by Mark Chandik | Mar 18, 2024

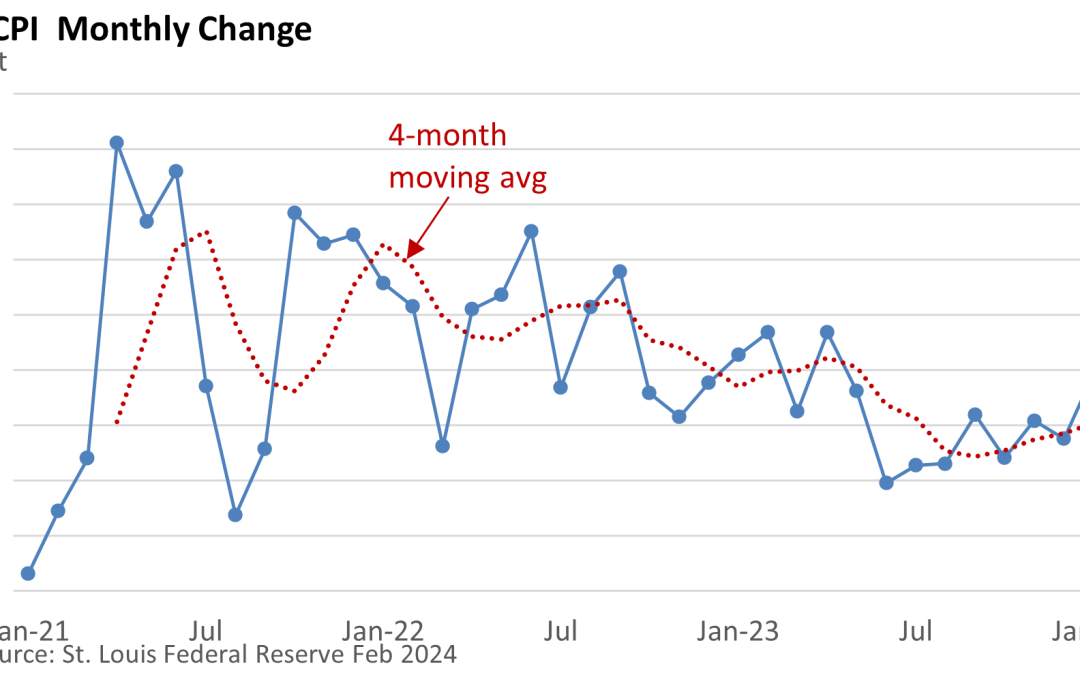

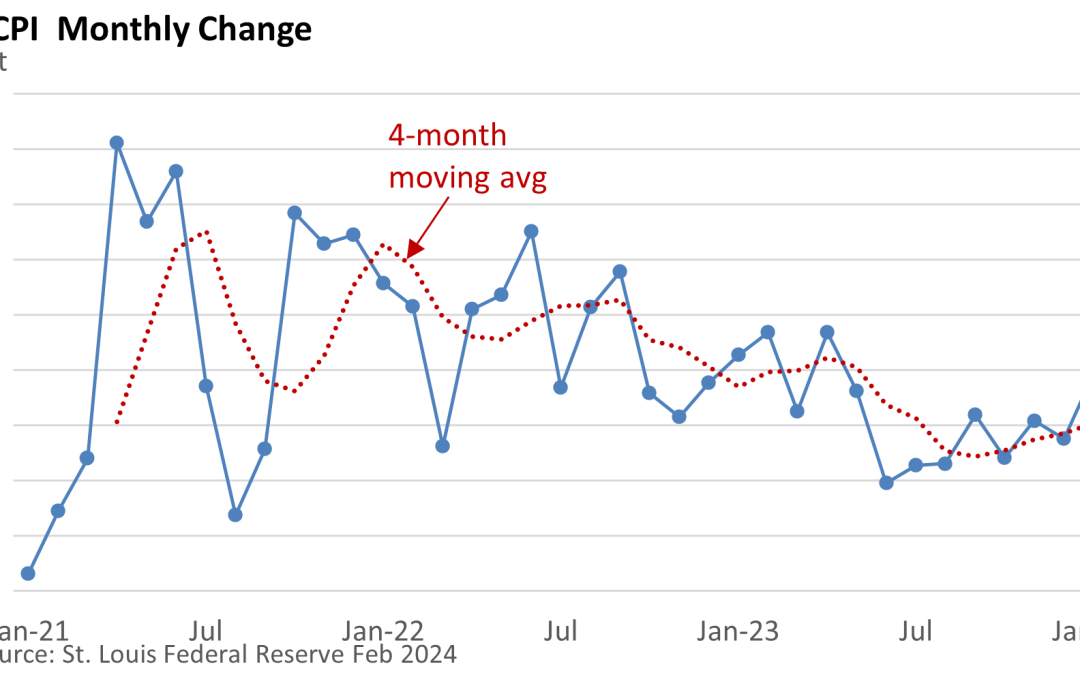

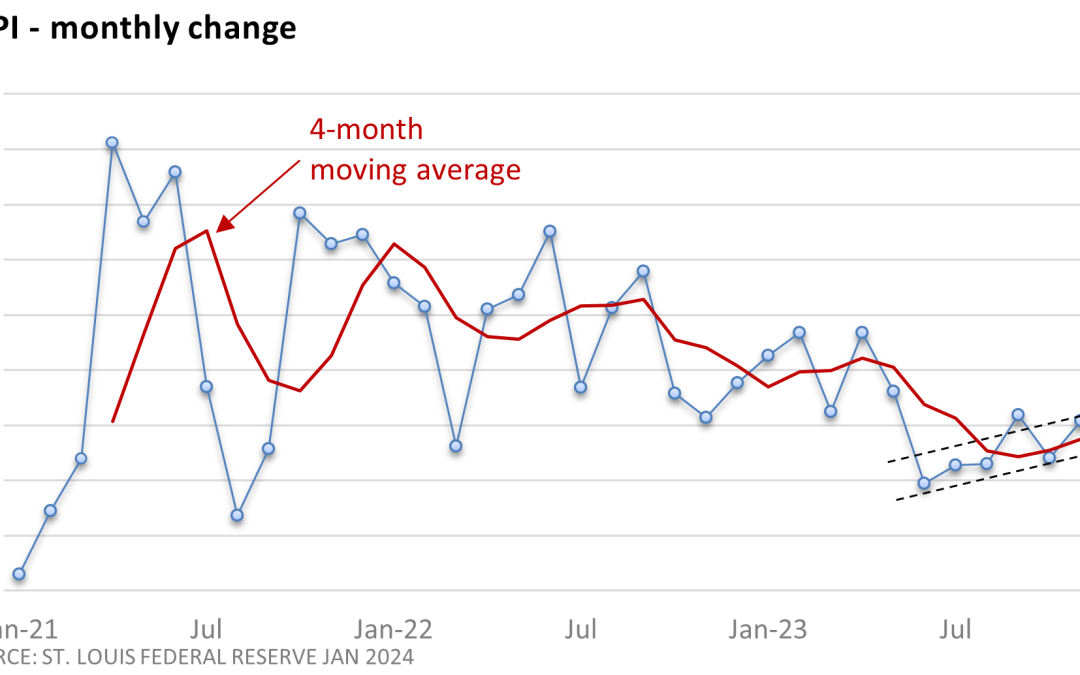

Weekly Market Commentary The road to price stability has been long and arduous. Inflation doesn’t just impact investors. It impacts everyone, from shoppers to travelers to those on a fixed income. February’s Consumer Price Index (CPI) marks the second straight month...

