by Mark Chandik | Jan 22, 2024

Weekly Market Commentary Economists have been warning for quite some time that Fed rate hikes will slow economic growth. Whether it results in a soft landing, which is the preferred outcome for investors, or a hard landing (recession), the rate hikes would be expected...

by Mark Chandik | Jan 16, 2024

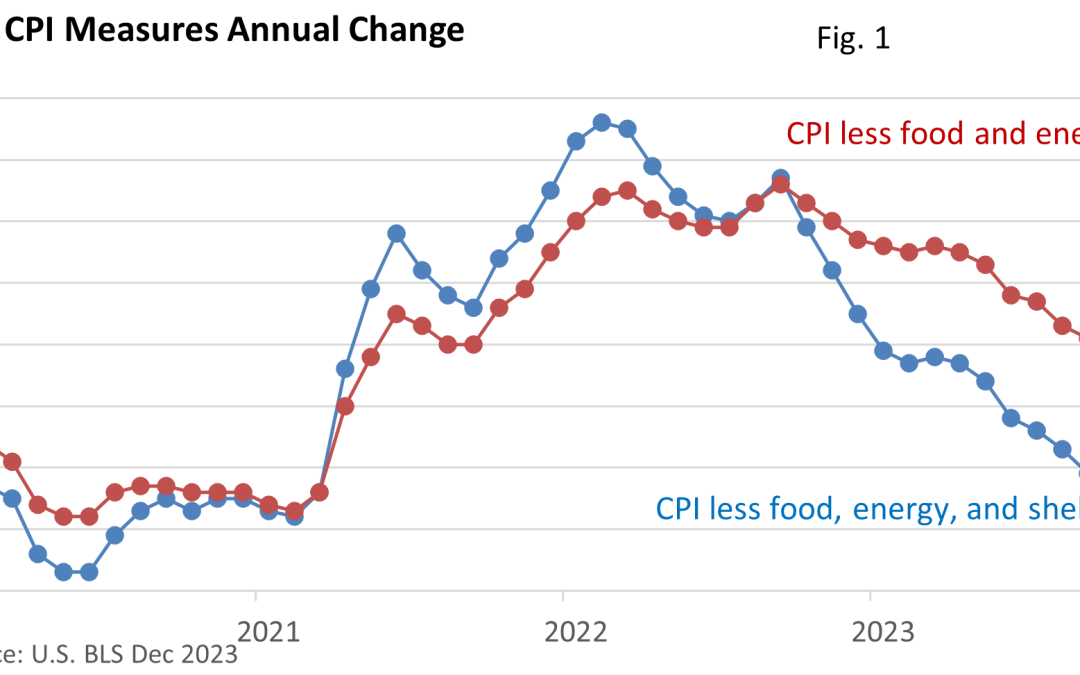

