by Mark Chandik | Oct 28, 2024

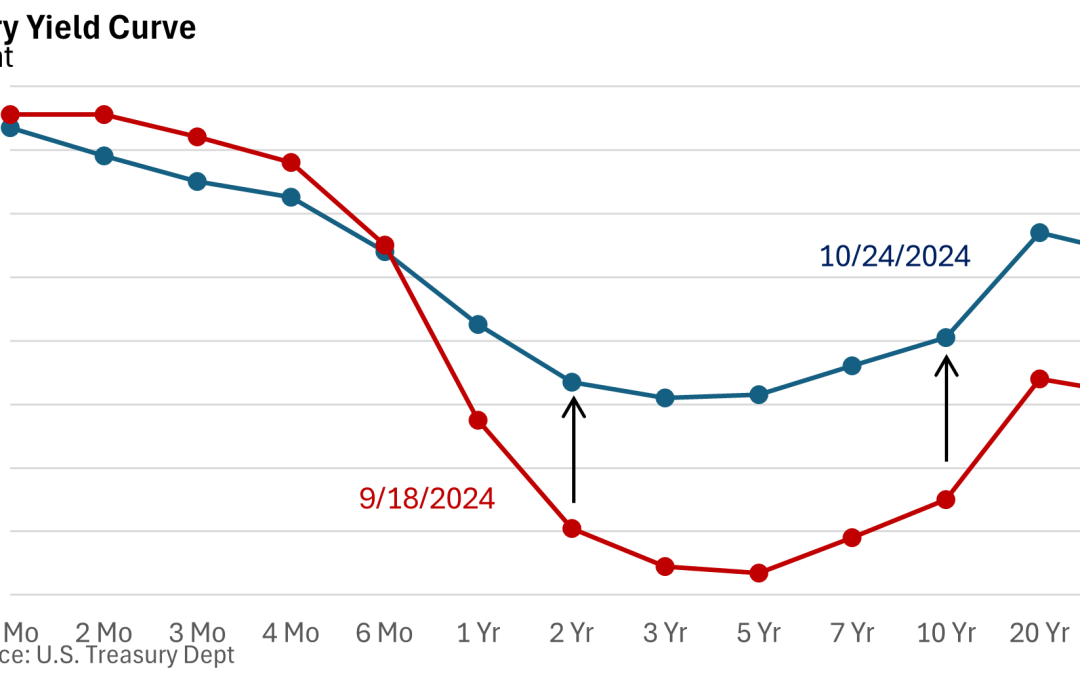

Last month, the Federal Reserve reduced its key interest rate, and the consensus suggested (and still suggests) that the Fed will cut rates two more times before the year ends. A closely watched tool from the CME Group is pricing in a quarter-point rate cut at the...

