by Mark Chandik | Jun 3, 2024

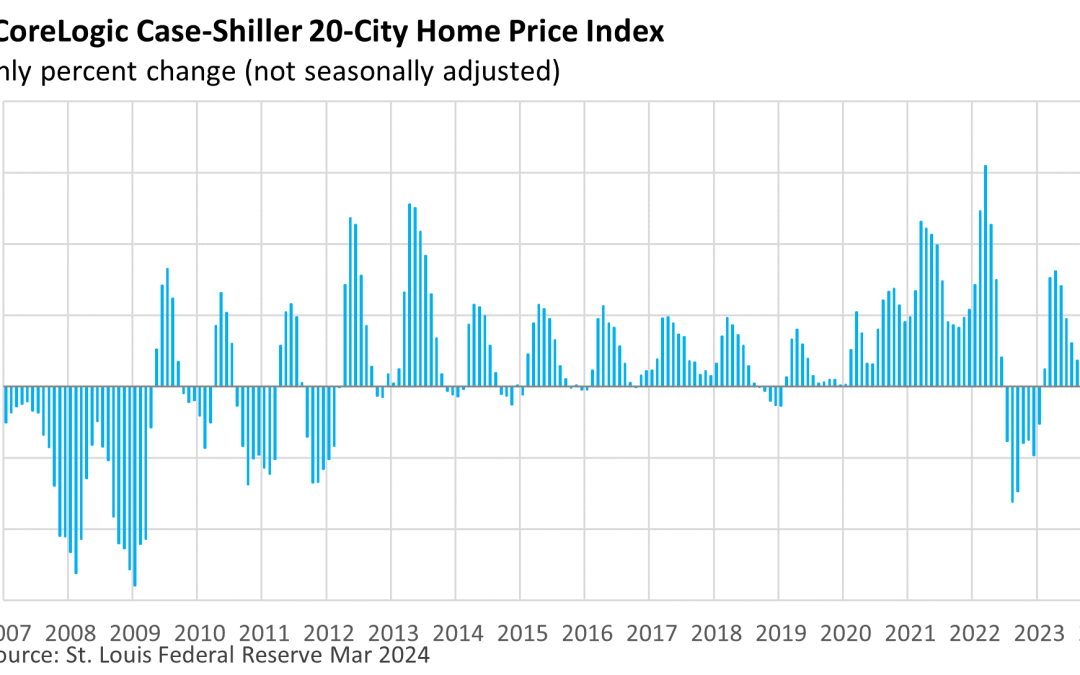

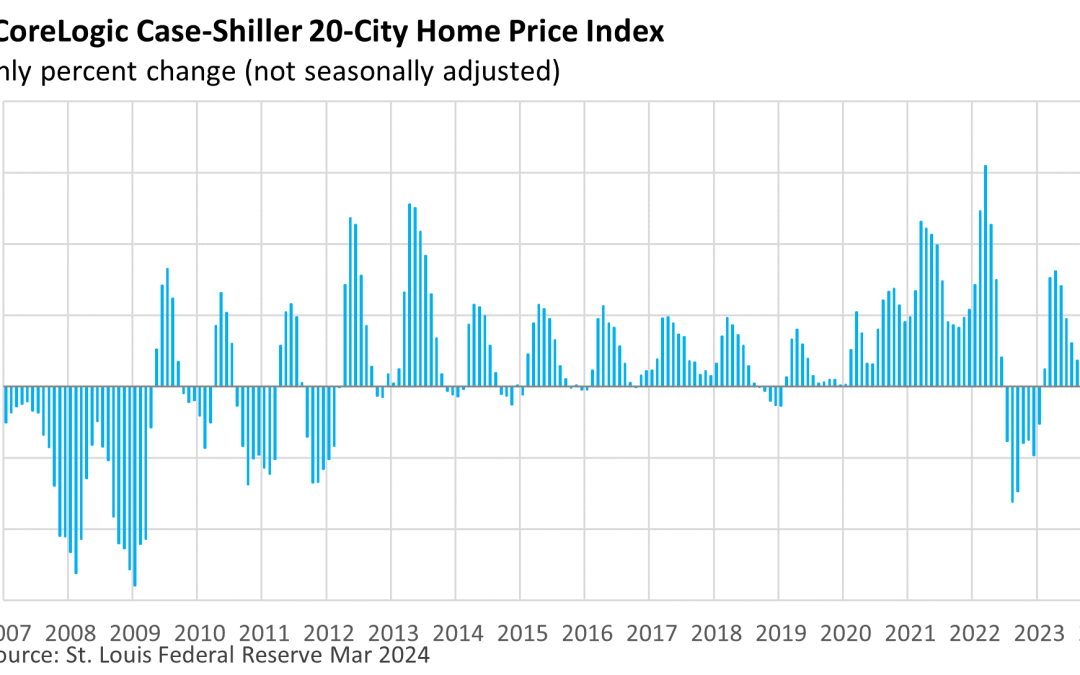

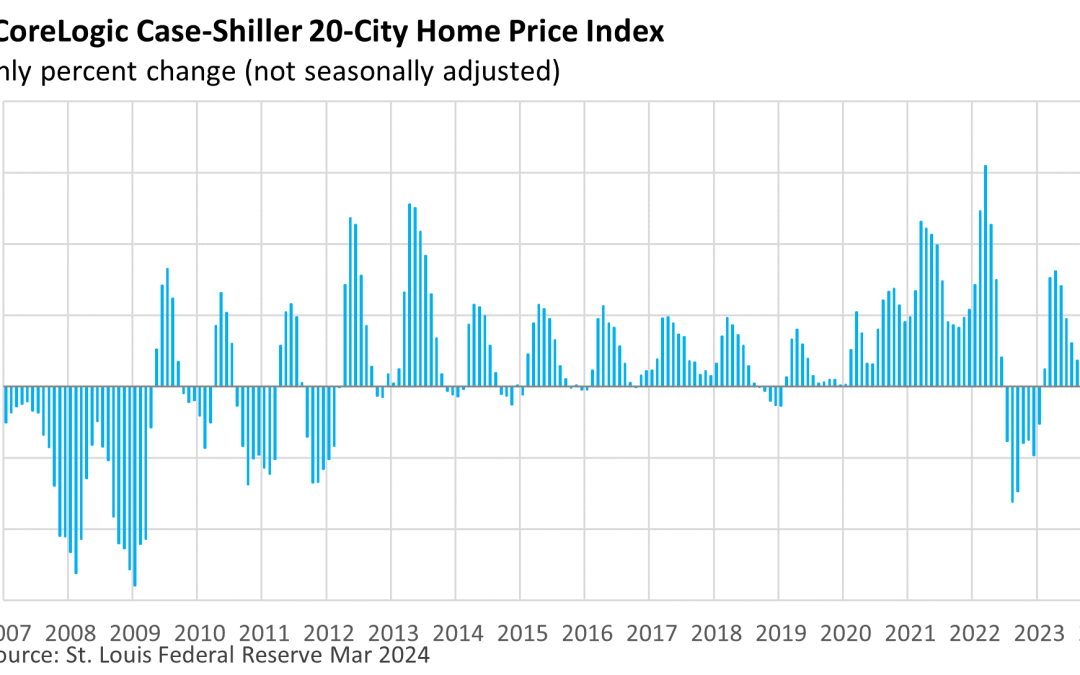

Weekly Market Commentary The price of a home hit a new record, according to the latest data on housing prices. The S&P CoreLogic Case-Shiller 20-City Home Price Index, which measures monthly housing prices in 20 major metropolitan areas, rose 1.6% on a...

by Mark Chandik | May 28, 2024

Weekly Market Commentary Stocks have been drifting higher for several weeks as investors search for a catalyst that could drive shares in either direction. Interest rates can influence market direction, but there hasn’t been much news recently on the rate front....

