by Mark Chandik | Jan 2, 2024

Weekly Market Commentary A December 29th Wall Street Journal title summed the year up: What Did Wall Street Get Right About Markets This Year? Not Much. Back up to December 2022, when Moody’s Chief Economist Mark Zandi captured the most prevalent view at the time....

by Mark Chandik | Dec 28, 2023

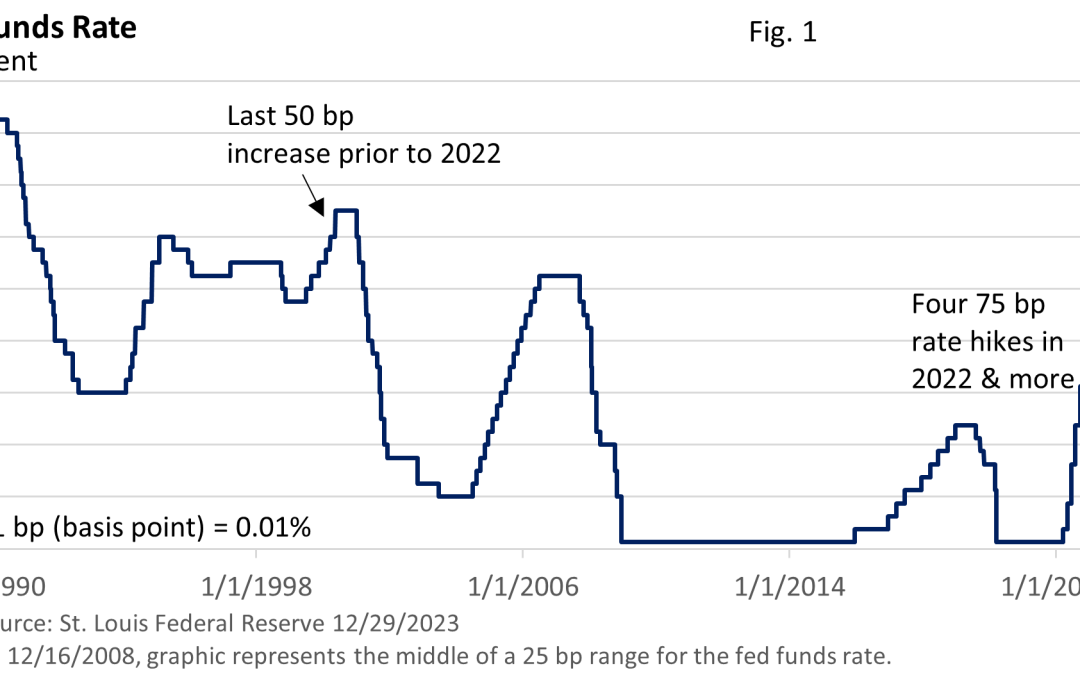

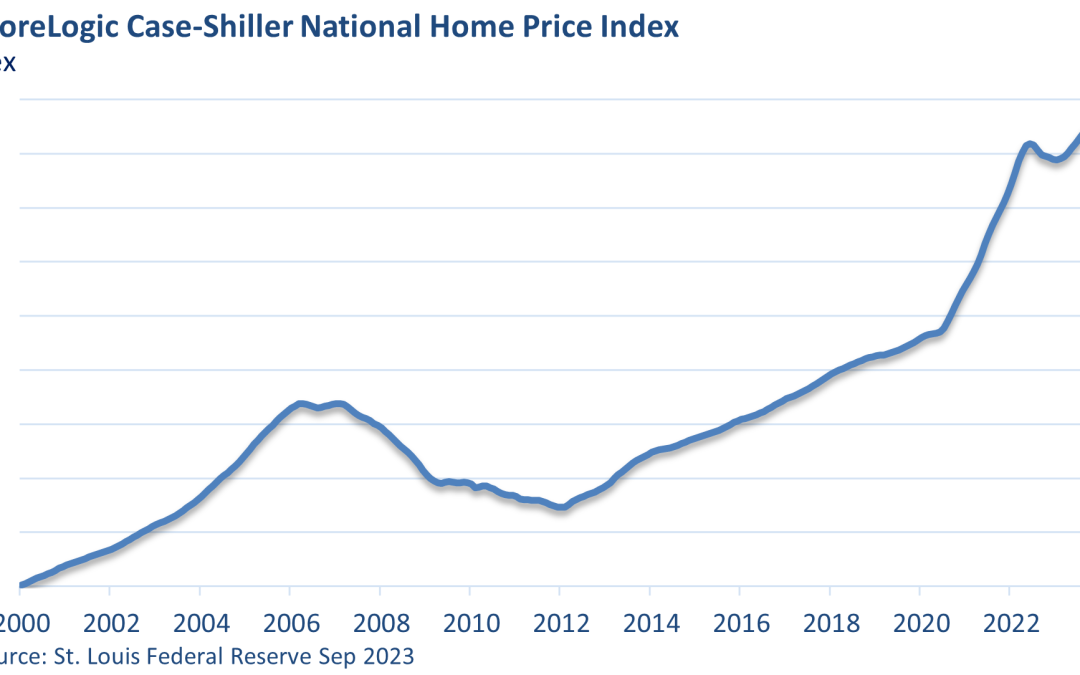

Weekly Market Commentary Mortgage rates have soared, and home sales are down sharply. Conventional wisdom would suggest that prices should be down. But housing prices have defied expectations, rising to record heights and locking first-time buyers out of the market....

