But the year wasn’t free of volatility. The bulls were thrown off track early in the year when unexpectedly steep tariffs were being levied, raising barriers to levels not seen in about 100 years.

In less than two months, the S&P 500 Index stumbled nearly 19%, per MarketWatch data, amid economic uncertainties stemming from steep taxes on many imported goods.

When most of the ‘reciprocal tariffs’ were delayed in mid-April, the S&P 500 registered its third-best daily advance (9.5%) since WWII, according to Bloomberg. That marked the bottom of the steep correction. Yet, the contrast between the dire predictions of trade experts and the president’s optimism regarding tariffs was stark.

Tariffs have yet to cause a widespread return of manufacturing jobs, but they have not led to much higher inflation either.

On the one hand, tariff advocates anticipated an economic boom led by manufacturing, while economists warned that a recession could ensue. Neither scenario played out in 2025.

One reason the dire predictions fell flat: the actual tariffs companies pay are lower than the headline numbers suggest.

Revenues from tariffs suggest that the effective average rate is about 12.5%, according to Pantheon Macroeconomics, well below the early April estimate of about 28% from the Yale Budget Lab.

In addition, some firms absorbed part or all of the tariff costs, retaliation from trading partners has been limited, and stockpiling ahead of anticipated levies helped ease the impact on consumers. One thing is certain: government coffers are benefiting from a surge in tariff revenue. Still, the Supreme Court is set to rule whether the statutes underpinning the emergency tariffs are unconstitutional.

Powering the market comeback

As economic fears from the tariffs began to recede, investors focused on economic and profit growth, Fed rate cuts in the fall (Figure 1), and the AI boom, driving major market indexes to new highs.

Concerns over persistently high inflation, a widening federal deficit, and lingering doubts about the Fed’s independence from executive branch interference appear to be fueling uncertainty among investors who have traditionally favored these bonds.

Why is this important? For various reasons. For starters, various consumer loan rates, including mortgage rates, closely track the 10-year Treasury yield.

