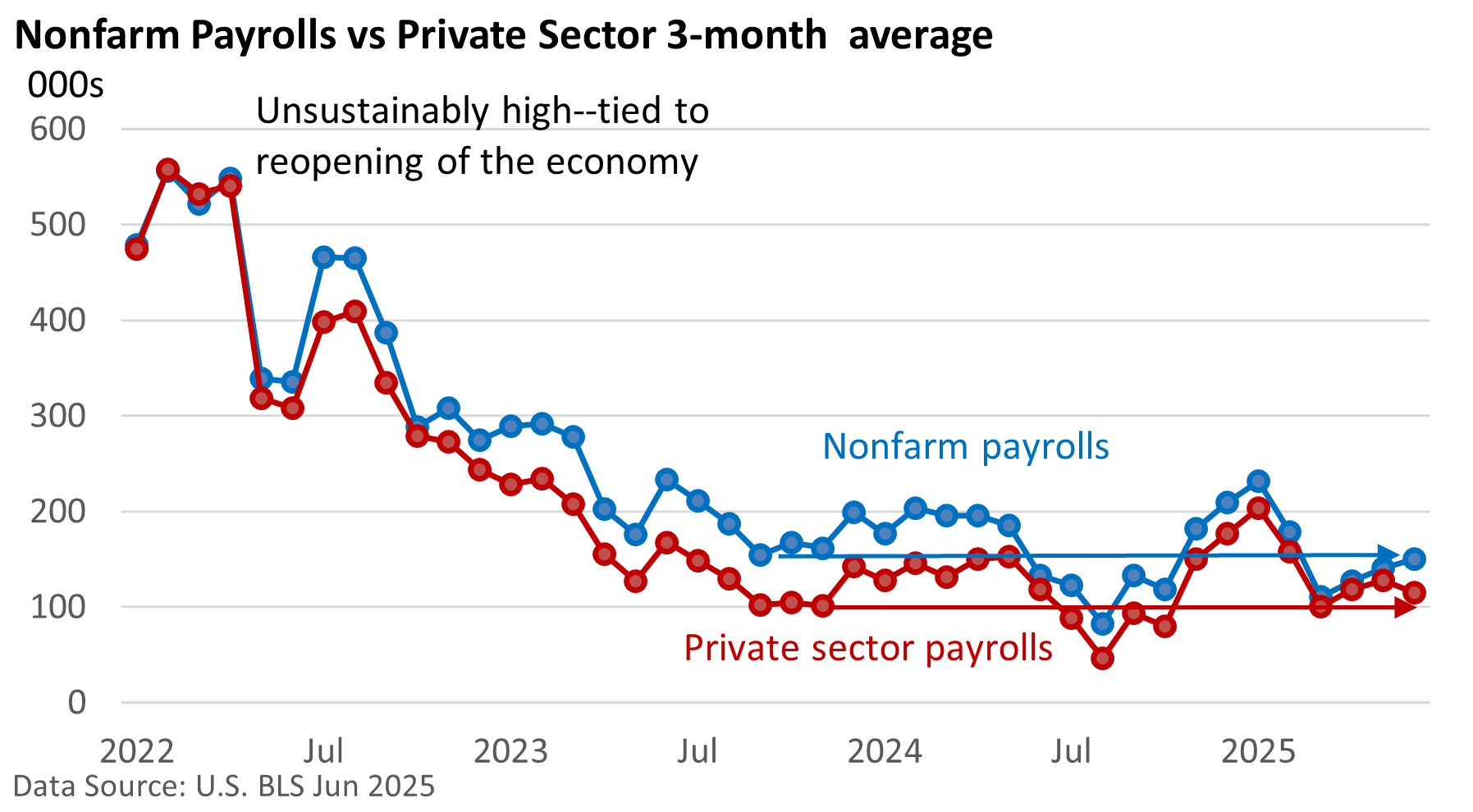

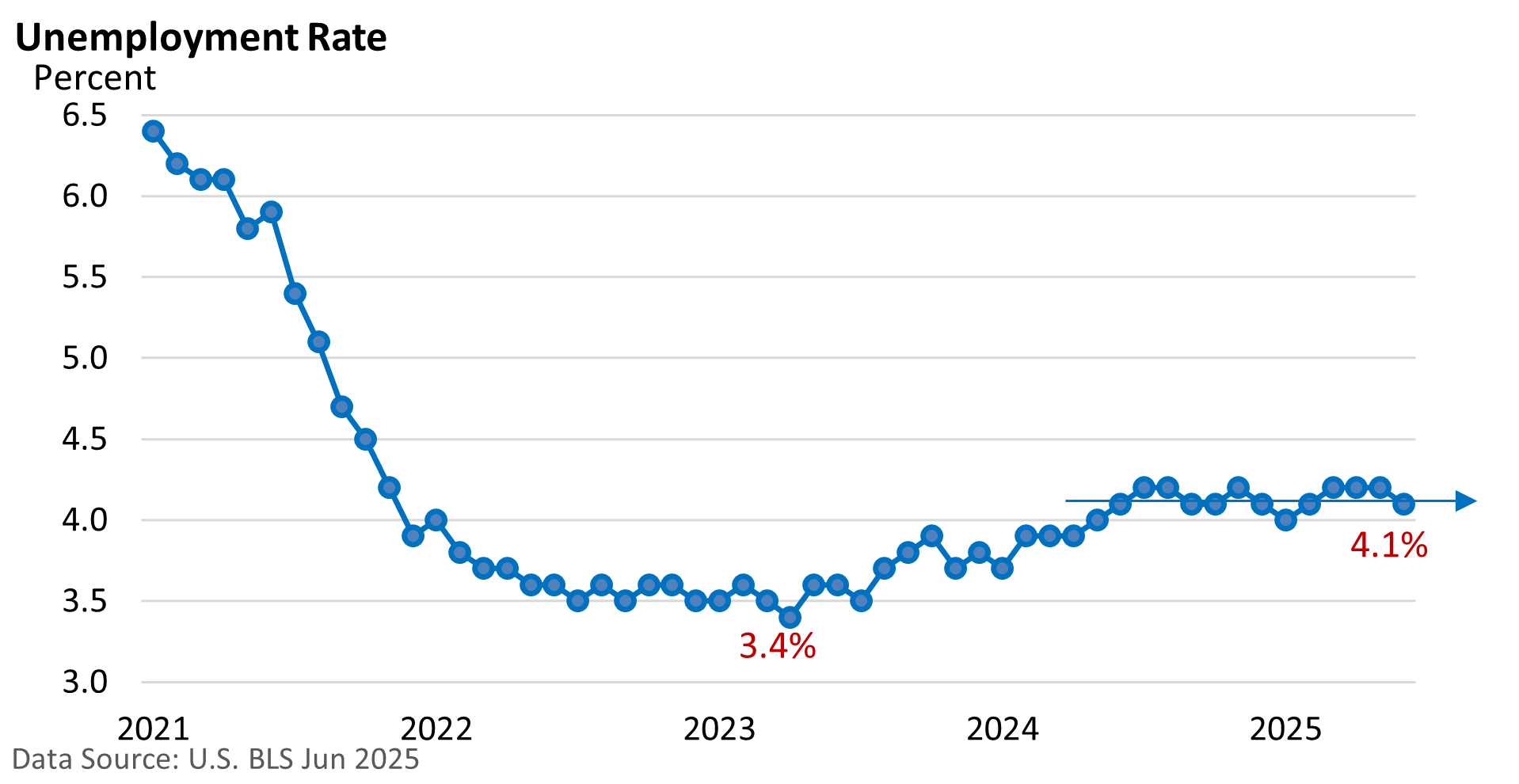

The US Bureau of Labor Statistics reported that nonfarm payrolls rose 147,000 in June, topping the forecast of 110,000 (Wall Street Journal), while the unemployment rate fell to 4.1% in June from 4.2% in May. Private sector jobs rose a more muted 74,000.

The headline number is encouraging, and continued talk about the decline of the labor market has once again missed the mark, but the headline likely exaggerates overall strength in June.

Let’s hit the high points. Again, payrolls rose 147,000, but half the increase occurred in government jobs.

Federal employment fell by 7,000 in June, marking the fifth consecutive monthly decline. In contrast, state government payrolls rose by 47,000, and local government jobs increased by 33,000—an unusually strong gain driven largely by hiring in education. The data appears quirky, however, likely reflecting seasonal distortions tied to the end of the school year.

Outside of government, the big contributors to the private sector were leisure & hospitality and health care.

Yet, taking the long view, we really haven’t seen that much change in hiring over the last couple of years.

One piece of good news: the jobless rate fell. It has been in a narrow range for about a year.

Hiring wasn’t robust in the private sector last month, but the number of jobless filing for unemployment insurance remains low, according to the Department of Labor.

Bottom line—investors reacted favorably, and the major averages finished higher, including new records for the S&P 500 Index and the Nasdaq Composite, according to MarketWatch.