by Mark Chandik | Jan 21, 2025

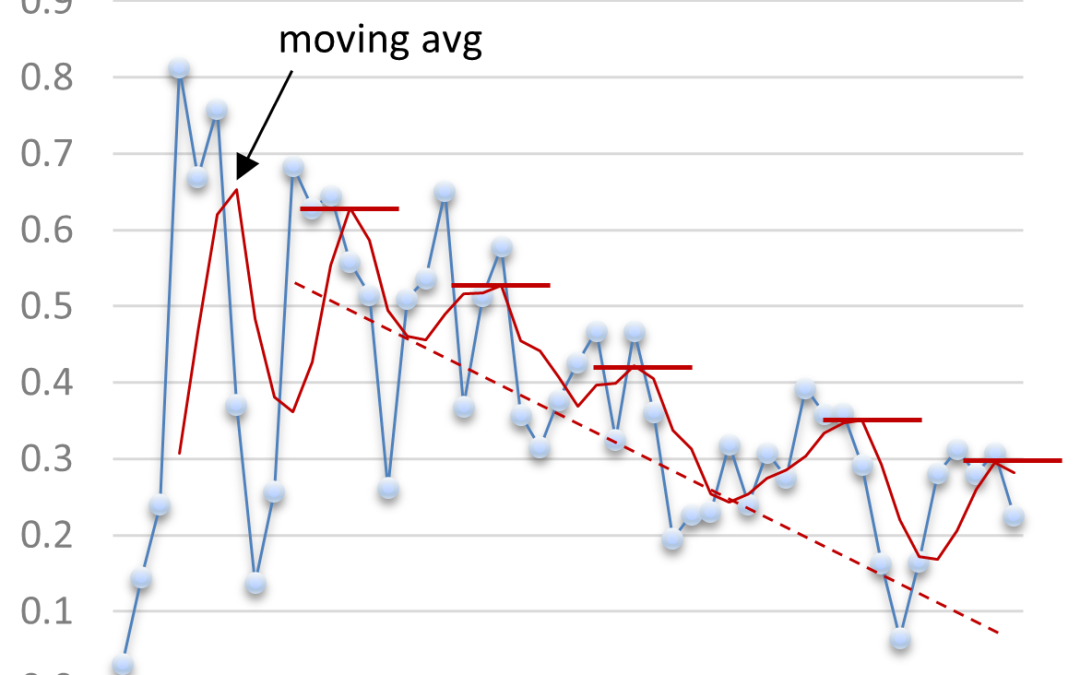

It’s prudent to cautiously eye rapid changes in market sentiment caused by short-term traders. A week ago, our summary focused on a strong jobs report, rising bond yields, and general concerns about inflation. There was a sense of despair among traders at week’s end....