by Mark Chandik | Mar 12, 2024

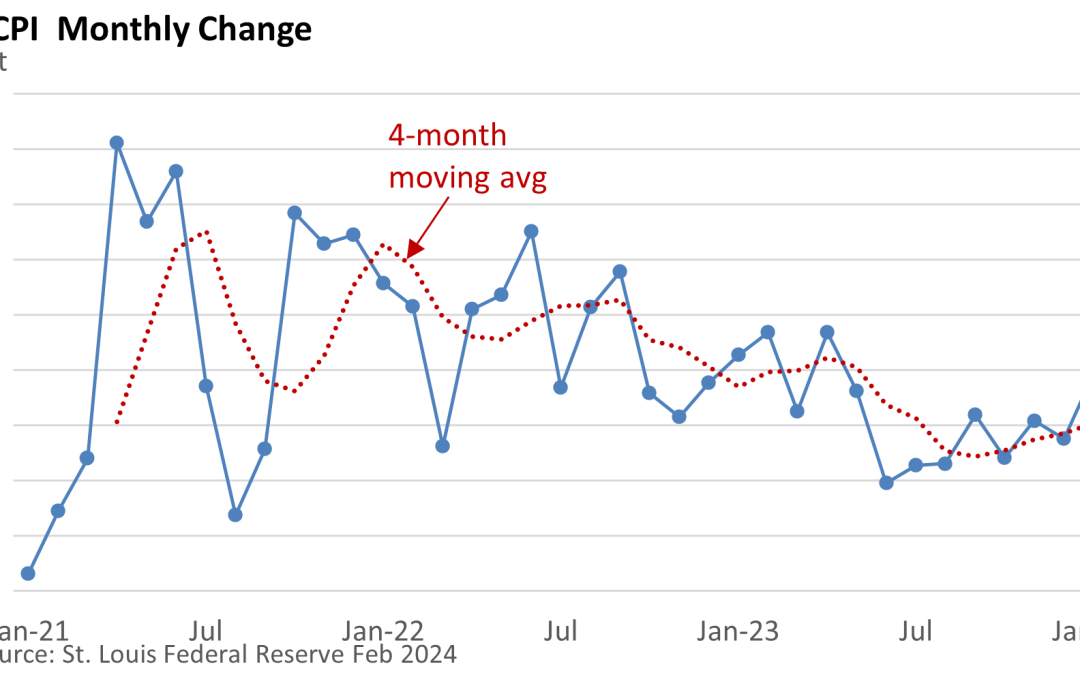

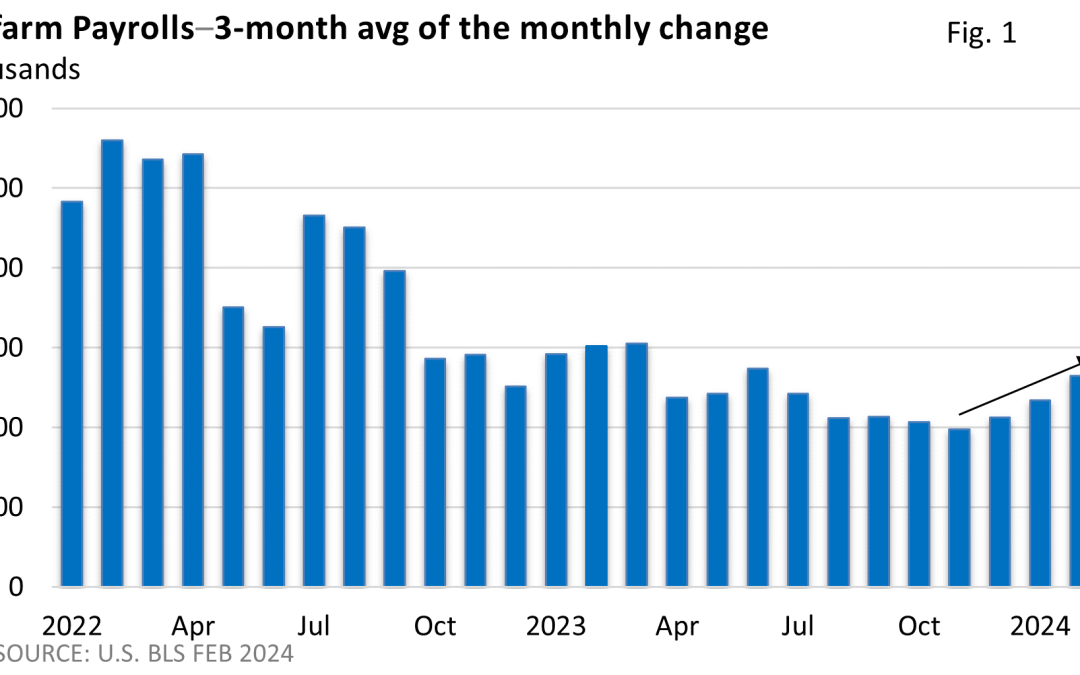

Weekly Market Commentary On Friday, the U.S. Bureau of Labor Statistics (BLS) reported that employers added 275,000 net new jobs in February. The hiring boom continues, right? Well, it’s not quite that simple. Let’s dive in. January’s red-hot increase of 353,000 was...

