Prosperity Partners Blog

Powell’s Victory Lap (Sort Of)

Fed Chief Powell’s much-anticipated speech against the picturesque backdrop of the Grand Tetons in Jackson Hole, WY, virtually assures that the Fed will reduce interest rates next month. In a short 16-minute speech, Powell said the magic words. “The time has come for policy to adjust.

Economic Anxieties Subside

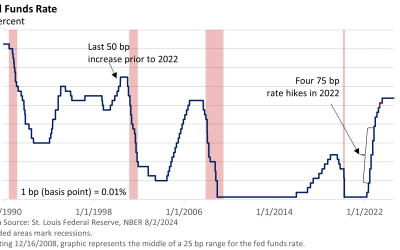

As expected, the Federal Reserve kept its key rate, the fed funds rate, unchanged at 5.25 – 5.50%. After holding the fed funds rate steady for a year, Fed Chief Jay Powell twice-mentioned that a September rate cut is on the table at his press conference.

A Rollercoaster and the Carry Trade

As expected, the Federal Reserve kept its key rate, the fed funds rate, unchanged at 5.25 – 5.50%. After holding the fed funds rate steady for a year, Fed Chief Jay Powell twice-mentioned that a September rate cut is on the table at his press conference.

A September Rate Cut is on the Table, Softer Economic Data Raises Worries

As expected, the Federal Reserve kept its key rate, the fed funds rate, unchanged at 5.25 – 5.50%. After holding the fed funds rate steady for a year, Fed Chief Jay Powell twice-mentioned that a September rate cut is on the table at his press conference.

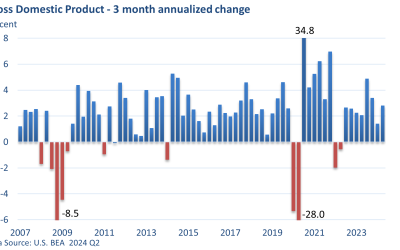

Brisk Pace for GDP

The U.S. Bureau of Economic Analysis reported that the Gross Domestic Product (GDP), the largest measure of goods and services, expanded at a brisk annualized pace of 2.8% in the second quarter. That’s up from 1.4% in the first quarter and well ahead of Bloomberg’s estimate of 2.0%.

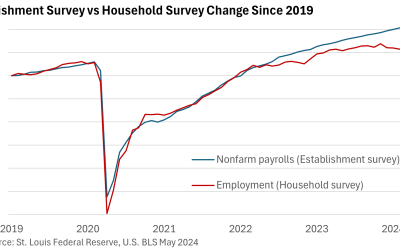

Two Graphs and a Data Table

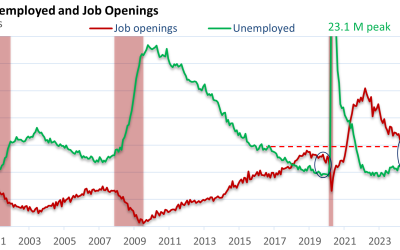

The labor market is moving back into balance. No longer do we come across articles touting the Great Resignation. In 2021 and 2022, it was ‘advantage employee.’ Employees still have some leverage, but the pendulum has gradually been swinging back to employers. Of course, this varies from industry to industry, but conditions are generally balanced.

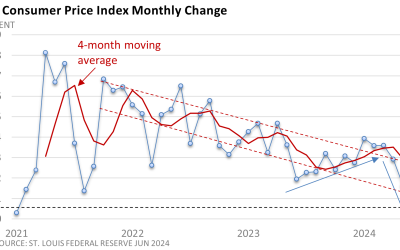

Another Soft Inflation Number Bolsters the Case for Lower Rates

In 2021 and 2022, soaring inflation sparked the most aggressive series of rate hikes in decades. While prices remain high, the rate of those price increases has slowed, and the Federal Reserve may finally be seriously considering a reduction in interest rates.

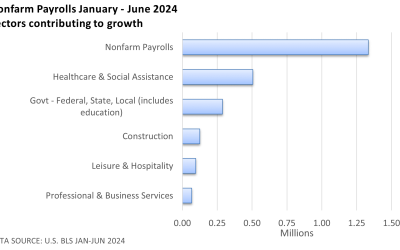

At First Glance, Another Solid Jobs Report

The U.S. Bureau of Labor Statistics (BLS) reported that nonfarm payrolls rose a solid 206,000 in June, topping the consensus forecast offered by Bloomberg News of 190,000. However, first glances may not always leave the correct impression. Private sector payrolls increased by a more modest 136,000, and nonfarm payrolls were revised downward by 111,000 in April and May.

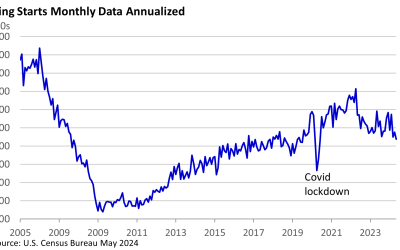

A Dysfunctional Housing Market

What happens when mortgage rates tumble below 3% and then spike above 7%? Unintended consequences are bound to play out. In hindsight, they aren’t difficult to spot. You’re a winner if you have no intention of moving and were lucky enough to lock in ultra-cheap rates just a few years ago. Those who want to move or renters who want to buy are less fortunate.

Mixed Signals

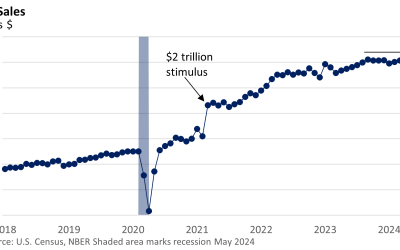

Much has been made of the remarkable resilience of the American economy. Forecasters who confidently called for a recession in 2023 got it wrong. So far this year, the economy is generating new jobs, and the U.S. economy has yet to falter.

A Steady-as-She-Goes Fed and a Tame Inflation Report

As expected, the Federal Reserve announced last Wednesday that it held its key rate, the fed funds rate, unchanged at 5.25 – 5.50%. The Fed left the door open to a cut in rates later in the year if inflation makes meaningful progress toward its 2% annual goal or if there is an unexpected weakening in the labor market.

Strong Jobs Report, with a Caveat

The U.S. Bureau of Labor Statistics reported that nonfarm payrolls in May rose 272,000, easily beating expectations of 190,000 per the Wall Street Journal. Over the past three years, nonfarm payrolls have usually topped expectations. That narrative remains intact.