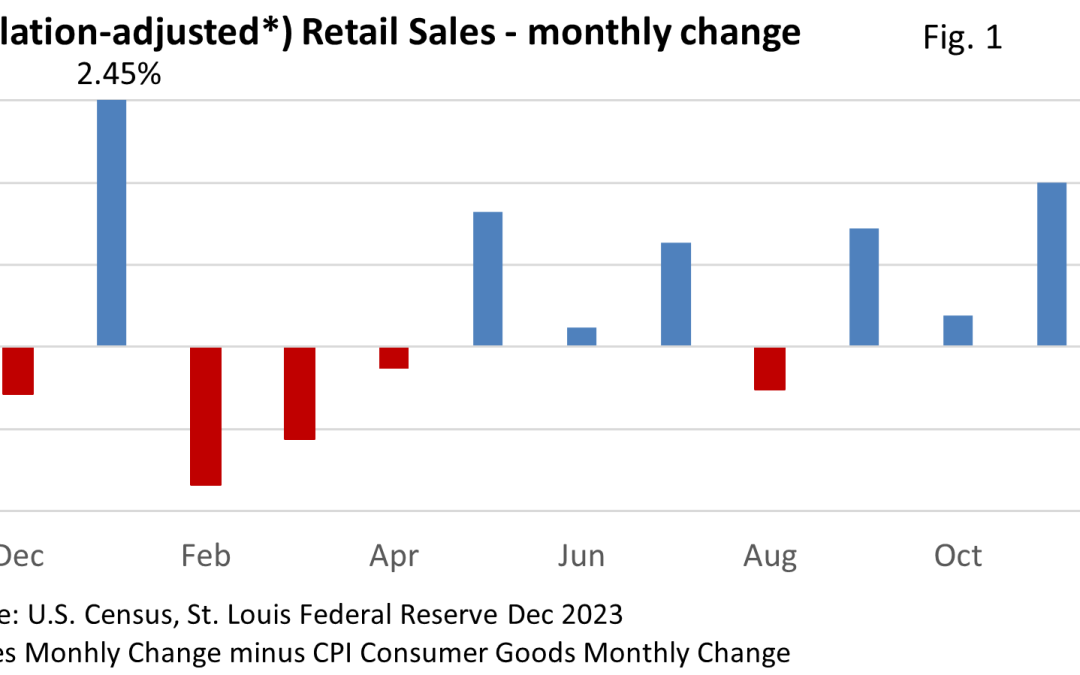

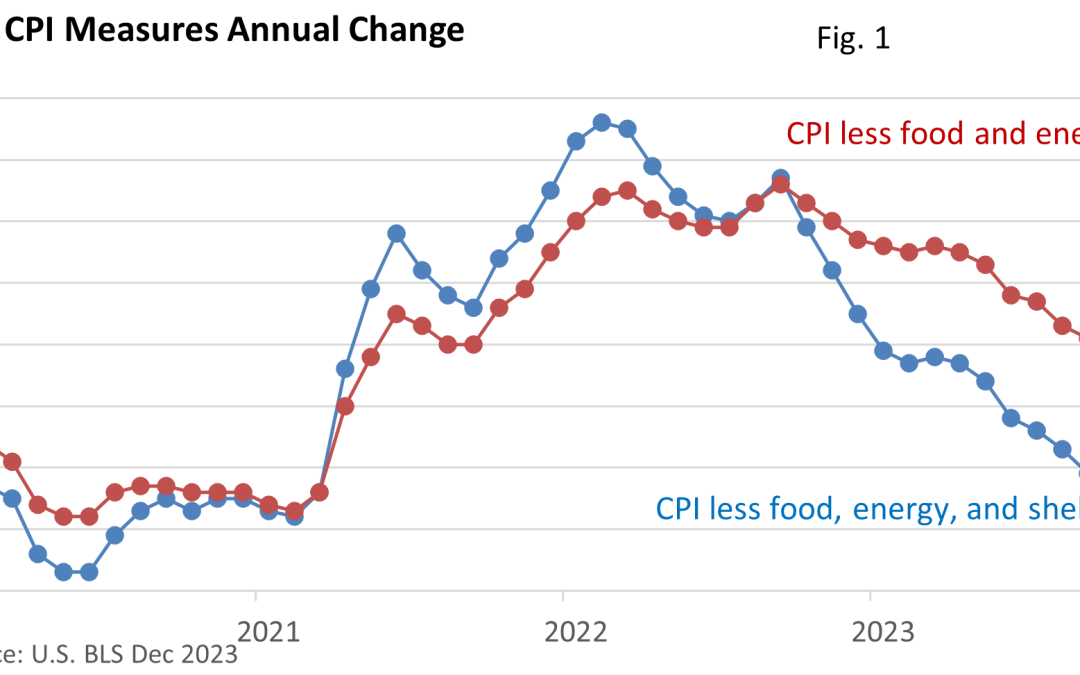

Weekly Market Commentary Investors eagerly anticipate the government’s monthly release of the CPI (Consumer Price Index). Why? Inflation affects everyone, and investors are no exception. The Federal Reserve’s efforts to curb inflation led to a bear market in 2022....