by Mark Chandik | Dec 18, 2023

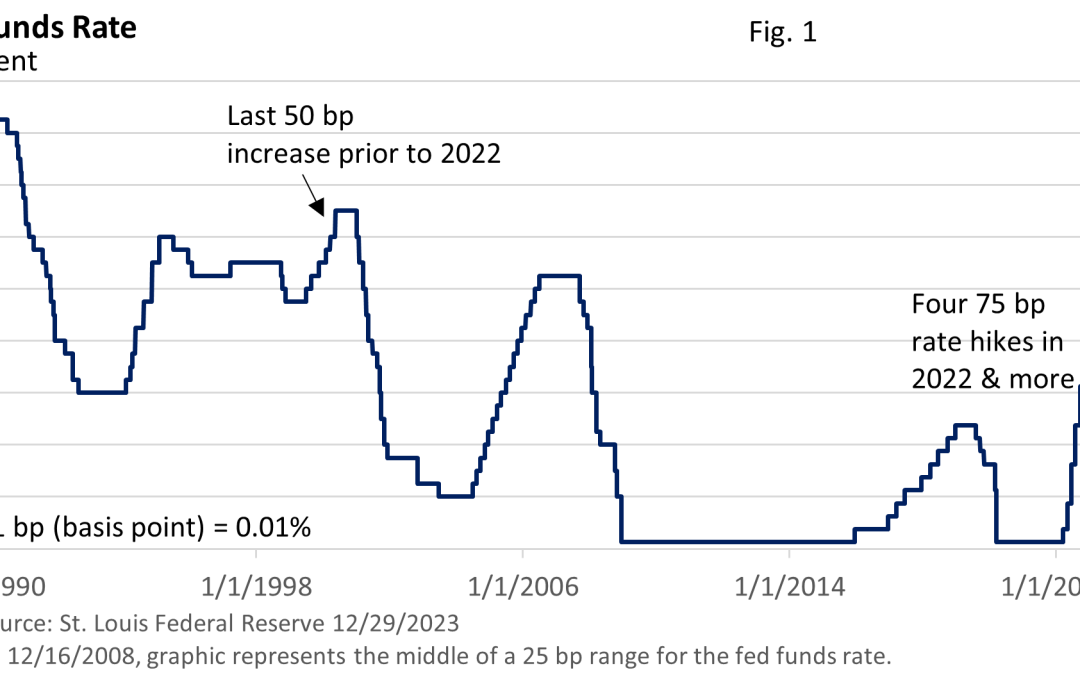

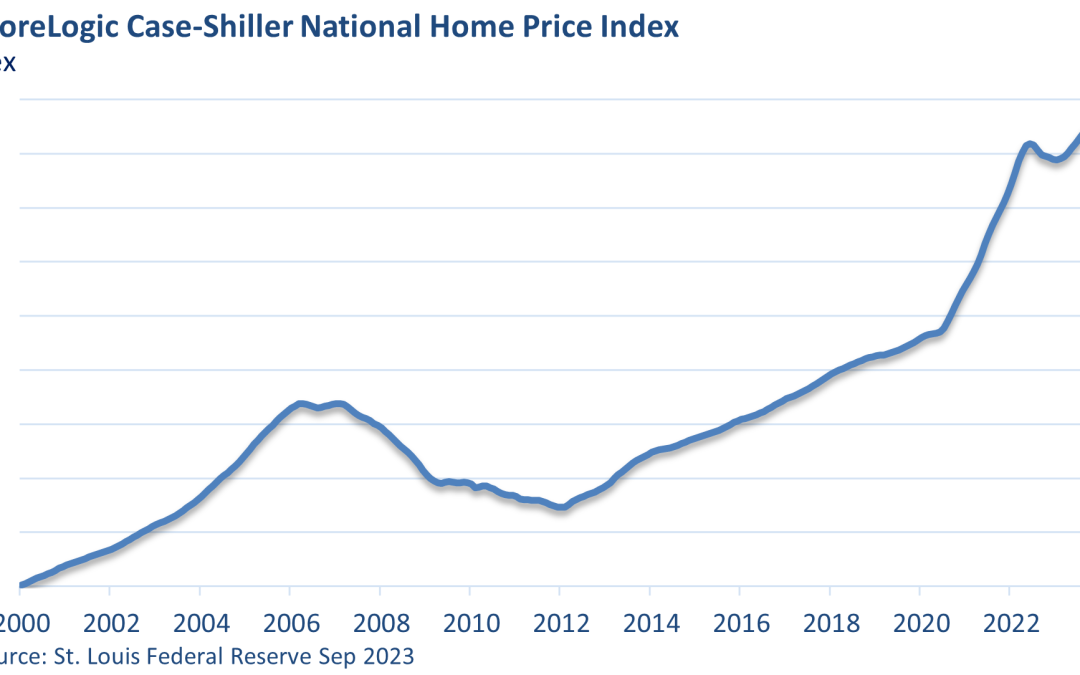

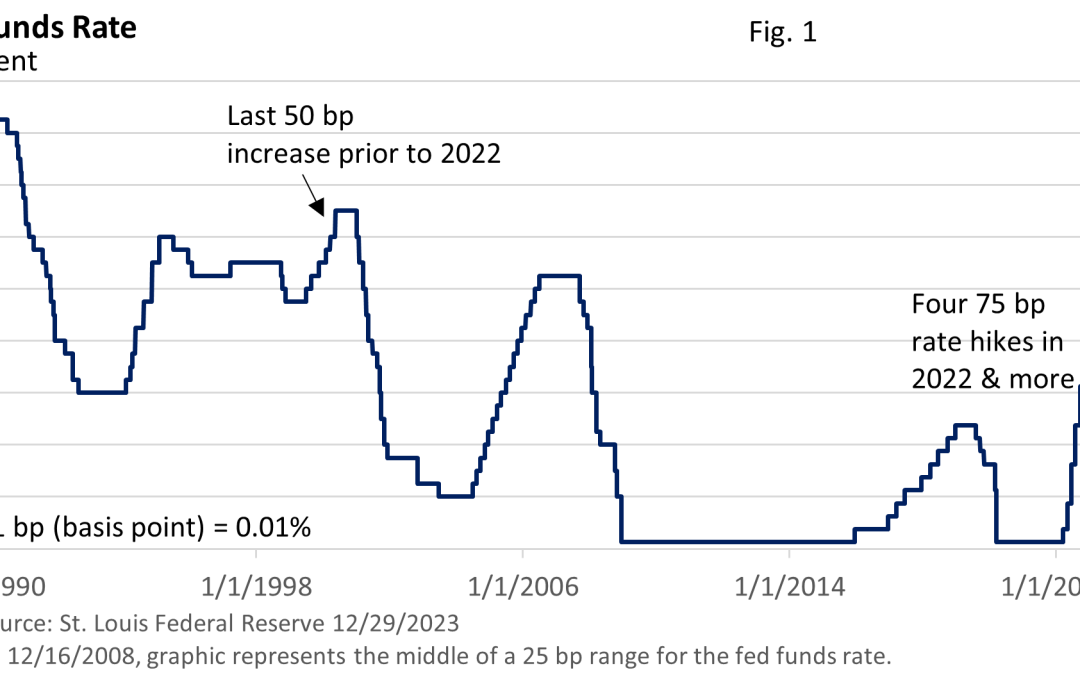

