by Mark Chandik | Jan 22, 2024

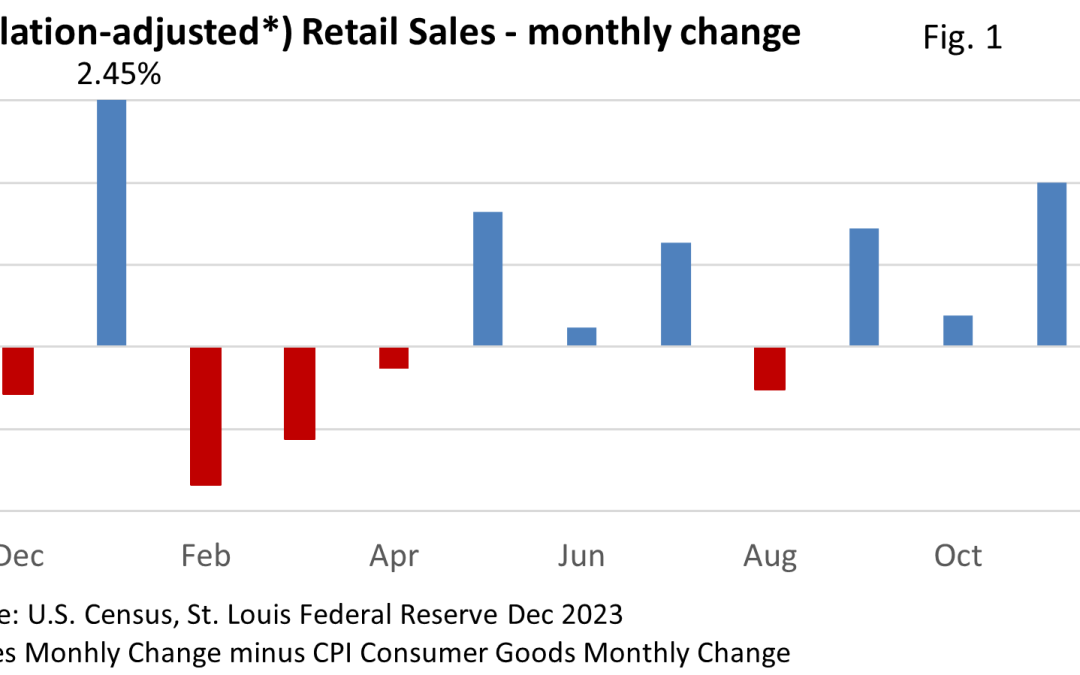

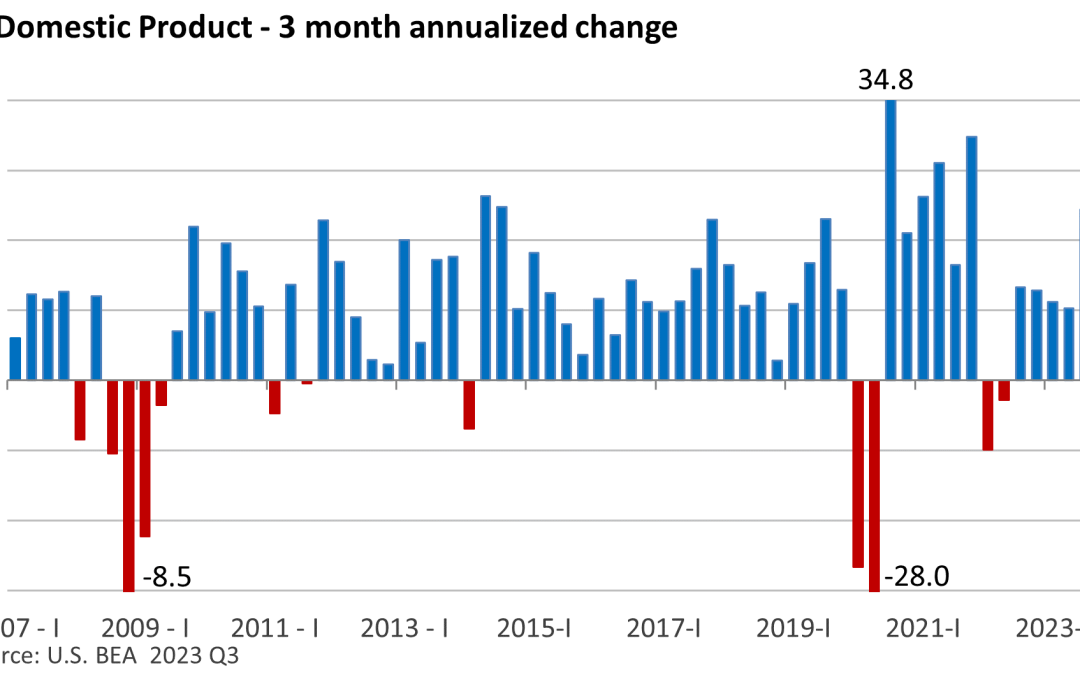

Weekly Market Commentary Economists have been warning for quite some time that Fed rate hikes will slow economic growth. Whether it results in a soft landing, which is the preferred outcome for investors, or a hard landing (recession), the rate hikes would be expected...