by Mark Chandik | Jan 8, 2024

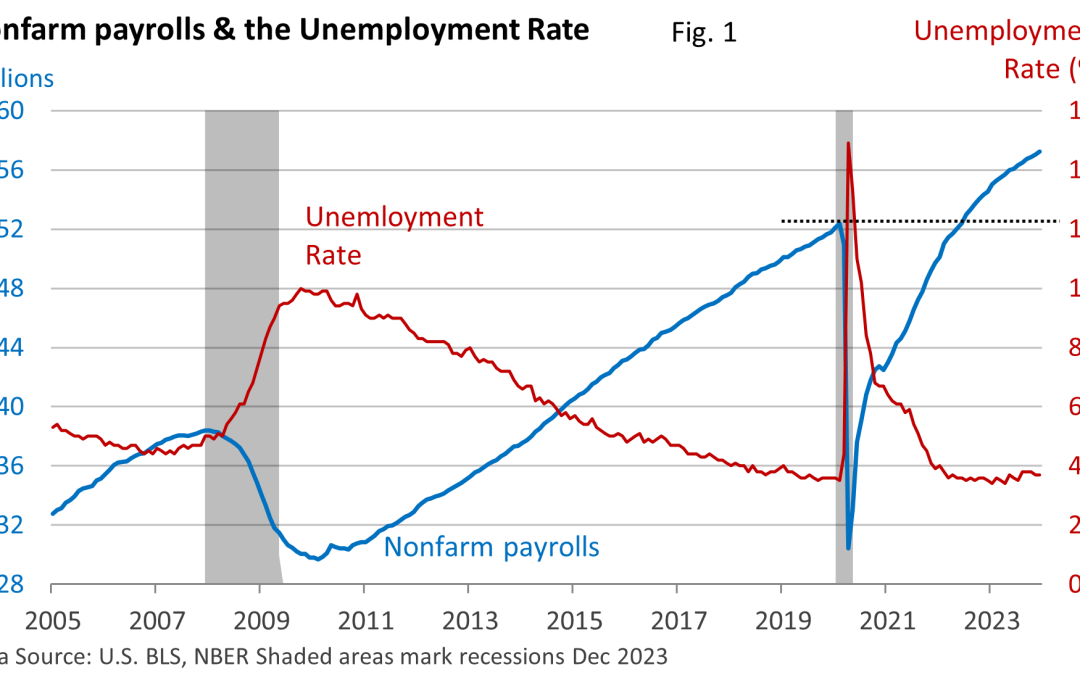

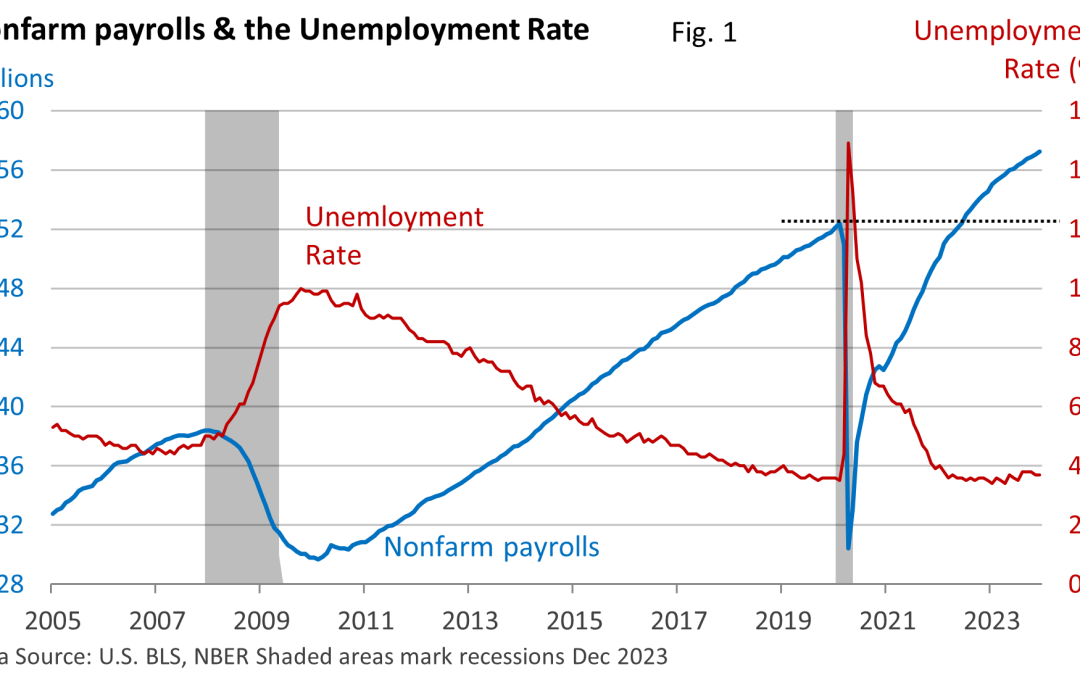

Weekly Market Commentary The U.S. Bureau of Labor Statistics (BLS) reported that nonfarm payrolls rose by 216,000 in December, while October and November were revised down by a total of 71,000. The unemployment rate held steady at 3.7% in December. The economy is...

