by Mark Chandik | Jan 26, 2026

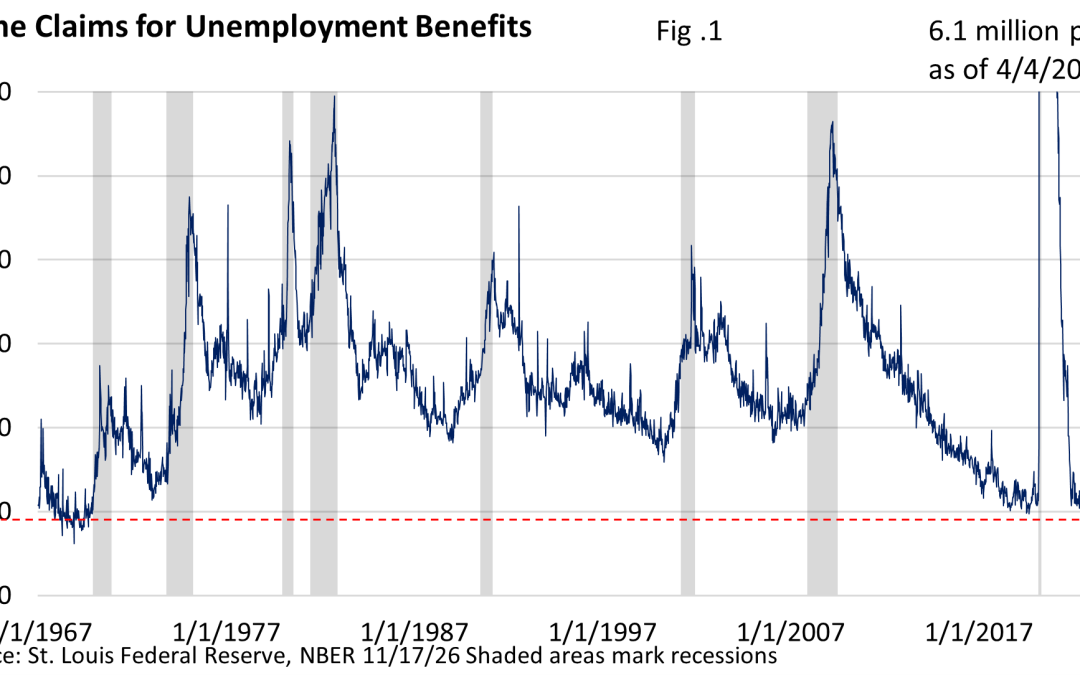

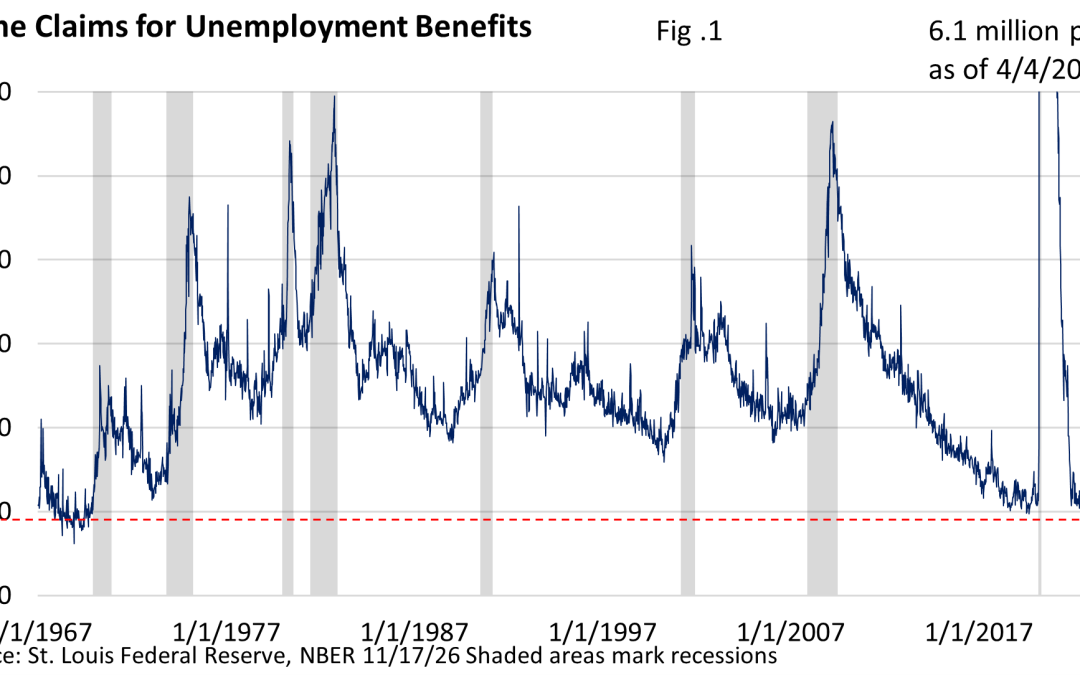

Much has been made of the sluggish hiring environment, but less attention has been paid to an important counterpoint: the persistently low level of layoffs. Figure 1 highlights the number of individuals who go online or head to their respective state’s unemployment...