by Mark Chandik | Jan 16, 2024

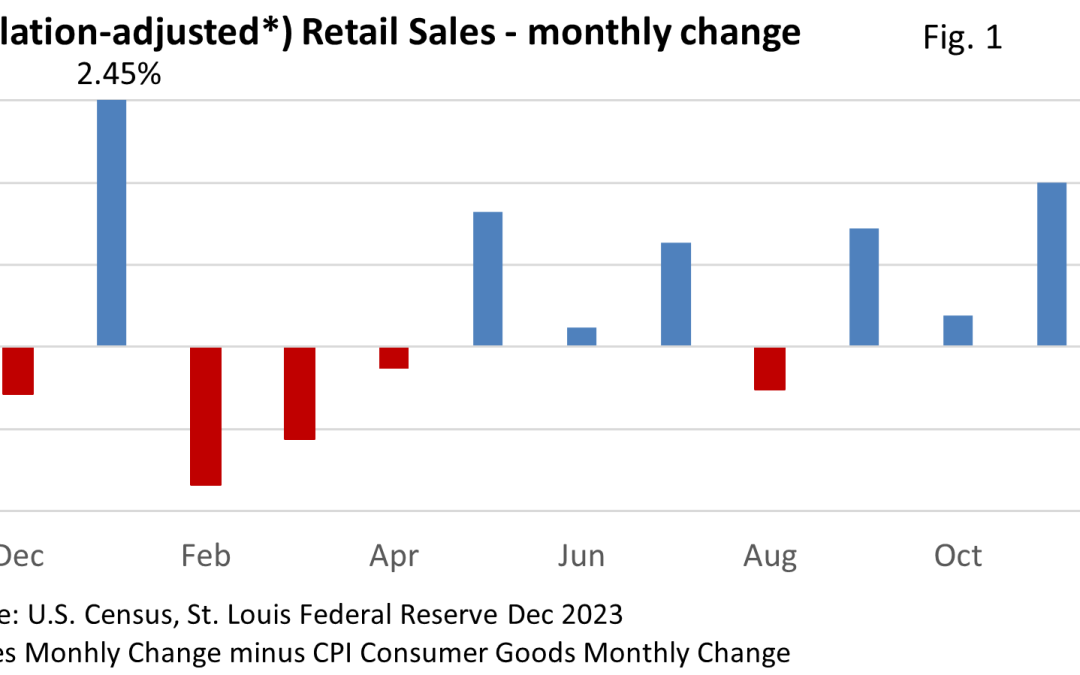

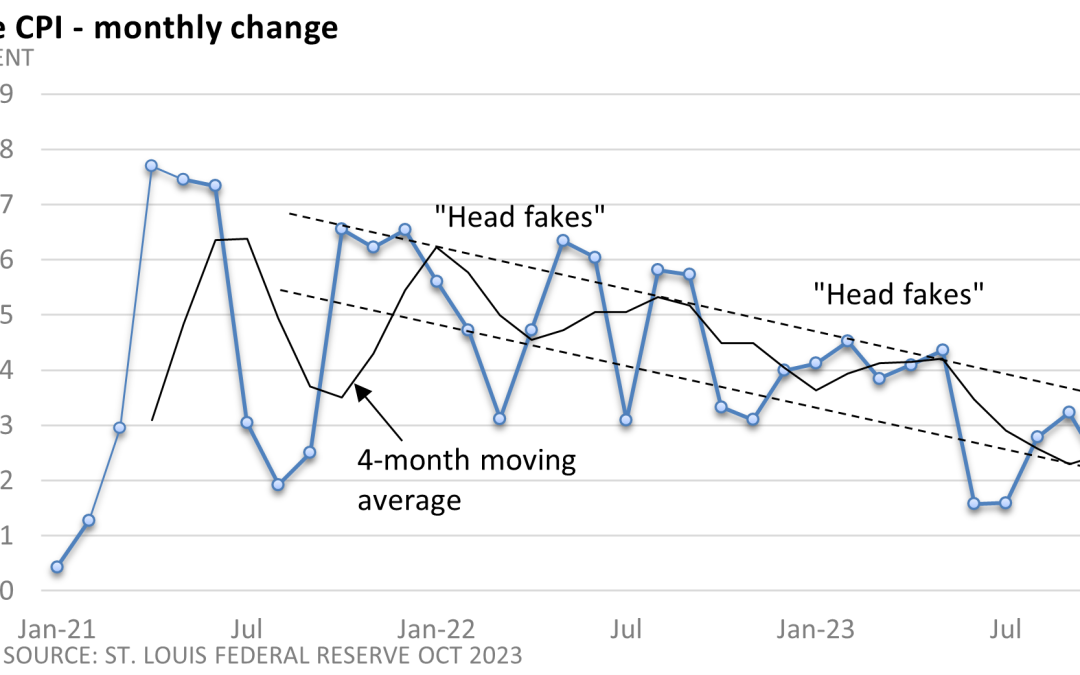

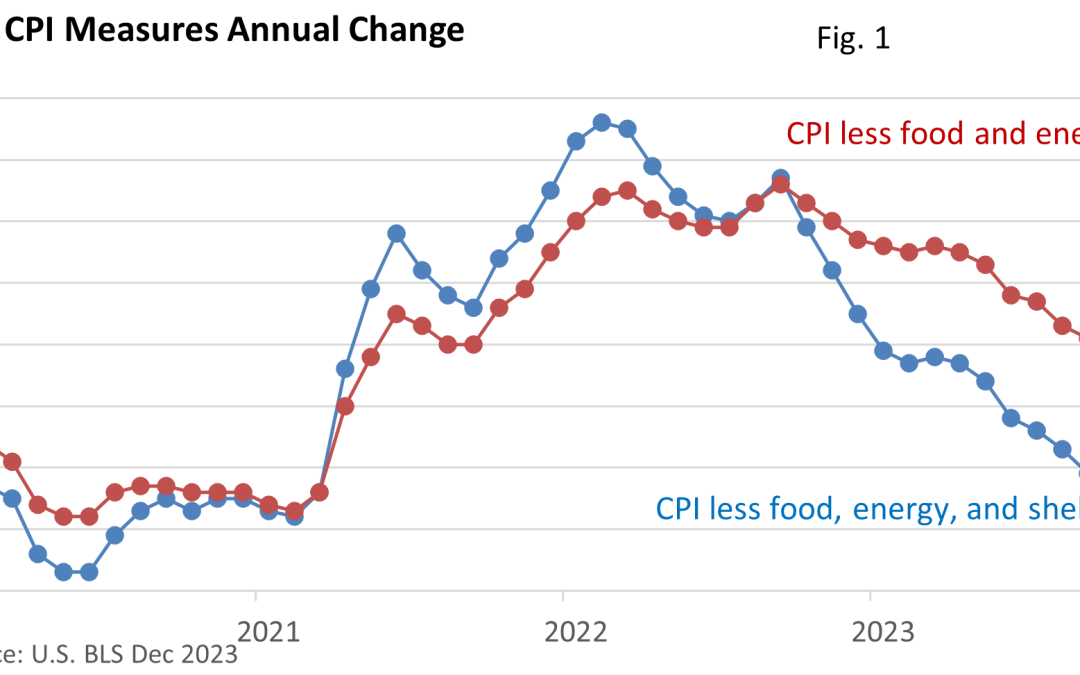

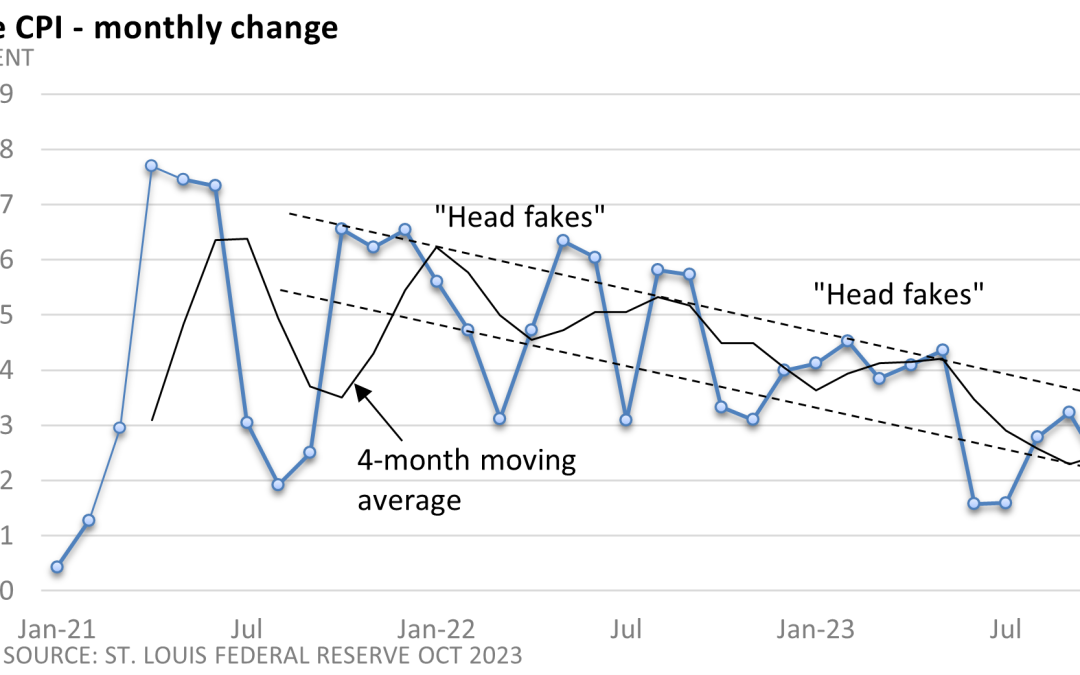

Weekly Market Commentary Investors eagerly anticipate the government’s monthly release of the CPI (Consumer Price Index). Why? Inflation affects everyone, and investors are no exception. The Federal Reserve’s efforts to curb inflation led to a bear market in 2022....