by Mark Chandik | Jan 2, 2024

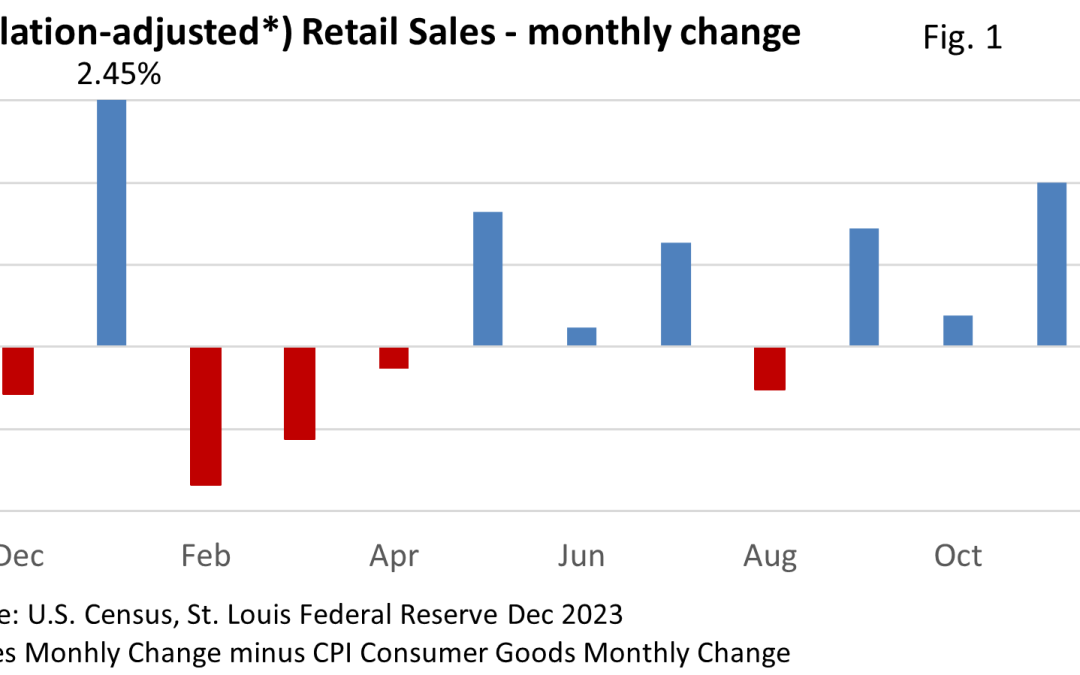

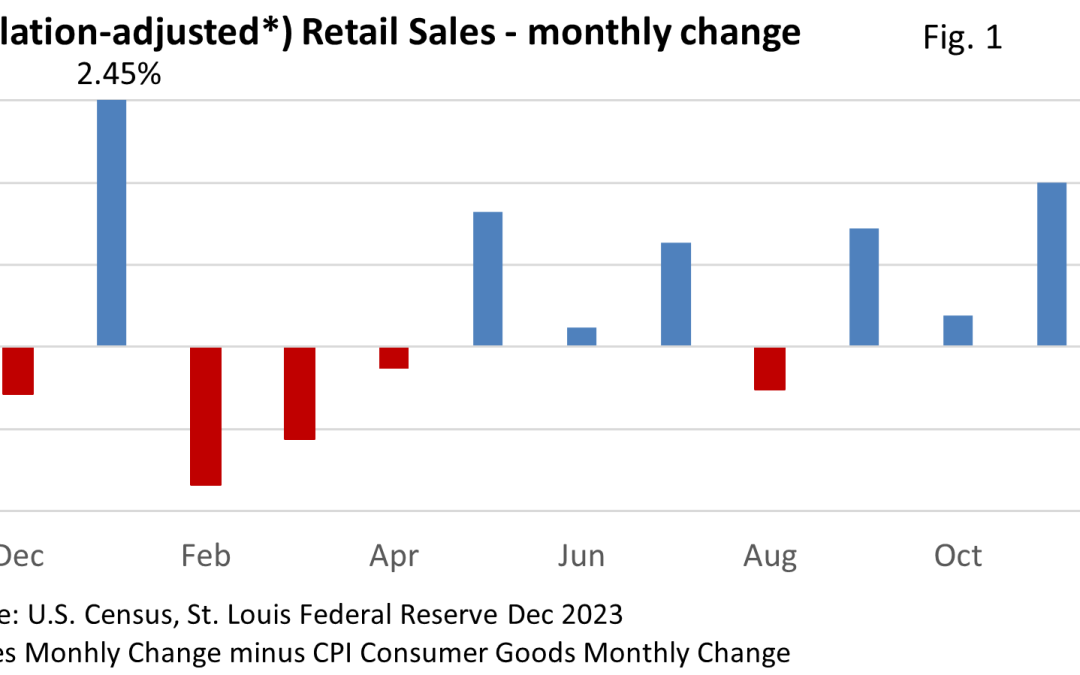

Weekly Market Commentary A December 29th Wall Street Journal title summed the year up: What Did Wall Street Get Right About Markets This Year? Not Much. Back up to December 2022, when Moody’s Chief Economist Mark Zandi captured the most prevalent view at the time....

