by Mark Chandik | Nov 7, 2022

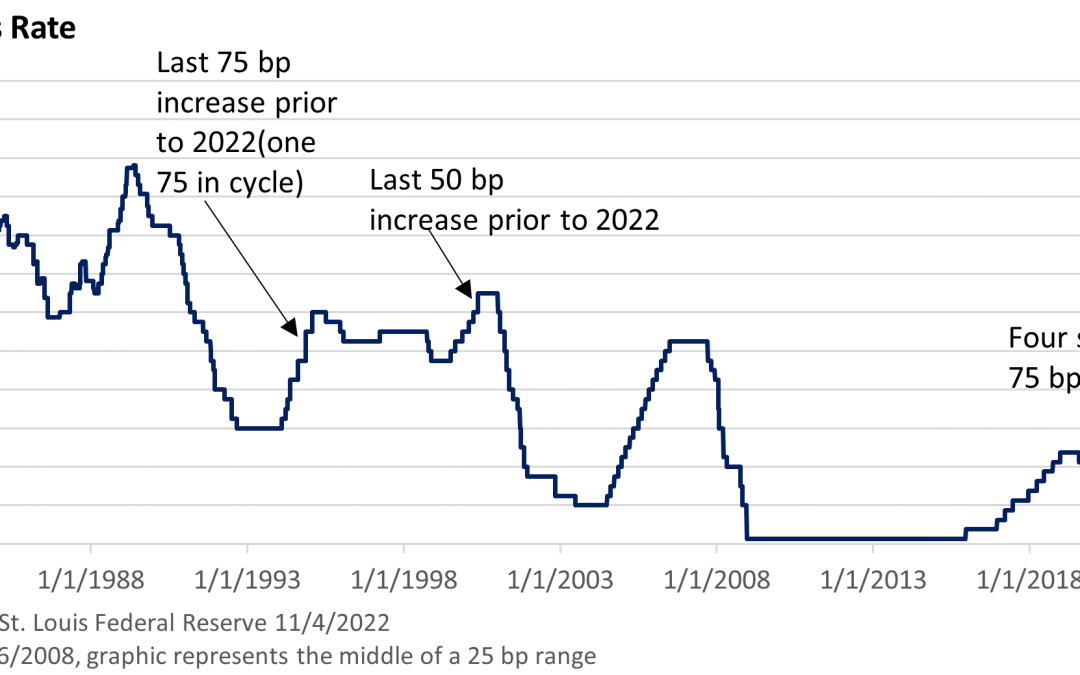

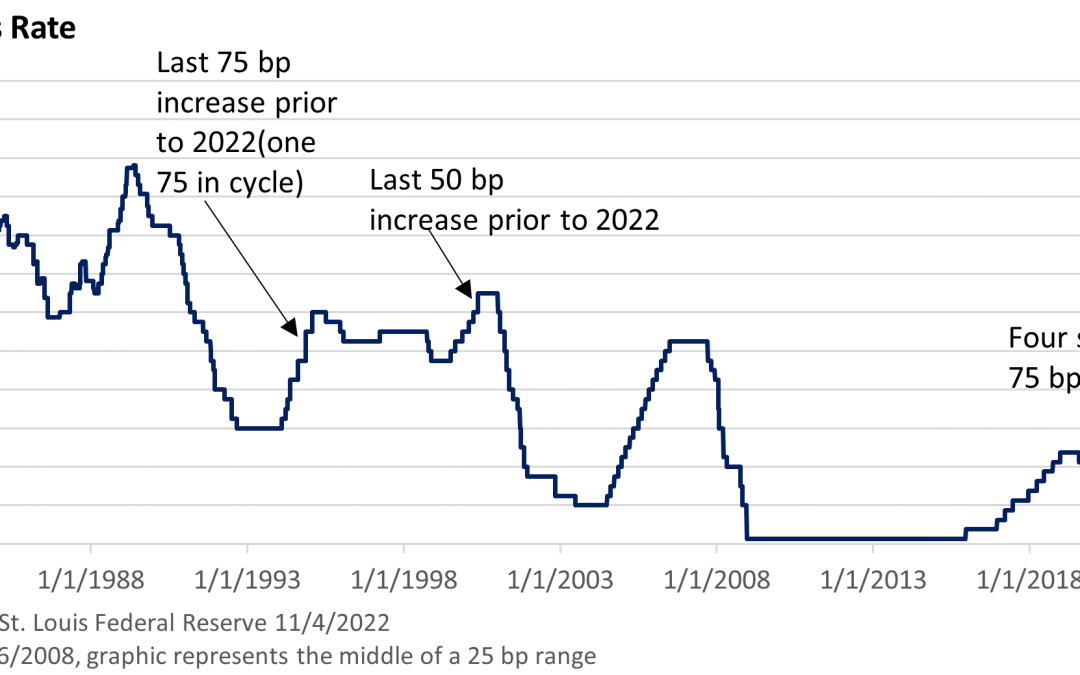

Weekly Market Commentary Smaller hikes but longer to the peak. That was the message from Fed Chief Jay Powell after the Federal Reserve hiked the fed funds rate by 75 basis points (bp, 1 bp =0.01%) to a range of 3.75—4.00% on Wednesday. The Fed may dial back the size...