by Mark Chandik | Dec 28, 2023

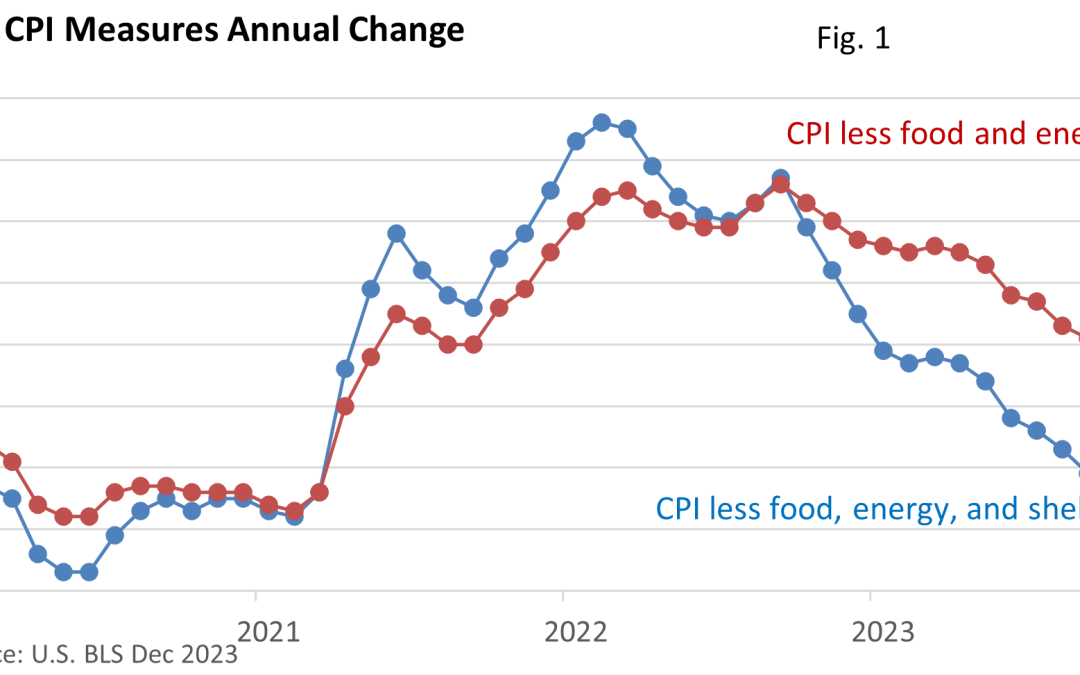

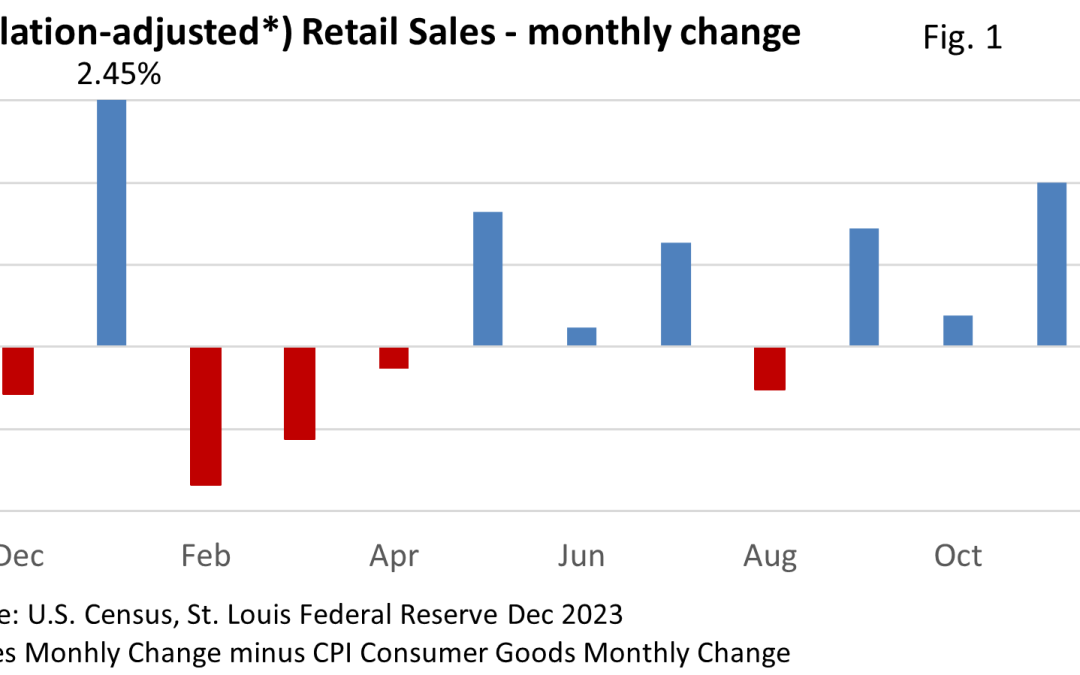

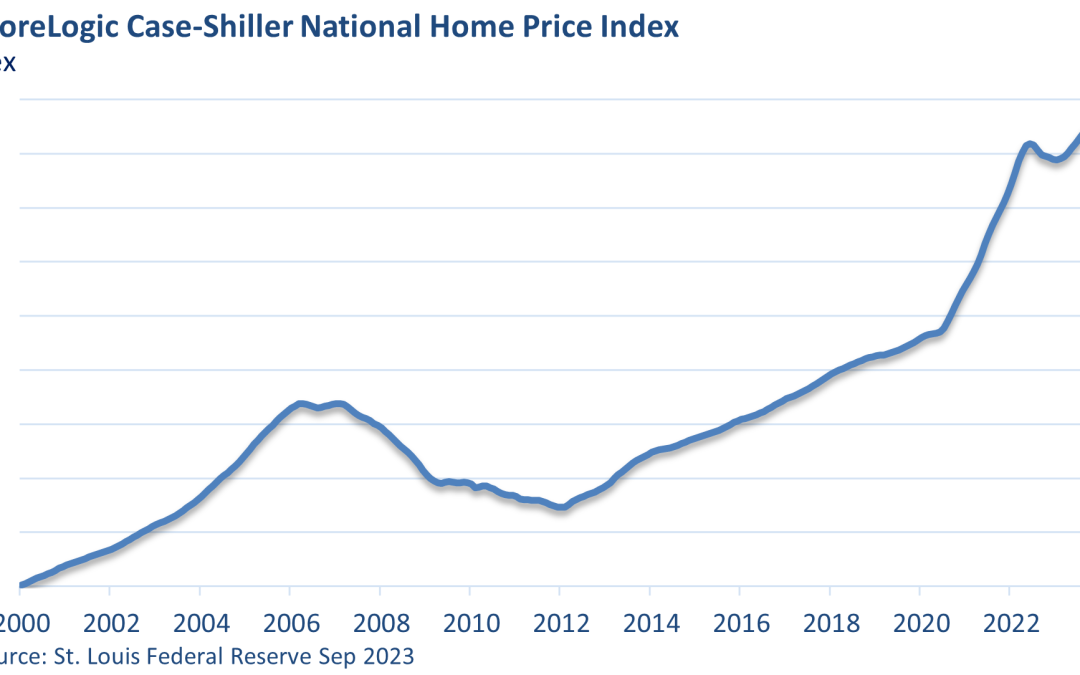

Weekly Market Commentary Mortgage rates have soared, and home sales are down sharply. Conventional wisdom would suggest that prices should be down. But housing prices have defied expectations, rising to record heights and locking first-time buyers out of the market....