by Mark Chandik | May 20, 2024

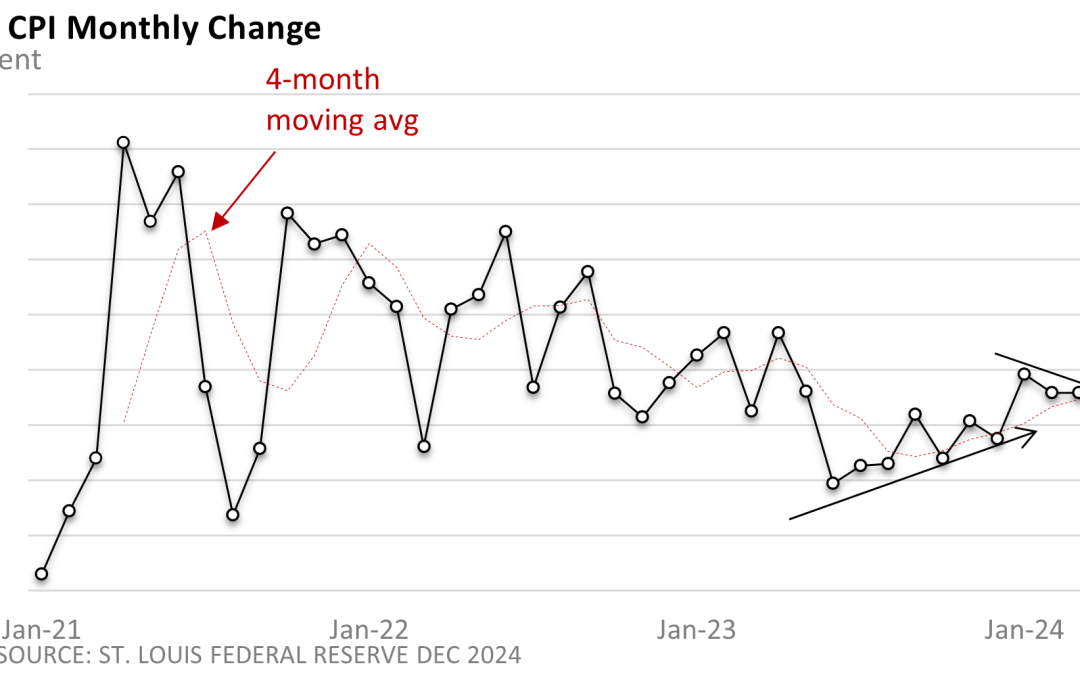

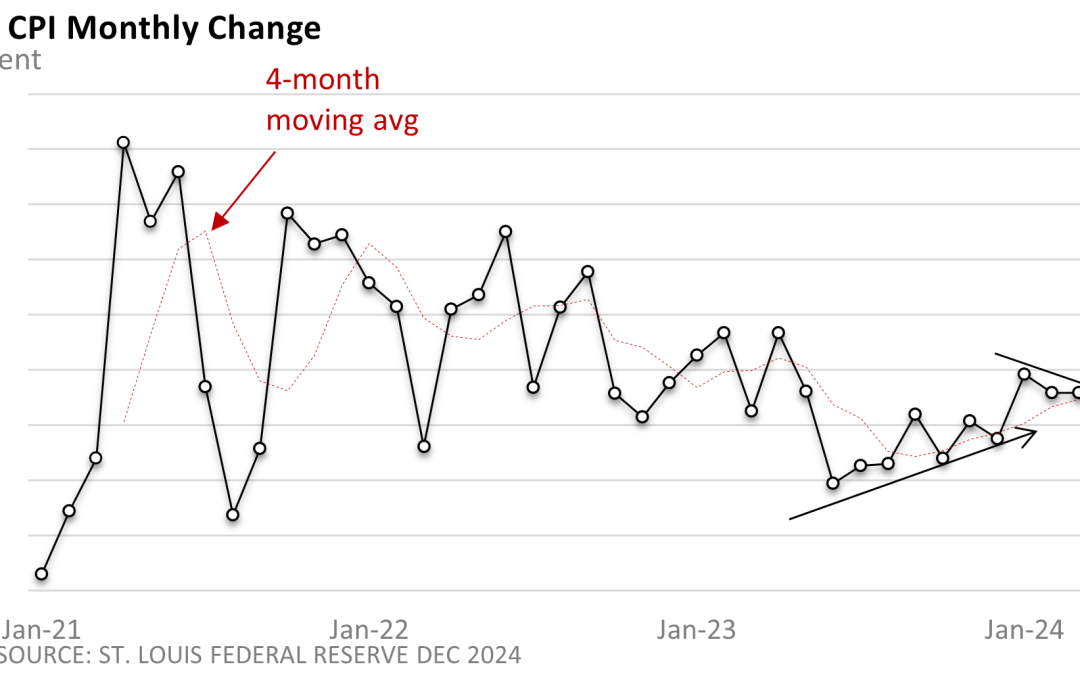

Weekly Market Commentary Investors celebrated an ‘in line with expectations’ CPI that suggested the rate of inflation isn’t accelerating. It’s a small win, but it was enough to send the three major market indexes, the Dow, the Nasdaq, and the S&P 500 to new highs....