by Mark Chandik | Jan 13, 2025

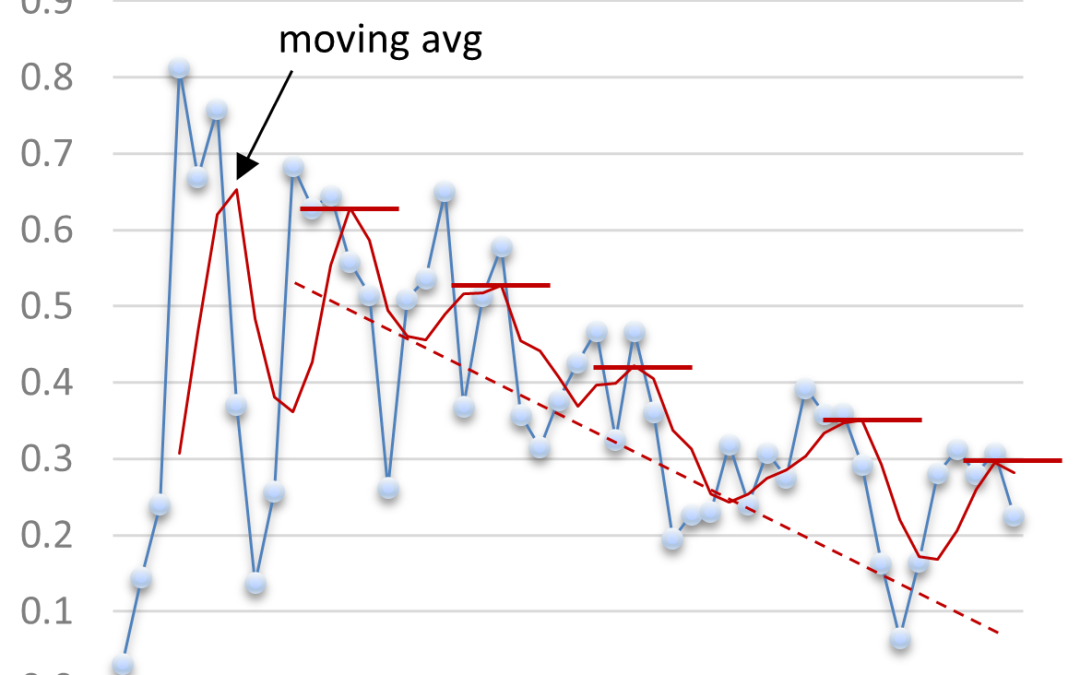

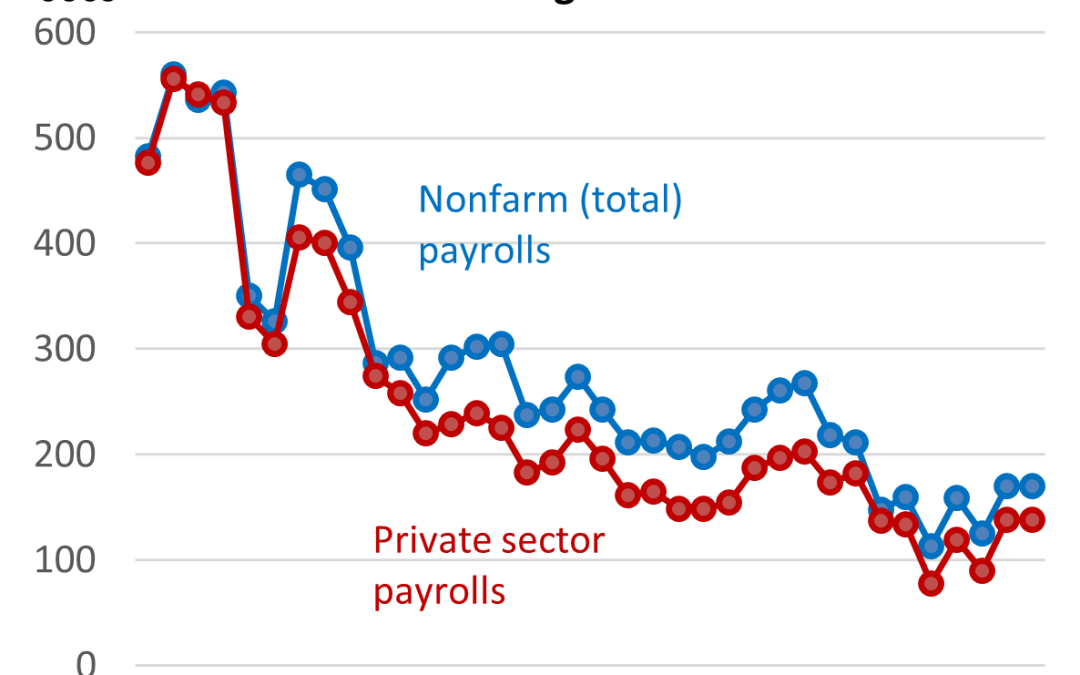

On Friday, the U.S. Bureau of Labor Statistics reported that nonfarm payrolls grew by 256,000 in December, easily surpassing analyst expectations of a more modest increase of 155,000 (Wall Street Journal). The unemployment rate eased to 4.1% last month from 4.2% in...