by Mark Chandik | Jan 20, 2026

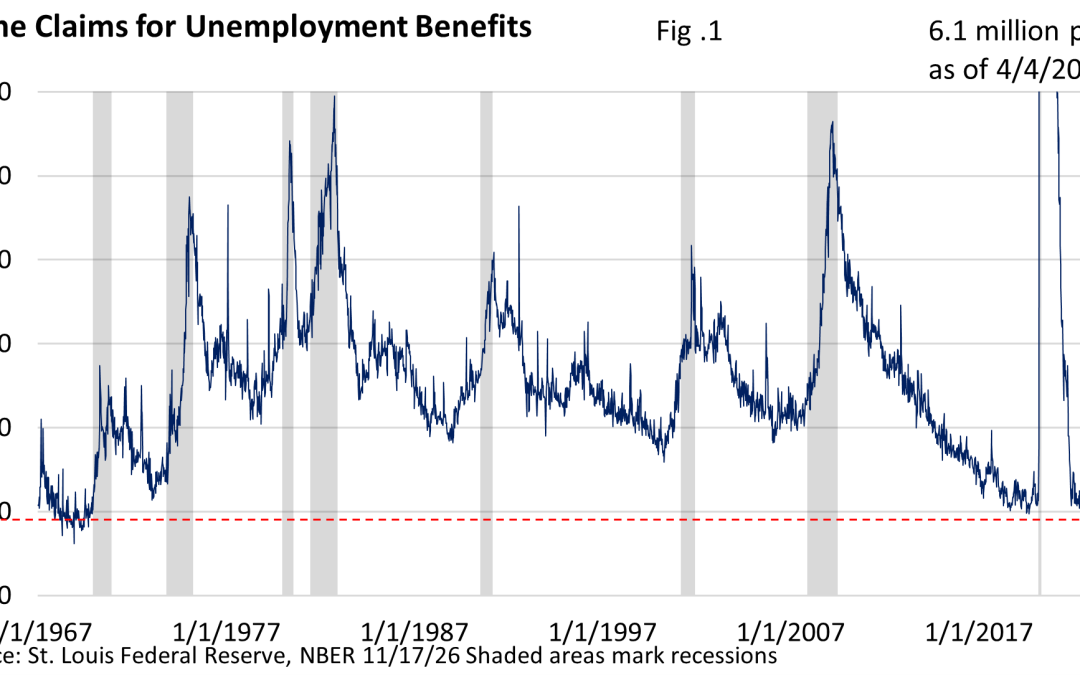

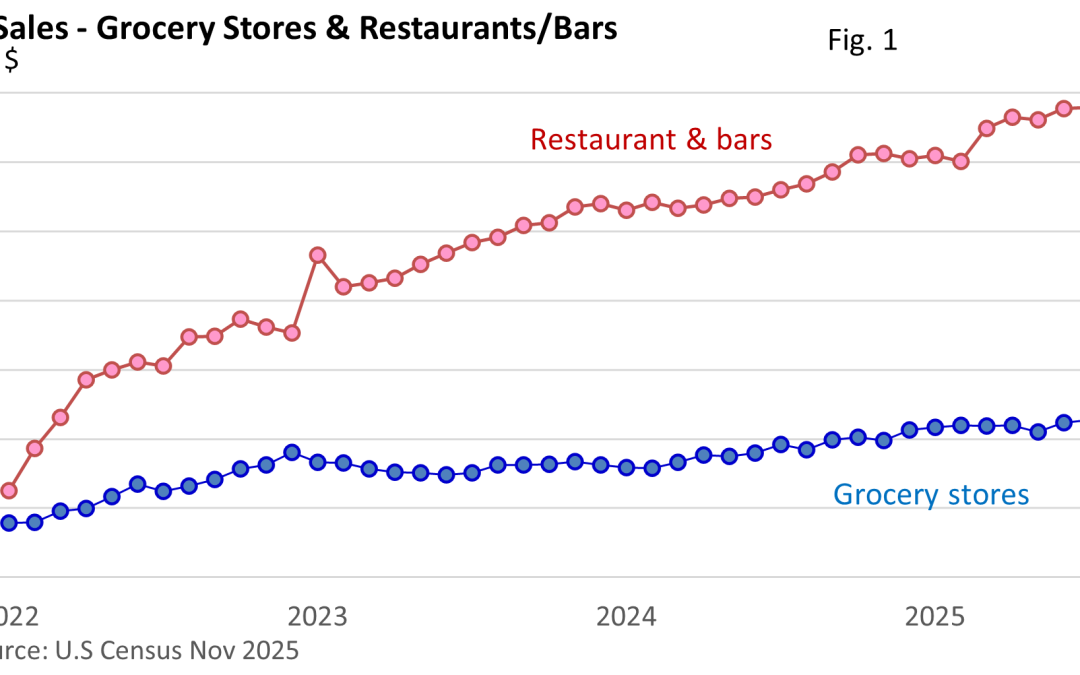

Let’s review one narrow economic indicator that provides a useful, though not standalone, measure of the overall economy’s health. The US Census categorizes it as ‘food services and drinking places.’ That can best be described as restaurants and bars. When the economy...

