by Mark Chandik | Apr 4, 2025

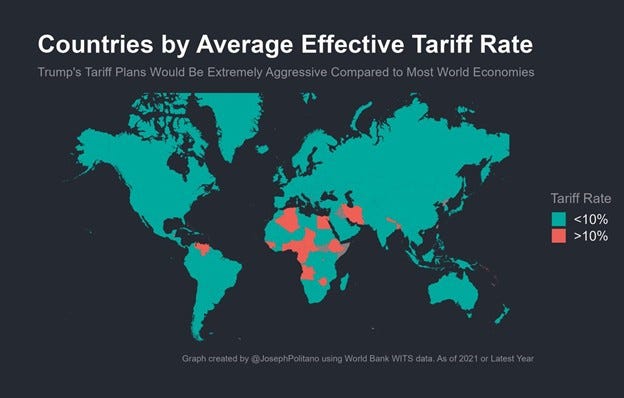

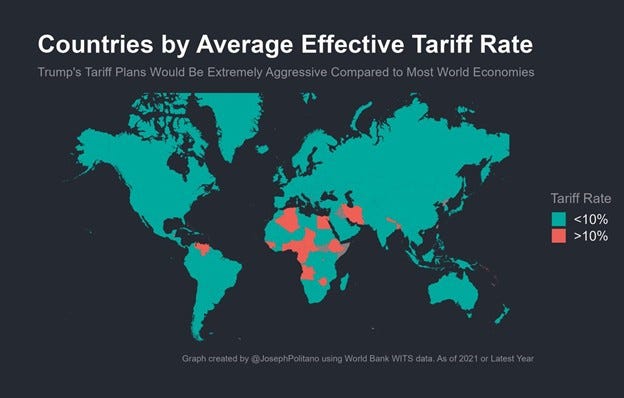

Two days ago, the White House announced massive tariffs on virtually every other country. Here are a few thoughts, in no particular order and written with our best effort at restraint, on one of the largest tax hikes in U.S. history: The odds of a recession are...

by Mark Chandik | Mar 31, 2025

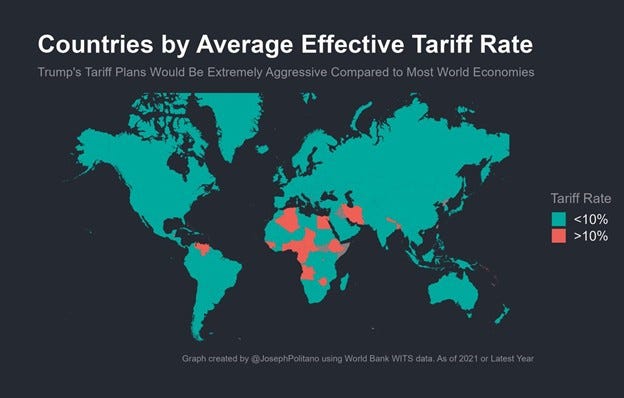

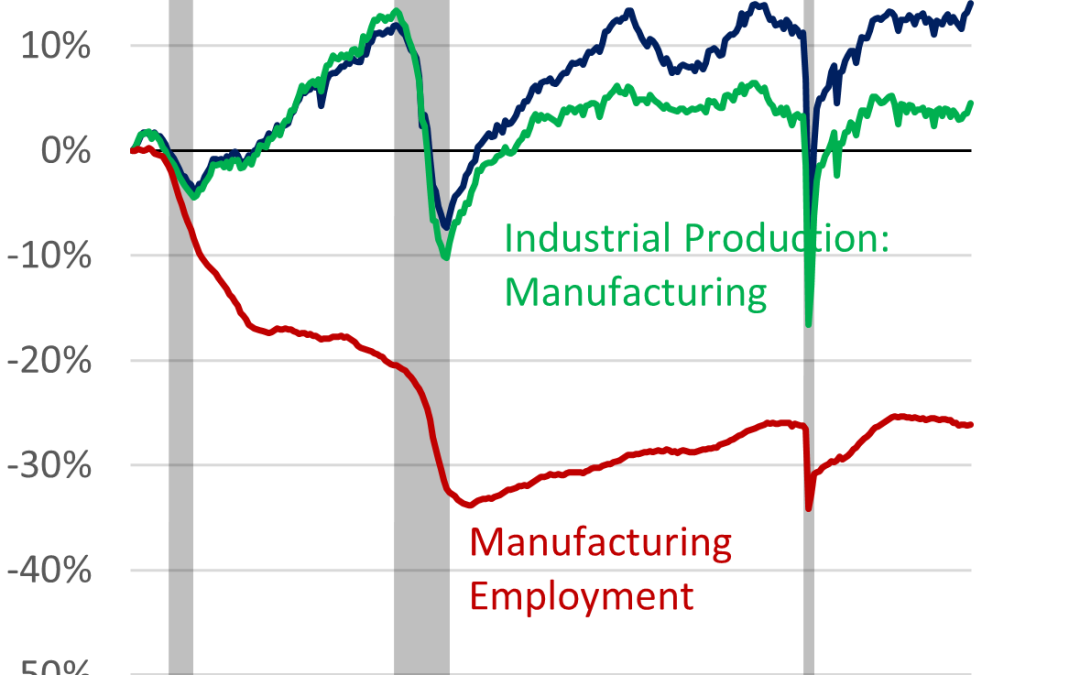

Over the past month, we have approached the issue of tariffs from the market’s perspective, specifically that of investors. Let’s take a different approach today. We’ll examine the issue from the perspective of domestic manufacturers and manufacturing workers....