by Mark Chandik | May 13, 2024

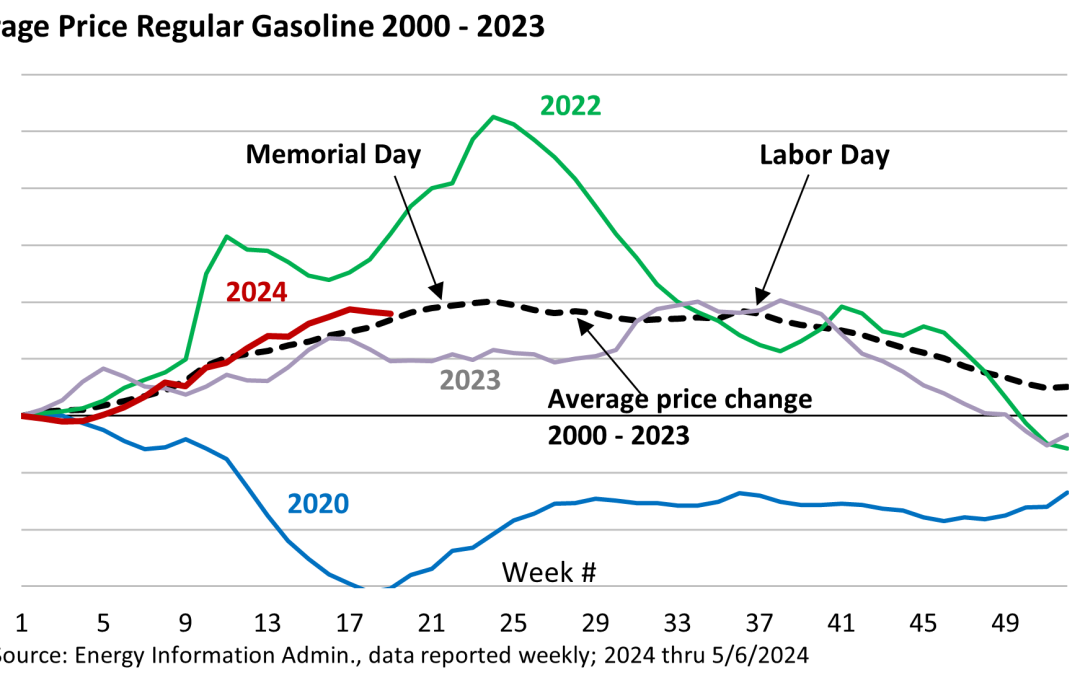

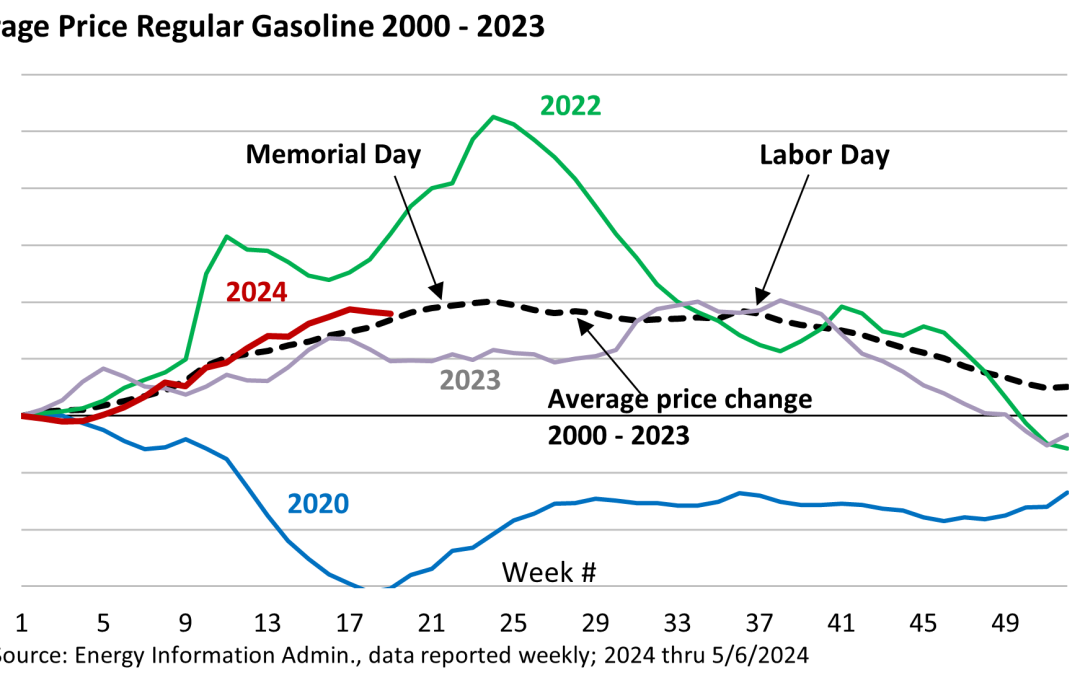

Weekly Market Commentary You’re right if you have this nagging feeling that gas prices rise in the spring. As the graphic illustrates, on average prices rise through Memorial Day, plateau over the summer, and slip in the fall. This year is no exception, as...