by Mark Chandik | Oct 21, 2024

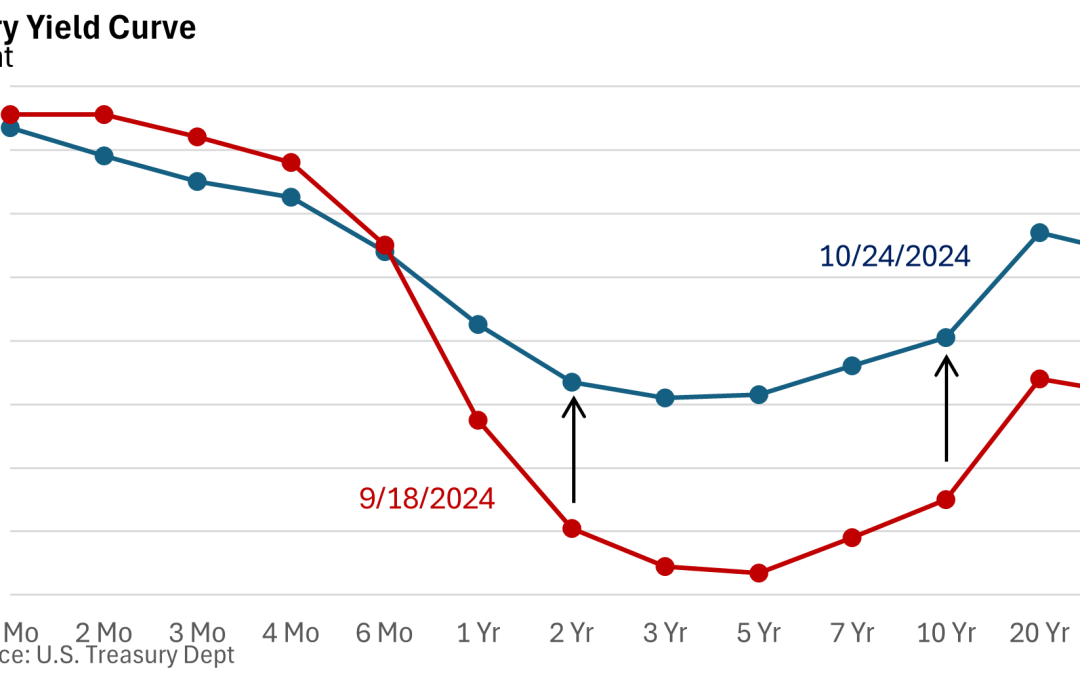

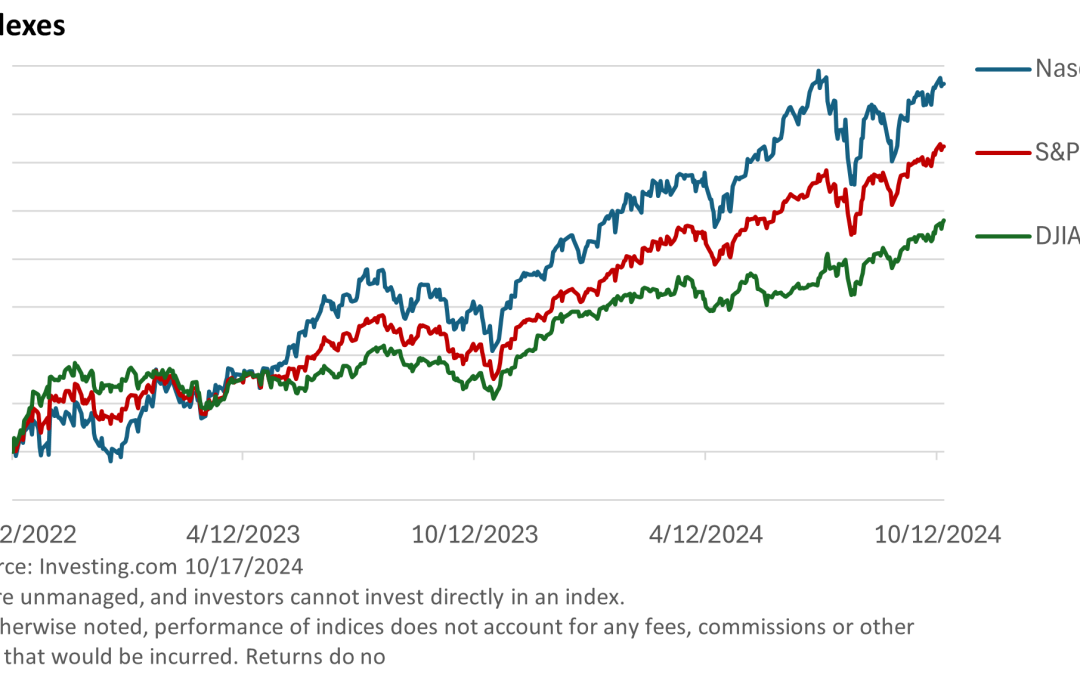

The bull market turned two years old last week. Since bottoming, the S&P 500 Index has climbed almost 64% (through 10/17/24). The index is up 22% from its early 2022 peak, according to data from the St. Louis Federal Reserve. Following the 2022 peak, the S&P...

