Otherwise, for investors, there has been little impact so far, and this has been the longest shutdown in history.

Despite the shortage of economic data, investors, economists, and Fed officials aren’t flying blind. Private-sector data, along with a remarkably strong Q3 earnings season, according to LSEG, suggests the economy is expanding.

Last week’s monthly labor report, which includes payroll growth and the unemployment rate, was delayed. It’s compiled and released by the US Bureau of Labor Statistics (BLS). But data from the private sector is providing investors with some insights.

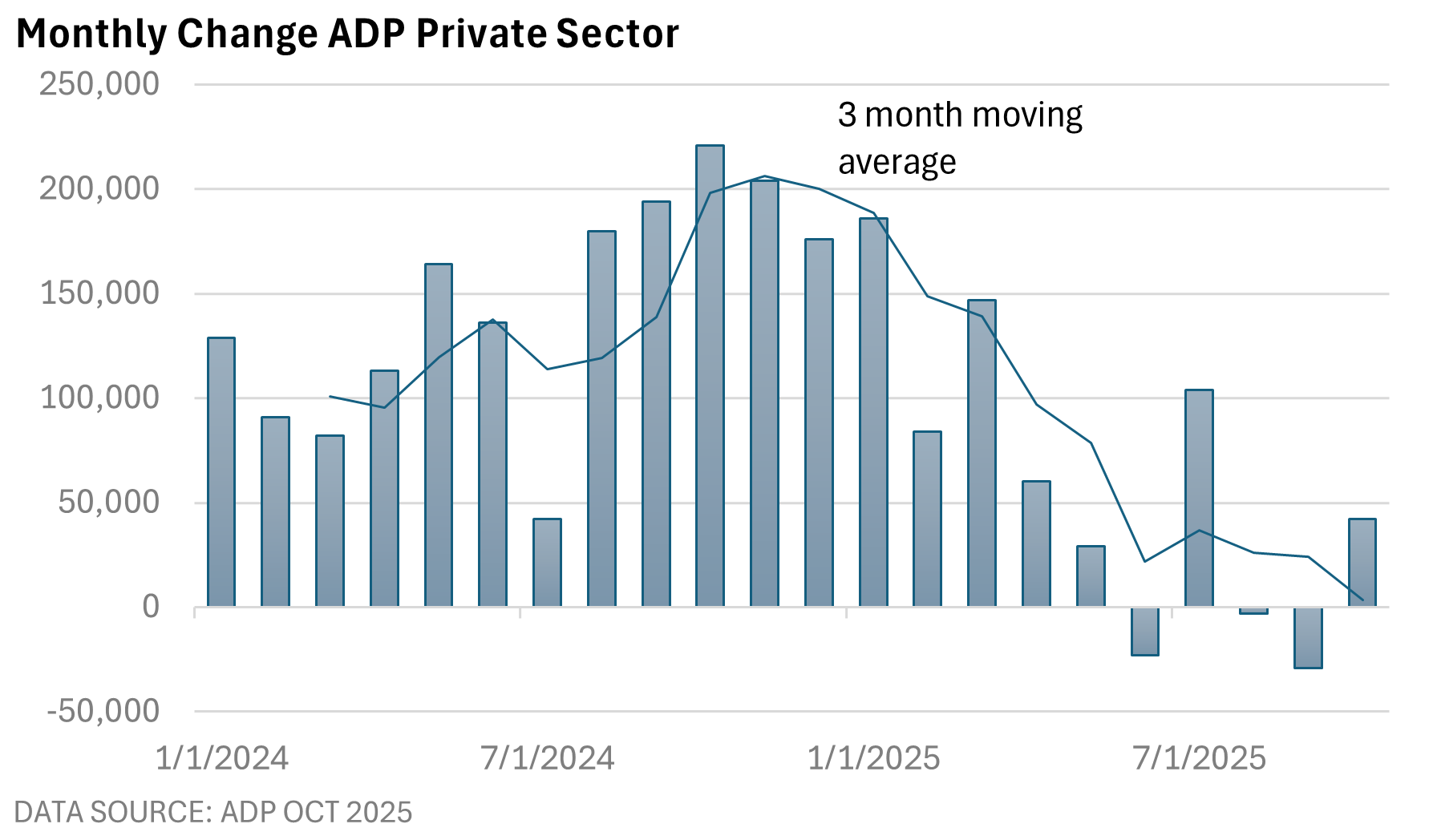

ADP releases its review every month, typically two days before the US BLS release. It does not cover federal, state, and local government employment, nor does it include public education. But it is comprehensive, as it includes the private sector.

During October, ADP reported a 42,000 increase in private-sector employment. Historically, that’s not impressive. But the survey did not detect a collapse in the job market that might be associated with a recession.

Notably, Federal Reserve Chair Jay Powell stated in late October that weekly state-level data on first-time unemployment insurance filings did not reflect a rise in layoffs.

Tech wobbles

Despite very strong earnings from major tech companies and firms that dominate AI, we’ve seen some selling in recent days. What gives?

Well, some of these stocks have been bid up to lofty levels. At these prices, investors practically demand perfection. Strong Q3 revenue and earnings may not be enough. Even an upbeat Q4 forecast, if it lacks visibility about 2026, can encourage some traders to hit the sell button and take profits.

For companies that have seen their shares rise sharply, even exceptionally strong earnings can be overshadowed by aggressive capital spending forecasts, which may introduce uncertainty for investors.

After a significant run-up, periodic pullbacks are a natural part of market behavior.