by Mark Chandik | Oct 31, 2022

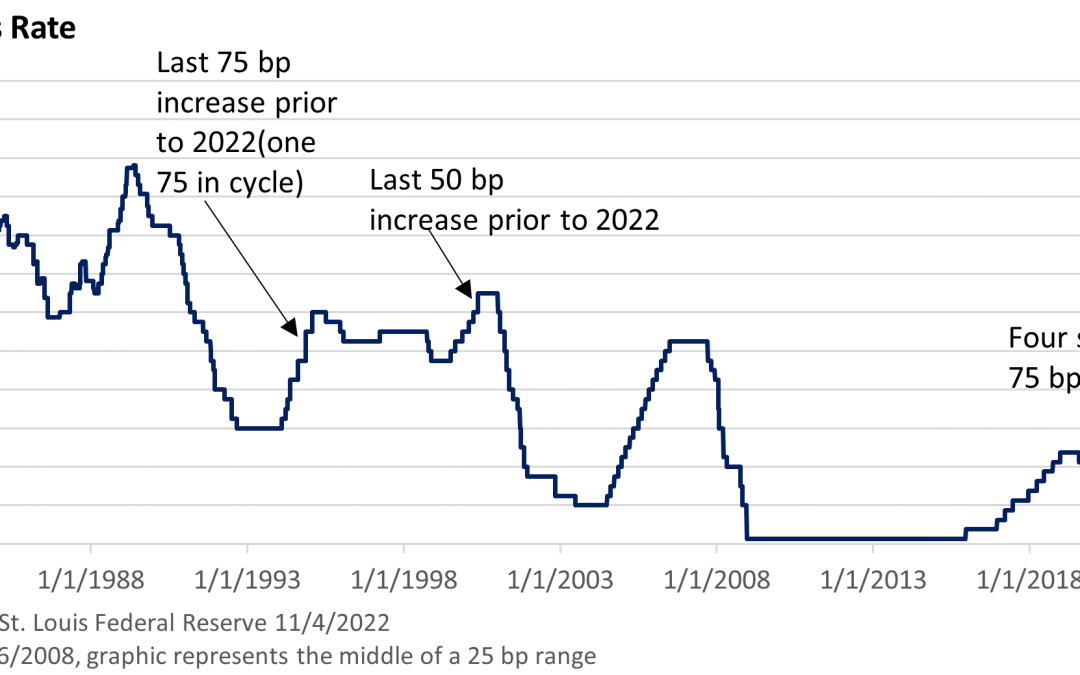

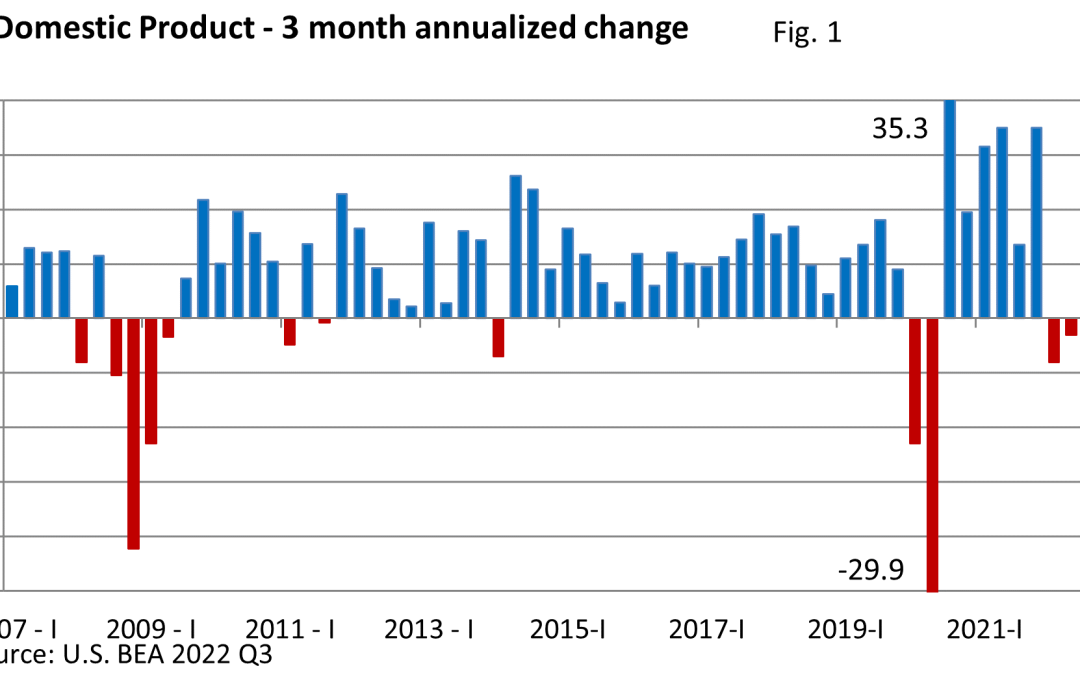

Weekly Market Commentary The U.S. Bureau of Economic Analyst reported that Q3 Gross Domestic Product (GDP), which is the largest measure of goods and services, expanded at an annualized pace of 2.6%, erasing the declines from Q1 and Q2—recession averted, for now. It’s...

by Mark Chandik | Oct 24, 2022

Weekly Market Commentary Every month, the Conference Board releases what’s called the Leading Economic Index, or the LEI. The LEI consists of 10 economic components, whose changes tend to precede what happens in the economy. The LEI has always turned lower before the...