by Mark Chandik | Oct 7, 2024

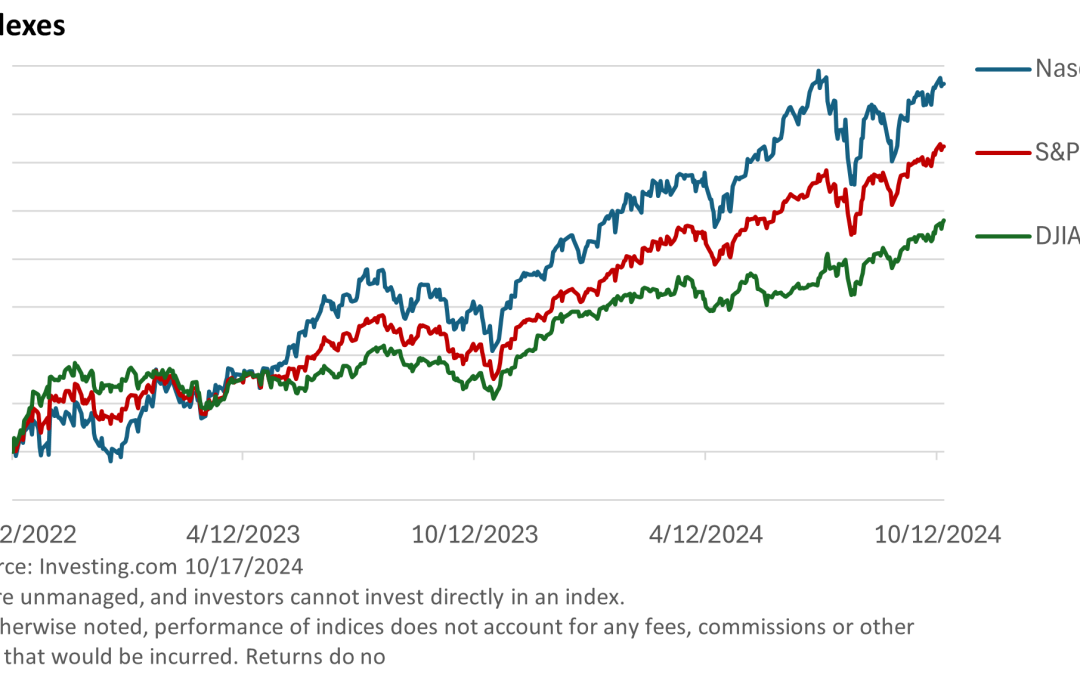

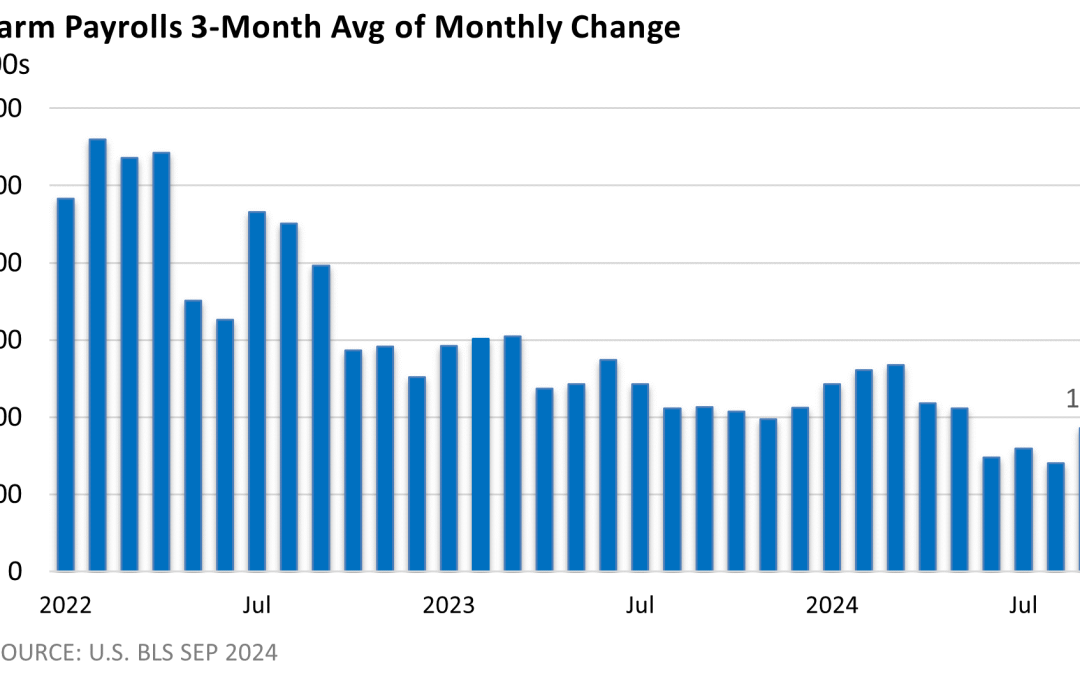

Well, that was unexpected. The U.S. Bureau of Labor Statistics reported that the economy added a whopping 254,000 jobs in September, about 100,000 more than economists surveyed by Bloomberg had projected. The unemployment rate, expected to hold steady at 4.2%, slipped...