by Mark Chandik | May 6, 2024

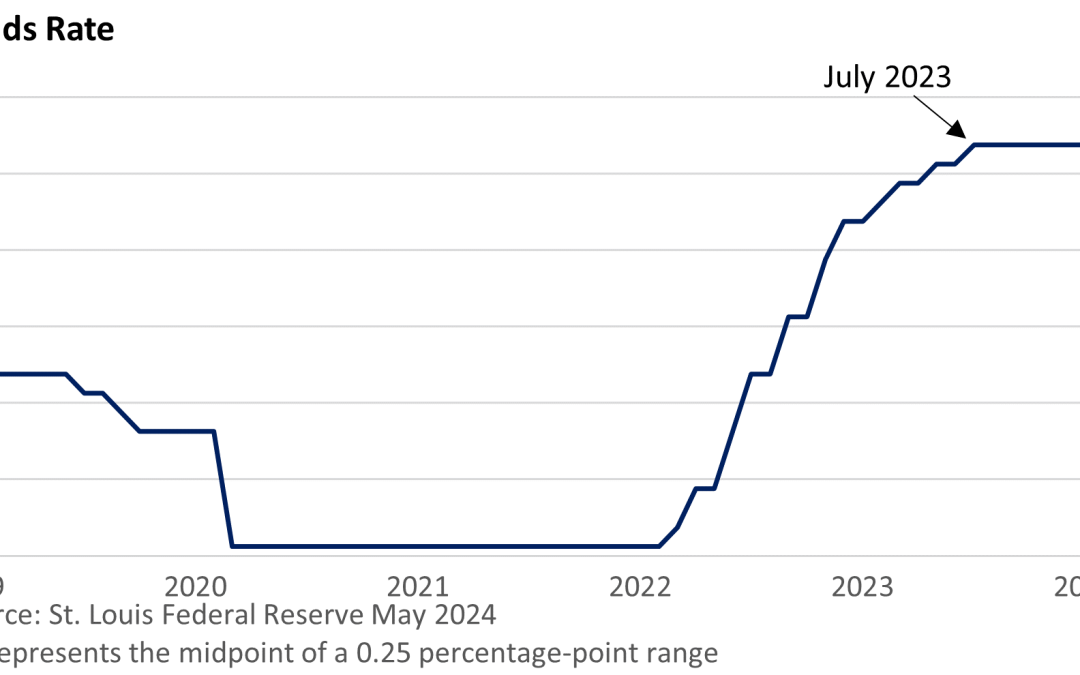

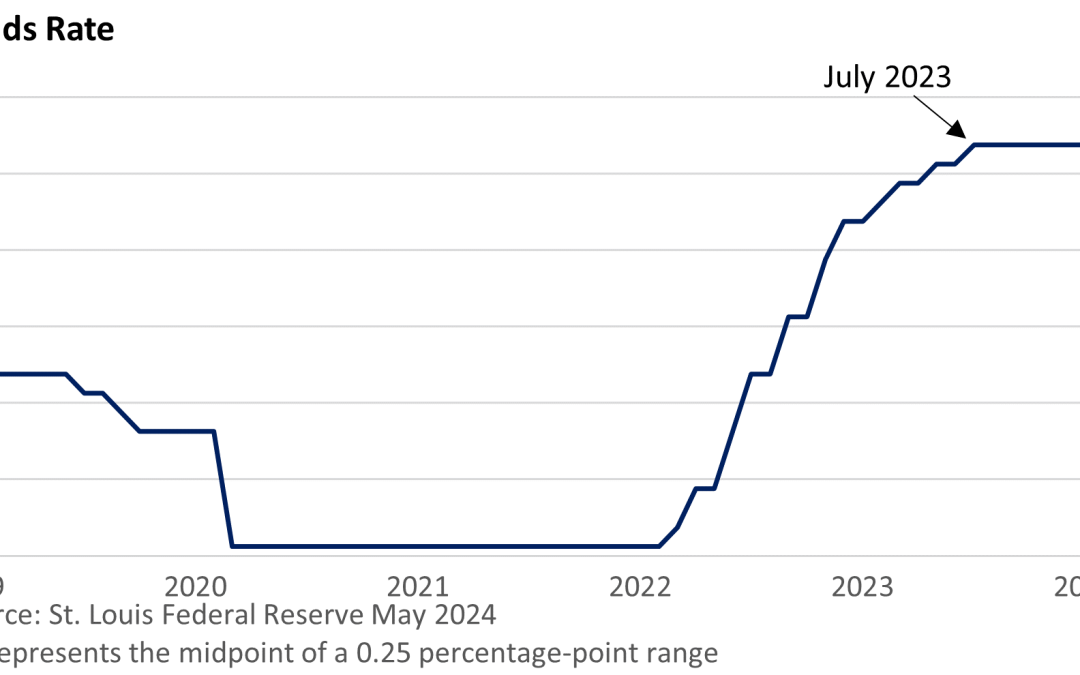

Weekly Market Commentary We often discuss the Federal Reserve and interest rates because both greatly impact investors. For starters, changes in interest rates have a significant impact on stock prices and income earned on savings. Sharply higher rates in 2022 pushed...

