by Mark Chandik | Mar 6, 2023

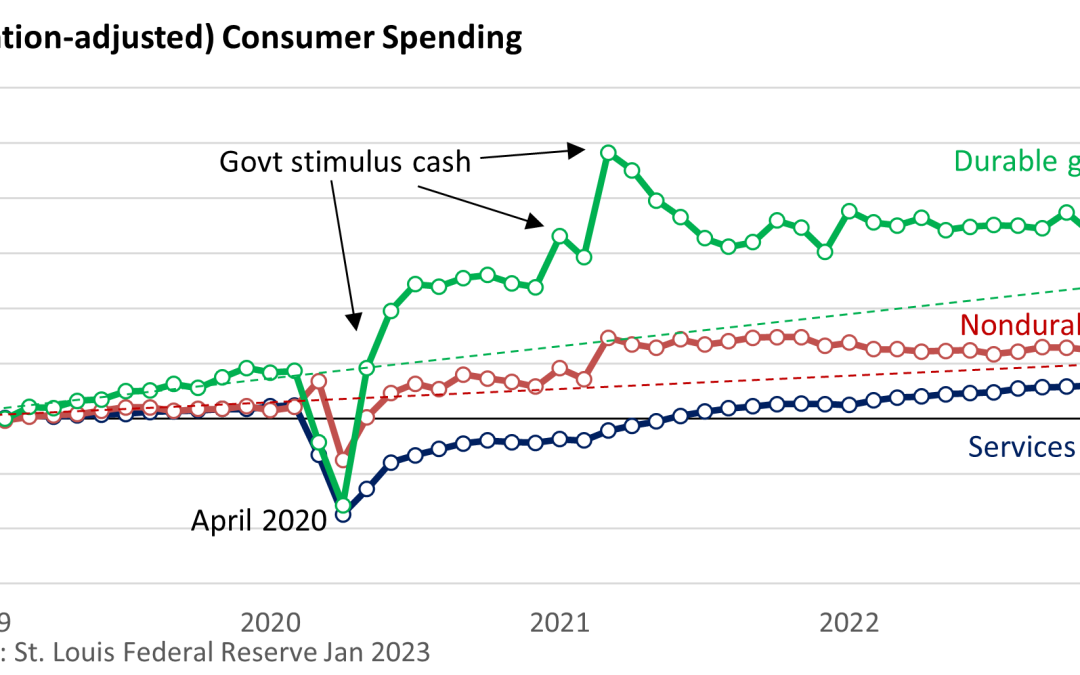

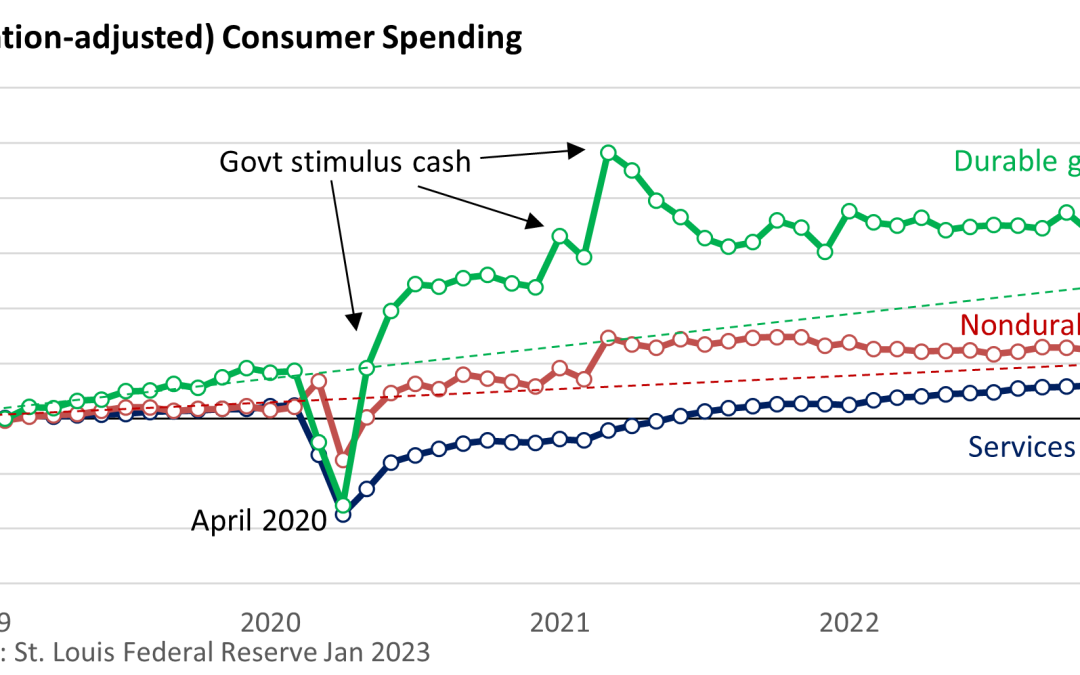

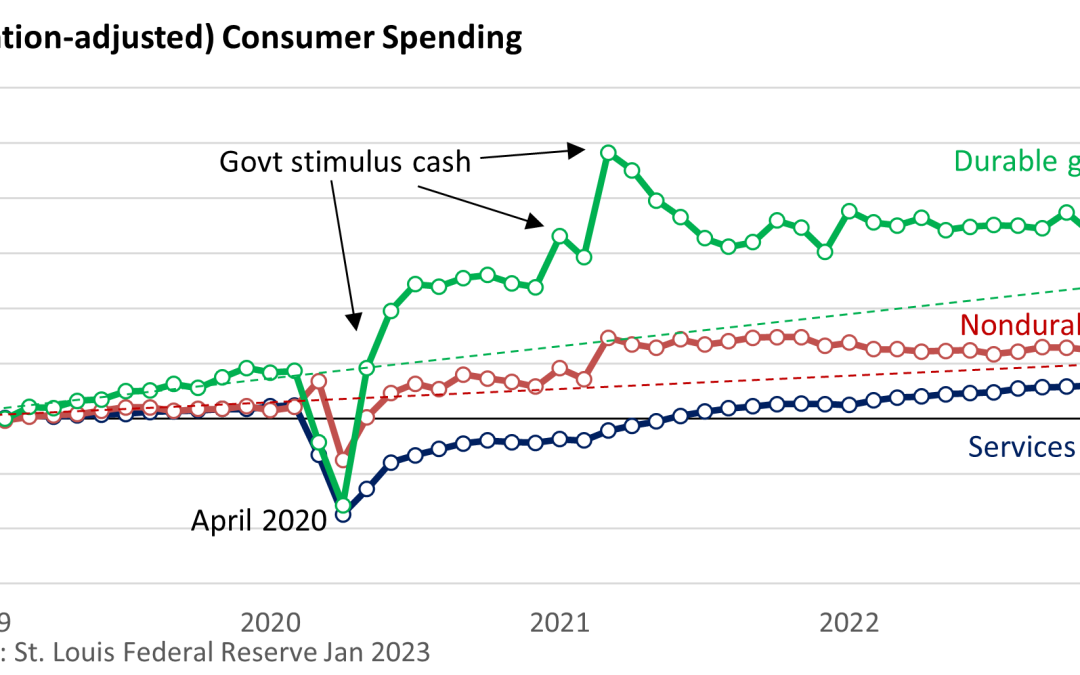

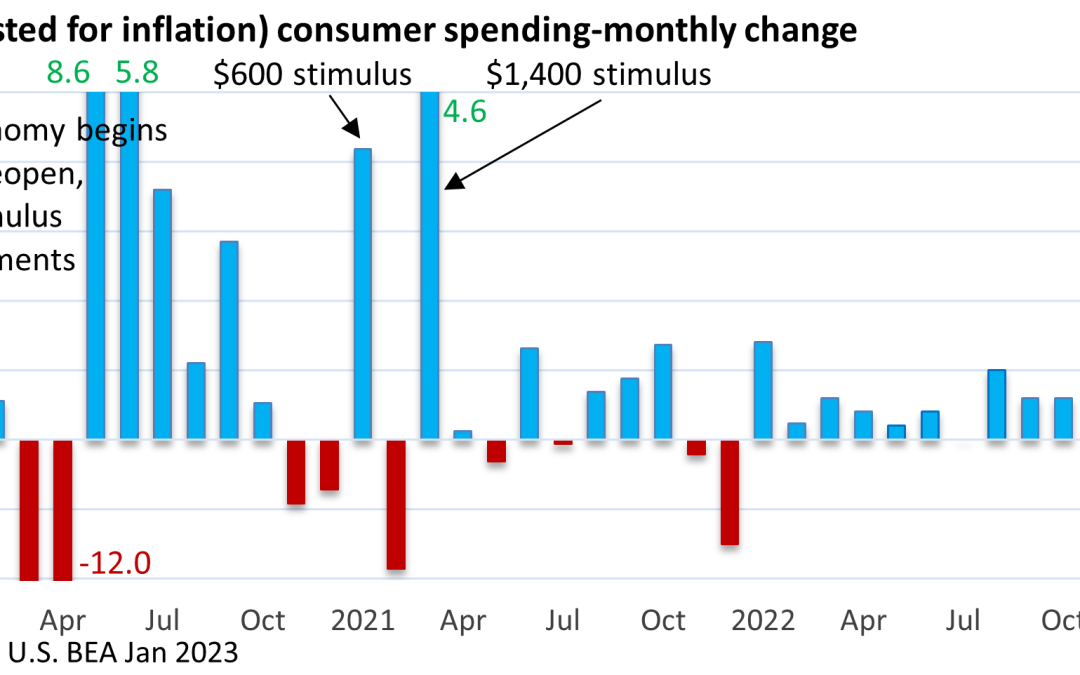

Weekly Market Commentary The economic distortions tied to that pandemic and the government’s massive response to prop up the economy have been far-reaching. Before continuing, let’s look at some facts and definitions. Consumer spending accounts for 70% of the total...

by Mark Chandik | Feb 27, 2023

Weekly Market Commentary Last year, the economy appeared to be headed toward one of two scenarios. There was a narrow path to what is called a ‘soft landing.’ A soft landing is a slowdown in economic growth that leads to a slowdown in inflation. It’s accomplished...

