by Mark Chandik | Dec 12, 2022

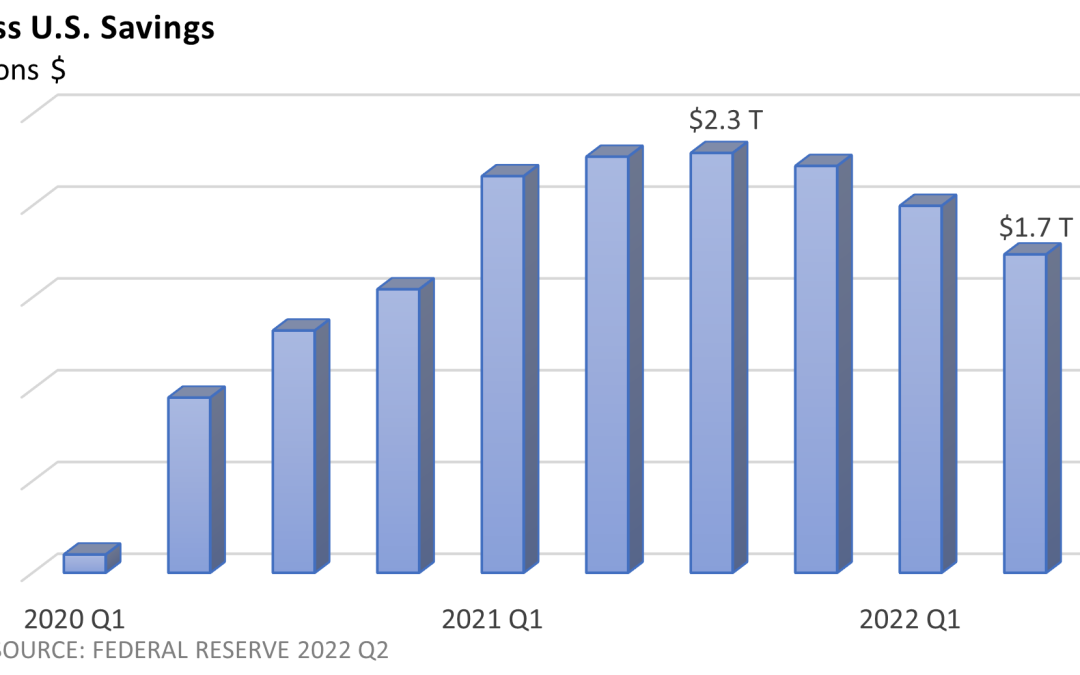

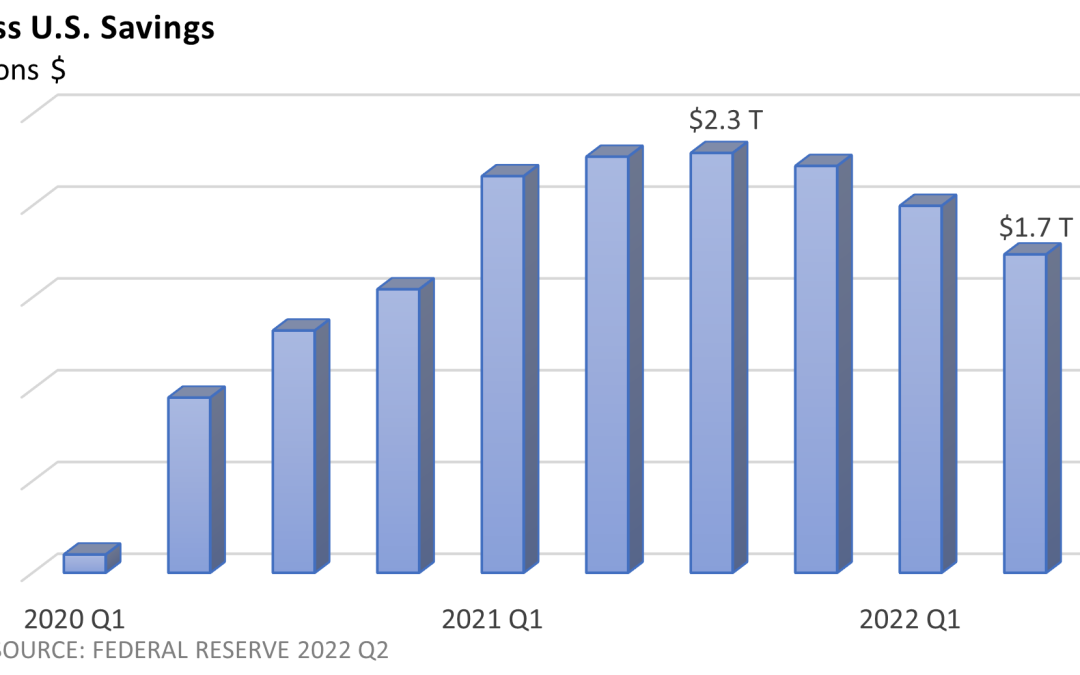

Weekly Market Commentary The Federal Reserve, interest rates, and inflation have been big topics this year. Chatter about a possible recession has been part of the conversation, too. A few weeks ago, we looked at the enormous amount of stimulus cash that remains in...

