by Mark Chandik | Sep 2, 2025

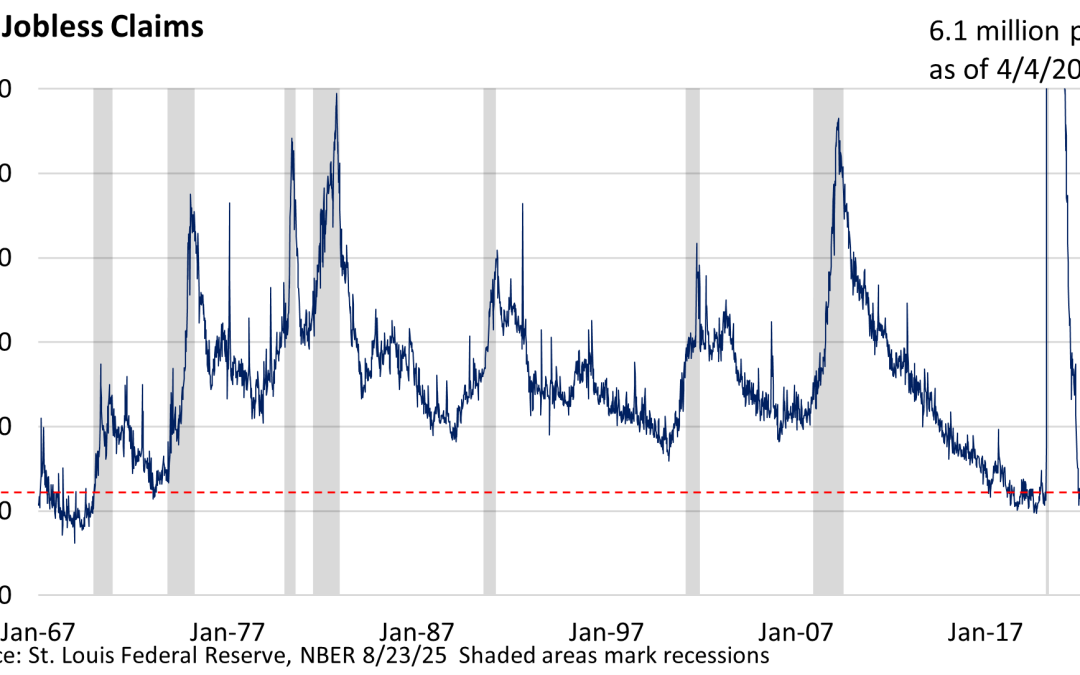

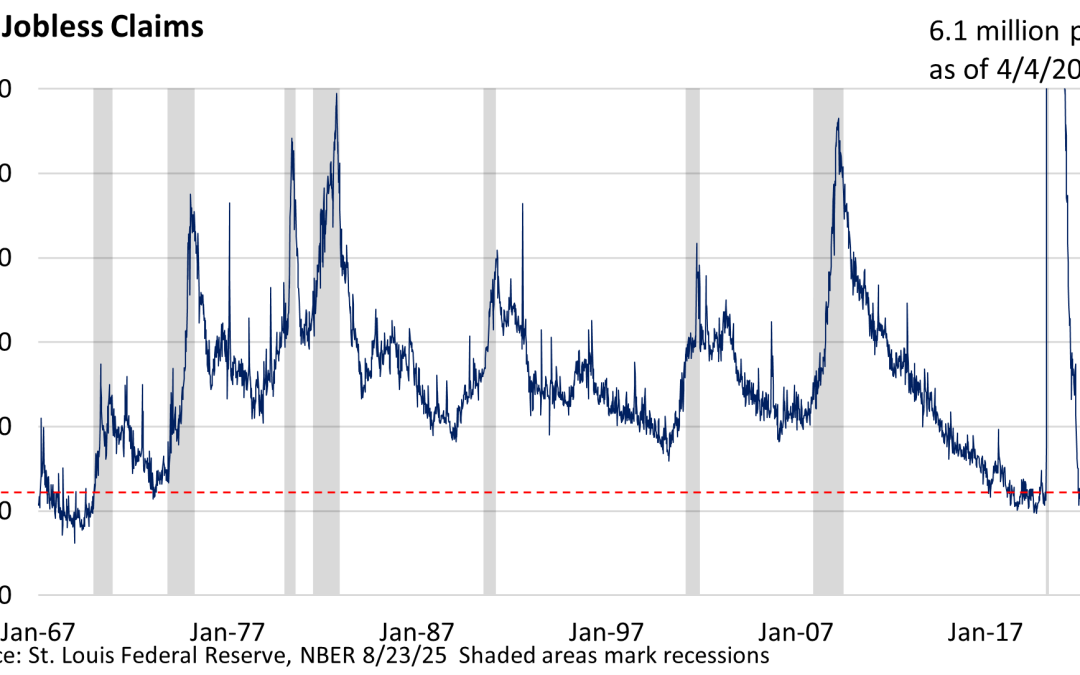

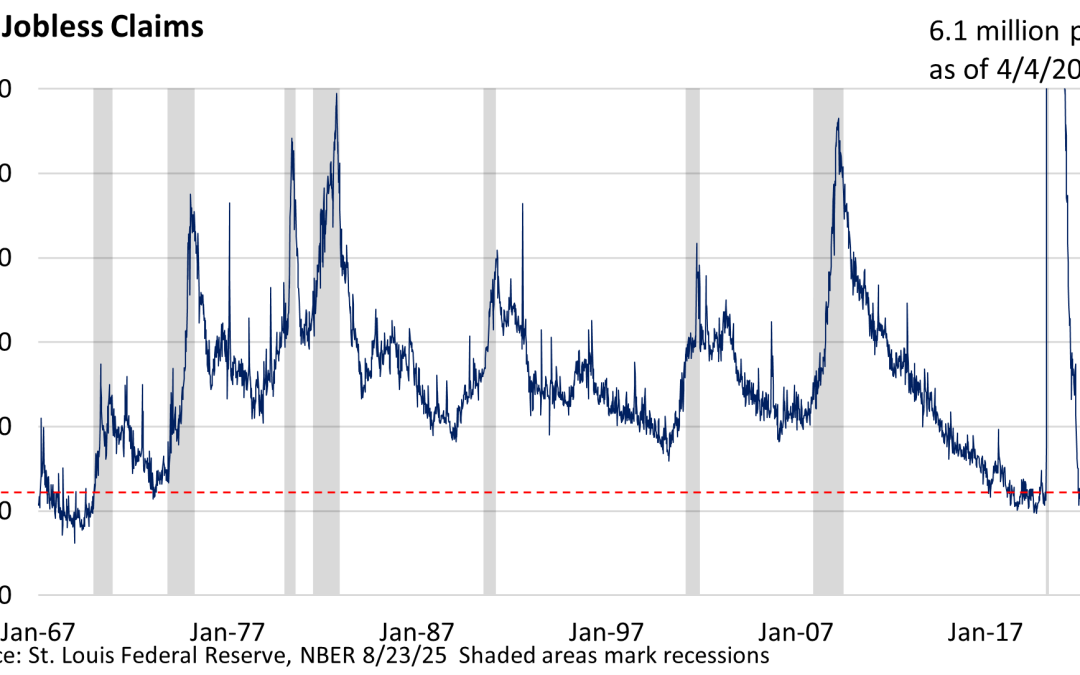

Initial claims for unemployment insurance measure the number of people filing for unemployment benefits for the first time. The data is released weekly, making it one of the most up-to-date indicators of labor market conditions. It is a key economic indicator because...