by Mark Chandik | Jan 6, 2025

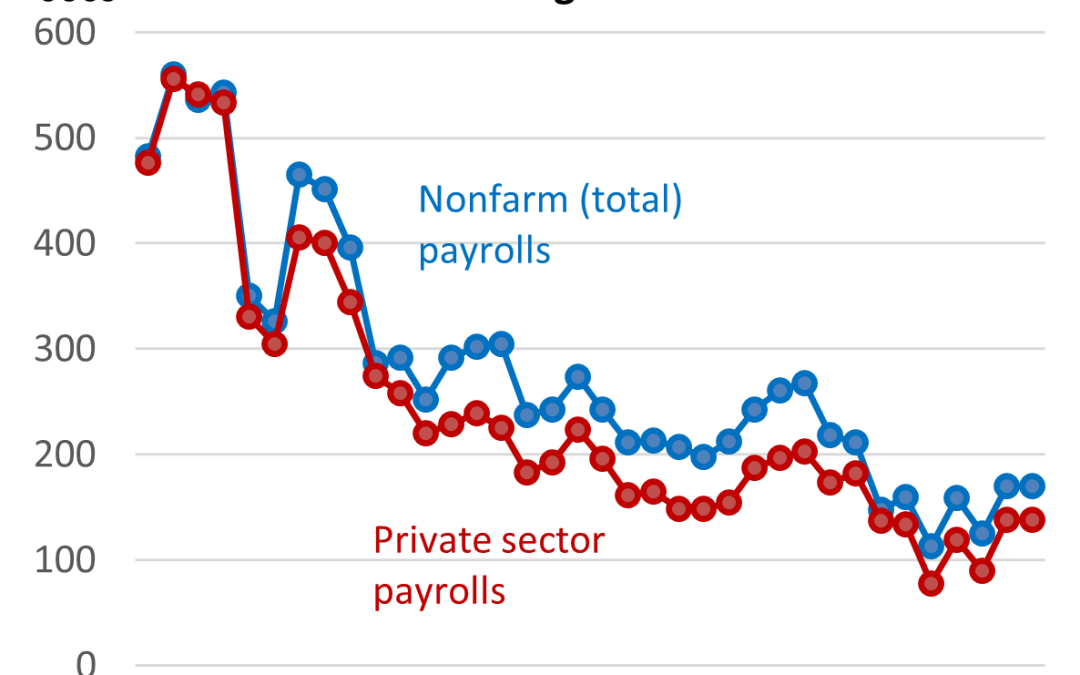

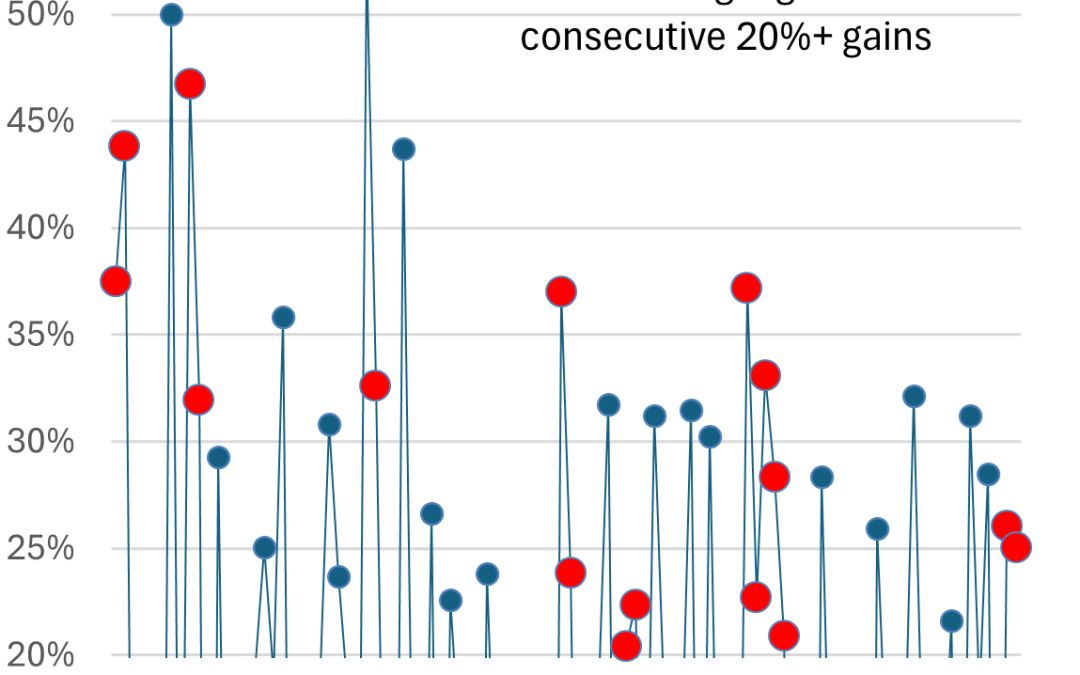

In late 2022, a new bull market emerged from the ashes of a nine-month bear market, leading to 2023’s impressive rise of over 26% for the closely followed S&P 500 Index, according to S&P Global (including dividends reinvested). Cautious sentiment that...