by Mark Chandik | Sep 30, 2024

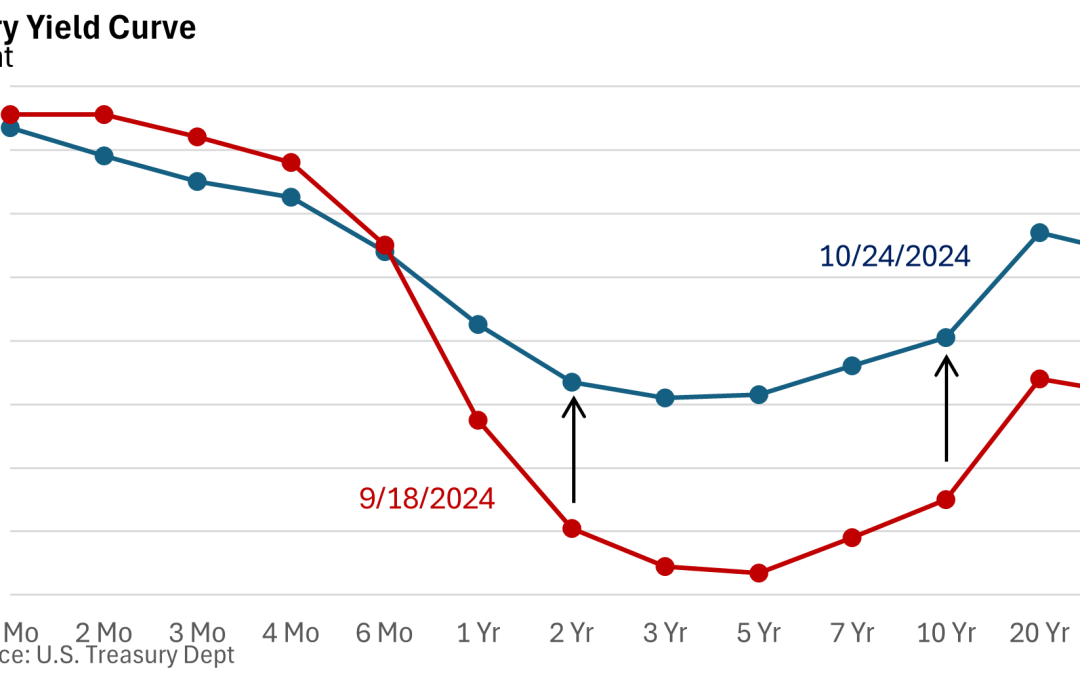

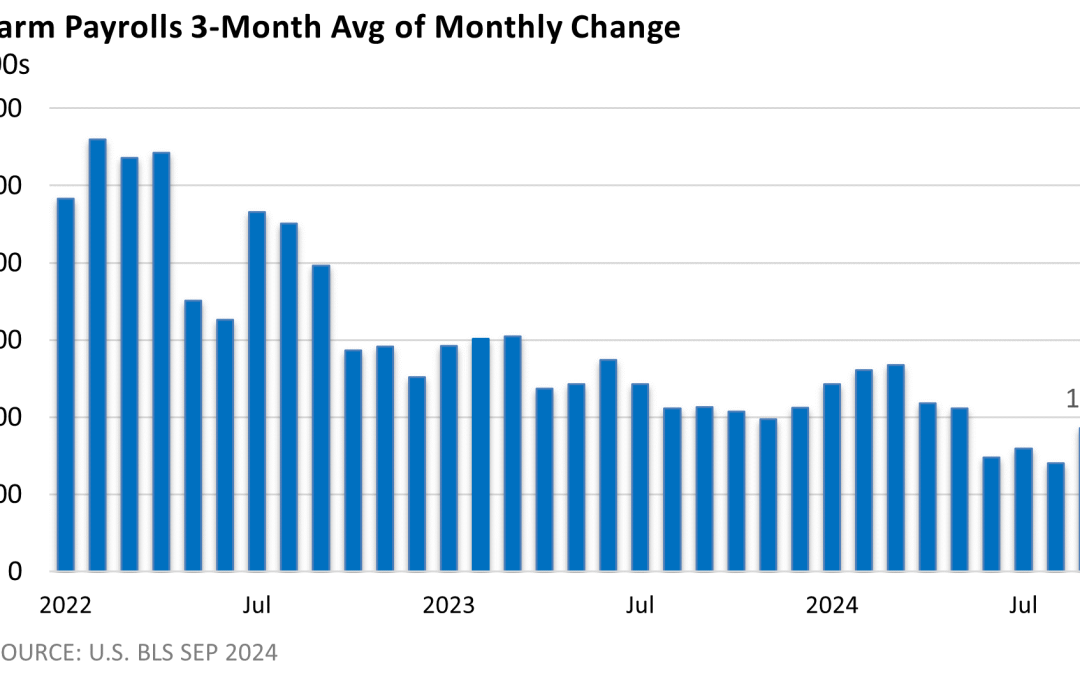

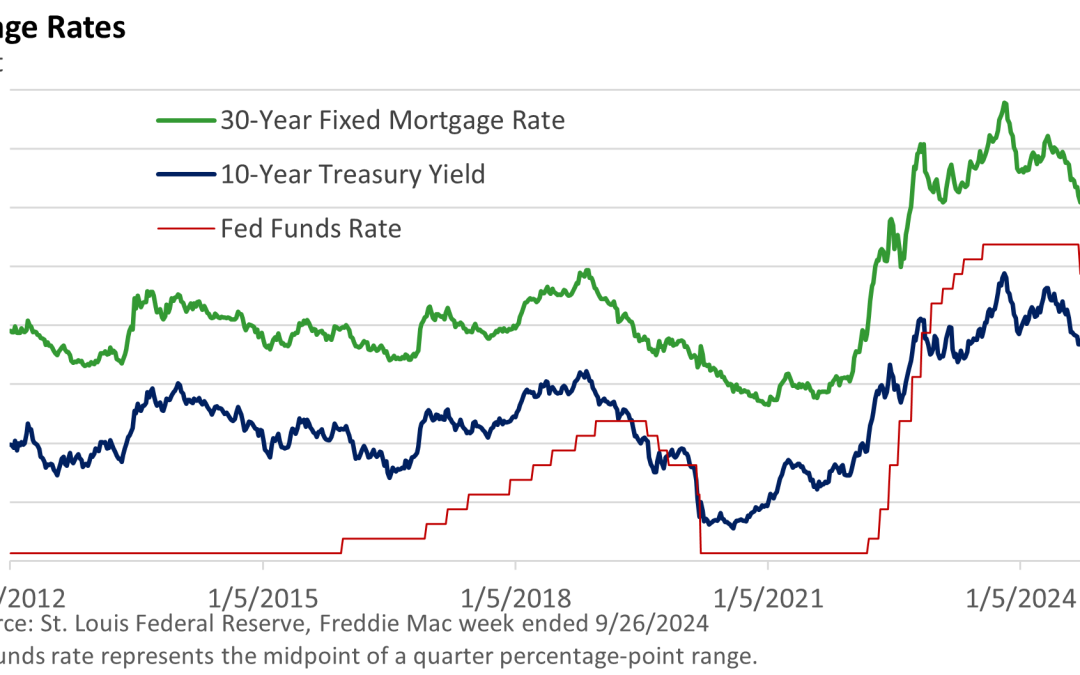