by Mark Chandik | Jan 12, 2026

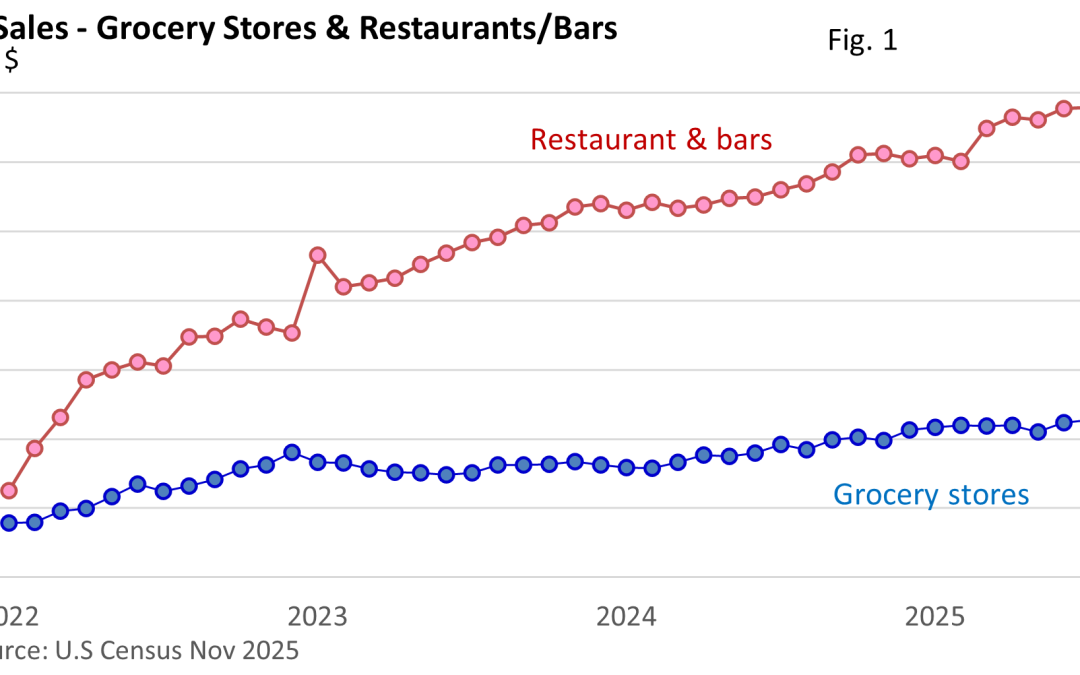

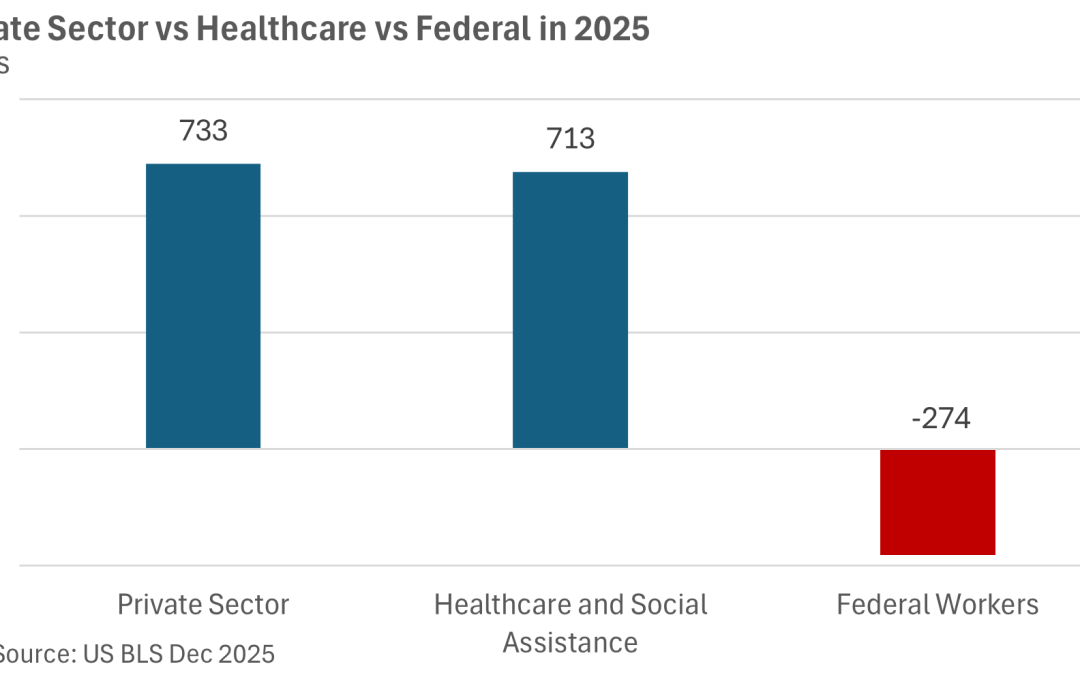

On Friday, the U.S. Bureau of Labor Statistics reported that nonfarm payrolls increased by 50,000 in December, underscoring a year of persistently sluggish job growth. The unemployment rate offered a glimmer of optimism, edging down to 4.4%. November’s 4.6% rate was...

