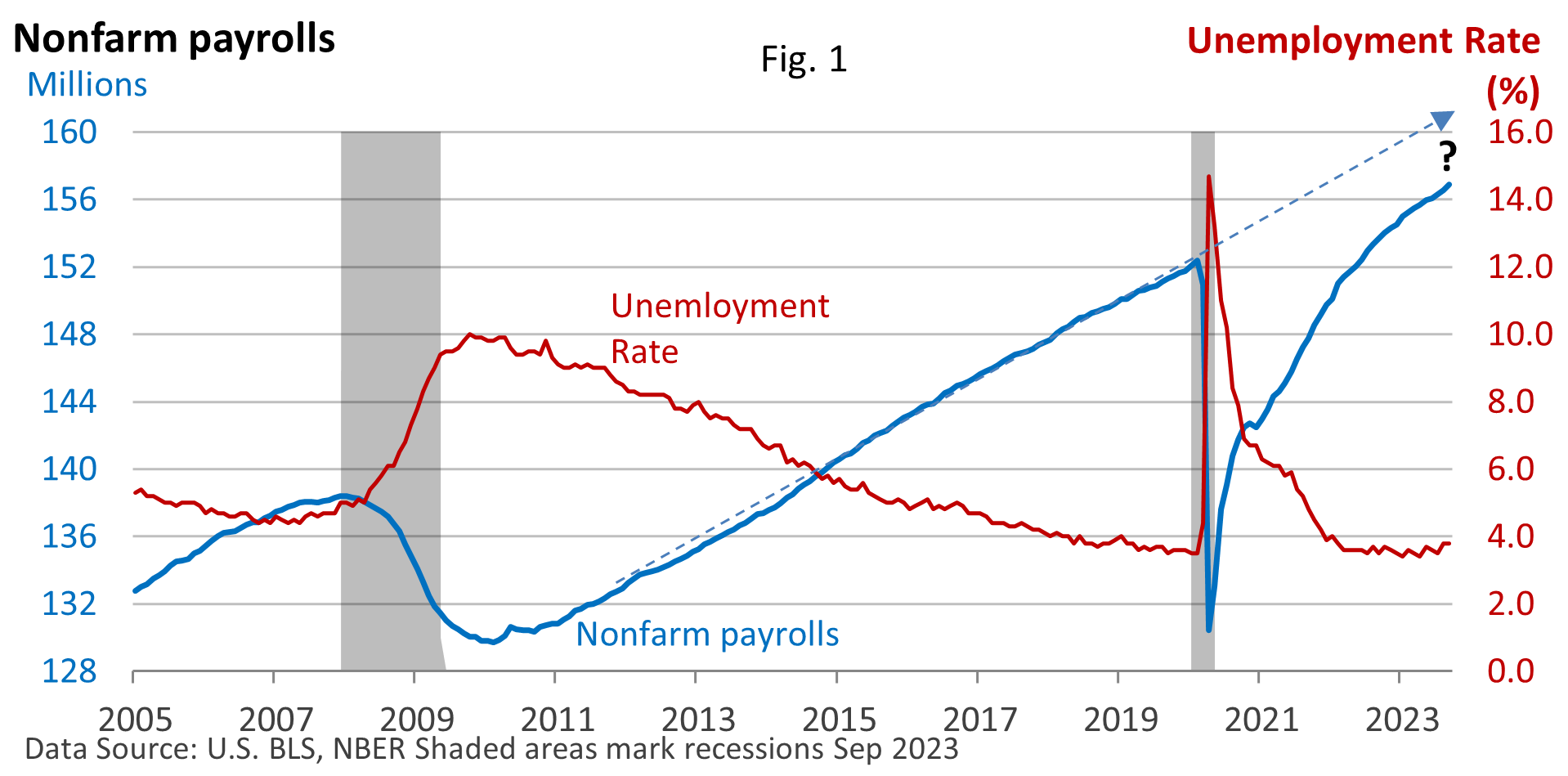

September recorded an increase of 336,000 in payrolls, easily topping the estimate of 170,000, according to Dow Jones Newswires. The unemployment rate held steady at 3.8%.

It is the latest economic report that is signaling economic momentum, as the data has defied economists’ forecasts of a slowdown led by rising interest rates and inflation.

In part, the strong number was aided by government jobs, which rose by 73,000 last month (U.S. Bureau of Labor Statistics [BLS] data). Of that, 40,000 came from state and local education.

Education has been a big contributor to government job growth this year. But 263,000 new private sector jobs shouldn’t be overlooked. It’s a healthy number.

Some job growth may simply be tied to pandemic- and lockdown-related distortions that have not yet worked through the job market (Figure 1).

Job vacancies remain high, and some folks are still returning to the job market.

It’s not simply job growth that suggests the economy is powering ahead. Layoffs measured by the Department of Labor have recently declined, and the U.S. BLS just reported a big increase in job openings for the month of August.