by Mark Chandik | Dec 28, 2023

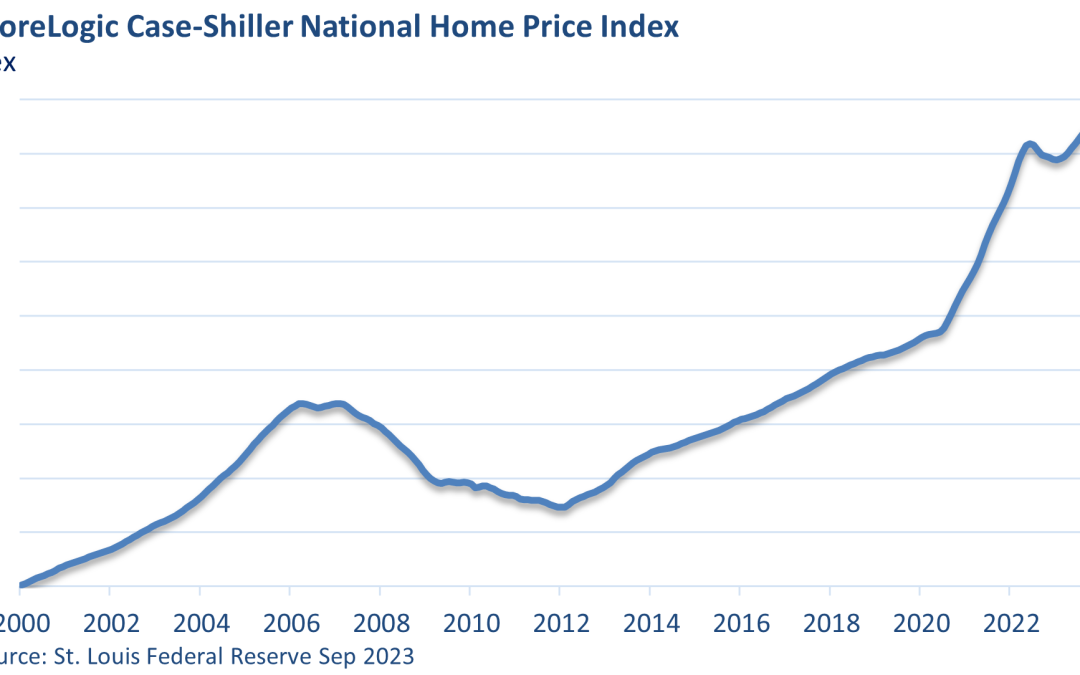

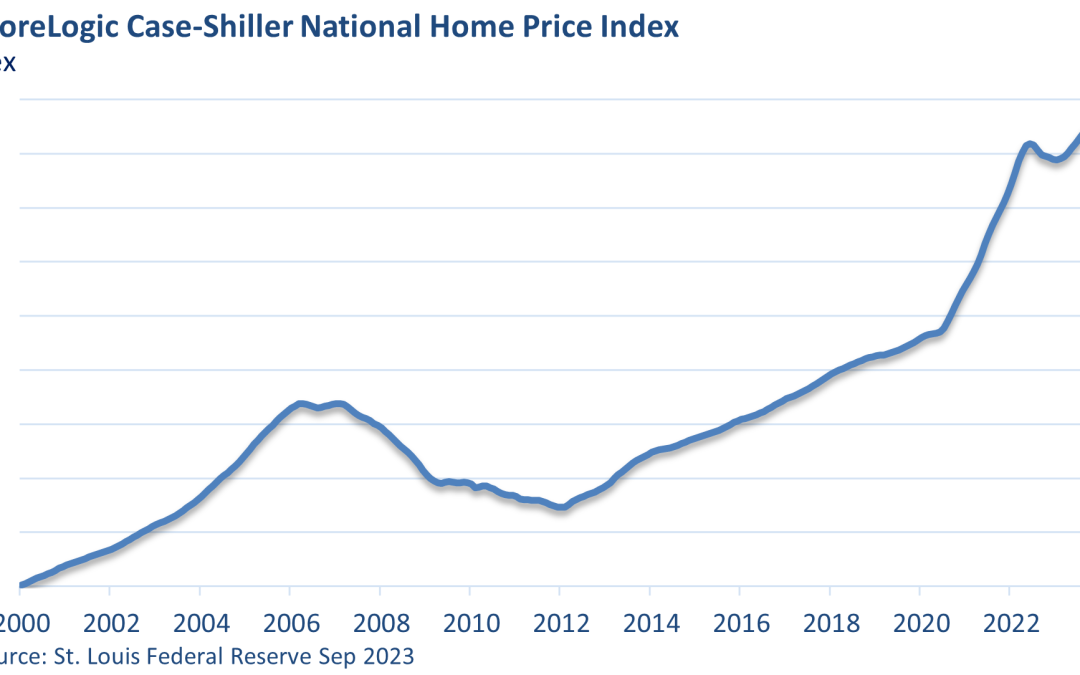

Weekly Market Commentary Mortgage rates have soared, and home sales are down sharply. Conventional wisdom would suggest that prices should be down. But housing prices have defied expectations, rising to record heights and locking first-time buyers out of the market....