by Mark Chandik | Aug 4, 2025

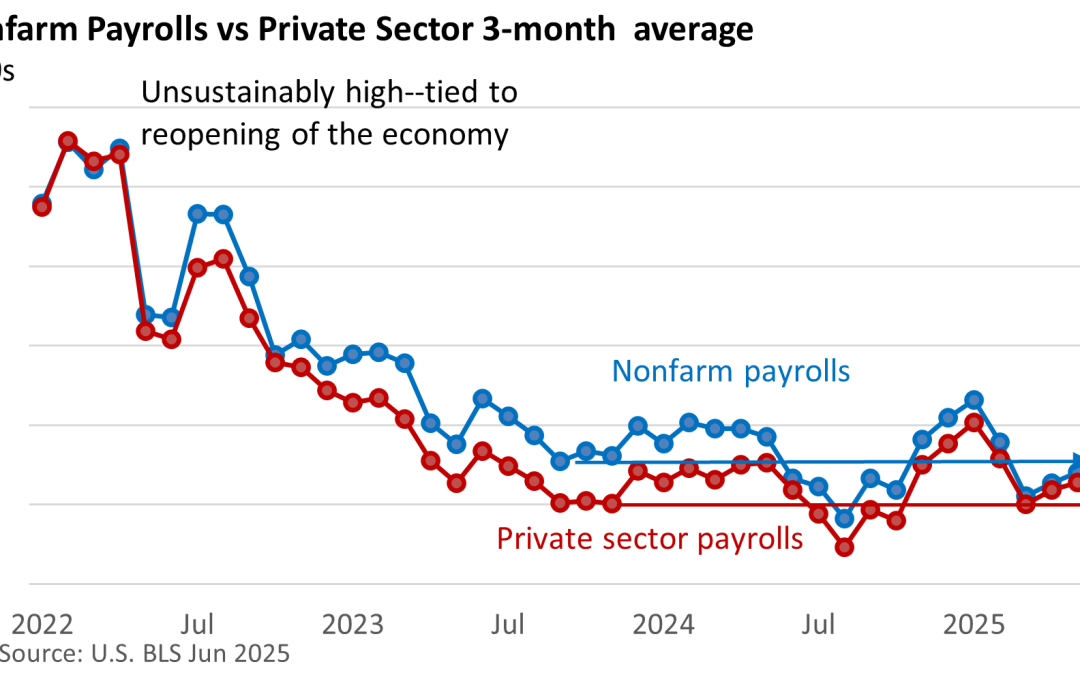

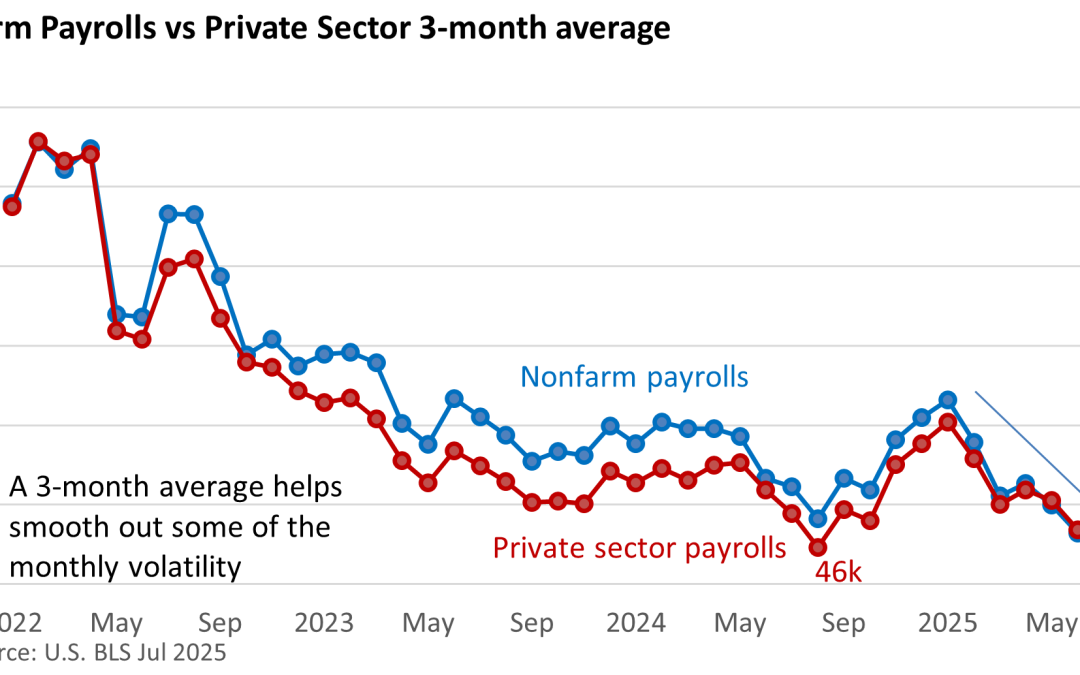

Last week was packed with economic developments, as reports poured in from all directions. We saw the release of second-quarter Gross Domestic Product (GDP) figures, the broadest measure of goods and services produced, alongside the July jobs report. As if that...

