by Mark Chandik | Jun 20, 2023

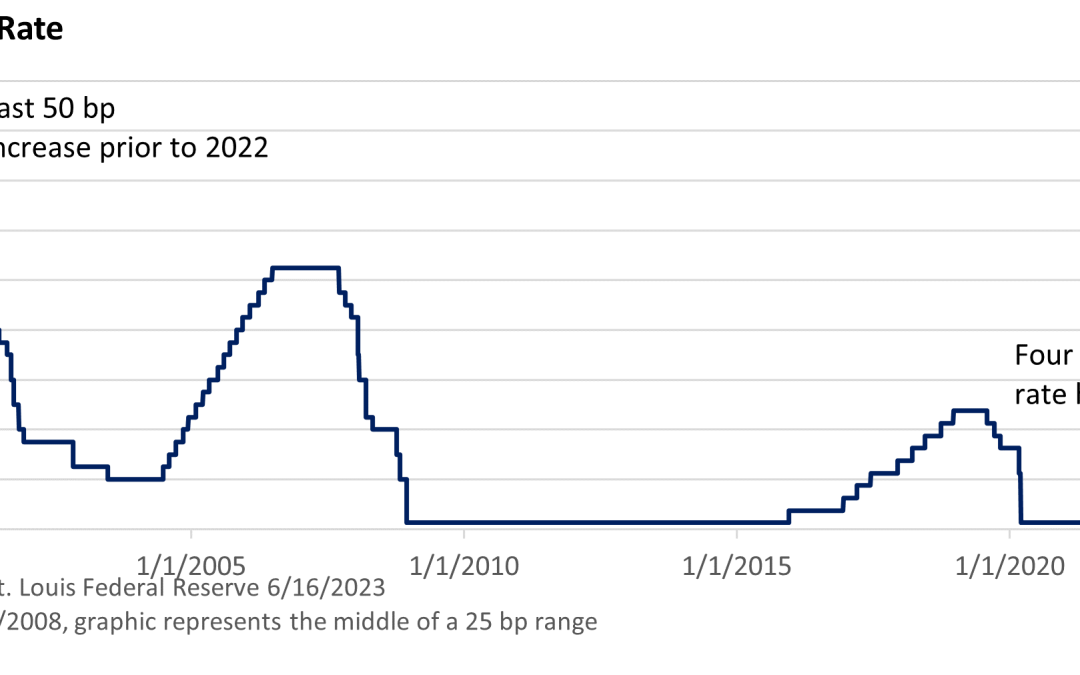

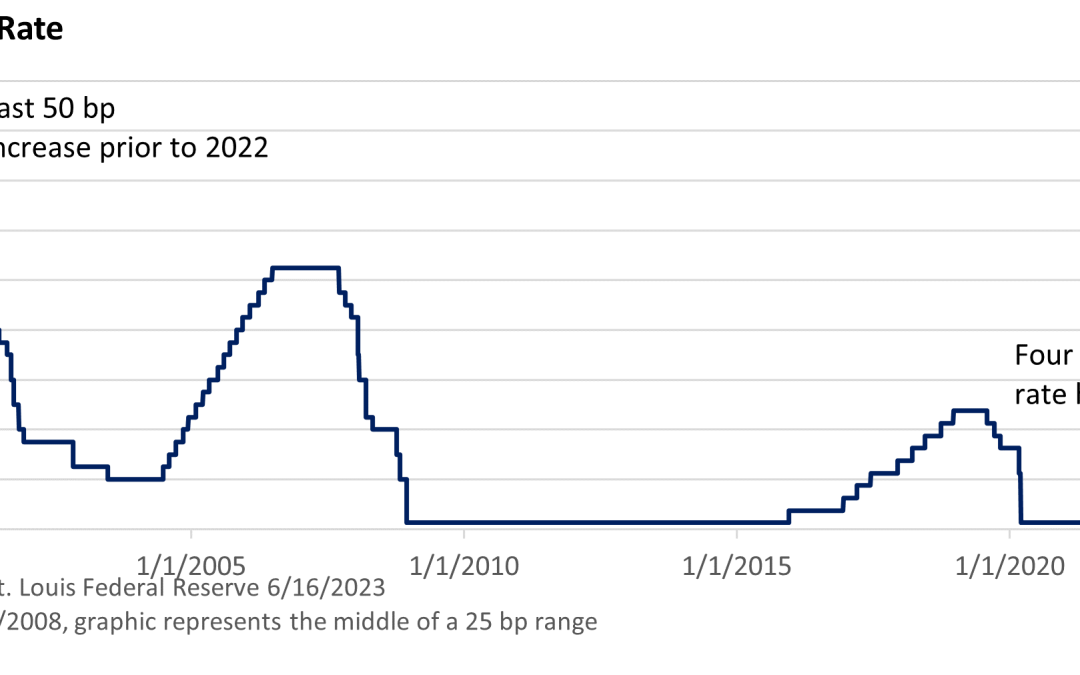

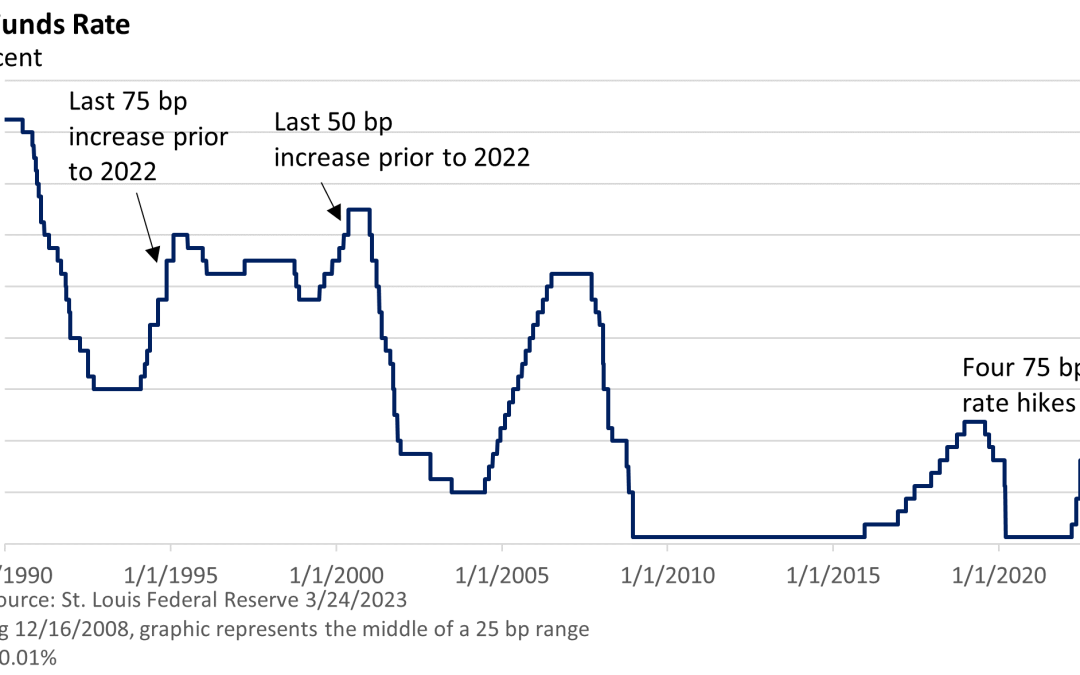