by Mark Chandik | Oct 17, 2022

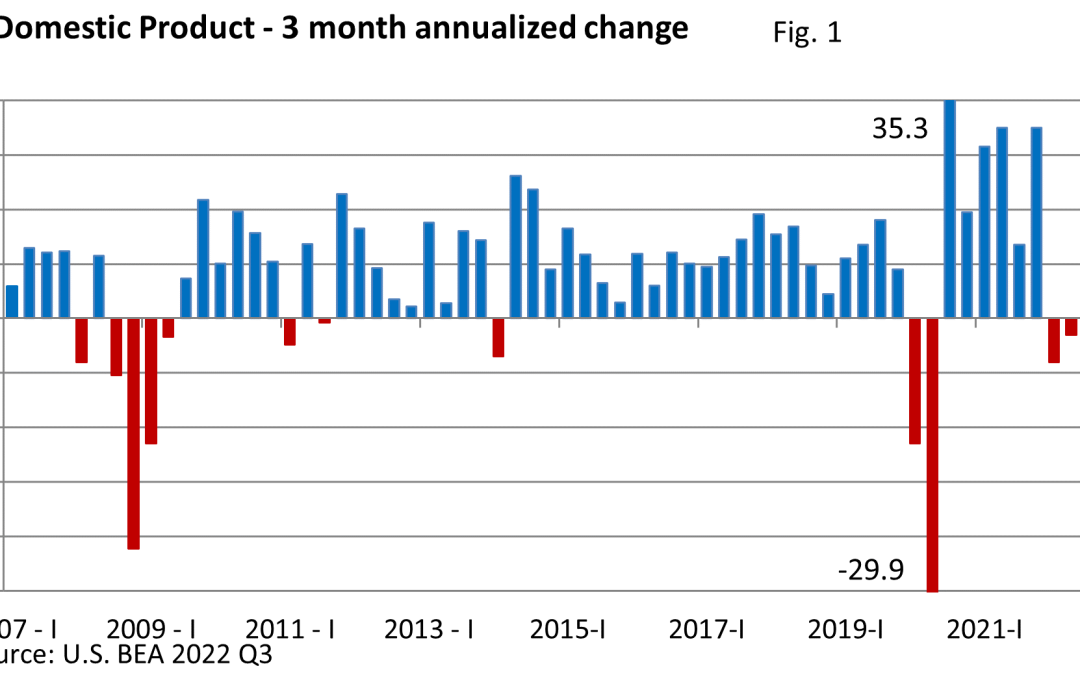

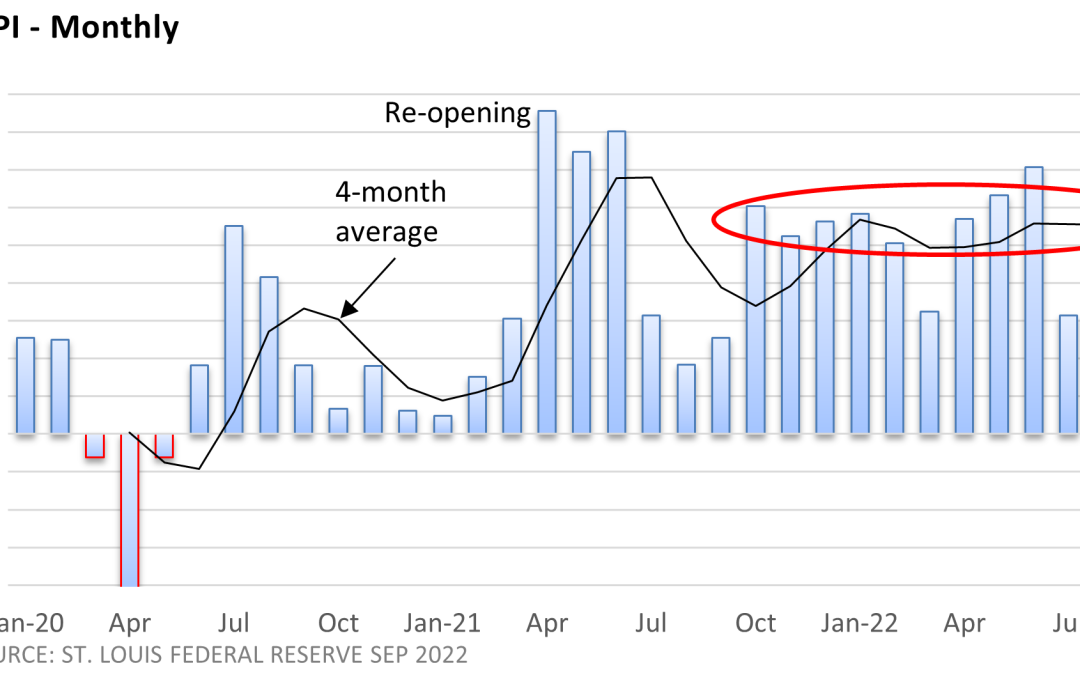

Weekly Market Commentary The release of the September Consumer Price Index (CPI) offered more sobering news, as inflation continues to run hot. The U.S. Bureau of Labor Statistics (BLS) reported the CPI for September rose 0.4% versus August. The core CPI, which...