by Mark Chandik | Dec 5, 2022

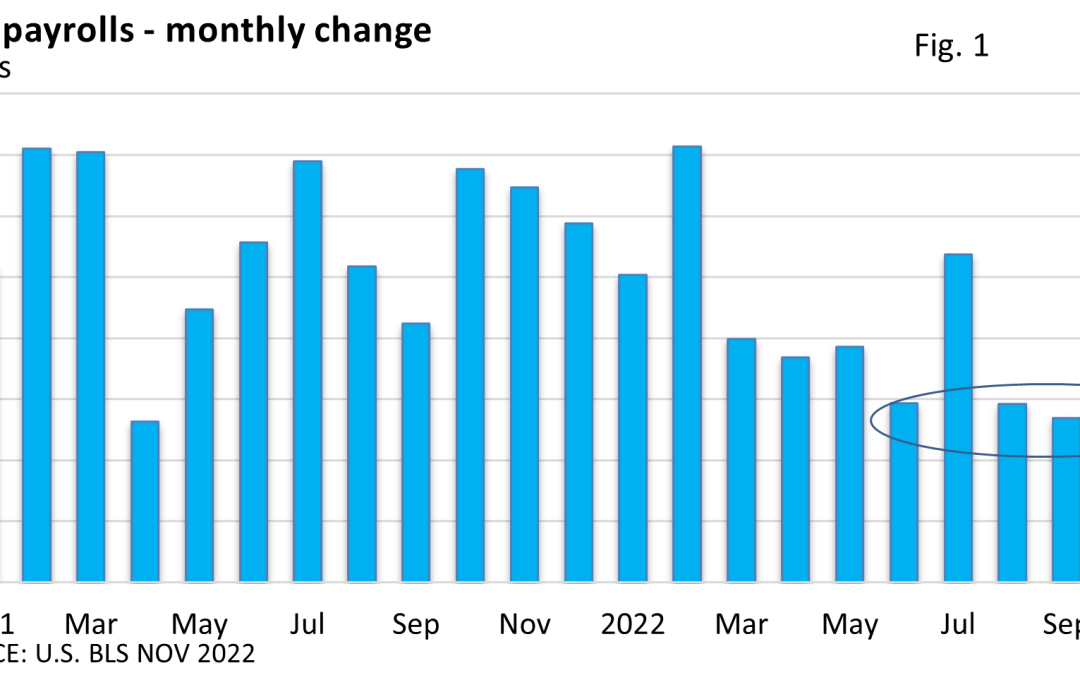

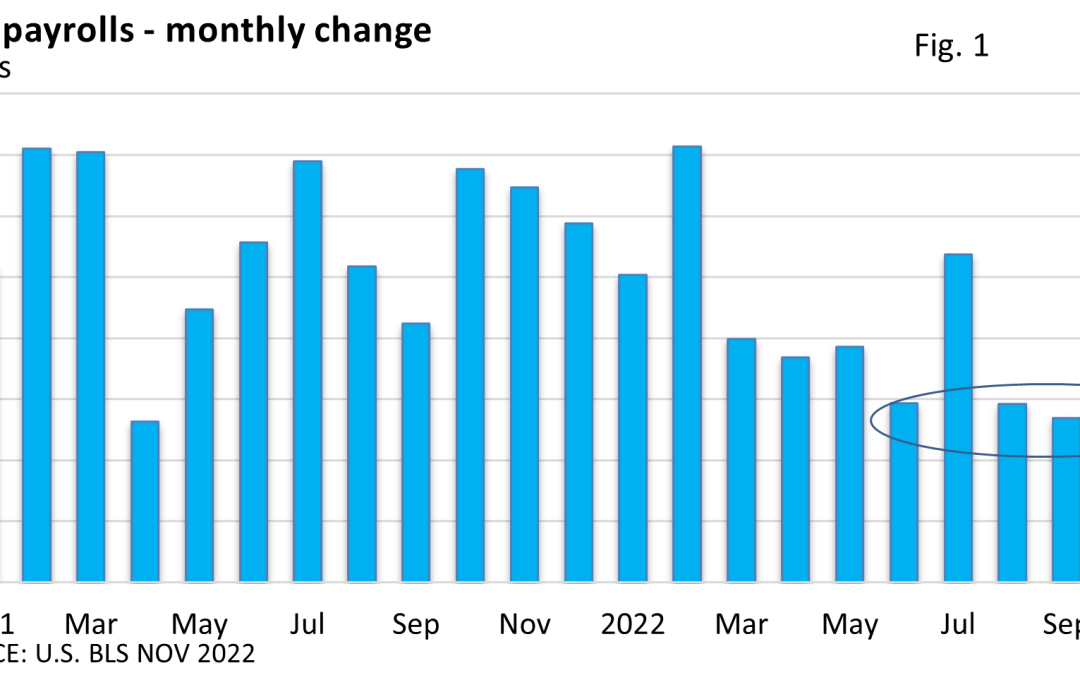

Weekly Market Commentary Can there be too much hiring? Can job growth be too fast? It seems like an odd question. But following a better-than-expected jobs report on Friday and the initial negative reaction (shares pared losses and finished mixed), the question is...

by Mark Chandik | Nov 21, 2022

Weekly Market Commentary Recession fears are rampant. Interest rates are up, which discourages spending, and housing, a leading economic indicator, has fallen into a steep recession. Reported on Friday, the Conference Board’s Leading Economic Index (LEI), which is...