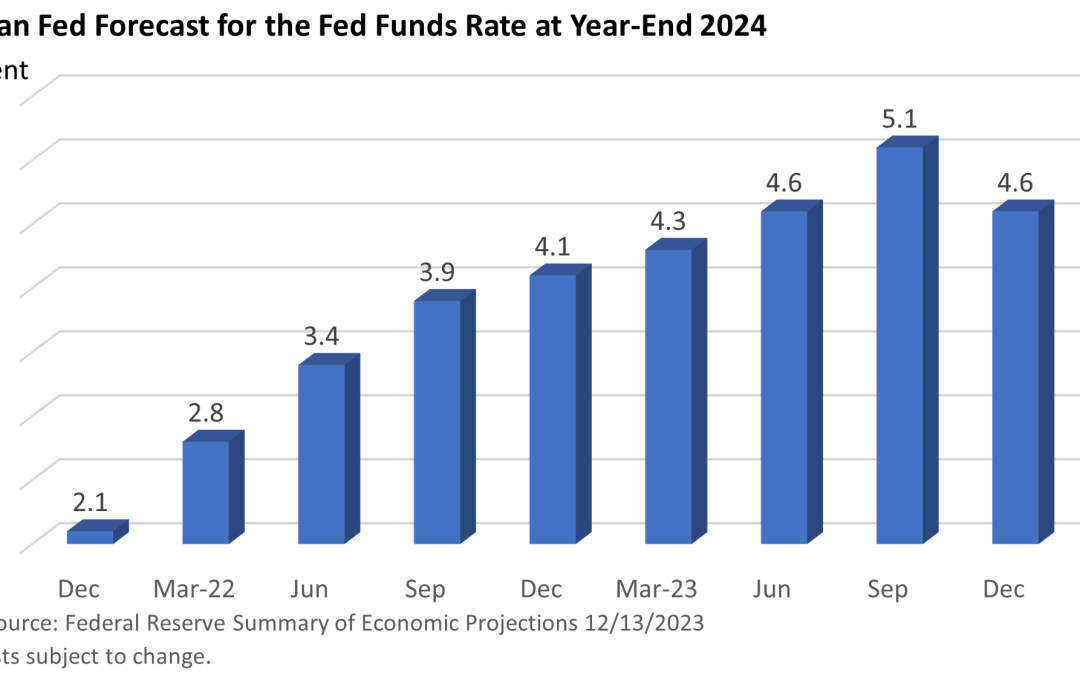

Weekly Market Commentary The meeting held by the Federal Reserve last week was the most consequential gathering of central bankers this year. The Fed held the fed funds rate at 5.25 – 5.50% as expected, but in so many words, the Fed pivoted on its rate stance. No...