by Mark Chandik | Mar 5, 2024

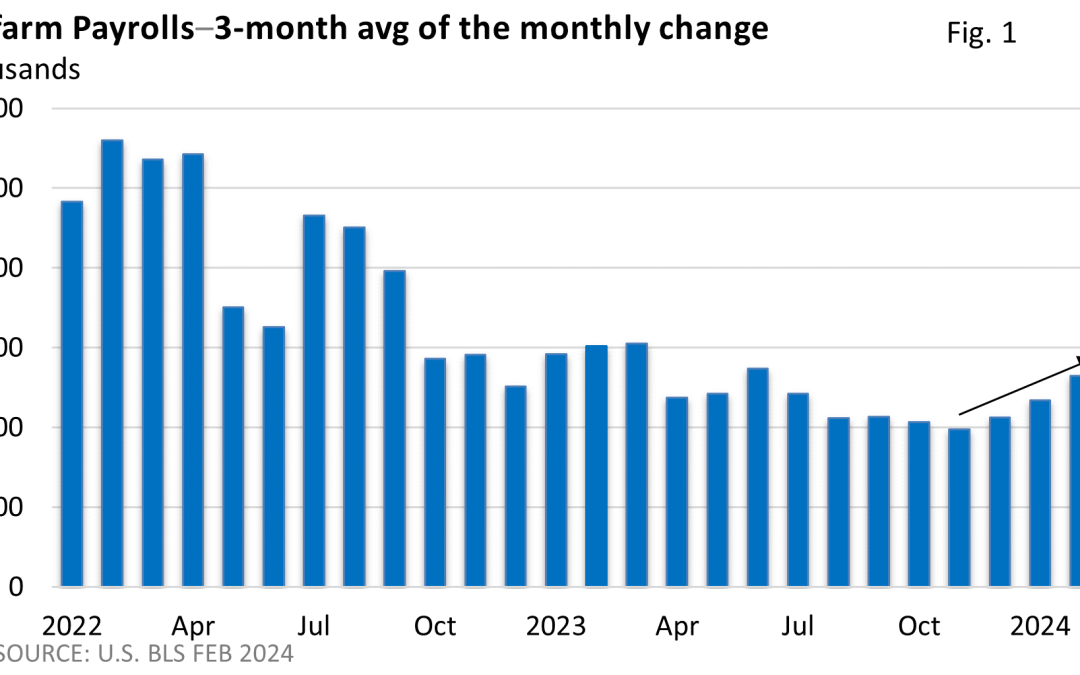

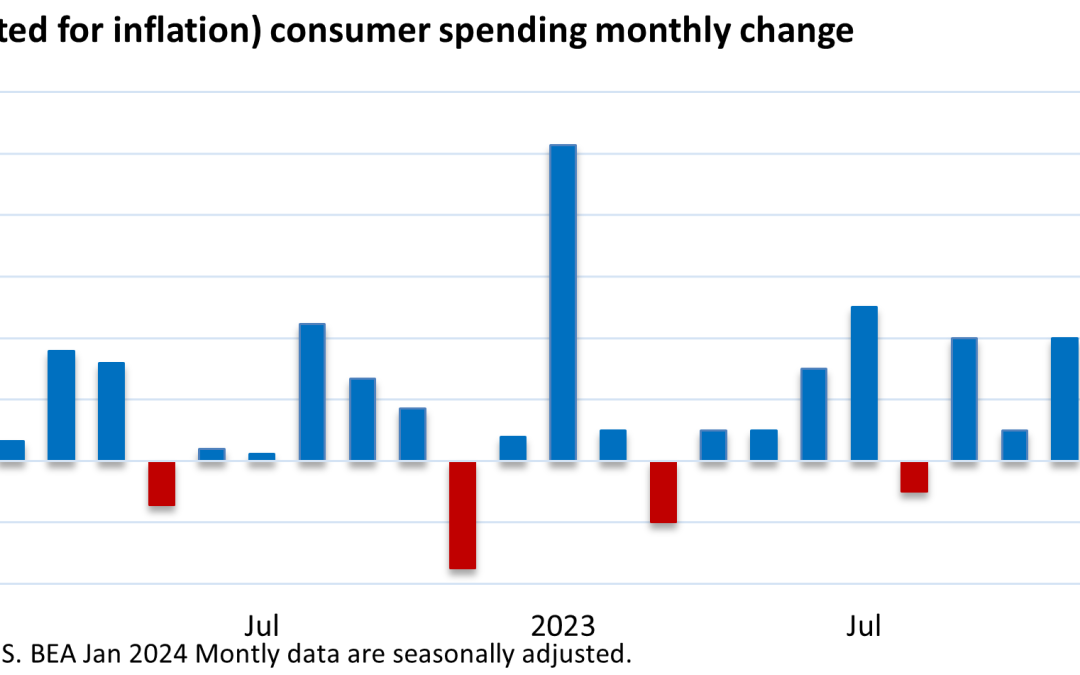

Weekly Market Commentary What is consumer spending? Loosely defined, consumer spending is the ‘stuff’ we buy. It is the goods and services we purchase. It is groceries, clothes, entertainment, health care, auto repair, insurance, appliances, utilities, wireless...