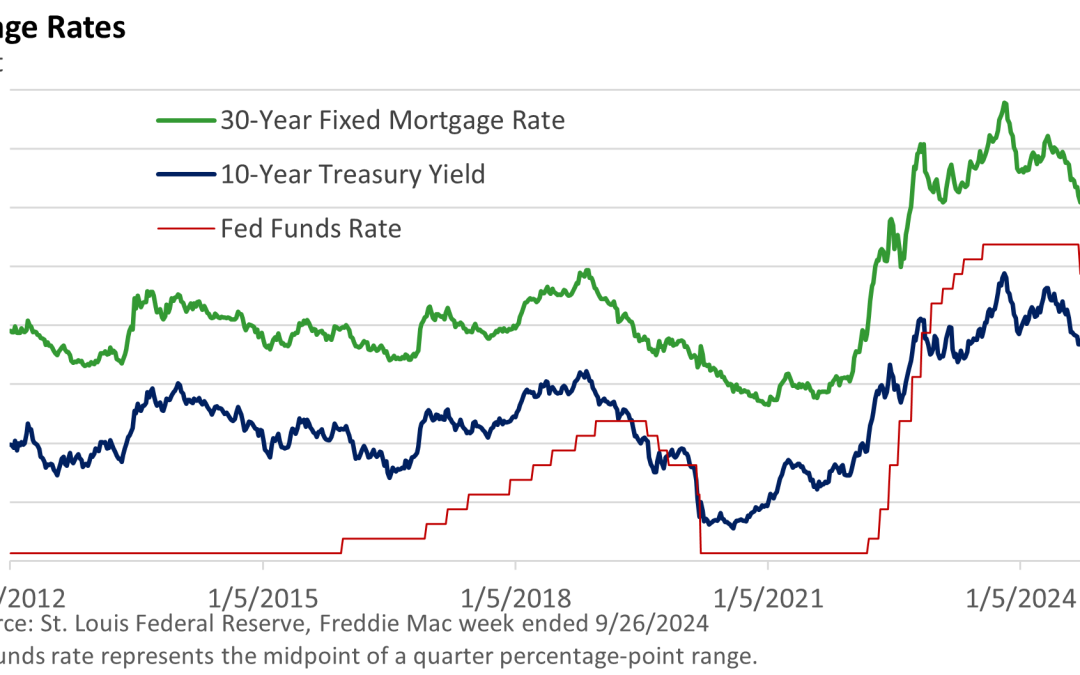

A recent online advertisement from a major bank read, “The Fed just lowered interest rates. Could refinancing save you money?” There is an implicit assumption in the ad that the Fed’s half-percentage point rate reduction brought about a significant drop in mortgage...