by Mark Chandik | Jul 29, 2025

Signed into law on July 4, the One Big Beautiful Bill (OBBB) Act introduces sweeping changes into the tax code that could influence how you plan for and pay your taxes. Given the depth and complexity of the new law, our review is not all-encompassing. But we’ll touch...

by Mark Chandik | Jul 21, 2025

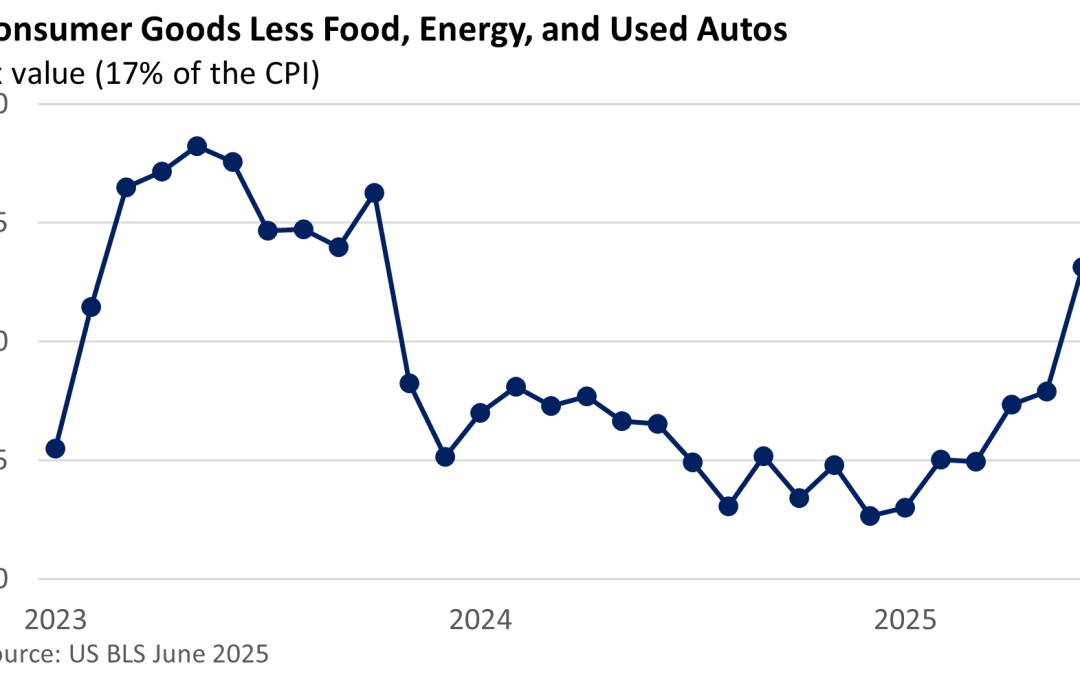

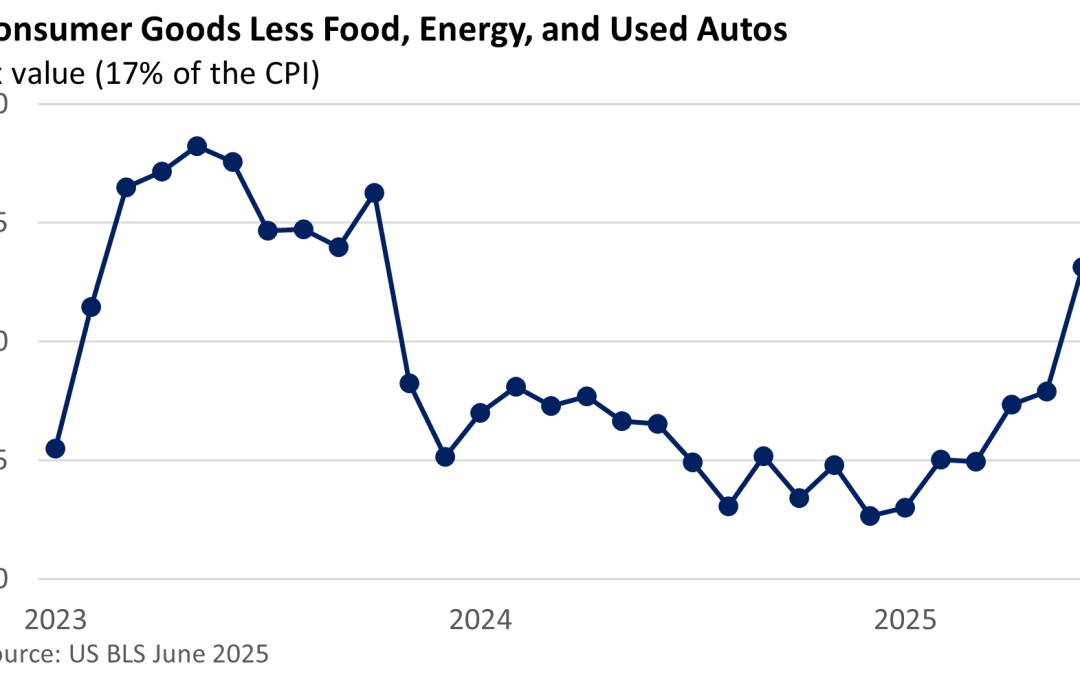

At first glance, June’s Consumer Price Index (CPI) was reassuring. The US Bureau of Labor Statistics reported that the CPI rose 0.3% in June as expected, while the core CPI, which excludes food and energy, rose a smaller-than-forecast 0.2%, per the Wall Street...