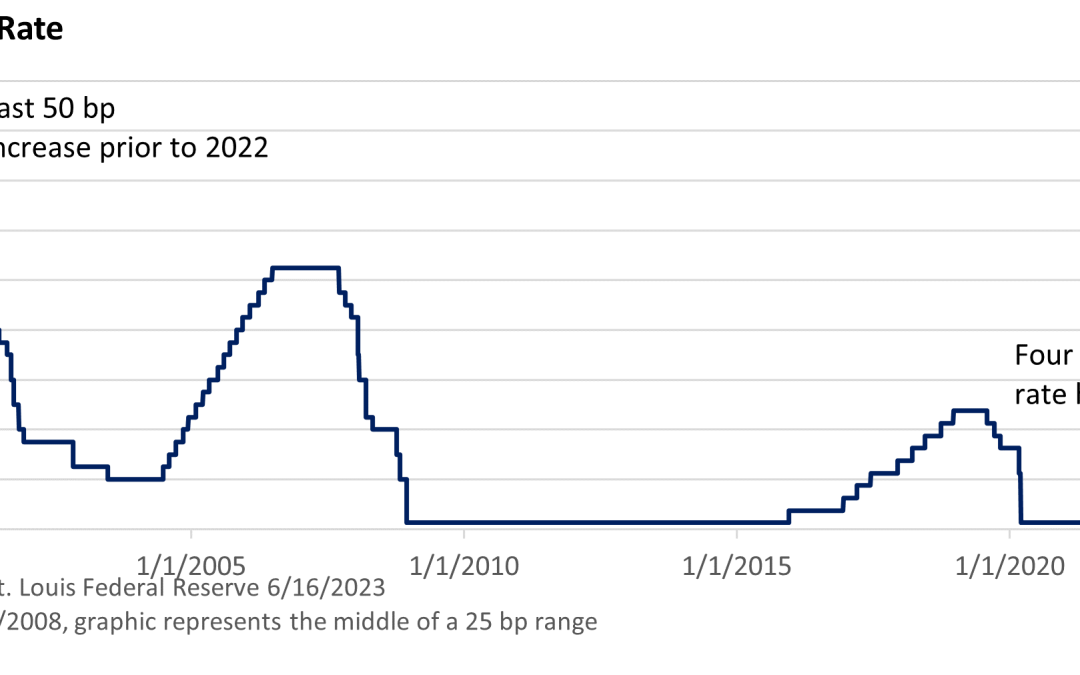

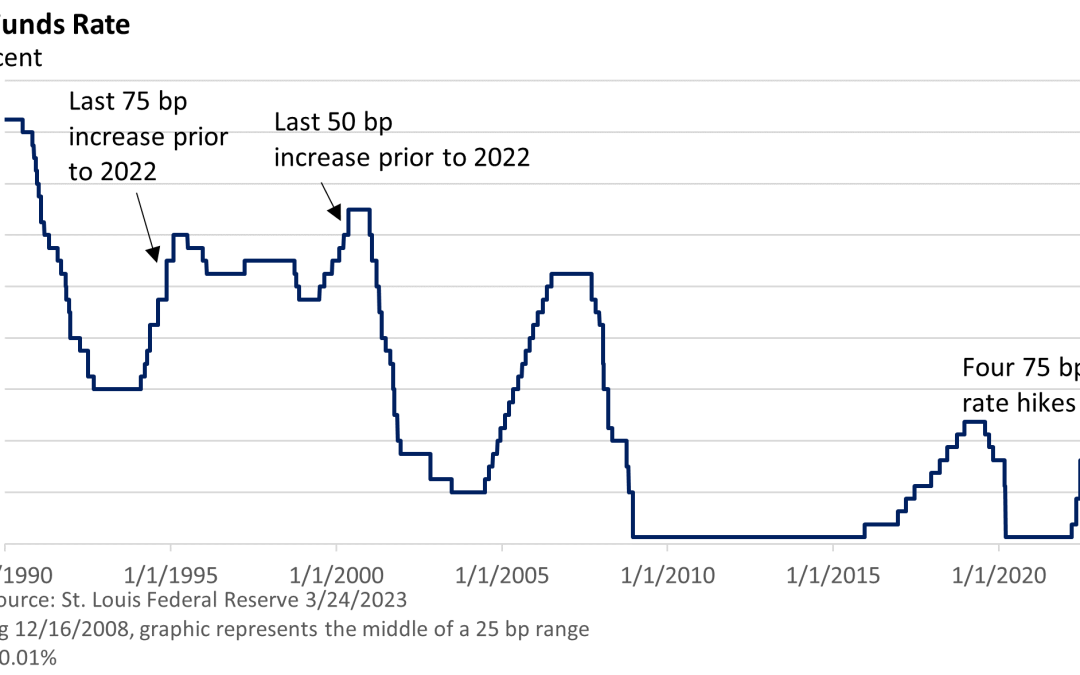

Weekly Market Commentary The Federal Reserve held the fed funds rate at 5.00–5.25% following ten consecutive rate increases that began in March 2022. The move was anticipated as policymakers had previously expressed their intention, allowing them time to assess the...