by Mark Chandik | Sep 30, 2024

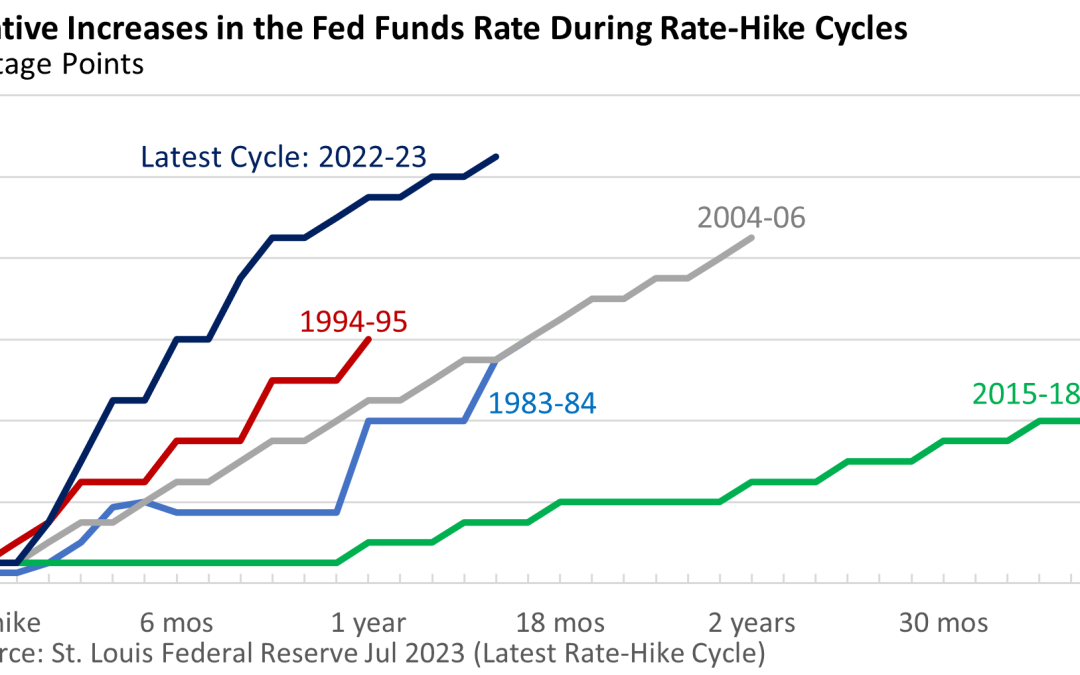

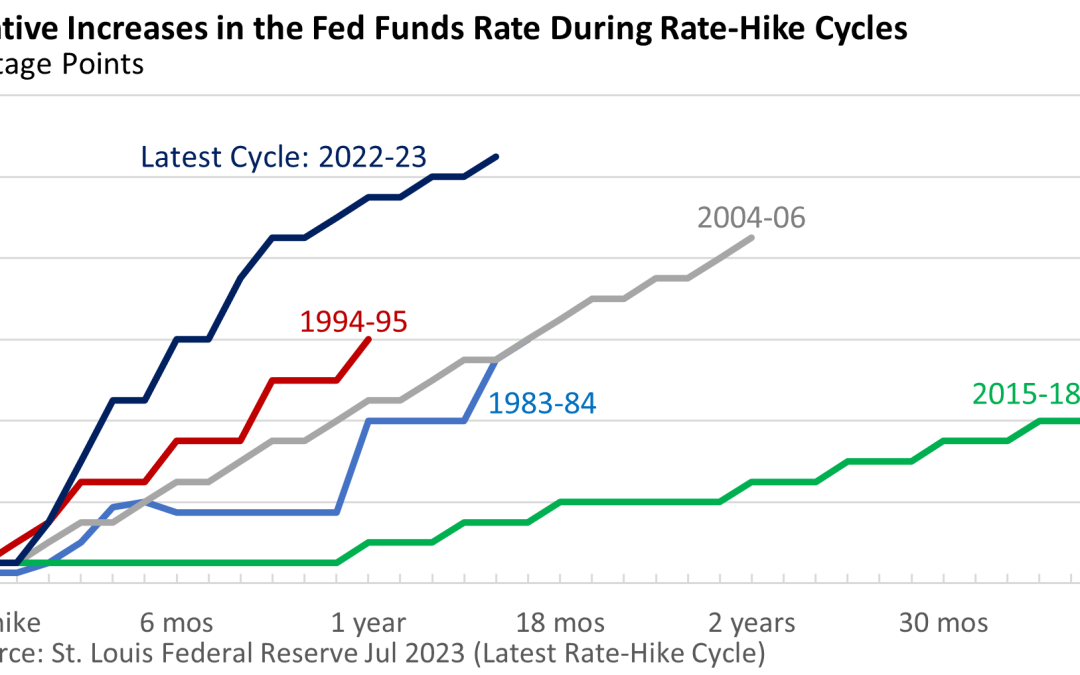

On Wednesday, the Federal Reserve announced a 50-basis point (bp, 1 bp = 0.01%) rate cut for the fed funds rate to 4.75 – 5.00%, its first reduction since 2020. The announcement marks the end of the most aggressive rate-hike cycle since 1980 when the Fed funds rate...