by Mark Chandik | Feb 20, 2024

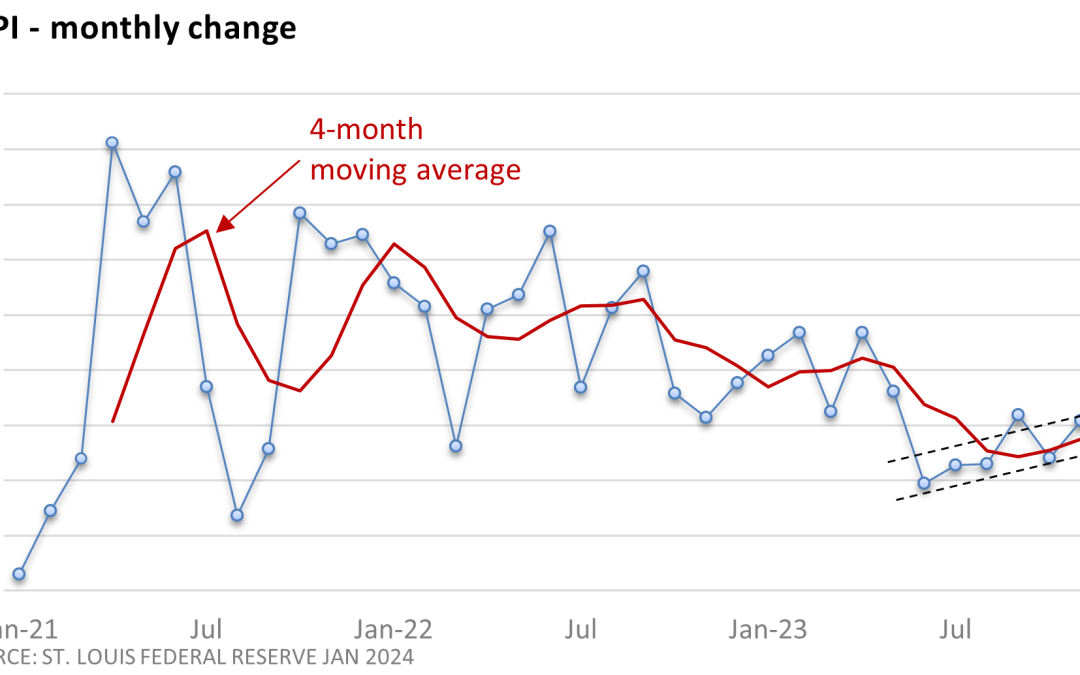

Weekly Market Commentary The road to price stability was never expected to be a straight line. The latest numbers show that the road isn’t even paved. Investors hit an unexpected pothole after the U.S. Bureau of Labor Statistics (BLS) reported January’s Consumer...

by Mark Chandik | Feb 12, 2024

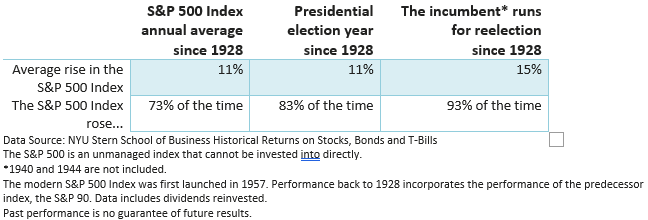

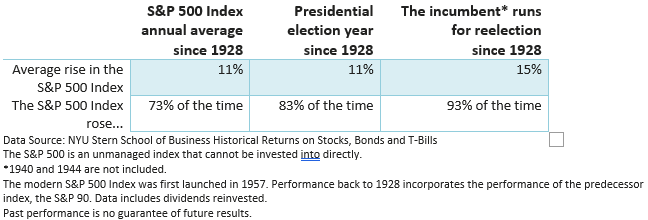

Weekly Market Commentary Last week, we examined the relationship between interest rates and stocks. This week, we will analyze market performance during presidential election years. So, what might we expect based on historical returns during a presidential election...