by Mark Chandik | Jul 14, 2025

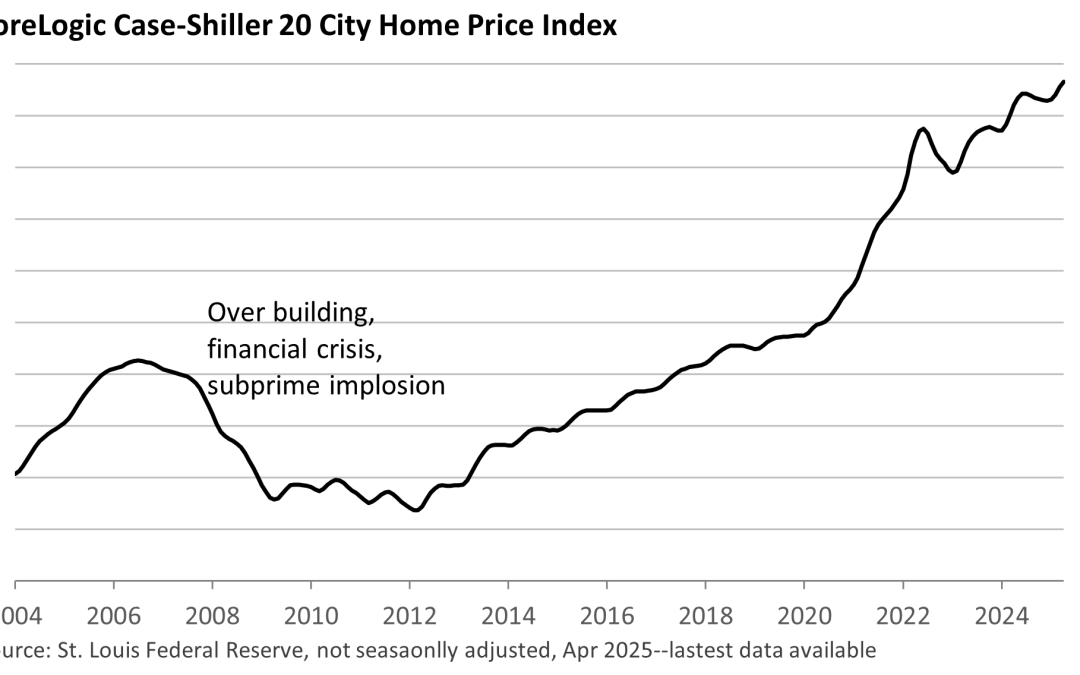

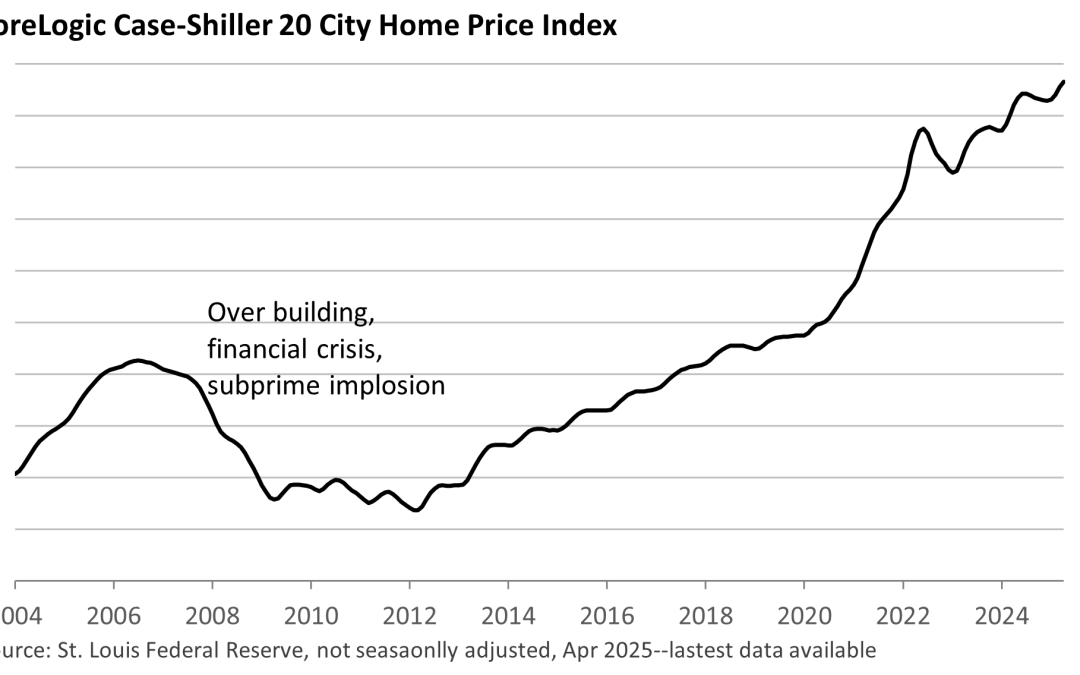

Home sales have fallen sharply over the last three years, with sales near the levels we last saw in 2008, according to the National Association of Realtors. Yet, unlike in 2008, housing prices haven’t collapsed this time around. Over the past 15 years, lending...

