Prosperity Partners Blog

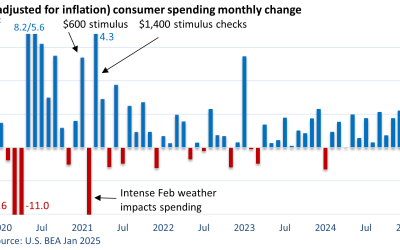

Front-Running Tariffs Distort GDP

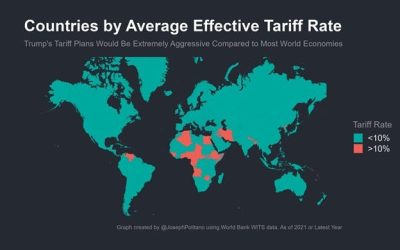

Reciprocal tariffs were announced Wednesday afternoon. In most cases, they are far higher than expected and varied considerably. Vietnam at 46%, the European Union at 20%, China at 54% (20% existing + 34% reciprocal), and the United Kingdom at 10%, according to the White House.

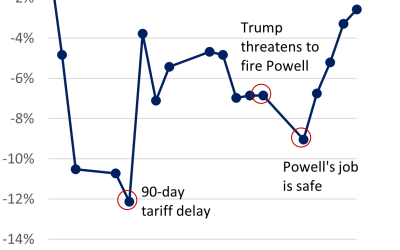

Trading on Headlines

Reciprocal tariffs were announced Wednesday afternoon. In most cases, they are far higher than expected and varied considerably. Vietnam at 46%, the European Union at 20%, China at 54% (20% existing + 34% reciprocal), and the United Kingdom at 10%, according to the White House.

Flexing Economic Muscles

Reciprocal tariffs were announced Wednesday afternoon. In most cases, they are far higher than expected and varied considerably. Vietnam at 46%, the European Union at 20%, China at 54% (20% existing + 34% reciprocal), and the United Kingdom at 10%, according to the White House.

Stocks End Volatile Week Higher but Certainty in Short Supply

Reciprocal tariffs were announced Wednesday afternoon. In most cases, they are far higher than expected and varied considerably. Vietnam at 46%, the European Union at 20%, China at 54% (20% existing + 34% reciprocal), and the United Kingdom at 10%, according to the White House.

Tariff Takedown

Reciprocal tariffs were announced Wednesday afternoon. In most cases, they are far higher than expected and varied considerably. Vietnam at 46%, the European Union at 20%, China at 54% (20% existing + 34% reciprocal), and the United Kingdom at 10%, according to the White House.

31 Thoughts on Tariffs

The Federal Reserve held its key rate, the fed funds rate, at 4.25 – 4.50% as expected. But Fed officials downgraded the economic outlook for 2025 and raised its forecast for inflation (again) in its quarterly Summary of Economic Projections.

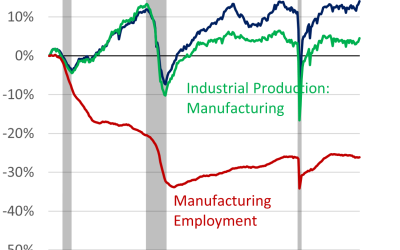

Manufacturing in Crisis

The Federal Reserve held its key rate, the fed funds rate, at 4.25 – 4.50% as expected. But Fed officials downgraded the economic outlook for 2025 and raised its forecast for inflation (again) in its quarterly Summary of Economic Projections.

Elevated Uncertainty, ‘Transitory’ Makes a Comeback

The Federal Reserve held its key rate, the fed funds rate, at 4.25 – 4.50% as expected. But Fed officials downgraded the economic outlook for 2025 and raised its forecast for inflation (again) in its quarterly Summary of Economic Projections.

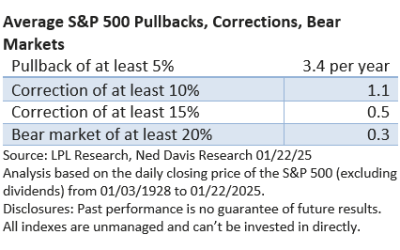

Entering a Market Correction

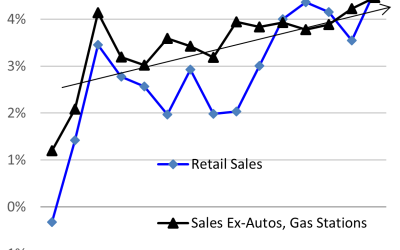

The February Consumer Price Index came in softer than expected, rising 0.2%, according to the U.S. BLS. The core CPI, which excludes food and energy, also rose 0.2%. The core CPI slowed to an annual rate of 3.1% from 3.3% in January. February’s rate was the slowest since early 2021.

Tariffs On, Tariffs Off, Tariffs Back On (Sort of)

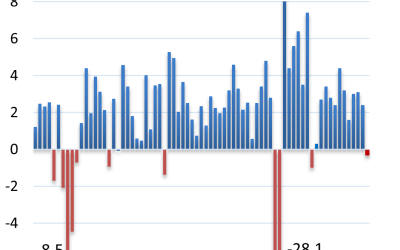

There are times when the economic data is strong, and when considered together, the economic reports surpass expectations. Such cycles run their course, and the economic reports turn softer. That overperform/underperform cycle can repeat itself multiple times during an economic expansion until the economy finally rolls over, and we land in a recession.

A Whiff of Uncertainty

There are times when the economic data is strong, and when considered together, the economic reports surpass expectations. Such cycles run their course, and the economic reports turn softer. That overperform/underperform cycle can repeat itself multiple times during an economic expansion until the economy finally rolls over, and we land in a recession.

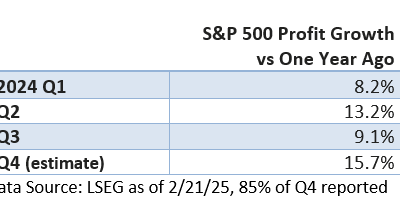

Earnings Impress

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.