by Mark Chandik | Nov 14, 2022

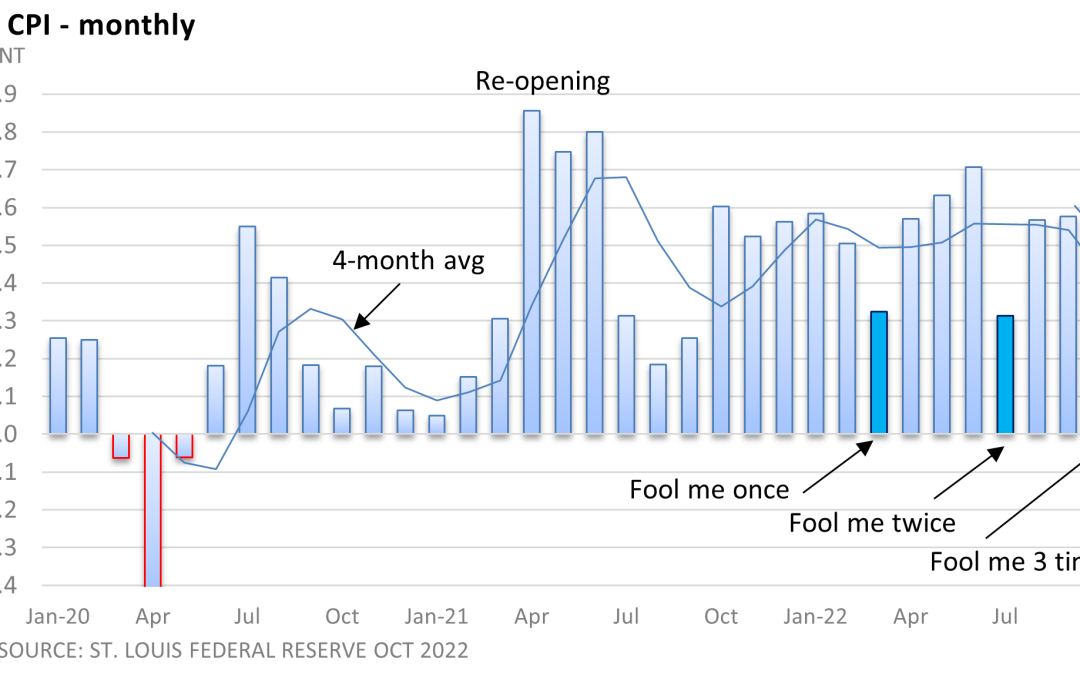

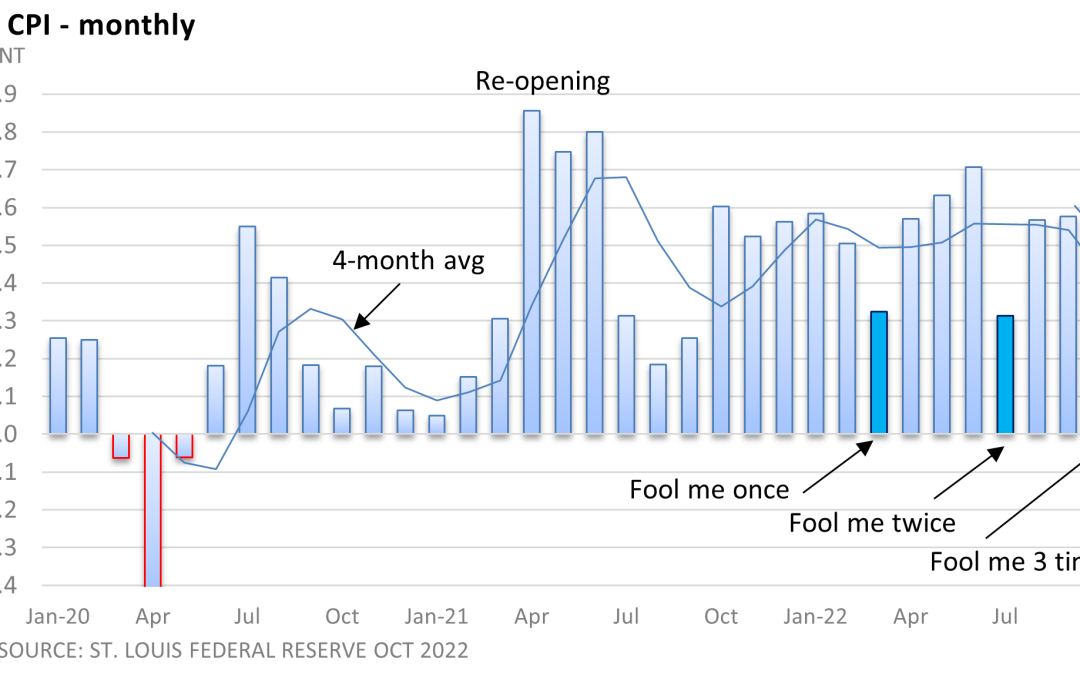

Weekly Market Commentary October’s slower-than-expected rise in the Consumer Price Index fueled a 5.53% rise in the S&P 500 Index on Thursday, which was the 15th-best trading day since 1953 when the 5-day trading week began, according to Bespoke. Why the huge...

by Mark Chandik | Nov 11, 2022

WIth another rocky quarter, equities continued their downhill slide with most equity indexes showing double-digit negative returns tear-to-date (YTD). The first half of the quarter we saw a bear market rally in July and August only to watch the S&P 500 Index post...