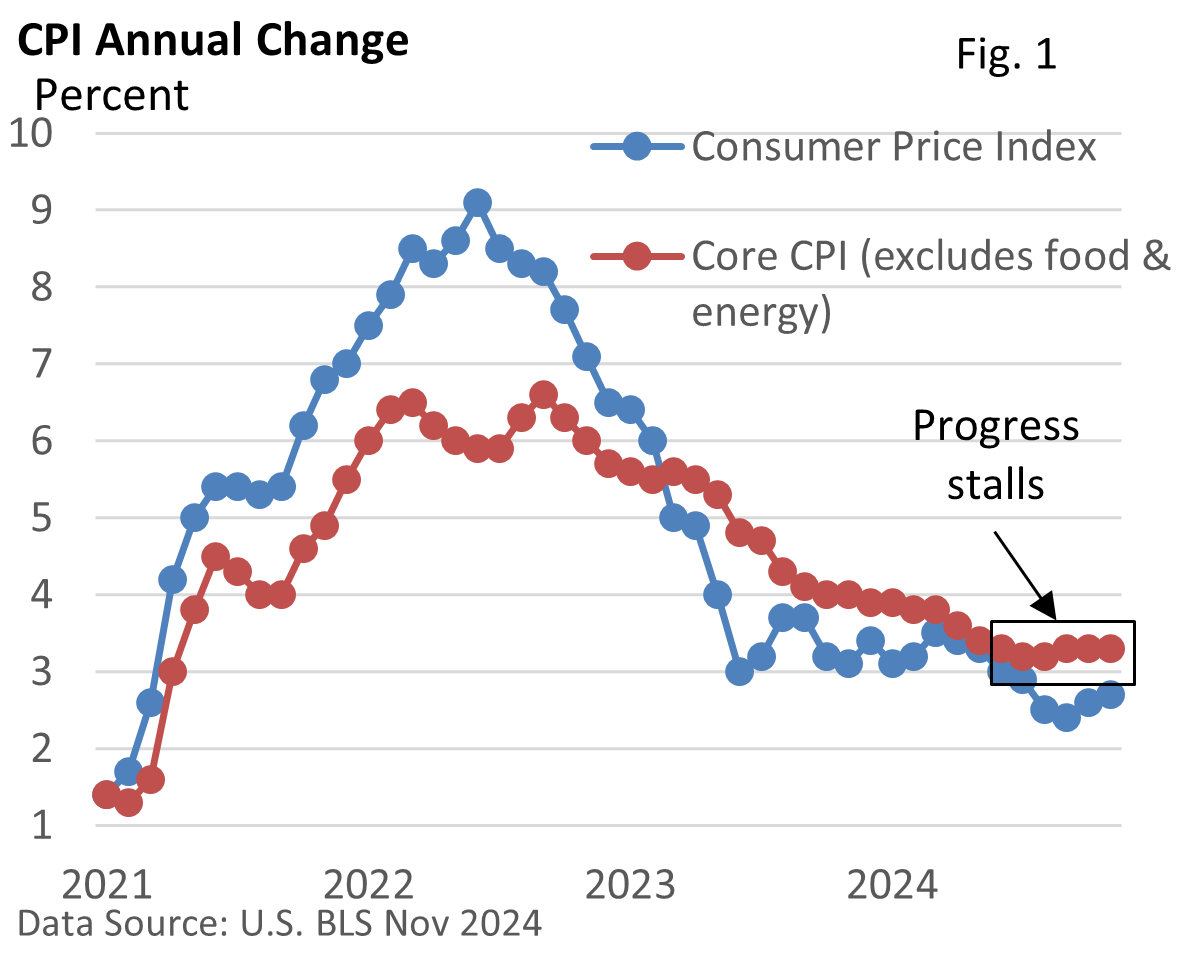

The monthly numbers are out, and while the rate of inflation is well off the 2022 peak, price hikes remain uncomfortably high.

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index (CPI) and the core CPI, which excludes food and energy, both rose 0.3% in November. The CPI is up 2.7% versus a year ago.

The core CPI held at 3.3% in November. And that illustrates a problem. Inflation has gotten stuck at a still-elevated level.

The annual core CPI has been running at 3.3% for 4 of the last 6 months (Fig 1).

