On Friday, the U.S. Bureau of Labor Statistics (BLS) reported that nonfarm payrolls rose by 227,000 in November, which came in just above the consensus forecast of 214,000 (CNBC).

The unemployment rate, measured by a different BLS survey, ticked up to 4.2% from 4.1%.

November’s increase was a recovery from just 36,000 in October, when hurricanes and Boeing’s (BA $154) strike negatively affected the data.

In part, November represented a catch-up.

Job growth last month was concentrated in health care, which rose by 72,000, and the leisure and hospitality sector, which grew by 53,000. All levels of government increased by 33,000.

Strictly speaking, gains were narrowly concentrated in November, which is something we’ve seen recently.

However, there appears to be a disconnect between solid economic growth and a slowdown in job creation.

Over the medium and longer term, economic growth supports job growth.

If sales are expanding at most companies, these same firms would be expected, on average, to add workers to support their growing businesses.

In addition, new businesses would be expected to hire.

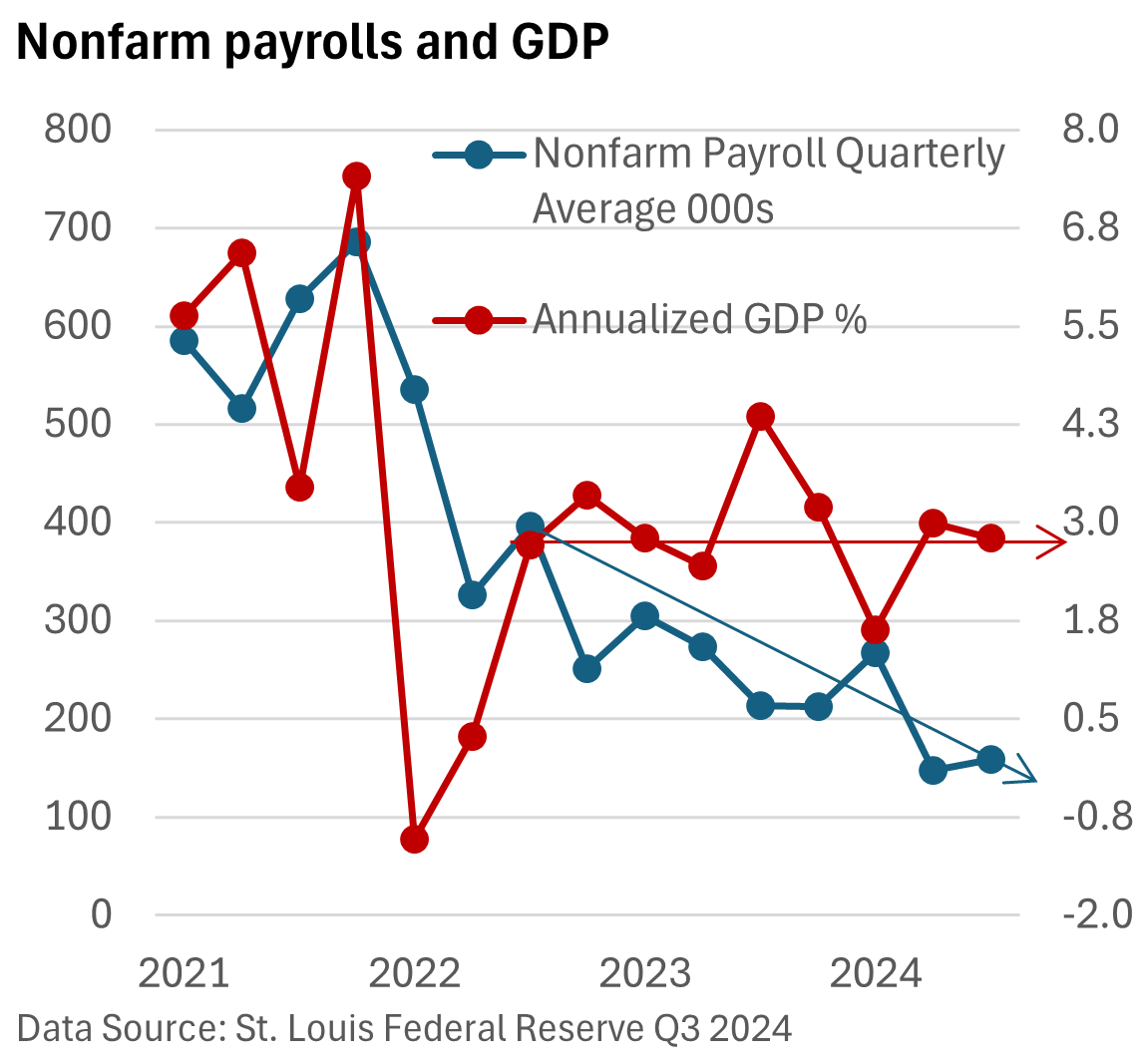

The graphic below highlights the average change in nonfarm payrolls per quarter (left side) and compares the change with quarterly Gross Domestic Product ((GDP), right side).

Robust GDP in 2021 coincided with robust employment growth, as the re-opening of the economy boosted both economic output and rehiring.

But look what’s happened since the 3rd quarter of 2022. GDP has been steady and solid, averaging an increase of 2.9% per quarter.

Soft economic landing? Hardly. But job growth has slowed.

Perhaps it can be explained by quirks in one or both surveys. But it’s a conundrum.

With inflation above the Fed’s target of 2% per year, GDP argues against rate cuts. However, the moderation in job growth has encouraged the Federal Reserve to reduce interest rates, even as GDP expands.