Prosperity Partners Blog

Fill ‘er Up

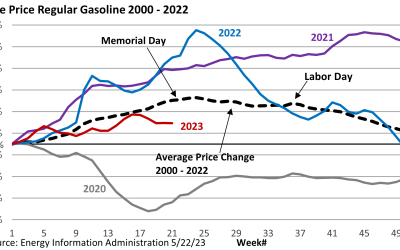

The days of pulling up to a gas station, rolling down the window, and asking the attendant to fill ‘er up are long gone. Nowadays, the responsibility falls on someone in the car to pump the gas. As we head into the summer season, it’s no coincidence that the price of gasoline tends to increase, especially as we approach Memorial Day weekend.

About That Earnings Apocalypse

Some investors were bracing for an earnings apocalypse. Once again, fears were exaggerated. It’s not the first time some have been expecting dire results. A CNBC story six months ago previewing Q3 profits suggested earnings could disappoint in a big way. They didn’t.

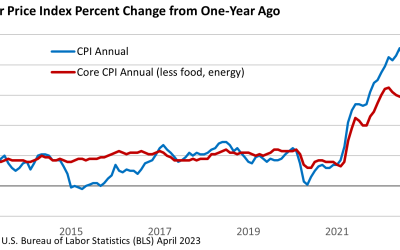

Easing Inflation, Stubborn Inflation

In the past, investors paid close attention to the monthly employment report. Today the focus has shifted to the CPI. Blame high inflation for the jump in interest rates, which has pressured the major stock market averages. The U.S. Bureau of Labor Statistics reported that while inflation eased in April, it remains high.

Crosscurrents

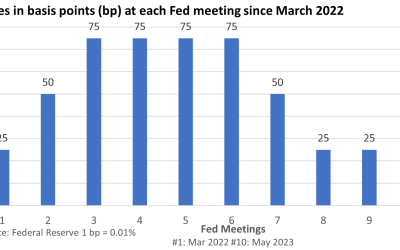

Here’s a paradox. What happens when an immovable object runs into an irresistible force? In today’s investing world, the Federal Reserve has been that immovable object, jacking up interest rates in order to quell inflation.

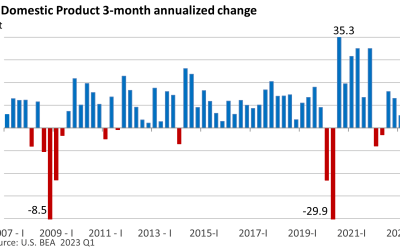

Making Heads or Tails Out of the Latest GDP Report

Gross Domestic Product (GDP) is the economy’s largest measure of goods and services. Preliminary data from the U.S. Bureau of Economic Analysis showed that GDP slowed from an annual pace of 2.6% in Q4 2022 to 1.1% in the first quarter of 2023.

Up or Down – Which Way From Here

Economic sentiment can shift on a dime. This year, terms like ‘soft landing (slowing growth, slowing inflation)’ and ‘hard landing (recession, slower inflation)’ have gotten the most play. Earlier in the year, a so-called ‘no-landing’ scenario (continued economic growth, high inflation) crept into the vocabulary. Occasionally, we hear ‘crash landing (steep recession, low inflation).’

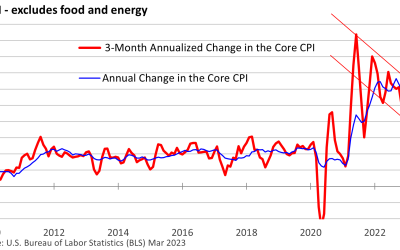

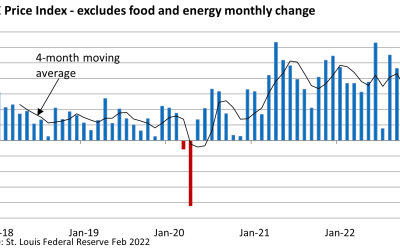

Latest Inflation News Offers Some Encouragement

The slowdown in the rate of inflation last month was aided by food and energy prices. The Consumer Price Index rose 0.1% in March versus February amid a 3.5% decline in energy prices and no change in food prices (U.S. Bureau of Labor Statistics data). Grocery stores actually fell 0.3%, while food at restaurants jumped 0.6%.

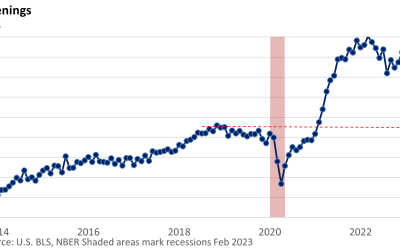

Hiccups in the Job Market

There have been no flareups since the bank failures in early March, and the crisis continues to simmer on the back burner. But anxieties haven’t completely subsided. Last week the U.S. Bureau of Labor Statistics reported that job openings fell 632,000 in February to 9.93 million. That’s on top of a downwardly revised 670,000 in January.

Inflation – It Hasn’t Gone Away

Inflation was uppermost on the minds of investors, Fed officials, and policymakers until the failure of Silicon Valley Bank (SVB) forced price stability to play second fiddle to banking stability. The banking crisis has eased amid tentative signs that actions taken by the U.S. Treasury, the FDIC, and the Federal Reserve are having their intended effect: preventing contagion.

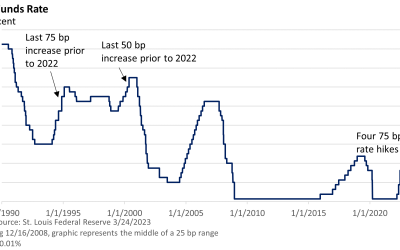

A Dovish Rate Increase

The Federal Reserve raised its key lending rate, the fed funds rate, by 25 basis points (bp, 1 bp = 0.01%) to a range of 4.75 – 5.00%, as most observers had expected. A few saw no change. Before the failure of Silicon Valley Bank (SVB), a consensus had been building for 50 bp.

Not a George Bailey Moment

George Bailey is the fictional character in the 1946 classic It’s a Wonderful Life. Set mostly in the 1920s and 1930s, George runs the Building & Loan, a thrift that’s besieged by worried depositors. George appealed to his customers not to panic, and the Building & Loan survived.

SVB Bank Failure and Bailout Dominates the Financial News

In the last 48 hours we’ve seen the 15th largest bank fail due to a lack of liquidity and then be bailed out by the Fed overnight. This crisis might stop the Fed from increasing rates next week. The Fed is caught between two tough decisions…….on the one hand wanting to tamper down inflation and on the other hand wanting to avoid additional bank failures.