by Mark Chandik | Dec 18, 2023

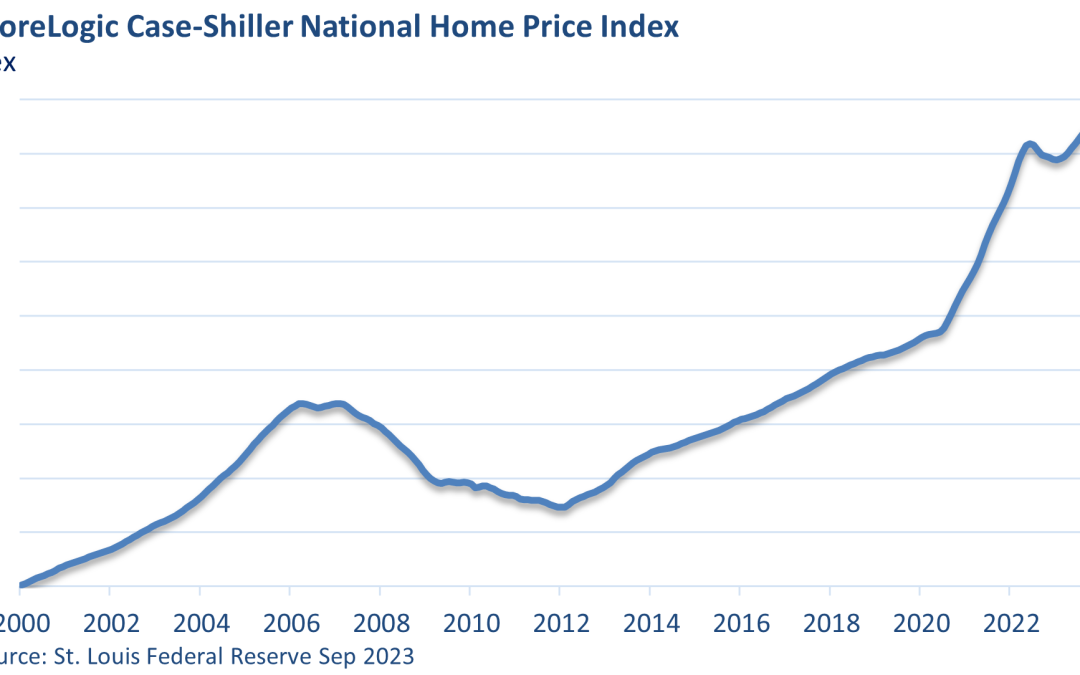

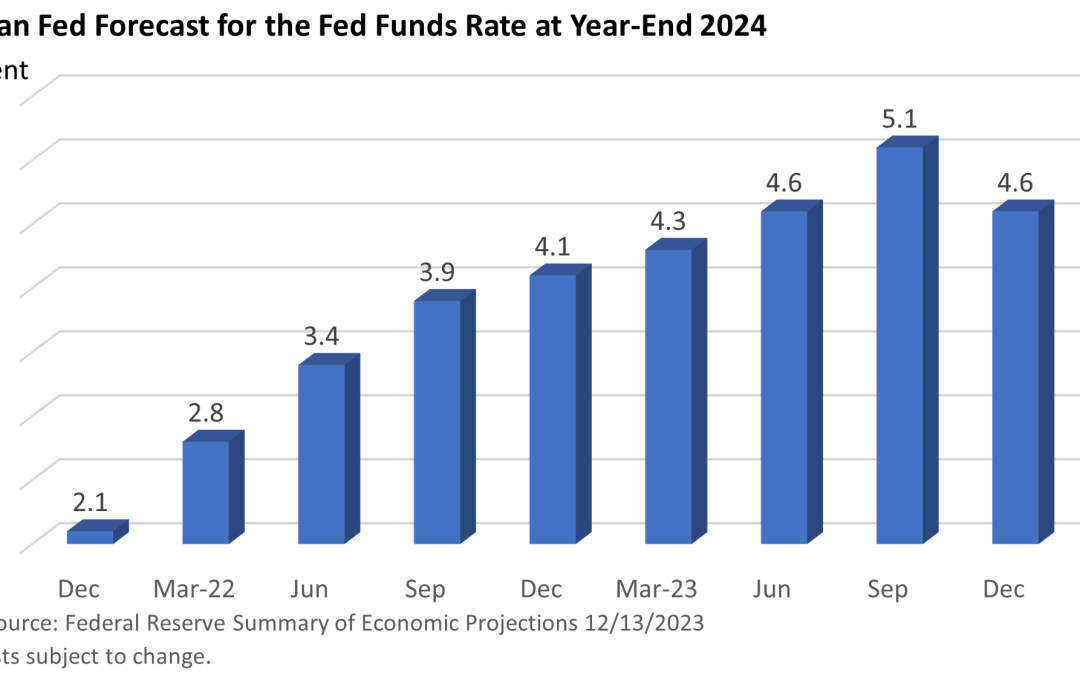

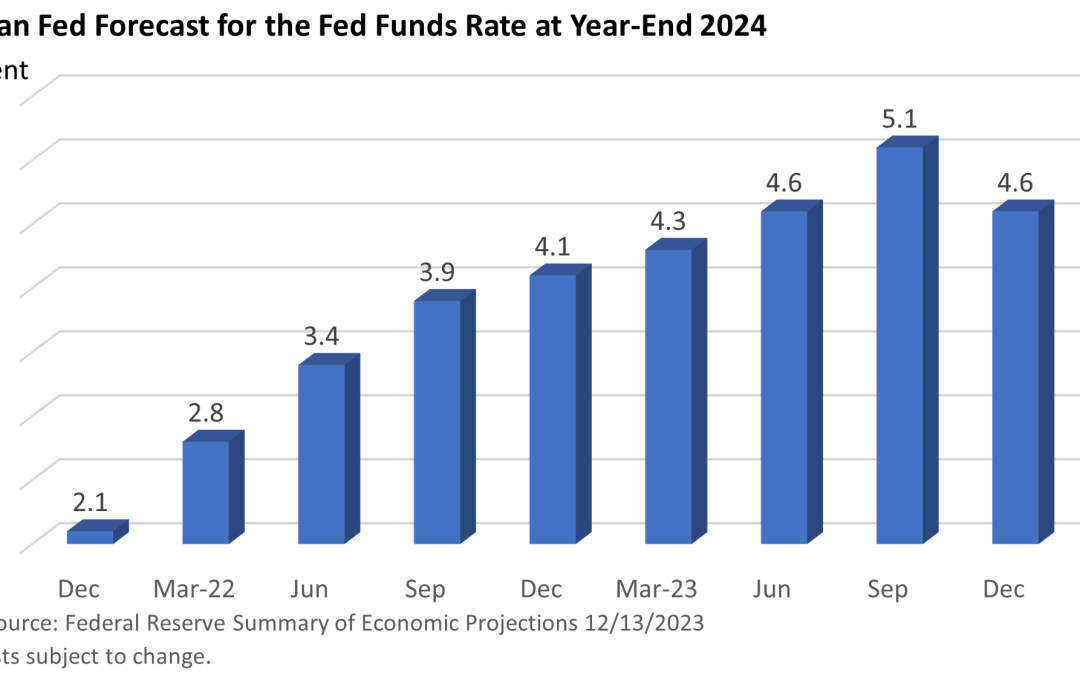

Weekly Market Commentary The meeting held by the Federal Reserve last week was the most consequential gathering of central bankers this year. The Fed held the fed funds rate at 5.25 – 