by Mark Chandik | May 15, 2023

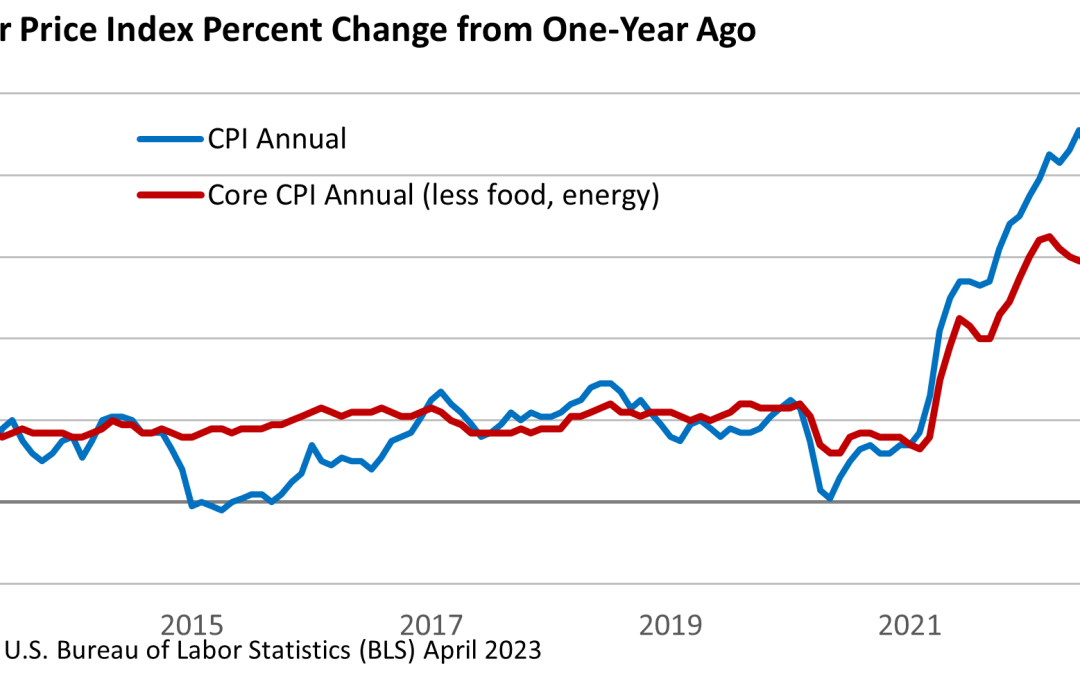

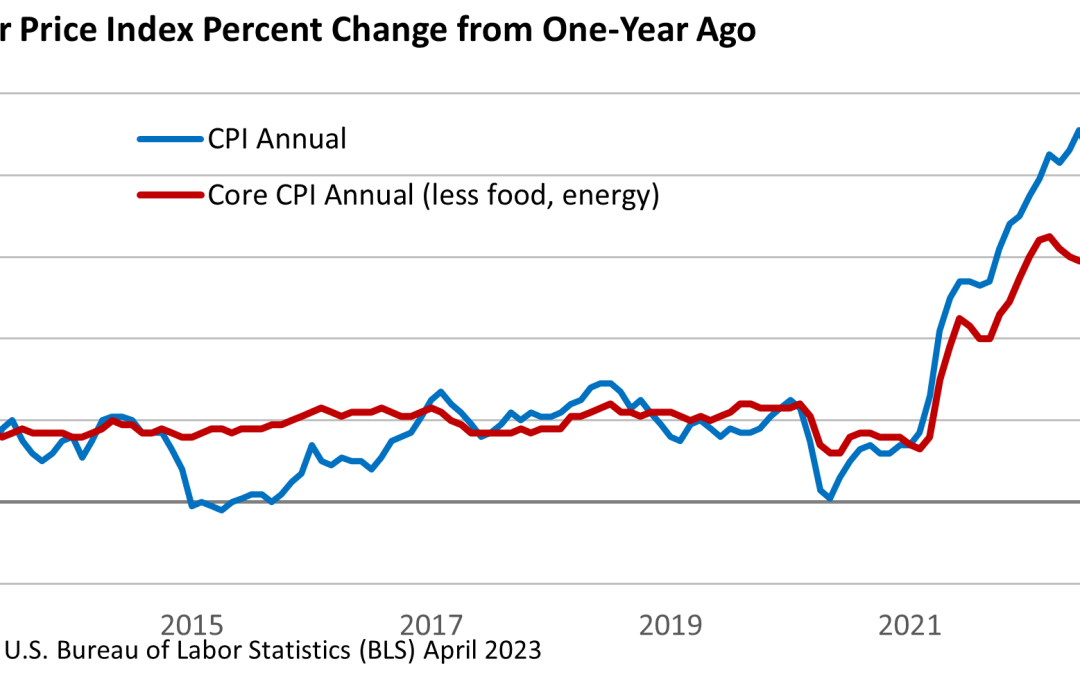

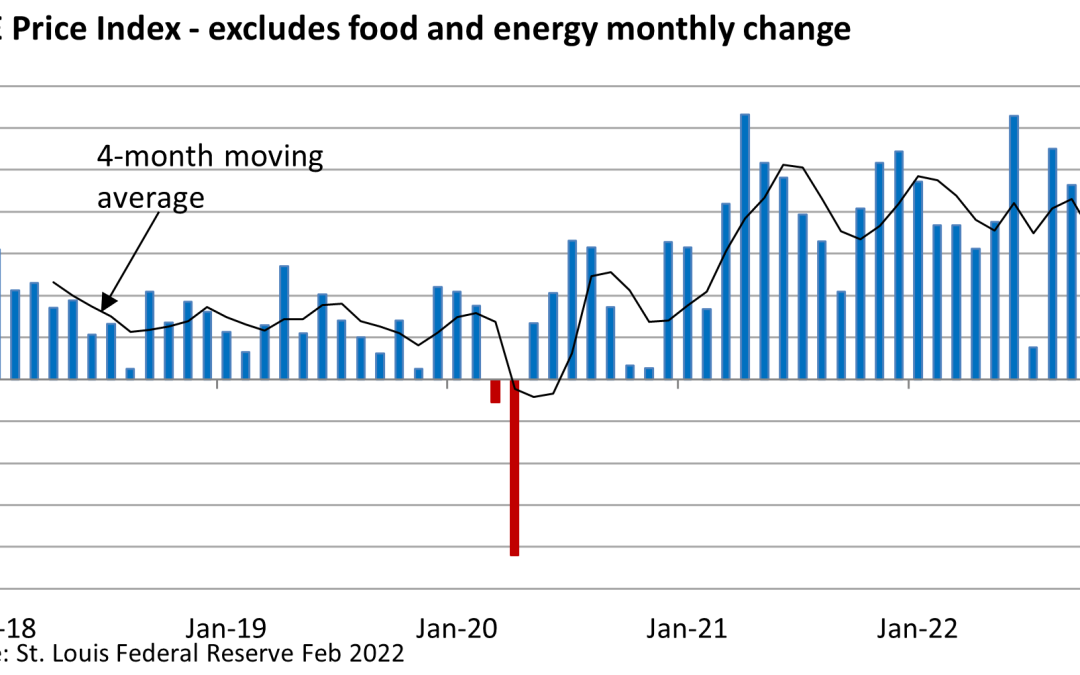

Weekly Market Commentary In the past, investors paid close attention to the monthly employment report. Today the focus has shifted to the CPI. Blame high inflation for the jump in interest rates, which has pressured the major stock market averages. The U.S. Bureau of...

by Mark Chandik | Apr 26, 2023

Weekly Market Commentary Economic sentiment can shift on a dime. This year, terms like ‘soft landing (slowing growth, slowing inflation)’ and ‘hard landing (recession, slower inflation)’ have gotten the most play. Earlier in the year, a so-called ‘no-landing’ scenario...