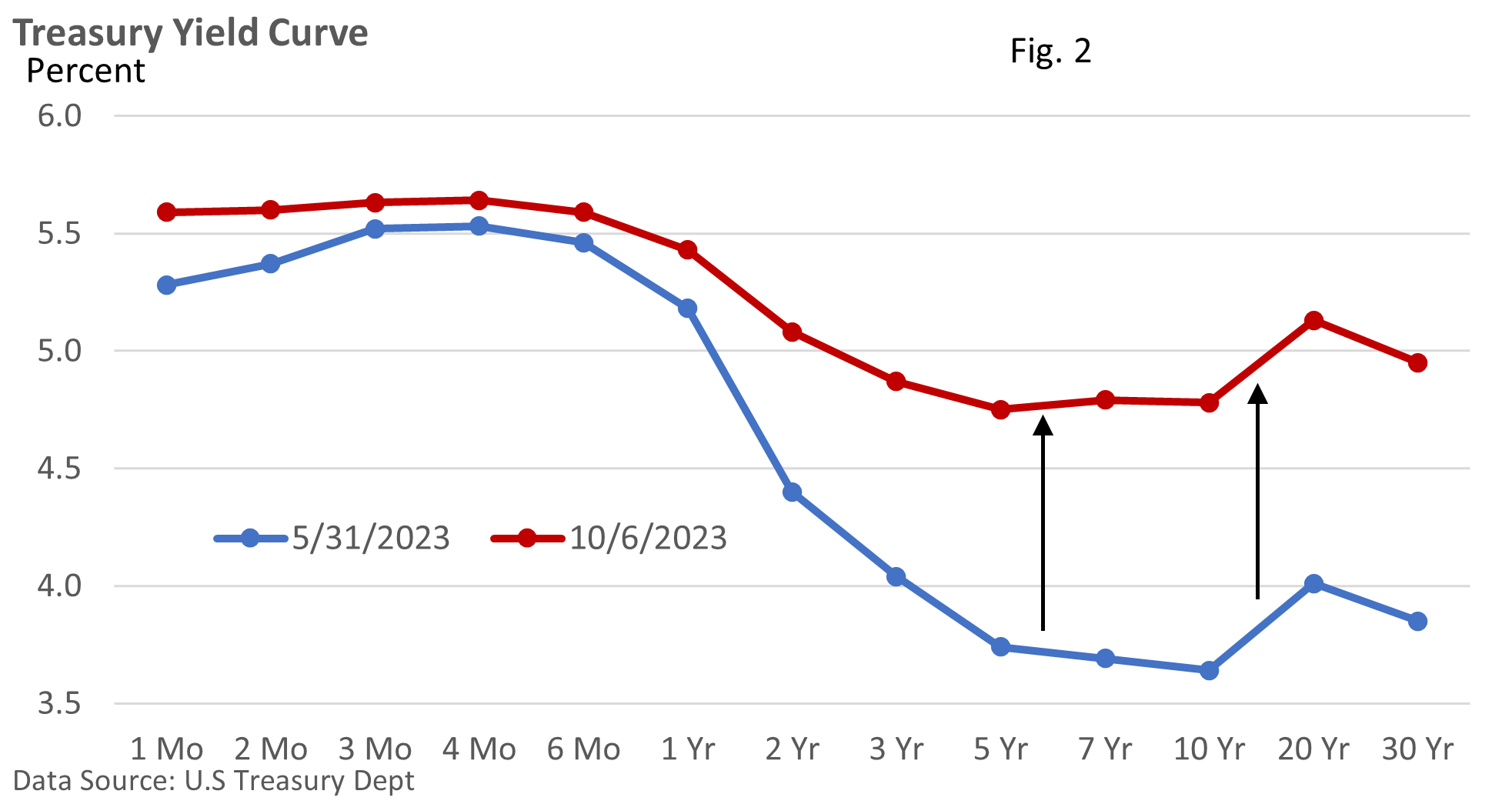

For investors worried about interest rates, the higher-for-longer theme remains in play.

Notably, longer-term Treasury yields have jumped. Figure 2 illustrates the yield on one-month T-bills through the 30-year Treasury bond as of May 31, 2023, and October 6, 2023. Look what’s happened to longer bonds. Yields are up sharply.

It’s difficult to quantify the reason completely, but let’s review three culprits.

- Investors didn’t expect a hotter-for-longer economy, and yields are repricing by going higher, i.e., the cost of money rises in response to upbeat economic growth.

- Fed officials have been repeatedly insisting that the fed funds rate will stay higher for longer (and longer and longer), which is influencing yields.

- Enormous borrowing needs by the federal government increase the supply of bonds, which means higher yields are needed to attract buyers.

There is some chatter that the big increase in longer-term bond yields is doing some of the heavy lifting for the Fed, reducing the need for the Fed to hike the Fed funds rate.

Ultimately, the direction of rates will largely depend on the economy’s performance. Jobs data are subject to revisions. But as we’ve seen this year, the much-forecasted recession has been shy about making an appearance.