by Mark Chandik | Jul 7, 2025

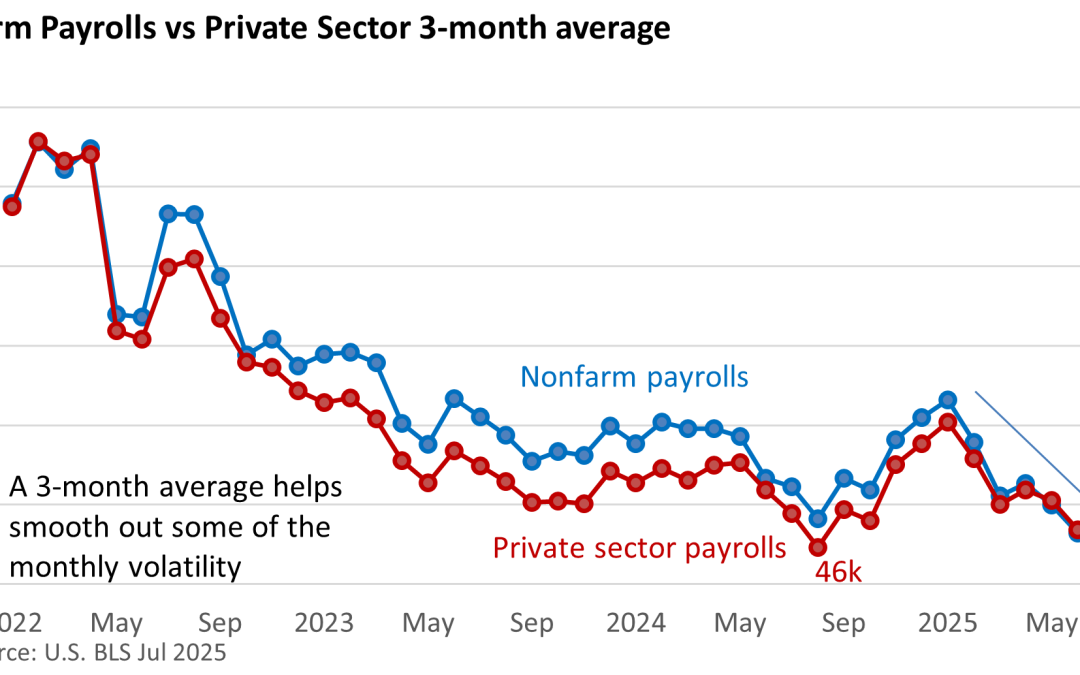

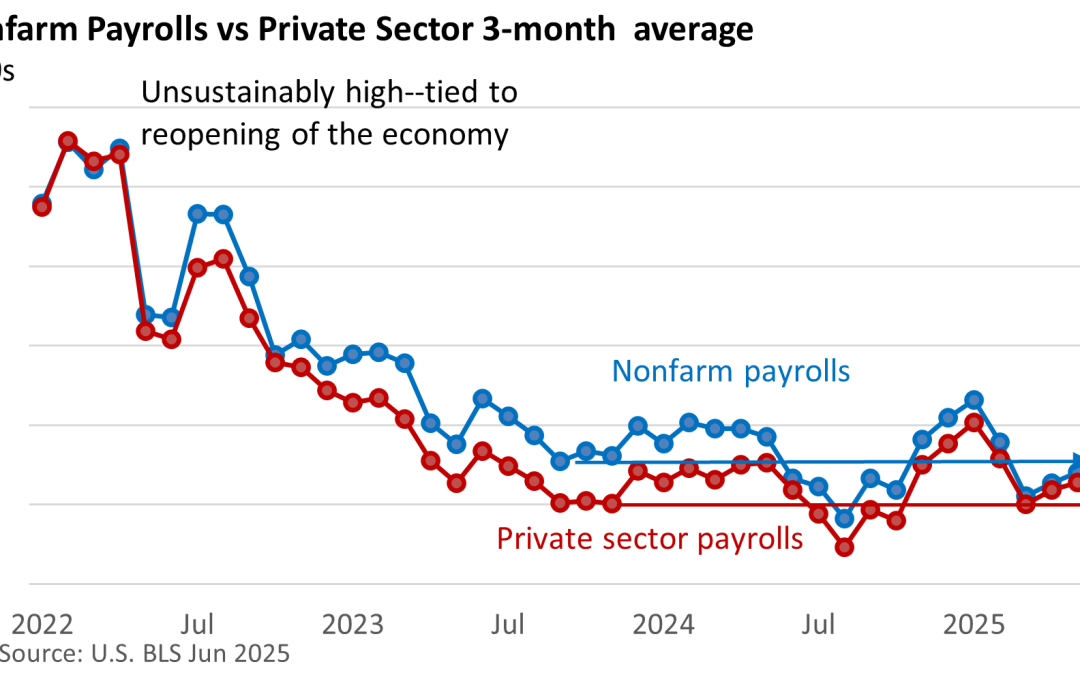

The US Bureau of Labor Statistics reported that nonfarm payrolls rose 147,000 in June, topping the forecast of 110,000 (Wall Street Journal), while the unemployment rate fell to 4.1% in June from 4.2% in May. Private sector jobs rose a more muted 74,000. The headline...