by Mark Chandik | Dec 11, 2023

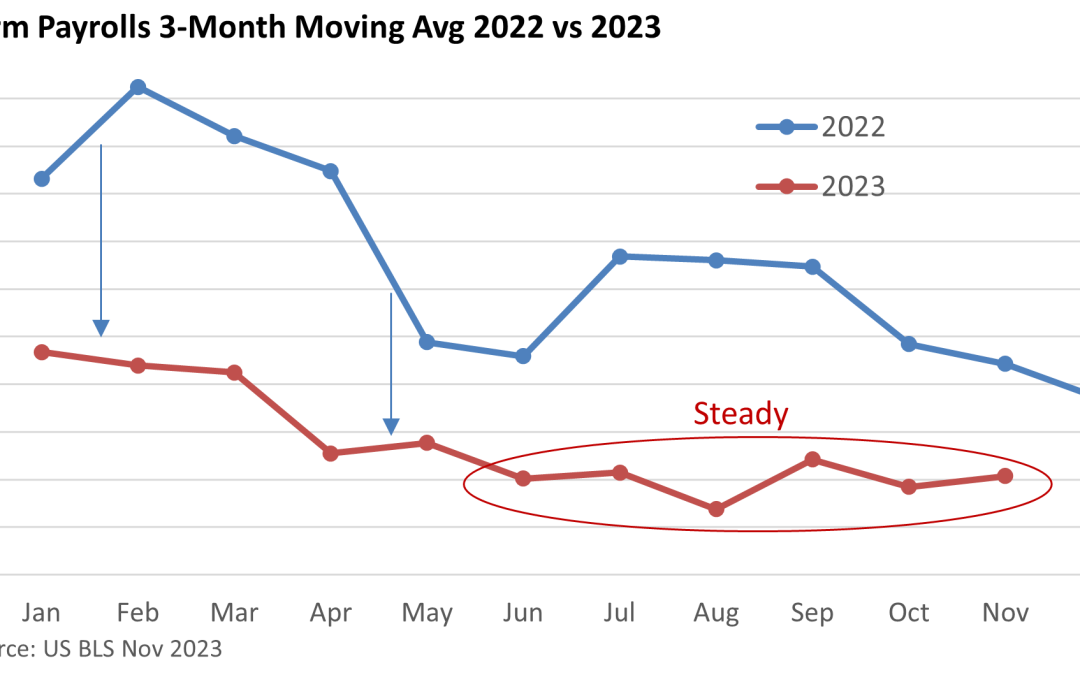

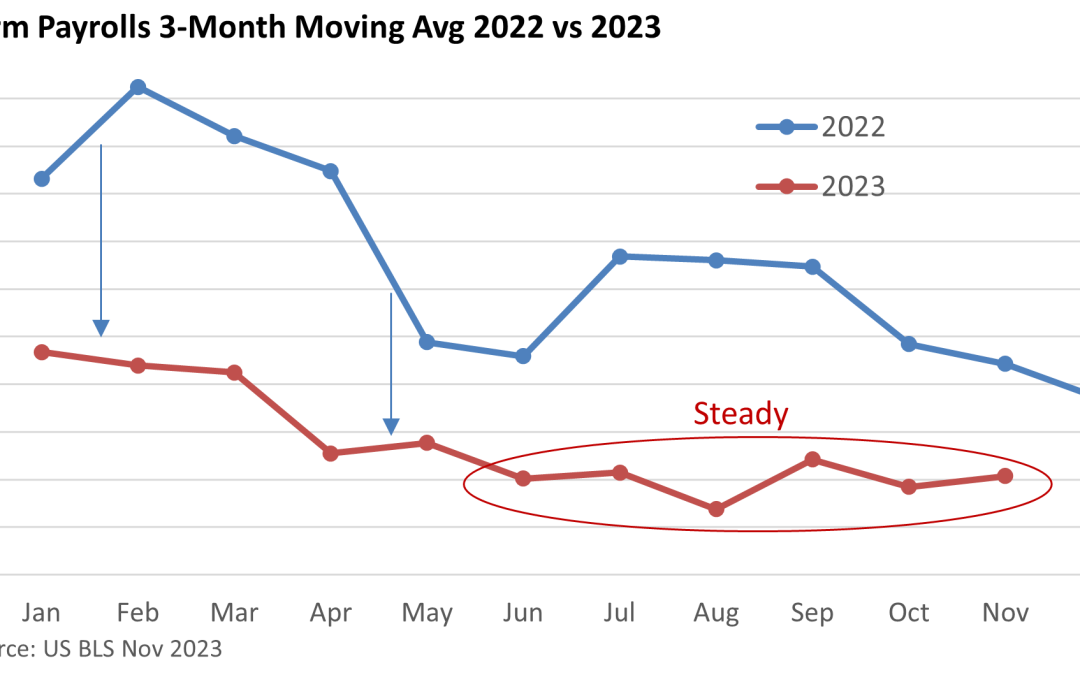

Weekly Market Commentary The latest jobs report did little to alter the economic outlook. Instead, it was a steady-as-she-goes report. Nonfarm payrolls grew by 199,000 in November, according to the U.S. Bureau of Labor Statistics (BLS). It was nearly in line with the...