by Mark Chandik | Feb 21, 2023

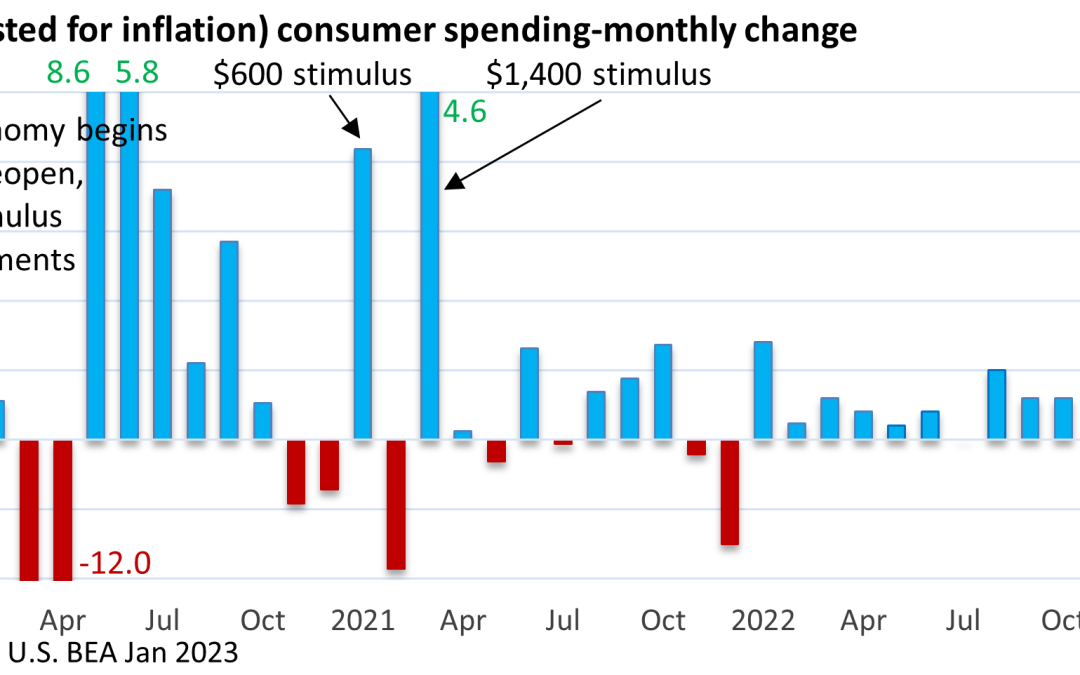

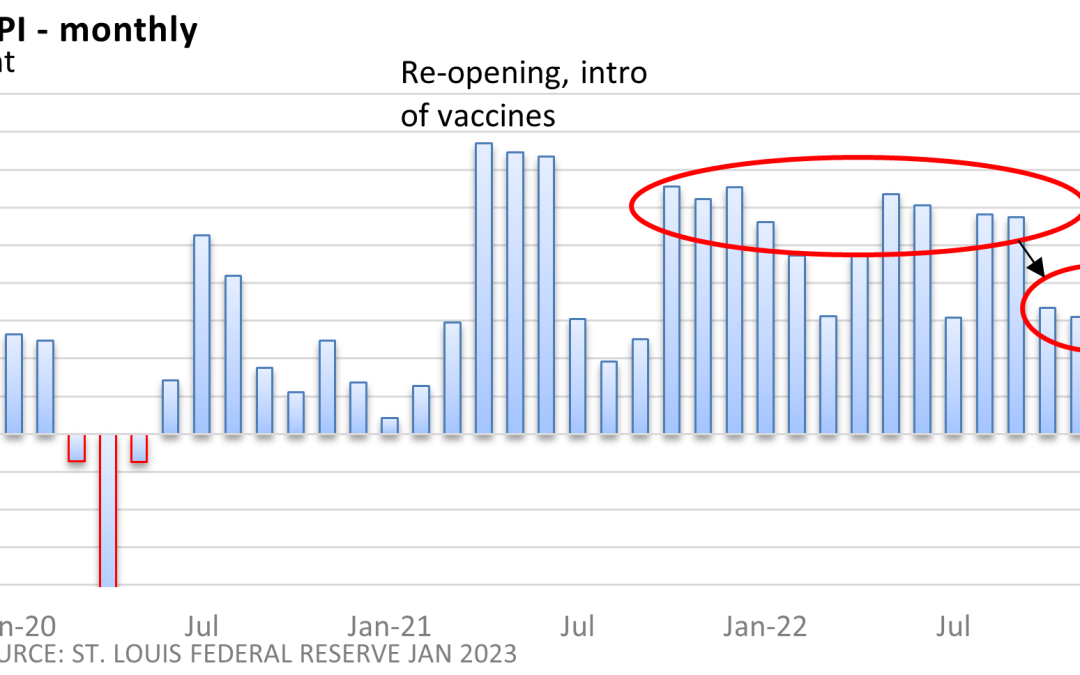

Weekly Market Commentary The Fed’s road to 2% annual inflation took a curious turn last week, disappointing some investors that had been expecting continued progress on inflation. The U.S. Bureau of Labor Statistics reported that the January Consumer Price Index...

