On Friday, the U.S. Bureau of Labor Statistics reported that nonfarm payrolls increased by 50,000 in December, underscoring a year of persistently sluggish job growth.

The unemployment rate offered a glimmer of optimism, edging down to 4.4%. November’s 4.6% rate was revised to 4.5%.

Despite upbeat economic growth, businesses have scaled back hiring after rapidly adding employees in 2022, as the economy reopened.

The unemployment rate is low, suggesting some equilibrium between the demand and supply of workers. Layoffs measured by first-time claims for unemployment insurance signal that layoffs are low, but firms aren’t adding many new jobs.

It’s what many economists are calling a “low hire, low fire” economy. Note the number of long-term unemployed (jobless for 27 weeks or more) is up by 397,000 versus one year ago (US BLS).

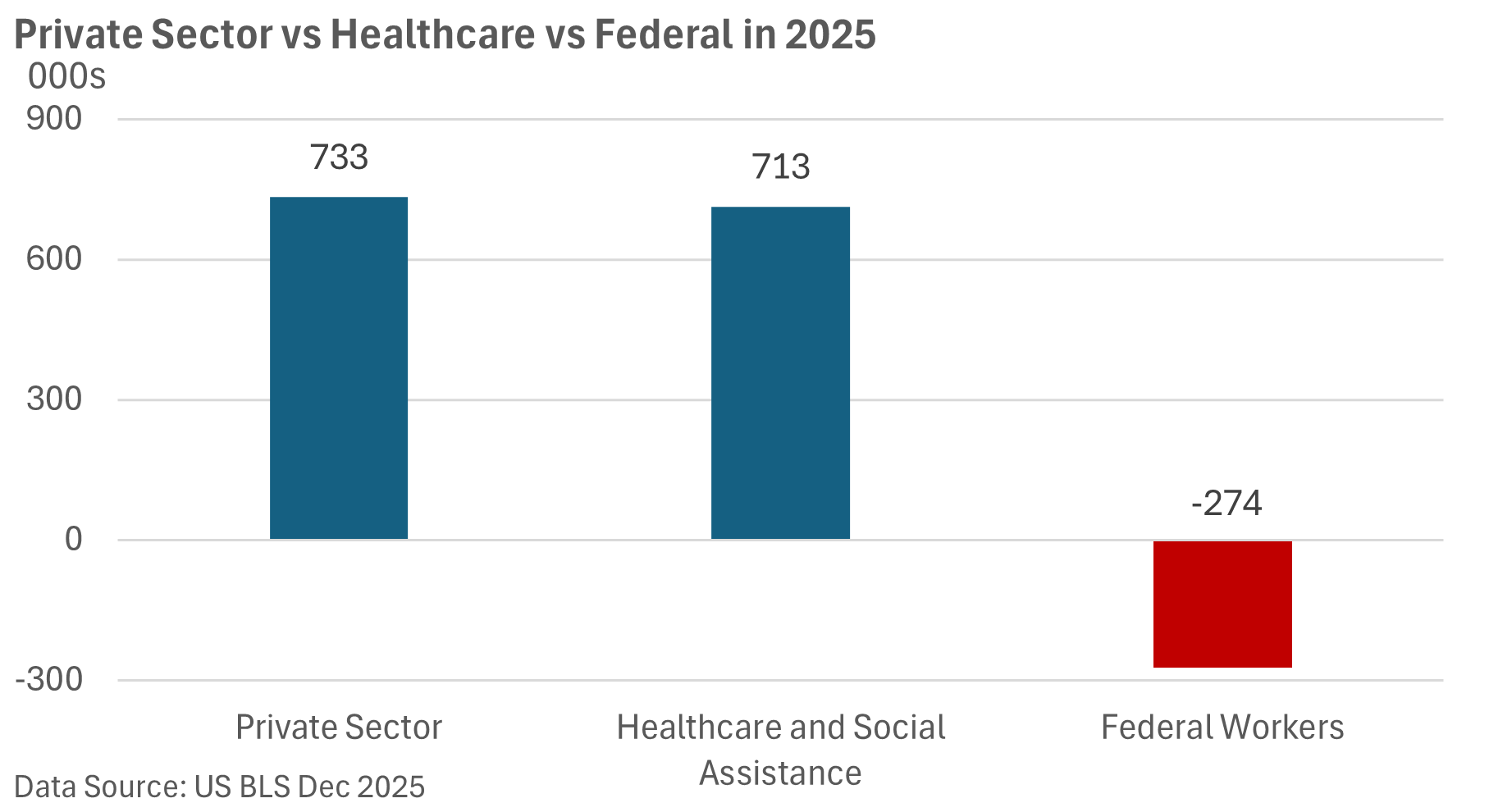

The graphic below sheds some light on job creation in 2025.

During 2025, private-sector payrolls rose by 733,000, with nearly all the gains occurring in one sector—healthcare. Meanwhile, the federal workforce was down by 274,000 last year. Manufacturing shed 68,000 positions.

For investors, economic growth equates to earnings growth at the nation’s largest companies. But there has been a disconnect between solid economic growth and subdued job gains.

While the drop in the jobless rate lowers already low odds of a January rate cut per a closely followed gauge from the CME Group, there’s little to suggest the Fed will abandon its accommodative stance anytime soon.

On Friday, the Dow and the S&P 500 Index both closed at record highs.