by Mark Chandik | Oct 11, 2022

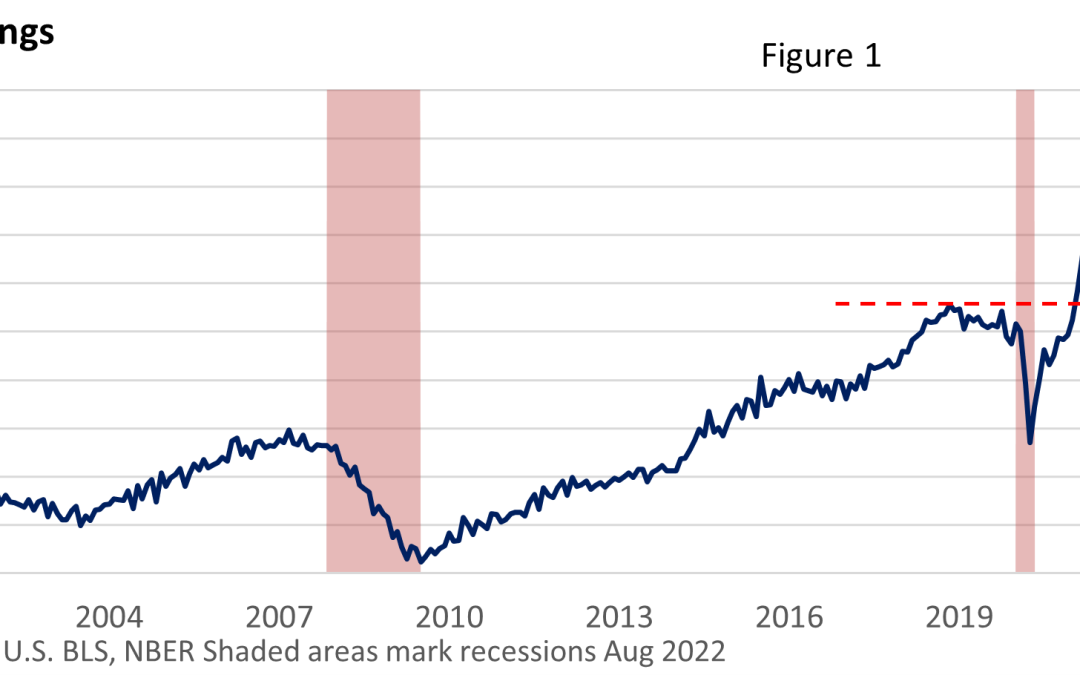

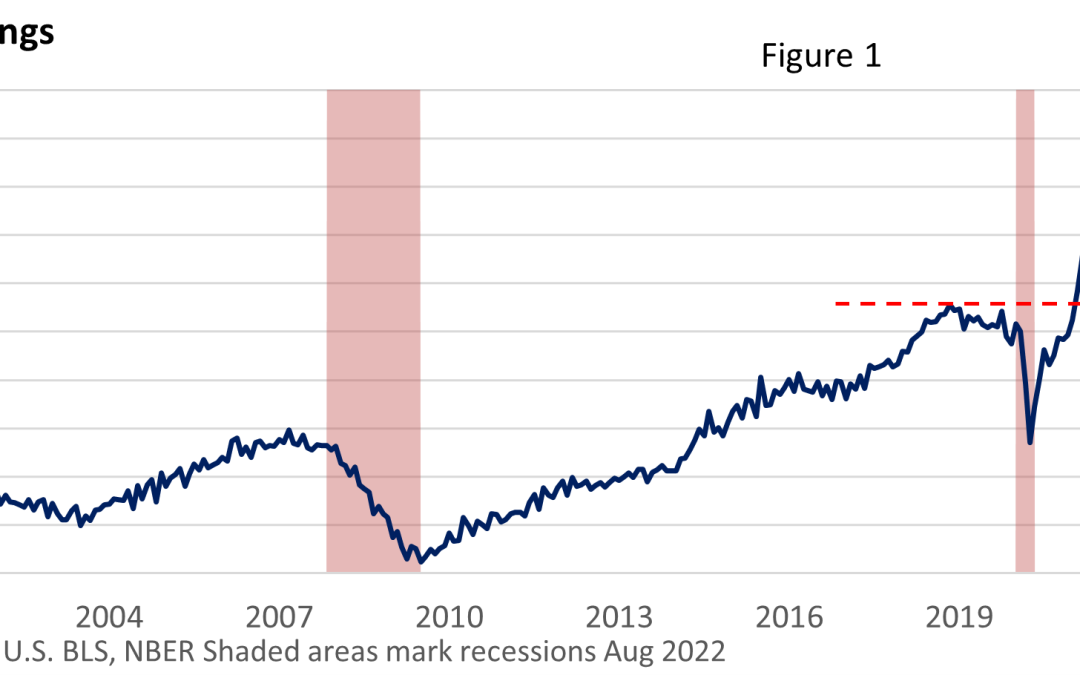

Weekly Market Commentary Last week, the U.S. Bureau of Labor Statistics (BLS) reported that job openings fell by 1.1 million in August to 10.1 million, the second steepest decline on record. Job growth continues, however, as evidenced by a 263,000 increase in nonfarm...