by Mark Chandik | Sep 16, 2024

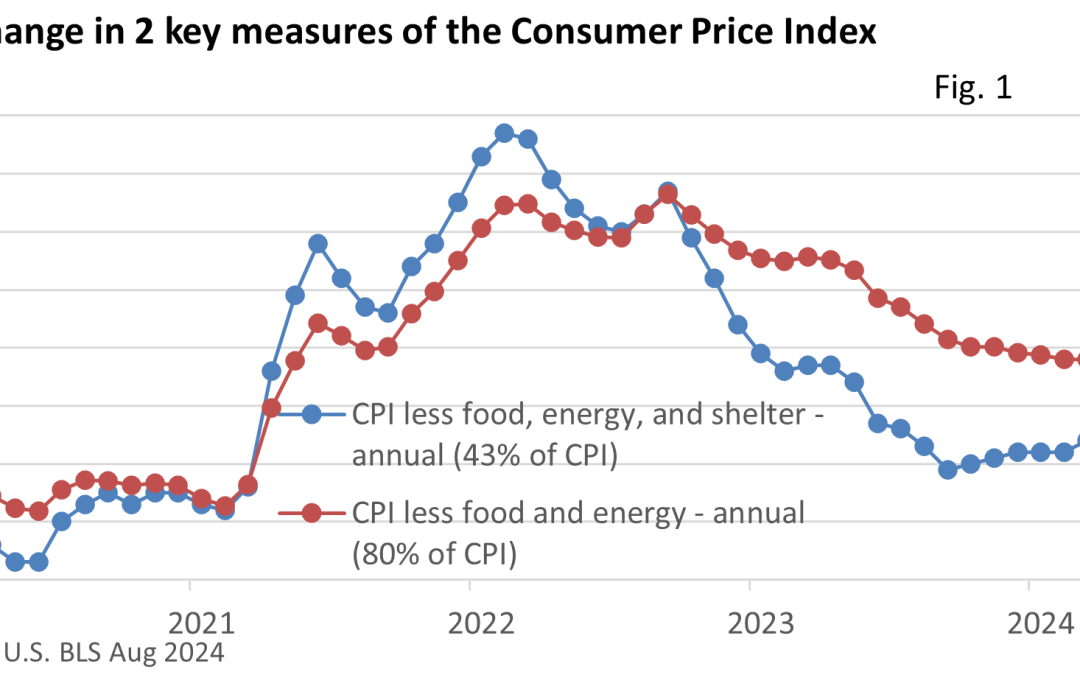

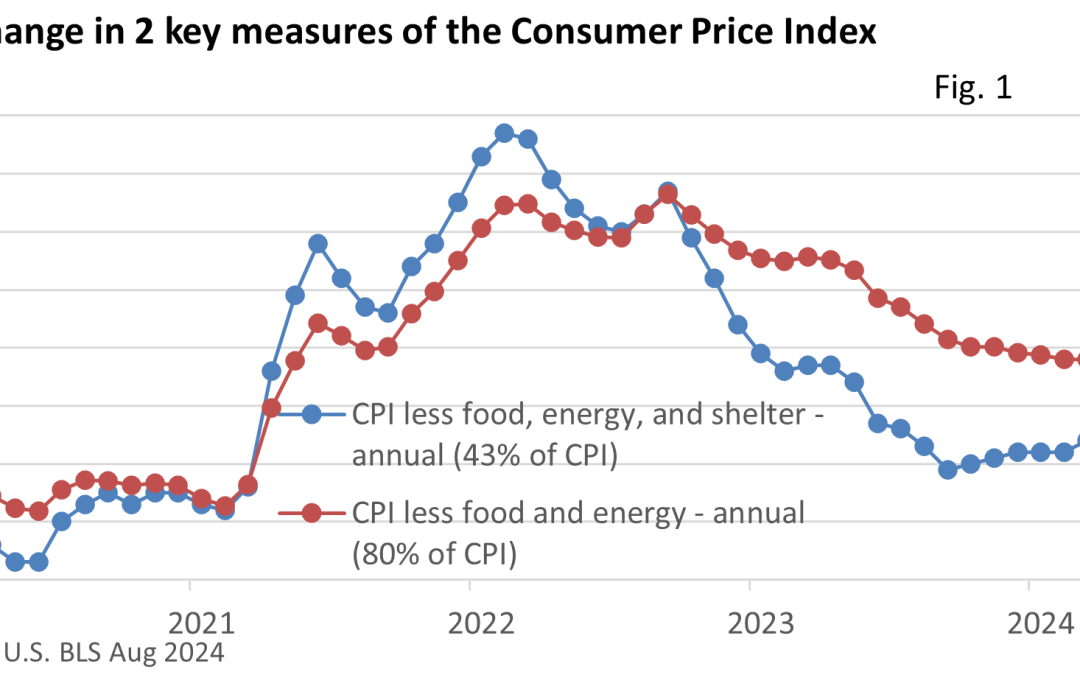

All indications point to a rate cut by the Federal Reserve this week. What’s behind the Fed’s rationale? Let’s look at three key metrics. Aided by lower gasoline prices and stable prices for consumer goods, the rate of inflation has slowed dramatically. Inflation has...