by Mark Chandik | Dec 4, 2023

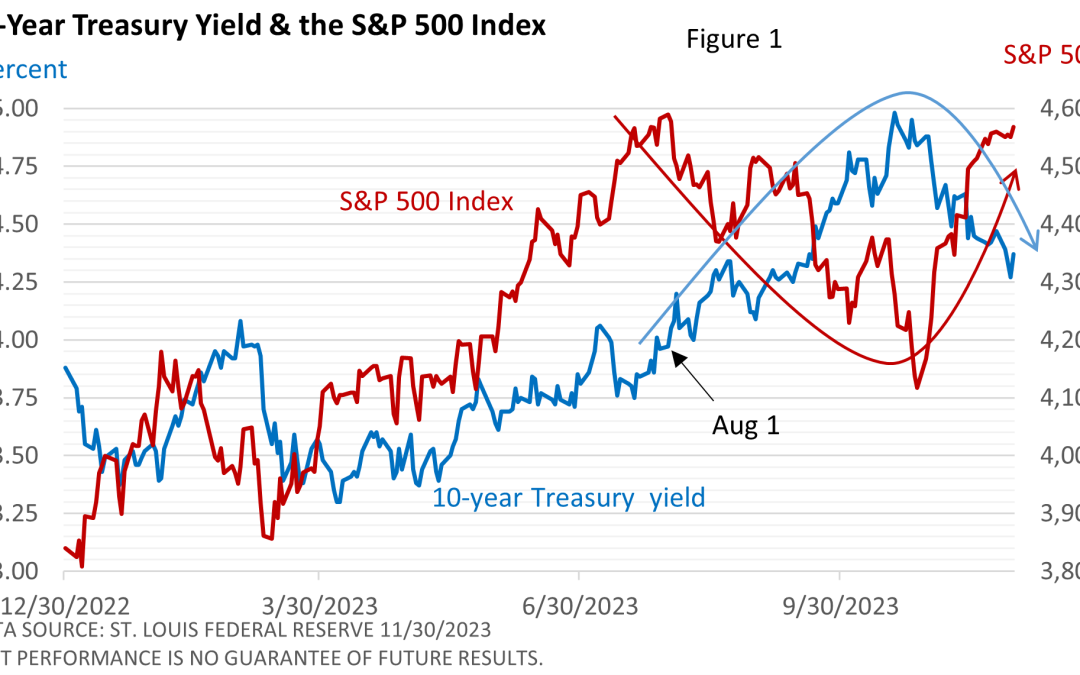

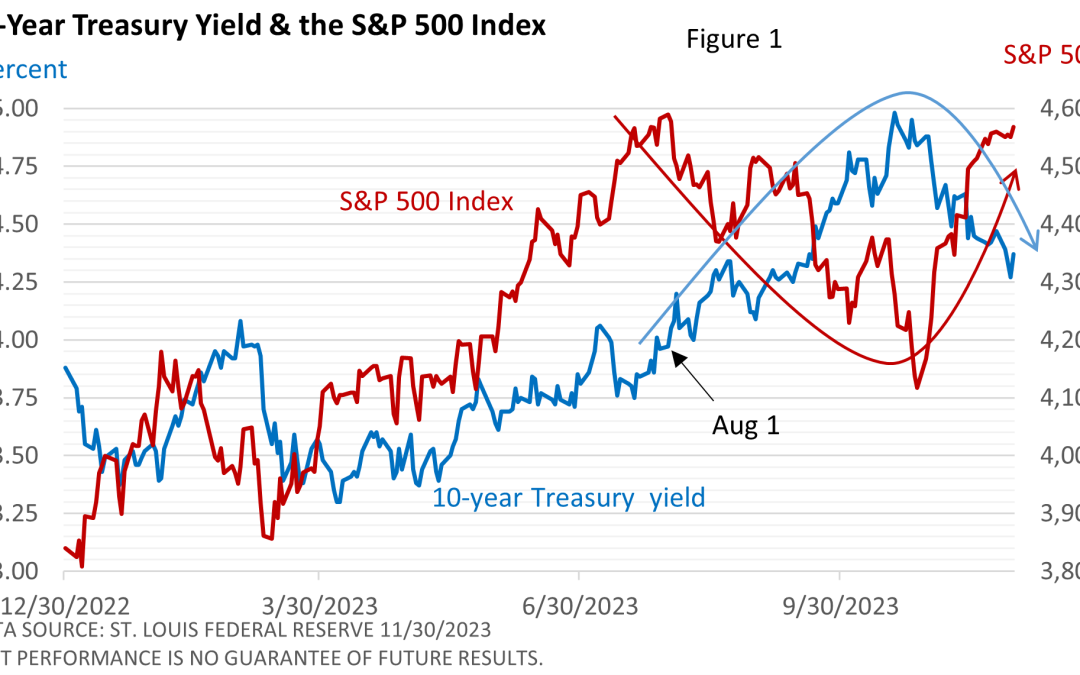

Weekly Market Commentary Many things influence the direction of stocks. Corporate profits, economic growth, general market sentiment, inflation, and interest rates are among those variables. At any given point, the influence of various factors on stocks will...