by Mark Chandik | Apr 22, 2024

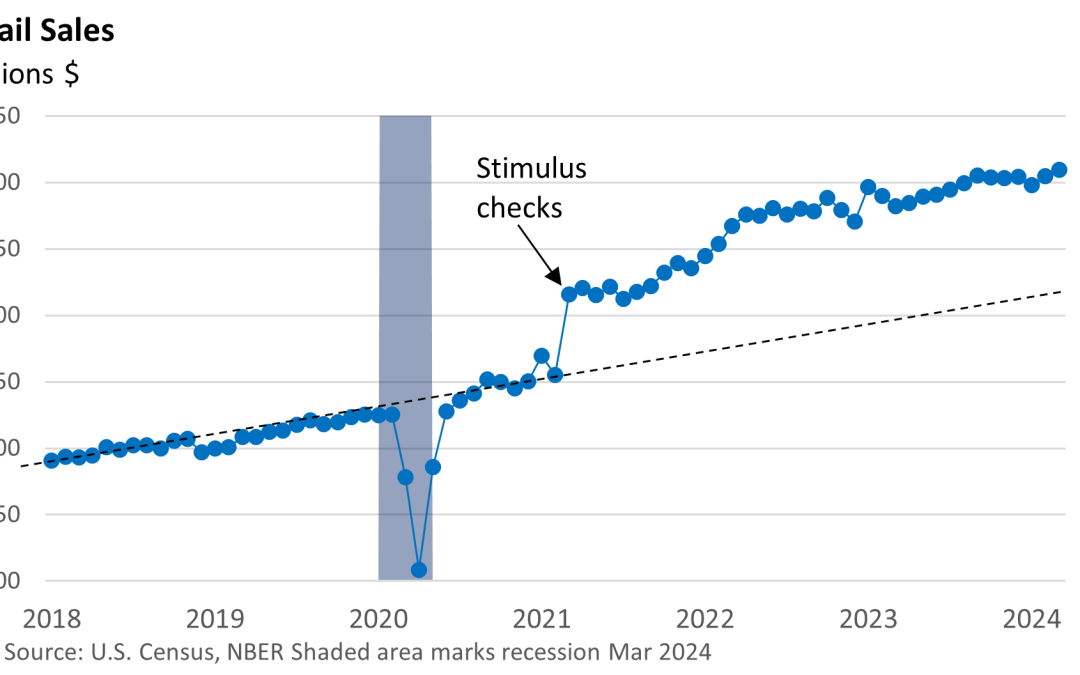

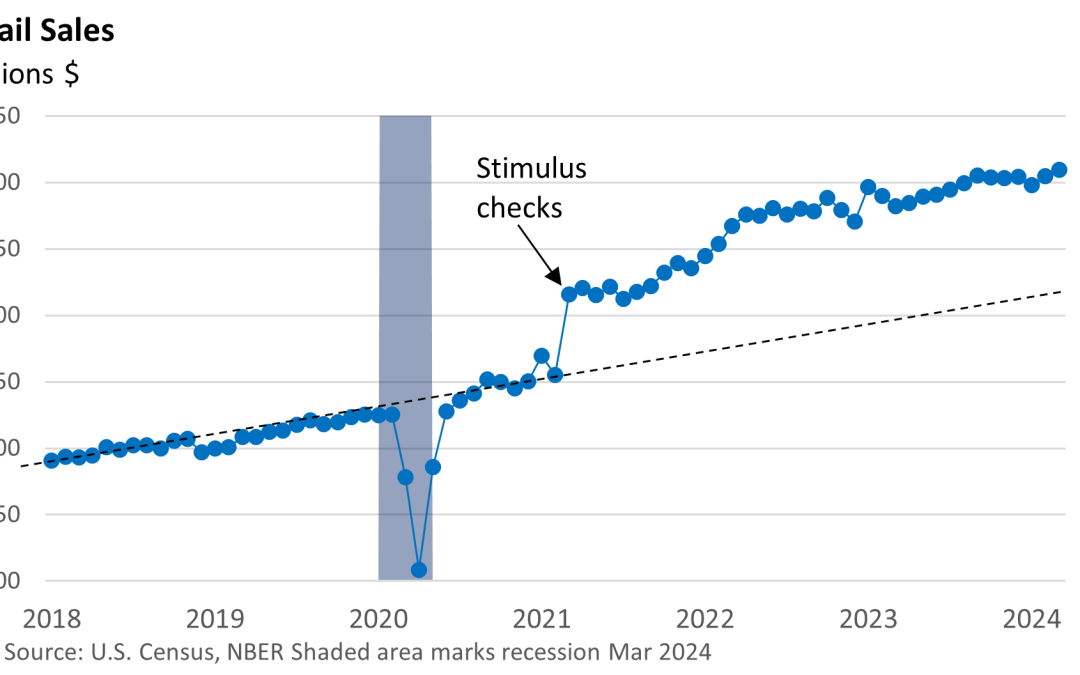

Weekly Market Commentary That ubiquitous phrase from one of America’s most extensive athletic footwear and apparel makers seems to have been adopted by most American shoppers. The U.S. Census Bureau reported last week that retail sales jumped 0.7% in March, following...