by Mark Chandik | Apr 17, 2023

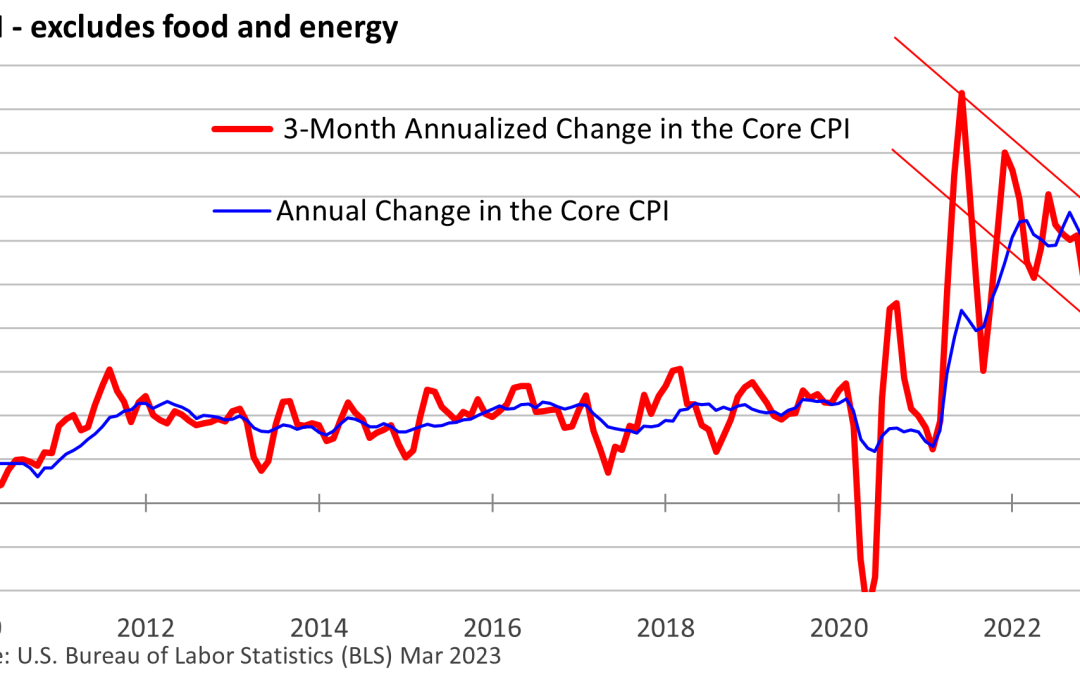

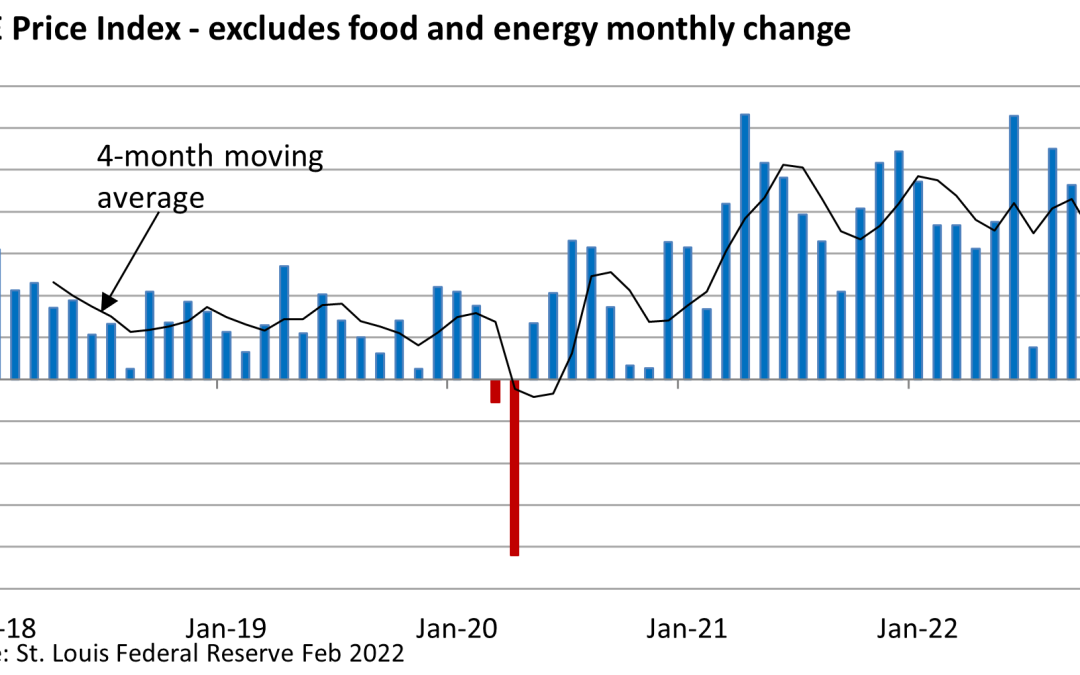

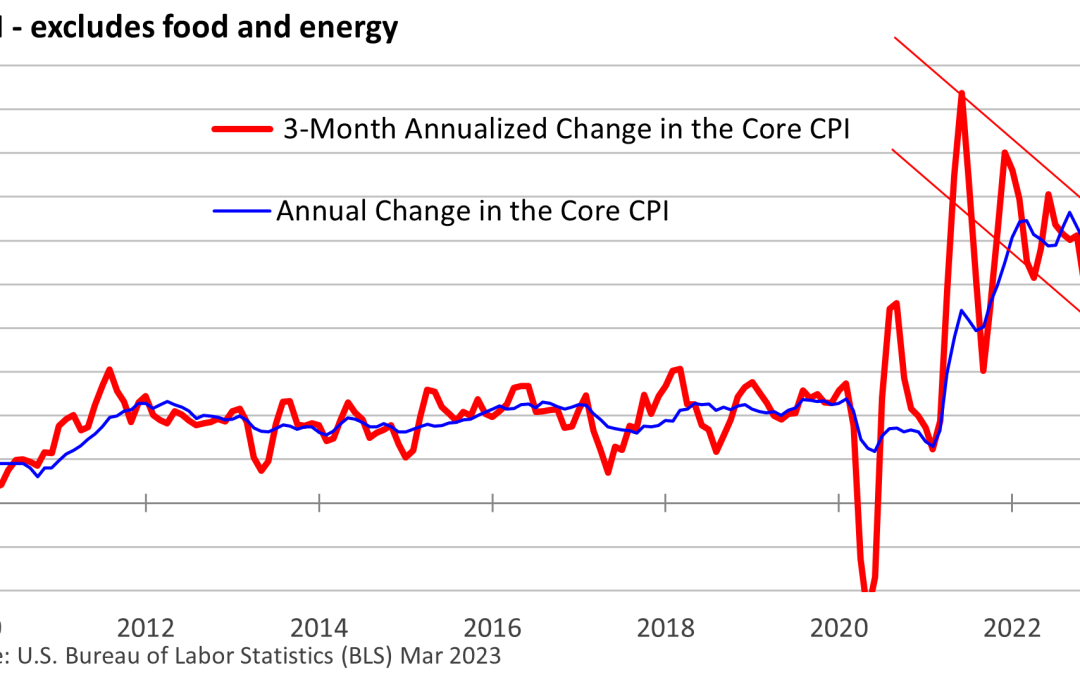

Weekly Market Commentary The slowdown in the rate of inflation last month was aided by food and energy prices. The Consumer Price Index rose 0.1% in March versus February amid a 3.5% decline in energy prices and no change in food prices (U.S. Bureau of Labor...

by Mark Chandik | Apr 4, 2023

Weekly Market Commentary Inflation was uppermost on the minds of investors, Fed officials, and policymakers until the failure of Silicon Valley Bank (SVB) forced price stability to play second fiddle to banking stability. The banking crisis has eased amid tentative...

by Mark Chandik | Mar 27, 2023

Weekly Market Commentary The Federal Reserve raised its key lending rate, the fed funds rate, by 25 basis points (bp, 1 bp = 0.01%) to a range of 4.75 – 5.00%, as most observers had expected. A few saw no change. Before the failure of Silicon Valley Bank (SVB), a...