by Mark Chandik | Feb 13, 2023

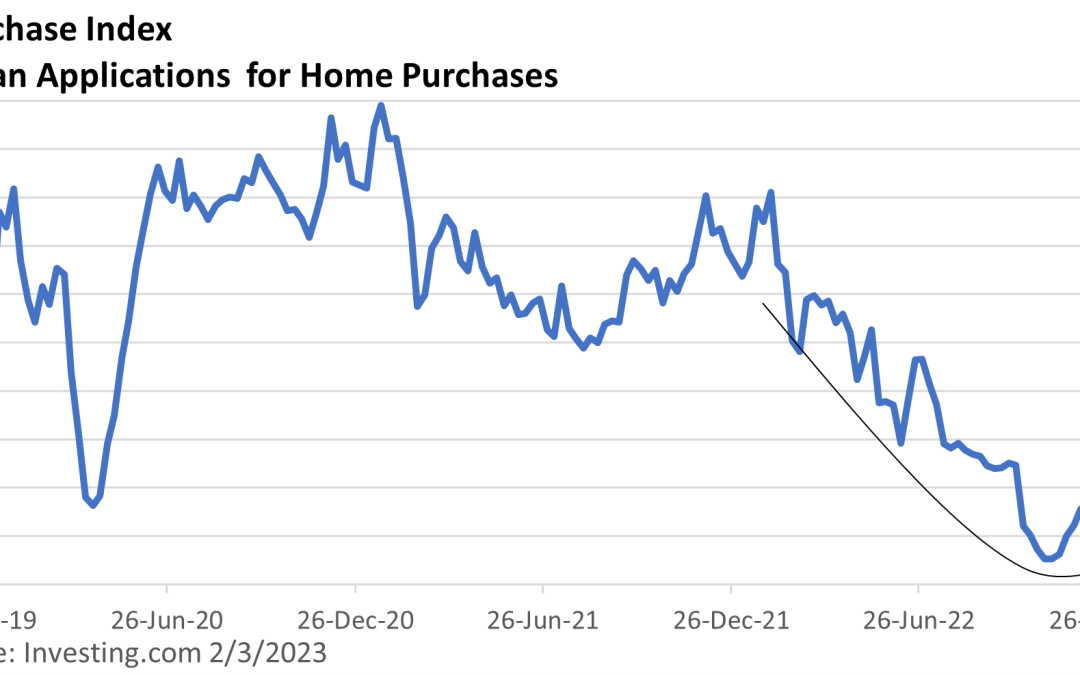

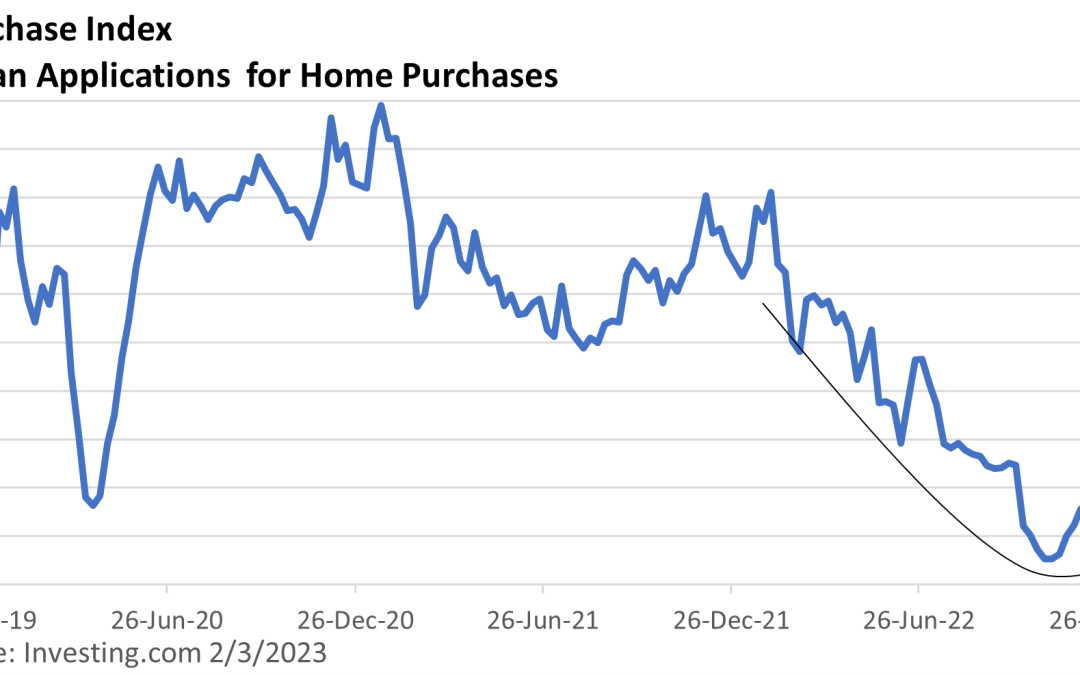

Weekly Market Commentary Rising interest rates are the result of the Federal Reserve’s campaign to snuff out inflation. The pain of rising rates has been felt in the financial sector. It has also been felt in housing. Housing sales tumbled since the beginning of 2022,...