by Mark Chandik | Jan 5, 2026

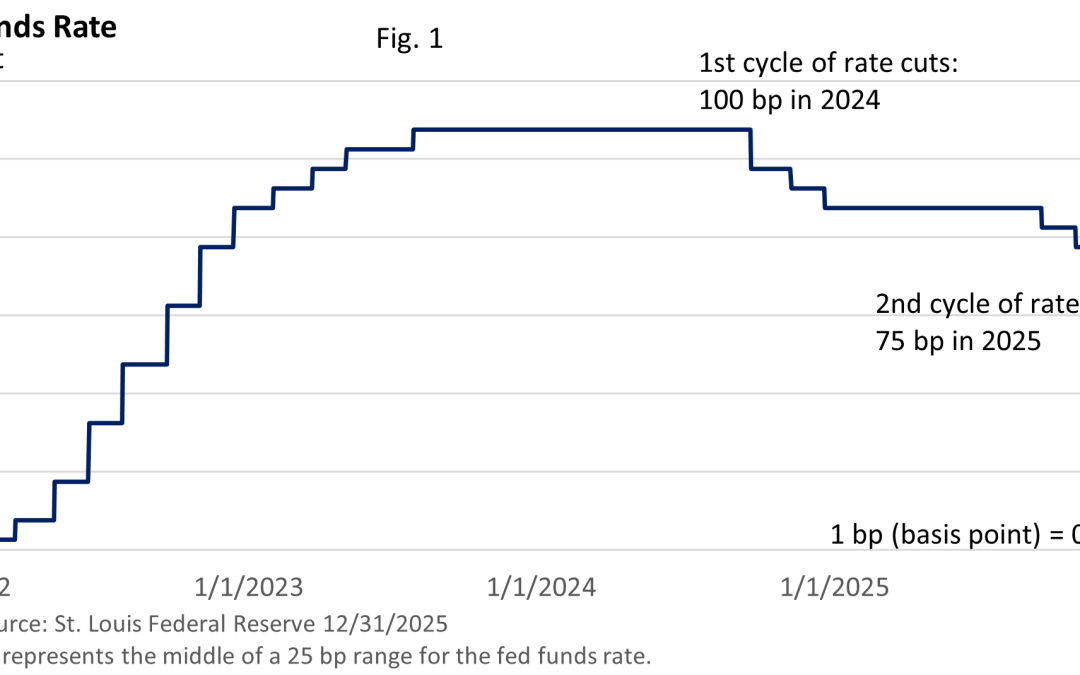

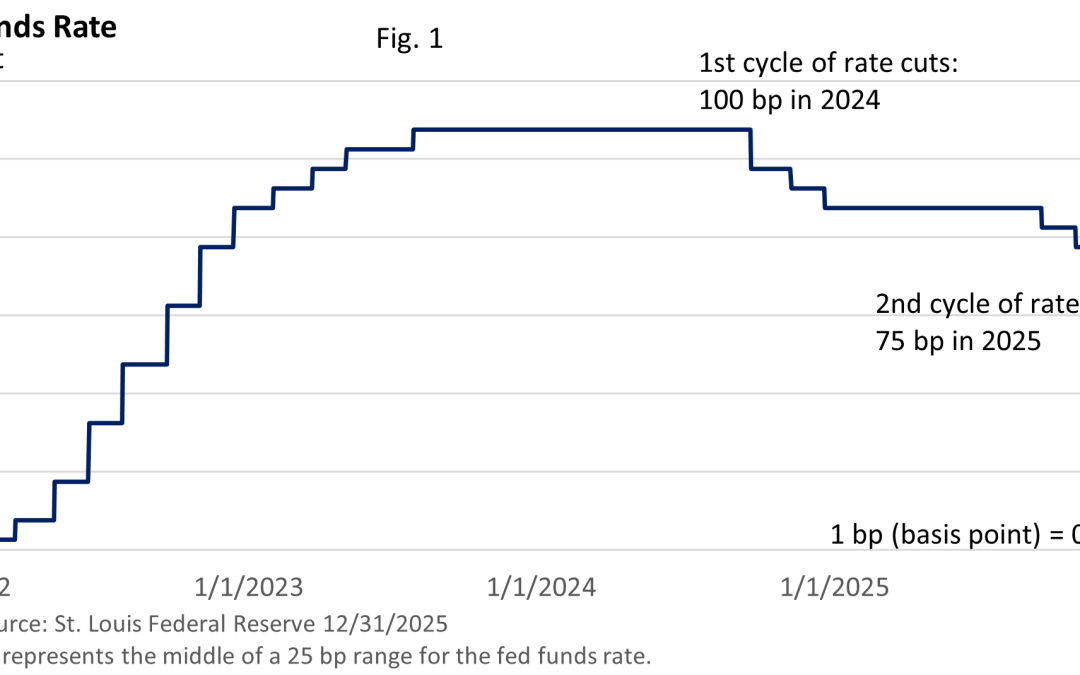

The bull market that began in late 2022 continued through last year. The S&P 500 Index, which posted gains that topped 20% in both 2023 and 2024, recorded an advance of 16.39% last year. But the year wasn’t free of volatility. The bulls were thrown off track early...

by Mark Chandik | Dec 22, 2025

The unemployment rate rose from 4.4% in September to 4.6% in November. The US Bureau of Labor Statistics did not conduct its household survey in October due to the government shutdown. The household survey includes the unemployment rate. The rise from the cyclical low...