by Mark Chandik | Nov 20, 2023

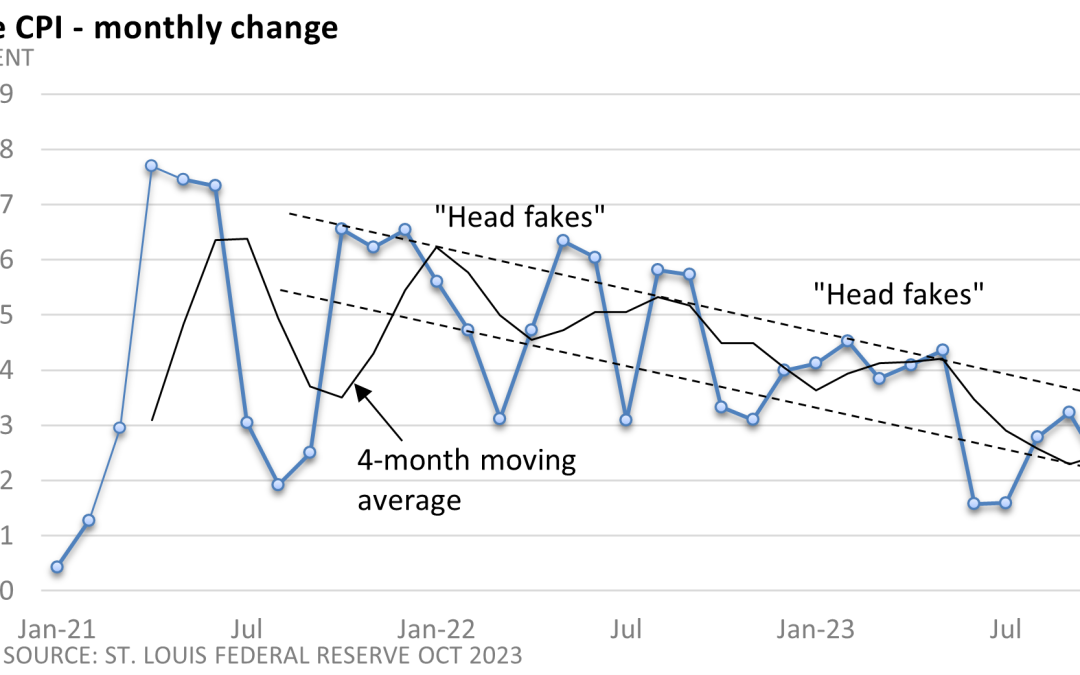

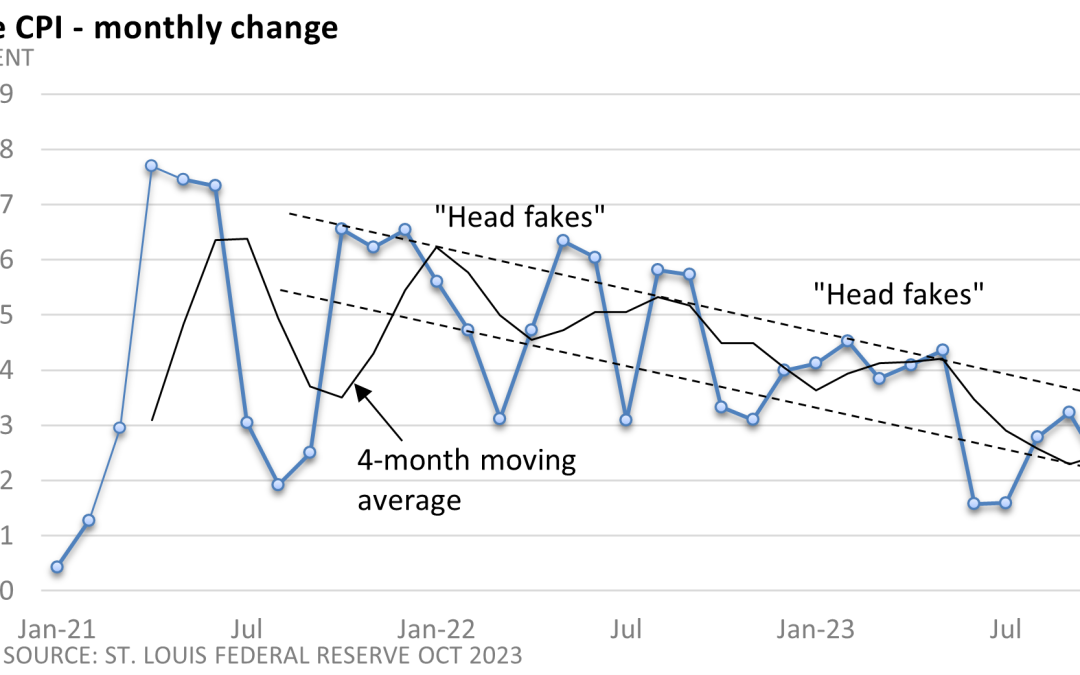

Weekly Market Commentary The U.S. Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) was unchanged in October from the prior month. It is up 3.2% from a year ago. Excluding volatile food and energy prices, the core CPI rose 0.2%. The core...