by Mark Chandik | Dec 23, 2024

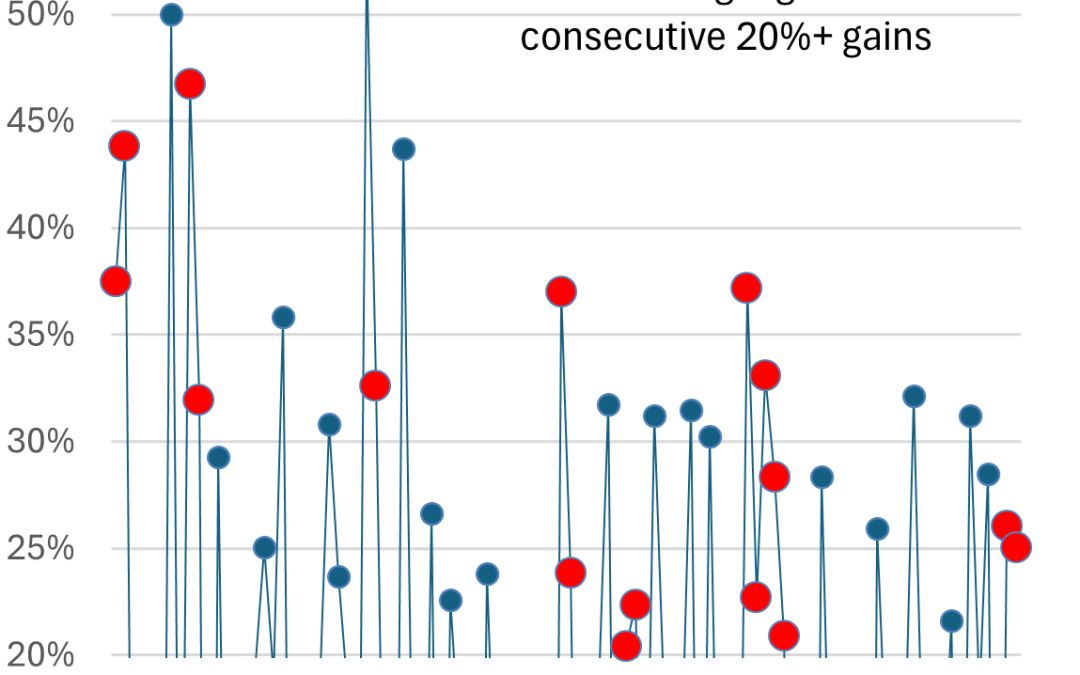

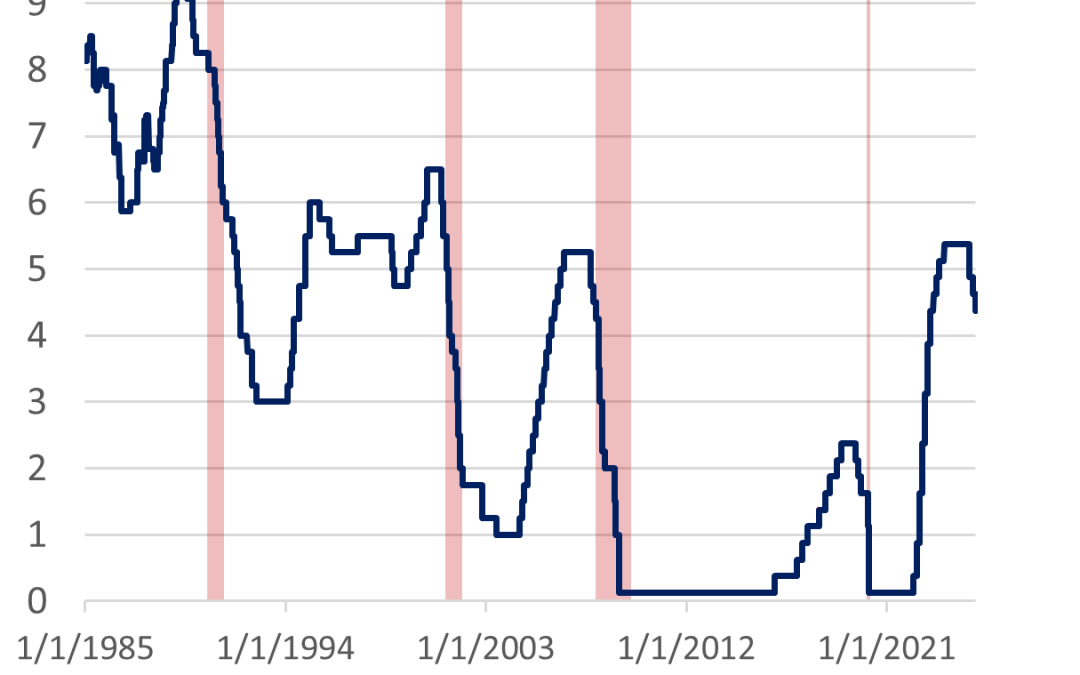

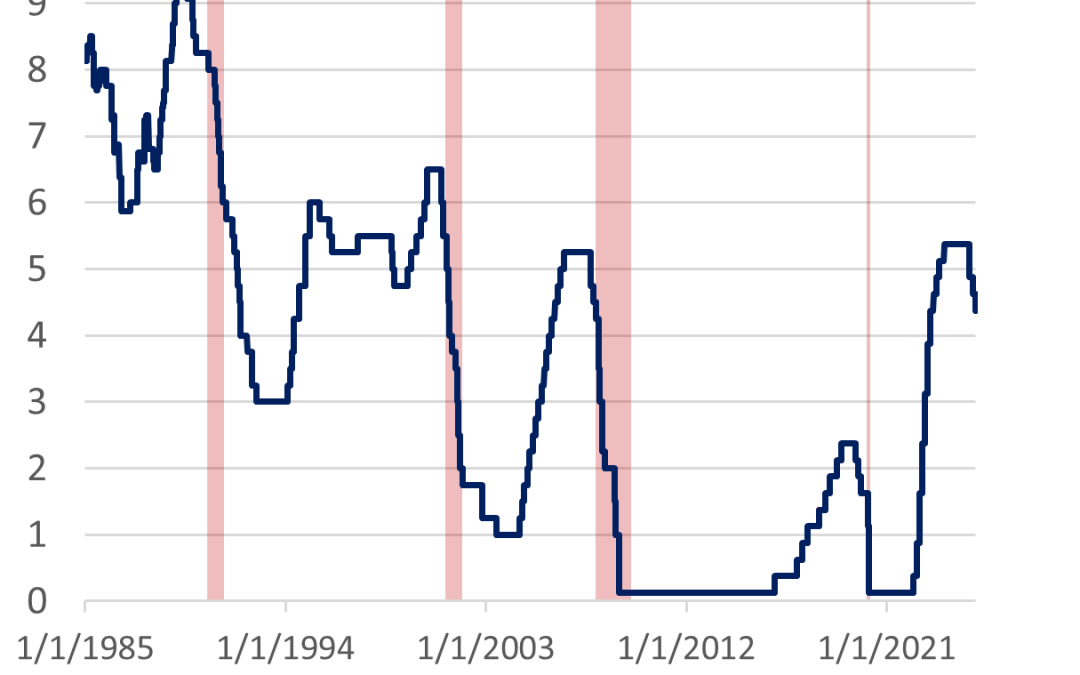

In a speech given nearly 70 years ago, then-Federal Reserve Chairman William McChesney Martin Jr. made a now-famous analogy when he said that during an expanding economy, the Fed should “remove the punch bowl” before the party gets out of hand. First things first, on...

