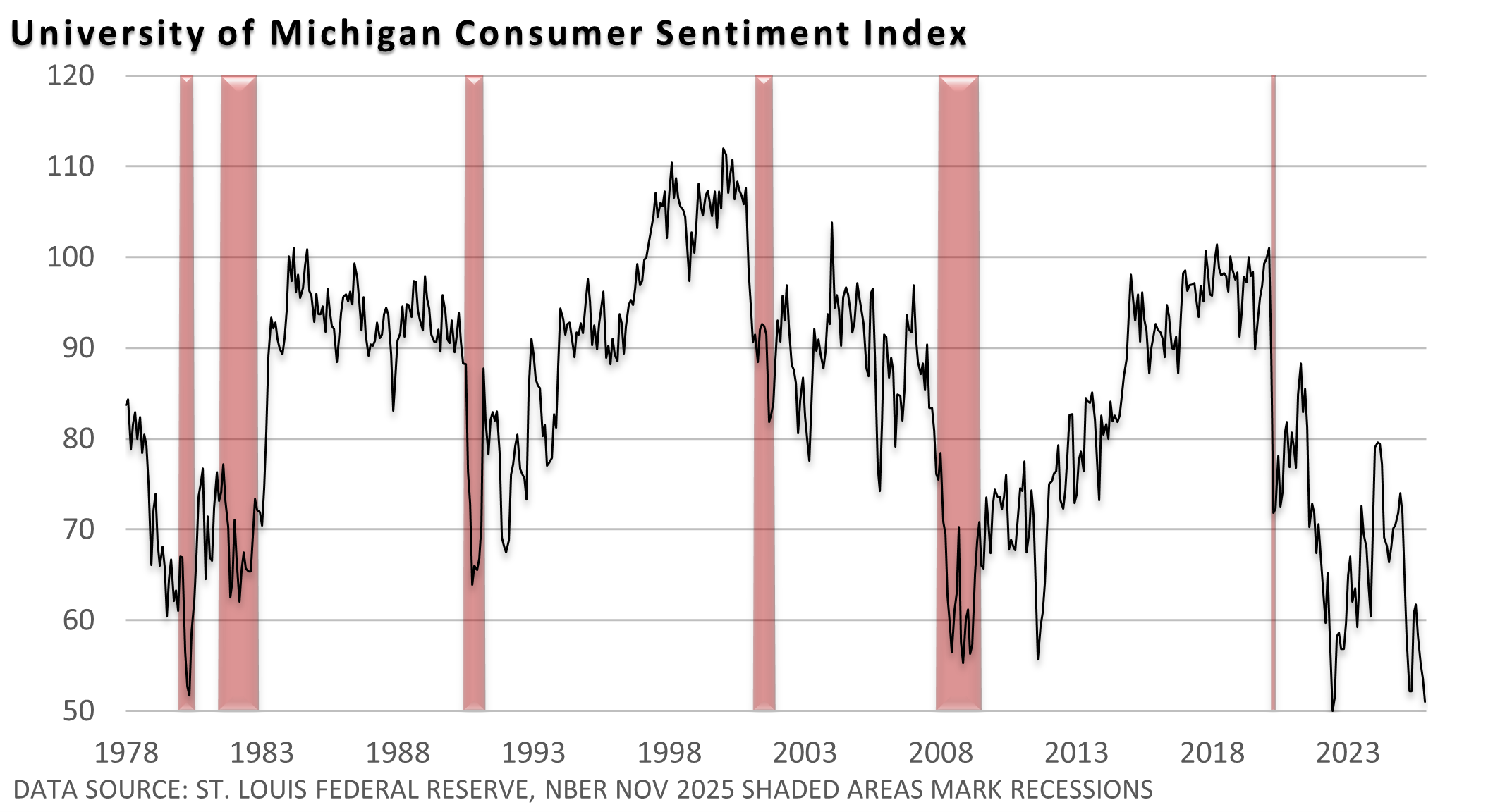

The graphic below illustrates the conundrum. The University of Michigan’s consumer sentiment survey is near an all-time low.

What people say and what they actually do don’t always match up. While a few big retail stores like Target (TGT $91) and Home Depot (HD $357) struggled in the third quarter, most shone.

Lowe’s (LOW $242) said it sees a home-improvement turnaround (Wall Street Journal), retail giant Walmart (WMT $111) hiked its earnings forecast (CNBC), and Urban Outfitters (URBN $74) had a strong quarter (Wall Street Journal).

Best Buy (BBY $79) also raised its sales forecast, Kohl’s reported an unexpected profit in the third quarter, and TJX Cos. (TJX $152) issued a strong outlook (CNBC).

In a strong economy, there will be a few misfires. In a recession, a few firms manage to execute exceedingly well. But the center of gravity for the retailers that have reported has been upbeat.

Possible reason for the disconnect

Consumer confidence surveys capture how people feel about the economy and their financial outlook, not what they’re actually doing with their money right now.

Prices aren’t climbing as fast as they were a few years ago, but they’re still high. And while higher-income households appear to be powering much of the retail strength, lower-income consumers are feeling squeezed.

Bottom line—consumers are still spending, and that supports overall economic activity and the economy as we head into the final month of the year.