2025 winners and losers

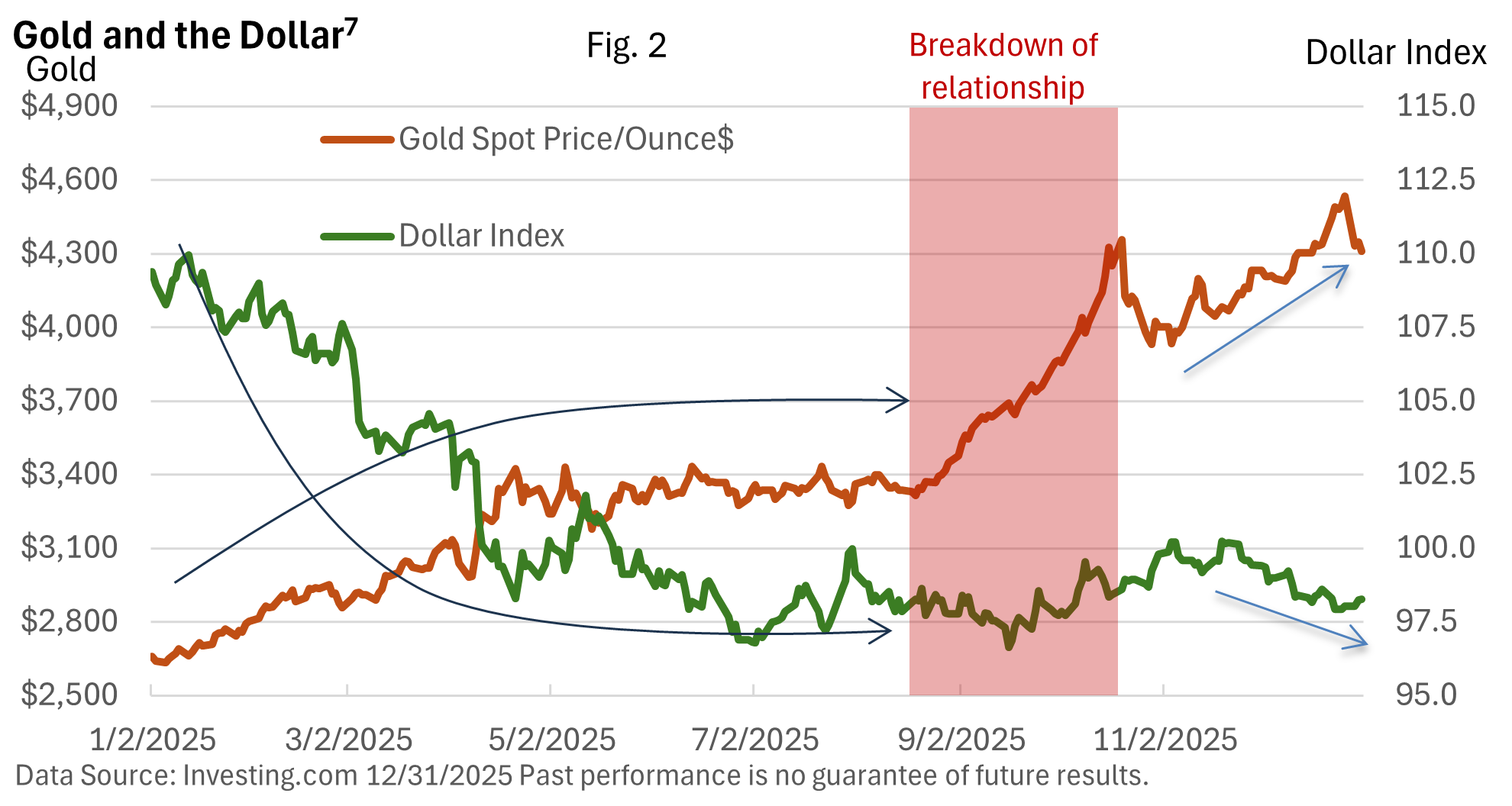

1. Gold was a big winner in 2025.

Gold was also aided by global central bank purchases, tariff and trade uncertainty, questions about the Fed’s independence, and Fed rate cuts. Investors wary of heightened geopolitical tensions and other risks, like the ballooning U.S. deficit, also aided the shiny metal.

Lastly, success begets success; call it momentum. The increase in price encouraged speculators to add to their positions. In other words, it’s FOMO—the Fear of Missing Out.

But precious metals can also be very unpredictable. We witnessed steep price drops in late October and again in late December.

2. Unlike gold, which thrived as a safe-haven asset amid geopolitical uncertainty, cryptocurrencies fell short of expectations. Crypto remains highly speculative, is very risky, and may be too speculative for some investors.

The recent weakness in crypto was surprising, especially given a more favorable regulatory environment under the current administration.

3. Meanwhile, oil suffered a decline last year amid concerns about the overall global economy and ample supply.

4. A somewhat unexpected twist for investors in 2025: the strong performance of international stocks.

After years of being the underdog, few were paying attention to overseas stocks.

Last year’s success in the international arena, much like the surprise in gold, underscores a fundamental truth.

Markets move in cycles and aren’t reluctant to defy even the most confident forecasts.

Why the strong intentional returns?

- Look no further than dollar weakness, as the move in currencies inflated returns on foreign assets when converted back into dollars.

- Looser fiscal policies caught the attention of investors, especially in European countries.

- Nagging worries about Fed independence spooked some investors, encouraging a flow of cash into international stocks.

- European and many international markets sport lower valuations, which helped attract investors.

- Ongoing trade tensions and tariff uncertainty weighed on US sentiment.

Bottom line—Holding global equities reduced home-country concentration and currency risk. Cyclical shift: After years of equity dominance, return cycles favored international markets last year.

A look ahead

As 2024 came to a close, the average forecast among 15 analysts placed the S&P 500 at 6,643 for year-end 2025, per the CNBC 2025 survey of market strategists. That implied an advance of about 13% from the 2024 year-end closing price of 5,882.

On December 31, 2025, the S&P 500 closed at 6,845.50. All in all, not bad for Wall Street’s seers. But is this normal? Do the best and brightest from the top Wall Street firms typically nail their year-end target?

The short answer is no. Let’s review Figure 3 below. The average forecast is represented by the blue bar.The actual return is in red.

Forecasts have historically varied by a wide margin over the last quarter of a century. The average miss per year between 2000 and 2024: 14.1 percentage points.

The widest miss was in 2008. In 2005, analysts hit the mark.

Given this year’s closing price of 6,845.50, that would amount to an advance of 11.4%, which is generally in line with the long-term average.

But let me also stress that, while long-term and patient investors have been rewarded, the S&P 500 rarely produces an annual advance that comes close to the average. Annual gains or losses can vary by a wide margin. In fact, only four years during that period, between 1980 and 2025, came within plus/minus percentage points of the average in Figure 4.

From 1980 to 2025, when the S&P 500 Index finished higher, the average increase was 19.1%. When the index finished lower, the year’s average loss was 13.8% (dividends reinvested).

The index delivered an annual gain in 83% of years and finished lower 17% of the time (data from LPL Research and DJ Indices; past performance does not guarantee future results).

Why do analysts struggle to hit the mark? Strategists grapple with human behavior and the unknown. As noted above, forecasts don’t always pan out. A bullish case can be advanced for 2026—expected profit growth, expected economic growth, and the consensus forecast for stable or falling interest rates. Yet, too much optimism leaves little room for disappointment.

Stocks are richly valued, much as they were at the beginning of 2025. The S&P 500 is heavily skewed toward the top 10 largest companies. Plus, when markets are priced for perfection, minor disappointments can lead to lower prices.

We saw that last year when steep tariffs were initially levied. When the dark cloud from tariffs began to clear, major market indexes recovered and moved to new highs.

Since 1980, maximum pullbacks during the year averaged 14.1% (Figure 4). In 2025, the maximum peak-to-trough drawdown for the S&P 500 was a steep 18.9%. Still, the average annual change was +13.3% (dividends reinvested).