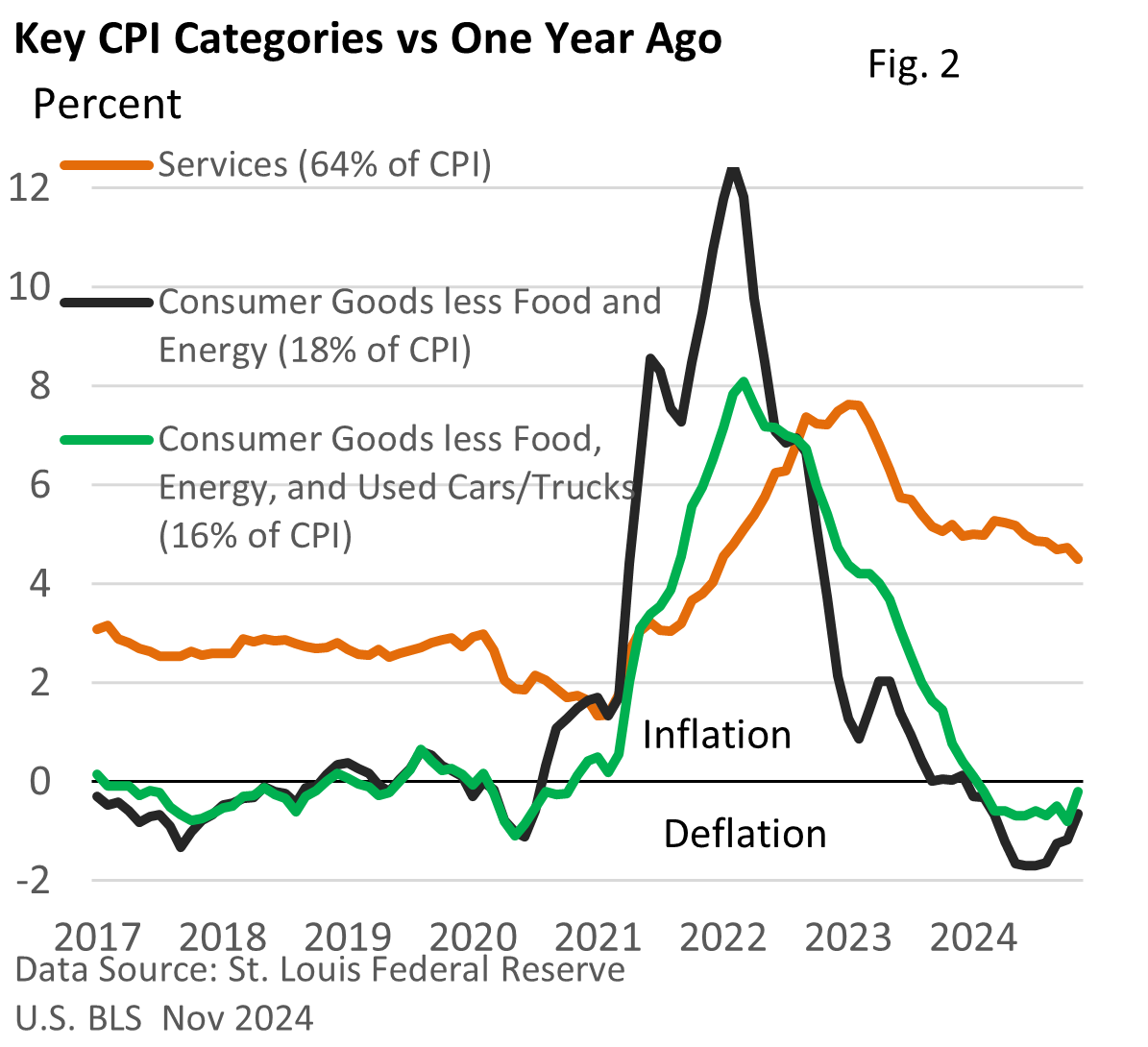

A more detailed review highlights what’s driving inflation (Fig 2).

Supply chains have righted themselves, and the sharp rise in inflation for consumer goods has been replaced by deflation (falling prices).

It’s a different story for services. Historically, services such as rent, health insurance, and auto repair have risen at a faster rate than consumer goods.

At 4.5% annually last month, services remain high but are in a gradual downward trend.

Why do investors care? The slowdown in inflation has encouraged the Federal Reserve to reduce interest rates.

This week, the Fed is widely expected to cut the fed funds rate by another 25 basis points (bp, 1bp = 0.01%). If so, it will mark a total of 100 bp since September.

Given mostly upbeat economic data and still elevated inflation, it’s generally expected that the Fed will briefly pause its rate-cut campaign in January.

Few, however, believe the Fed will signal rate hikes, but it may take a more cautious approach to lowering rates in the new year.

If the Fed adopts a more thoughtful approach at Wednesday’s meeting, we may experience some short-term volatility.

Investors, however, are not entirely reliant on Federal Reserve rate cuts to drive stock prices higher.

While stocks are seemingly priced for perfection and any disappointments can create conditions for a pullback, economic growth and rising corporate profits remain supportive of stocks. Further, enthusiasm in artificial intelligence has yet to abate.