by Mark Chandik | Dec 18, 2023

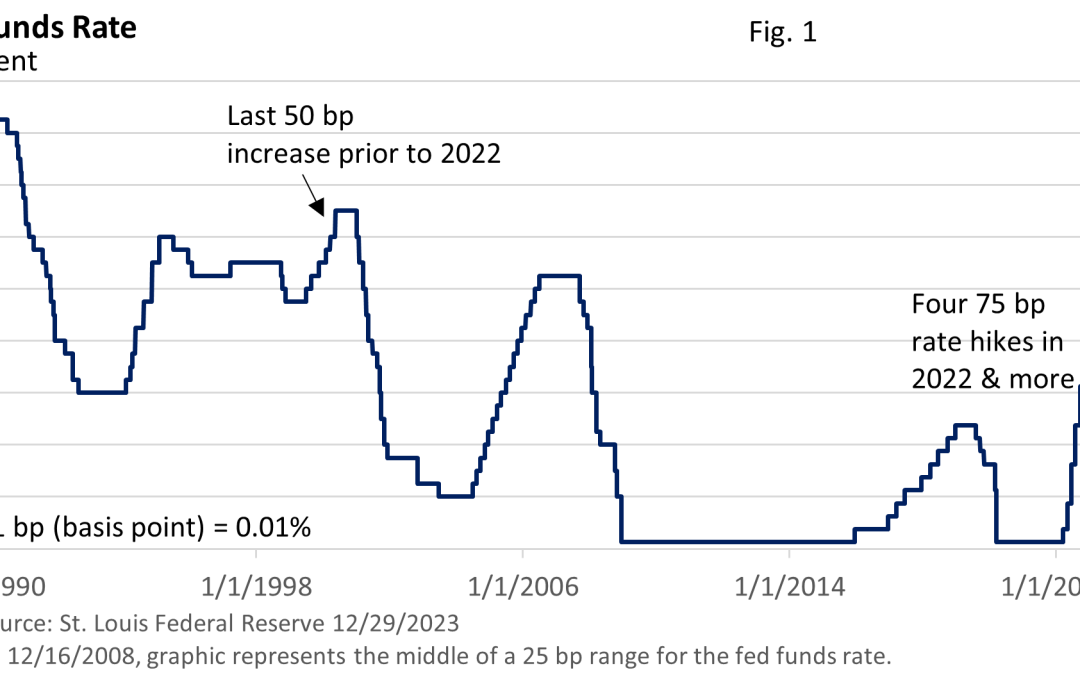

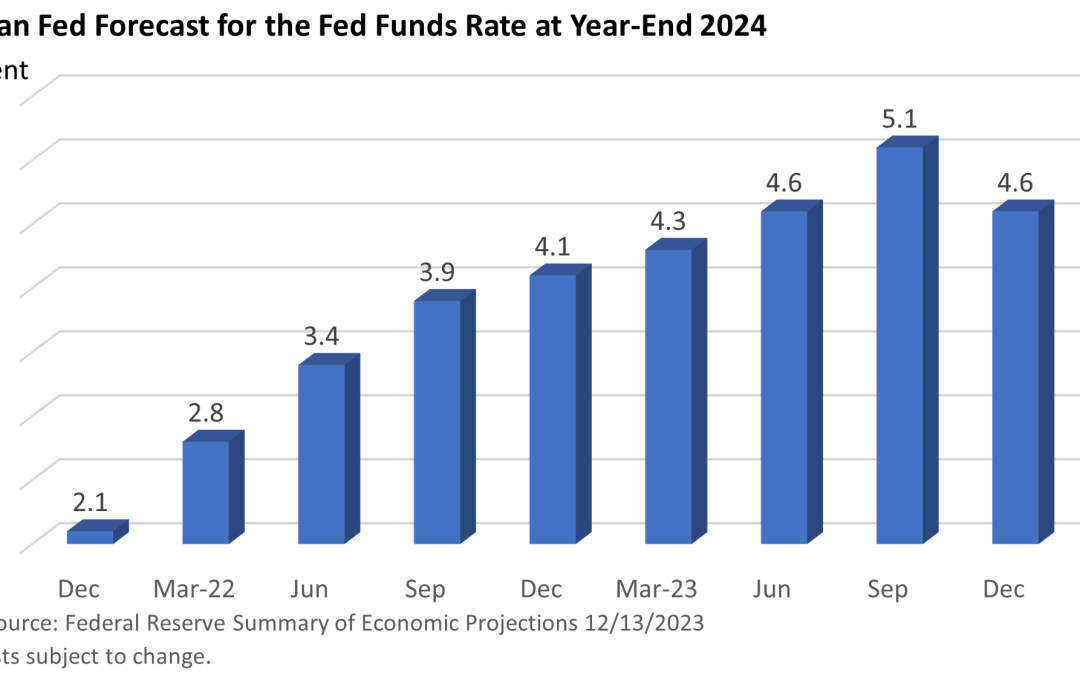

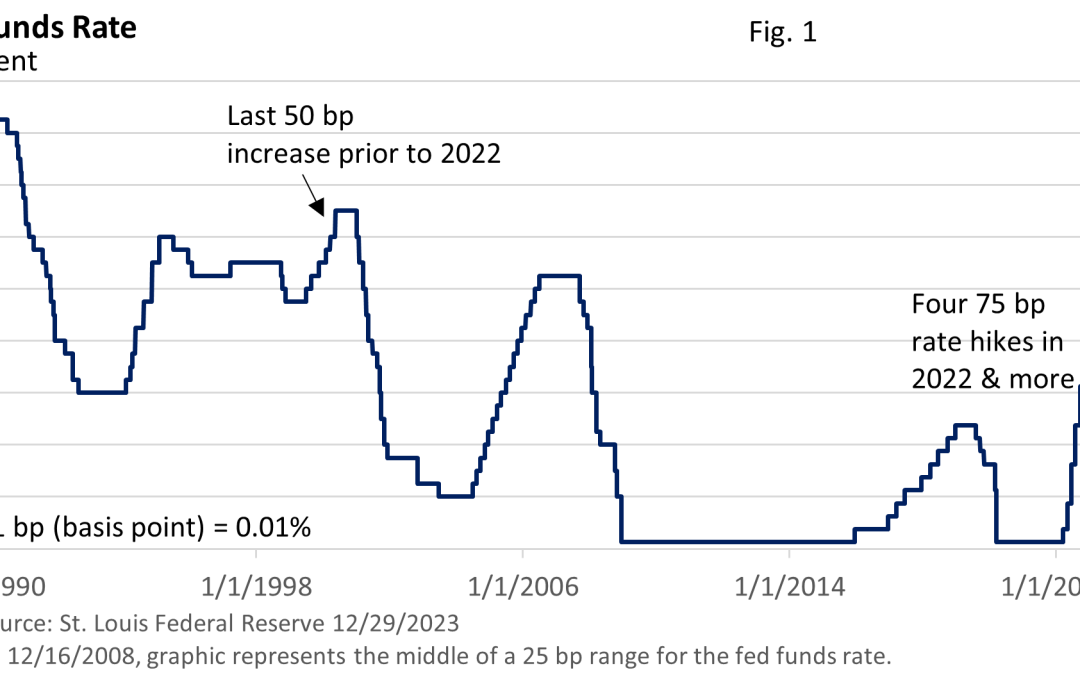