by Mark Chandik | Feb 6, 2023

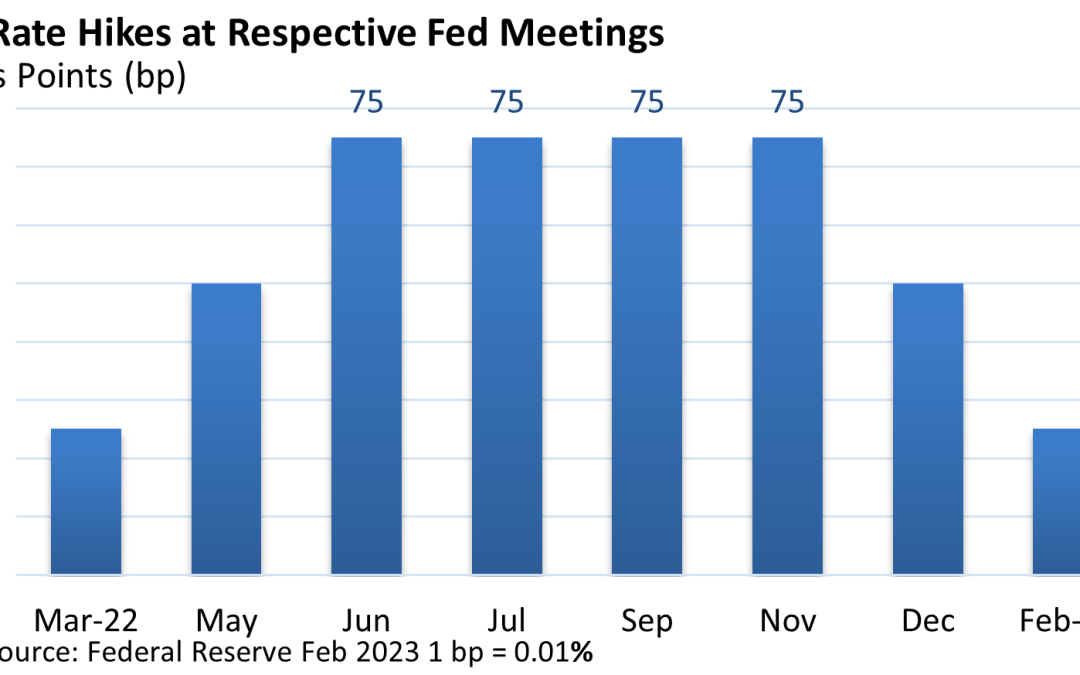

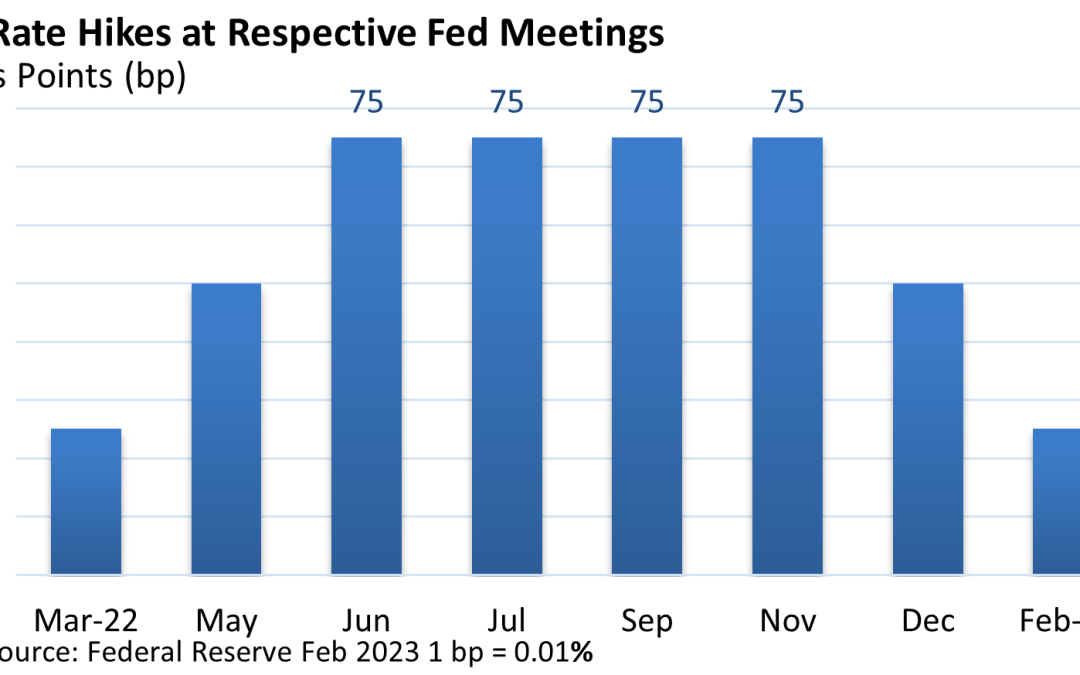

Weekly Market Commentary Last year, the Federal Reserve and Fed Chief Powell’s bite were probably worse than the bark. Rhetoric and commentary were forceful and were matched by a nearly unprecedented series of rate hikes, including four-straight 75 basis point (bp, 1...

by Mark Chandik | Jan 24, 2023

Weekly Market Commentary At the end of last year, Congress passed the SECURE Act 2.0, a follow-up to an overhaul of retirement laws passed just three years ago. The changes make it easier to save for retirement and may stretch out your savings while in retirement....