Prosperity Partners Blog

Explaining Away a Hot Inflation Report

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

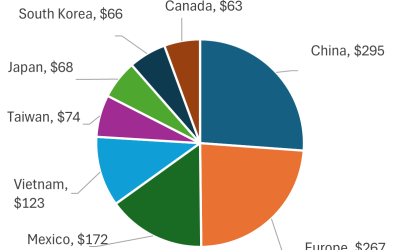

Tariff Threat in Play

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

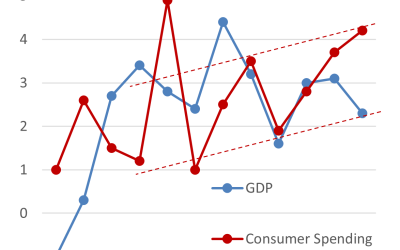

The Consumer Bolsters GDP

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

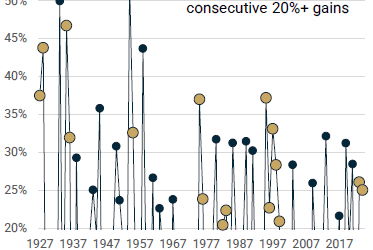

2024 Market Summary and Financial Forcast

Best Two Years in a Quarter-Century. In late 2022, a new bull market emerged from the ashes of a nine-month bear market, leading to 2023’s impressive rise of over 26% for the closely followed S&P 500 Index, according to S&P Global (including dividends reinvested).

Housing’s Worst Year in Nearly 30 Years

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

Despair to Jubilation and Beyond

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

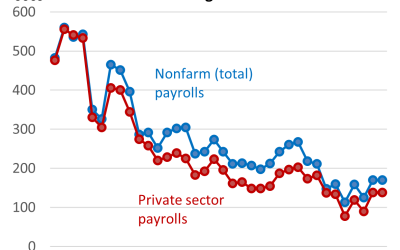

A Wall Street vs Main Street Jobs Report

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

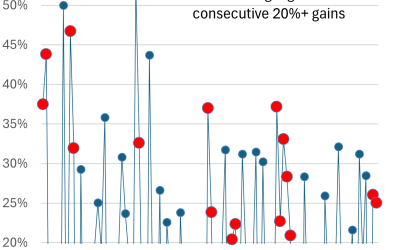

Best Two Years in a Quarter-Century

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

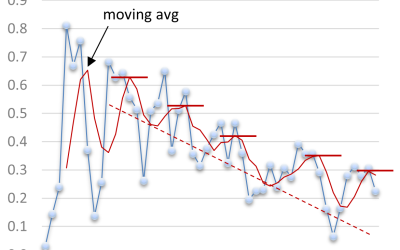

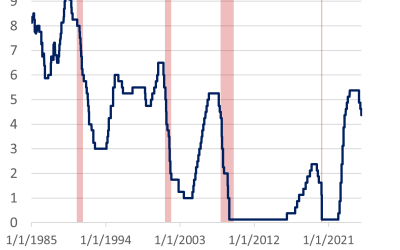

The Fed and the Punch Bowl

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

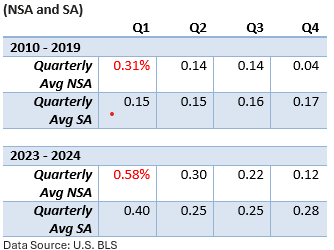

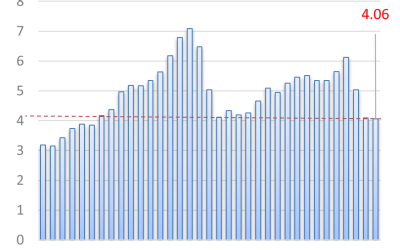

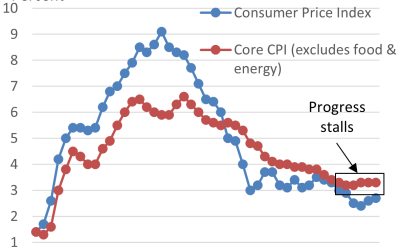

Sticky Inflation

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

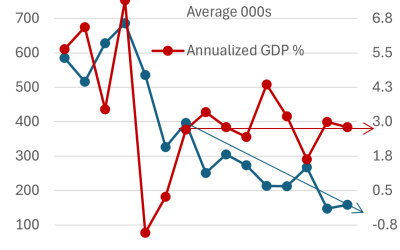

Job Growth and Economic Growth

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

Another Strong Earnings Season

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.