by Mark Chandik | Dec 16, 2024

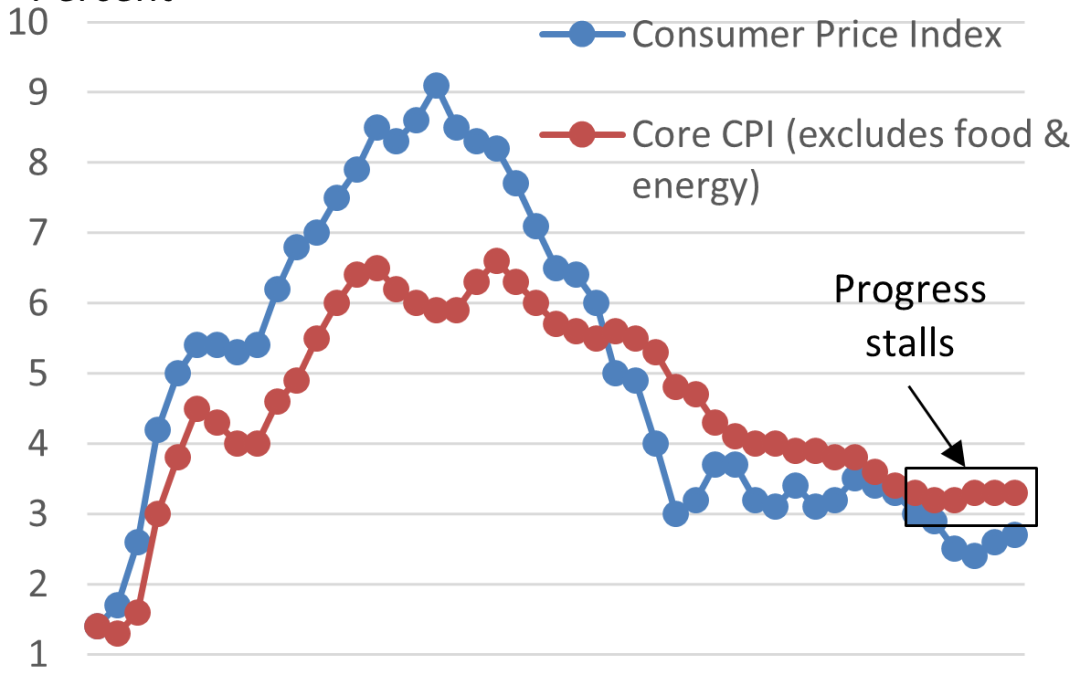

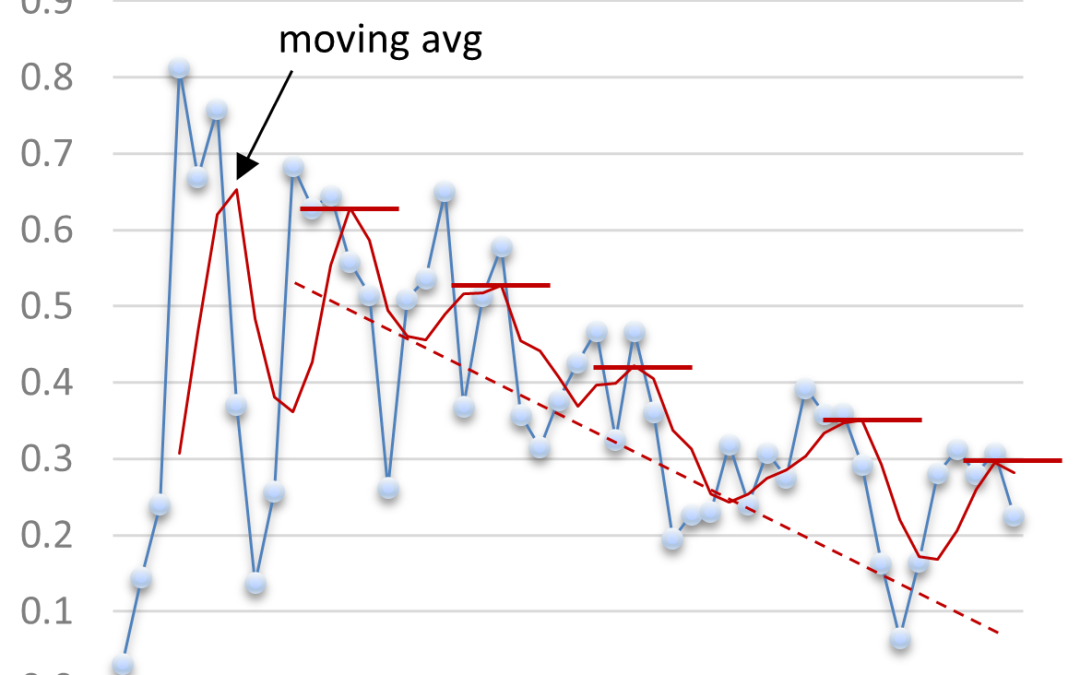

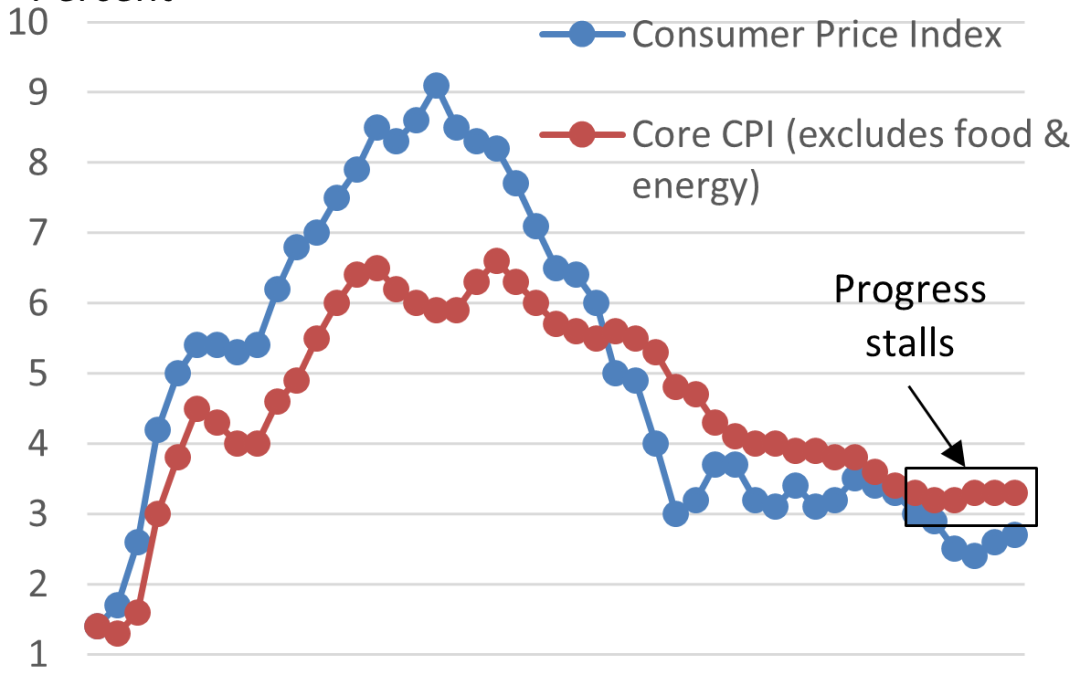

The monthly numbers are out, and while the rate of inflation is well off the 2022 peak, price hikes remain uncomfortably high. The U.S. Bureau of Labor Statistics reported that the Consumer Price Index (CPI) and the core CPI, which excludes food and energy, both rose...