Prosperity Partners Blog

Waiting… and Waiting for the Other Shoe to Drop

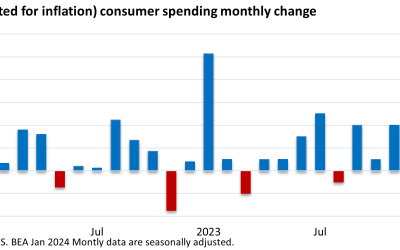

What is consumer spending? Loosely defined, consumer spending is the ‘stuff’ we buy. It is the goods and services we purchase. It is groceries, clothes, entertainment, health care, auto repair, insurance, appliances, utilities, wireless service, and much more.

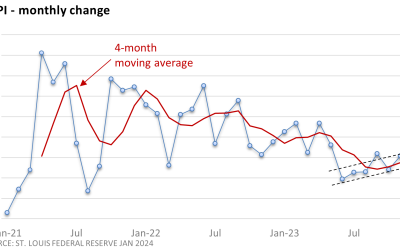

Price Check

The road to price stability was never expected to be a straight line. The latest numbers show that the road isn’t even paved. Investors hit an unexpected pothole after the U.S. Bureau of Labor Statistics (BLS) reported January’s Consumer Price Index (CPI).

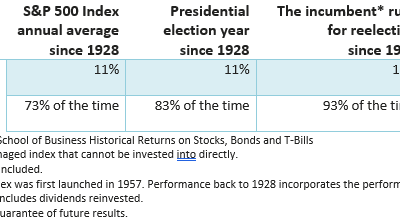

There is an Election This Year

Last week, we examined the relationship between interest rates and stocks. This week, we will analyze market performance during presidential election years. So, what might we expect based on historical returns during a presidential election year?

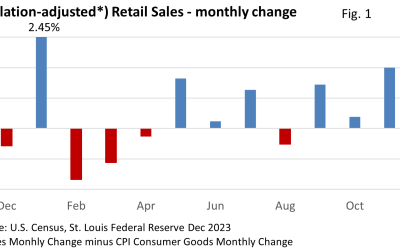

Waiting on the Long Awaited Soft Landing

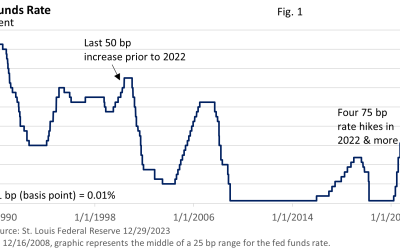

Economists have been warning for quite some time that Fed rate hikes will slow economic growth. Whether it results in a soft landing, which is the preferred outcome for investors, or a hard landing (recession), the rate hikes would be expected to blunt economic activity, at least to some degree.

To Measure Inflation, Let Me Count the Ways

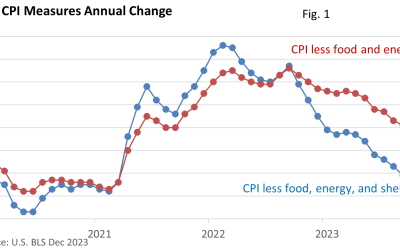

Investors eagerly anticipate the government’s monthly release of the CPI (Consumer Price Index). Why? Inflation affects everyone, and investors are no exception. The Federal Reserve’s efforts to curb inflation led to a bear market in 2022. However, fewer interest rate hikes in 2023 and a more lenient stance by the Fed contributed to the market’s recovery in 2023.

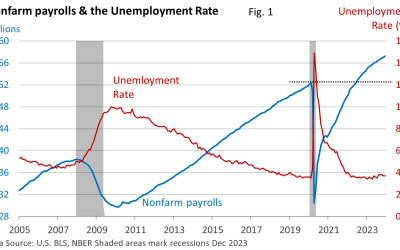

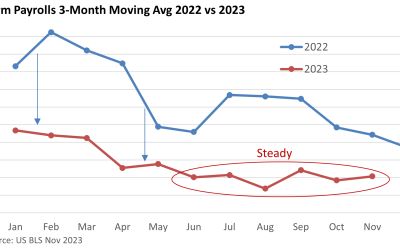

Steady Freddie Job Growth

The U.S. Bureau of Labor Statistics (BLS) reported that nonfarm payrolls rose by 216,000 in December, while October and November were revised down by a total of 71,000. The unemployment rate held steady at 3.7% in December.

The Blockbuster Year Few Expected

A December 29th Wall Street Journal title summed the year up: What Did Wall Street Get Right About Markets This Year? Not Much. “Usually, recessions sneak up on us. CEOs never talk about recessions,” Zandi said. “Now it seems CEOs are falling over themselves to say we’re falling into a recession.

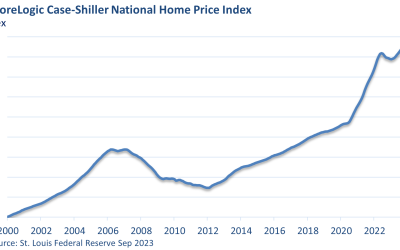

Home Prices Defy Conventional Wisdom

Mortgage rates have soared, and home sales are down sharply. Conventional wisdom would suggest that prices should be down. But housing prices have defied expectations, rising to record heights and locking first-time buyers out of the market.

Ensuring Smooth Communication: Whitelisting Our New Domain

As our company transitions from www.fdpwm.com to www.prosperity-pwm.com, we want to ensure seamless communication with our valued clients. Whitelisting our new domain is crucial to prevent important messages from being lost in spam folders.

The Most Consequential Fed Meeting of the Year

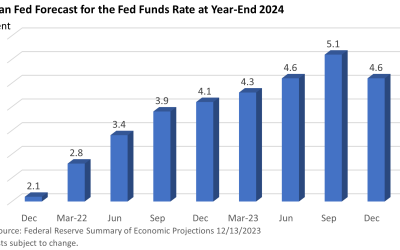

The meeting held by the Federal Reserve last week was the most consequential gathering of central bankers this year. The Fed held the fed funds rate at 5.25 – 5.50% as expected, but in so many words, the Fed pivoted on its rate stance.

Jobs Report – Nothing New

The latest jobs report did little to alter the economic outlook. Instead, it was a steady-as-she-goes report. Nonfarm payrolls grew by 199,000 in November, according to the U.S. Bureau of Labor Statistics (BLS). It was nearly in line with the consensus forecast among economists of 190,000 (CNBC). The unemployment rate fell to 3.7% in November from 3.9% in October.

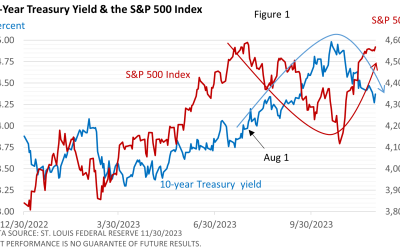

Bond Reversal Powers November Advance

Many things influence the direction of stocks. Corporate profits, economic growth, general market sentiment, inflation, and interest rates are among those variables. At any given point, the influence of various factors on stocks will fluctuate. In 2022, investors were predominantly concerned about the Fed’s efforts to combat inflation.