by Mark Chandik | Mar 24, 2025

The Federal Reserve held its key rate, the fed funds rate, at 4.25 – 4.50% as expected. But Fed officials downgraded the economic outlook for 2025 and raised its forecast for inflation (again) in its quarterly Summary of Economic Projections. Why was the...

by Mark Chandik | Mar 17, 2025

The February Consumer Price Index came in softer than expected, rising 0.2%, according to the U.S. BLS. The core CPI, which excludes food and energy, also rose 0.2%. The core CPI slowed to an annual rate of 3.1% from 3.3% in January. February’s rate was the slowest...

by Mark Chandik | Mar 10, 2025

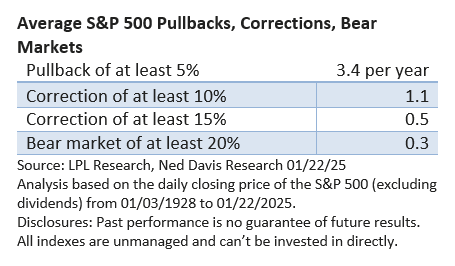

“The new Administration is in the process of implementing significant policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation. It is the net effect of these policy changes that will matter for the economy and for the path of monetary...

by Mark Chandik | Mar 3, 2025

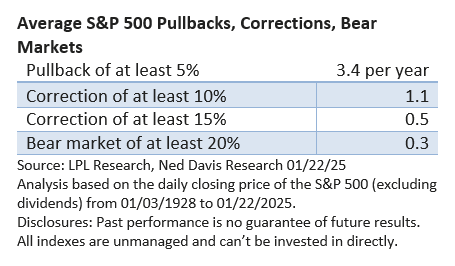

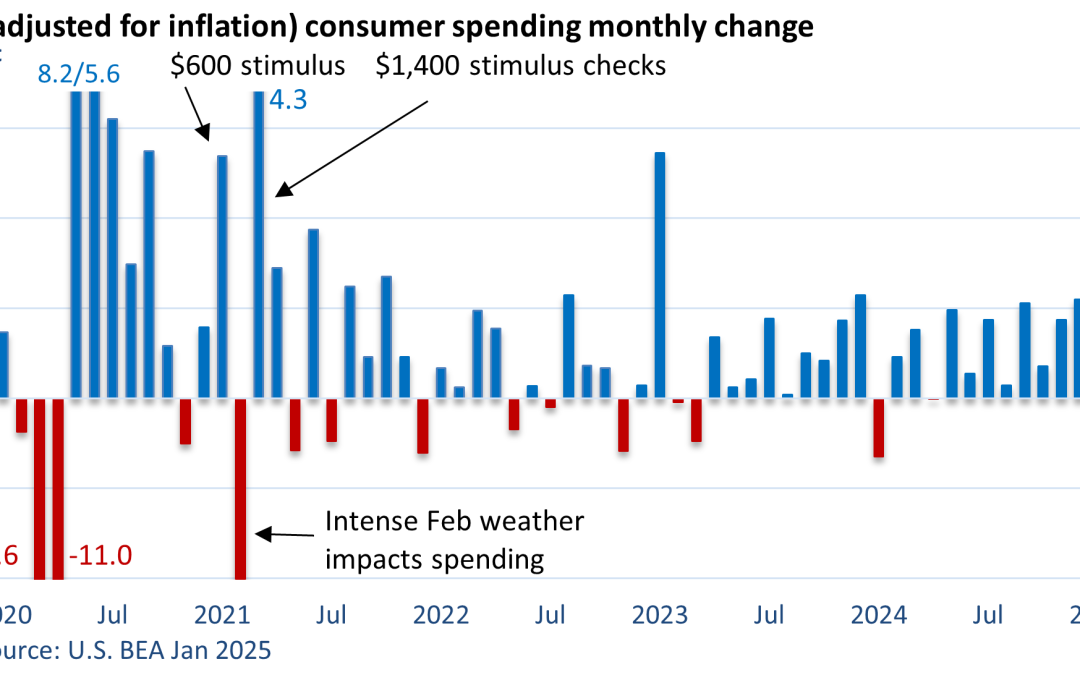

There are times when the economic data is strong, and when considered together, the economic reports surpass expectations. Such cycles run their course, and the economic reports turn softer. That overperform/underperform cycle can repeat itself multiple times during...