5.50% as expected, but in so many words, the Fed pivoted on its rate stance. No...

by Mark Chandik | Nov 20, 2023

Weekly Market Commentary The U.S. Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) was unchanged in October from the prior month. It is up 3.2% from a year ago. Excluding volatile food and energy prices, the core CPI rose 0.2%. The core...

by Mark Chandik | Oct 30, 2023

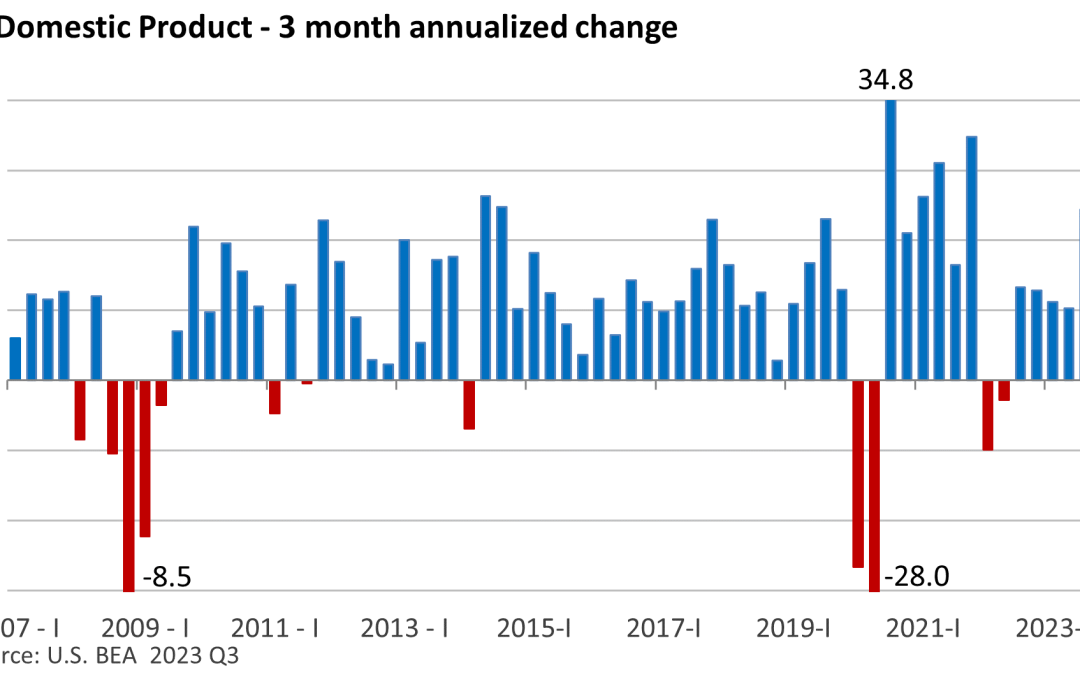

Weekly Market Commentary The U.S. Bureau of Economic Analysis (BEA) reported last week that Gross Domestic Product (GDP), which is the largest measure of goods and services for the economy, expanded at an annual pace of 4.9% in the third quarter. It’s the...