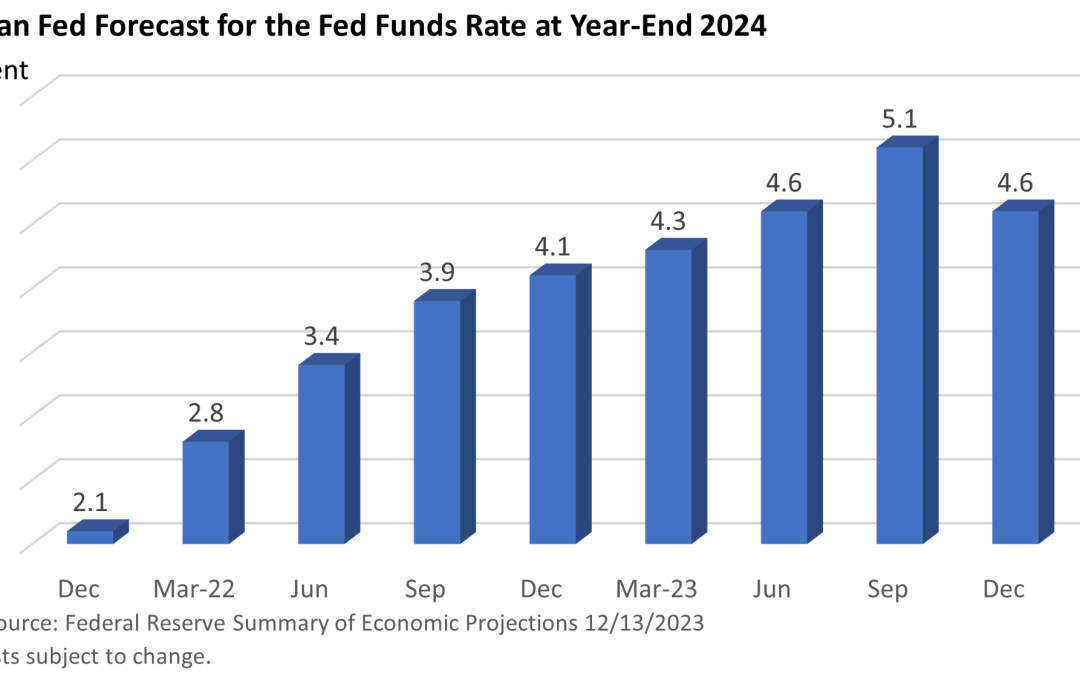

Weekly Market Commentary The meeting held by the Federal Reserve last week was the most consequential gathering of central bankers this year. The Fed held the fed funds rate at 5.25 – 5.50% as expected, but in so many words, the Fed pivoted on its rate stance. No...