Prosperity Partners Blog

Housing Prices Hit New Record

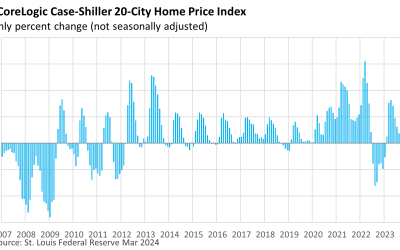

The price of a home hit a new record, according to the latest data on housing prices. The S&P CoreLogic Case-Shiller 20-City Home Price Index, which measures monthly housing prices in 20 major metropolitan areas, rose 1.6% on a nonseasonally adjusted basis in March.

Drifting Higher

Stocks have been drifting higher for several weeks as investors search for a catalyst that could drive shares in either direction. Interest rates can influence market direction, but there hasn’t been much news recently on the rate front.

How Do Investors Spell Relief?

Investors celebrated an ‘in line with expectations’ CPI that suggested the rate of inflation isn’t accelerating. It’s a small win, but it was enough to send the three major market indexes, the Dow, the Nasdaq, and the S&P 500 to new highs.

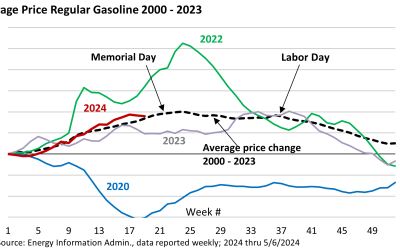

An Annual Ritual at the Gas Pump

You’re right if you have this nagging feeling that gas prices rise in the spring. As the graphic illustrates, on average prices rise through Memorial Day, plateau over the summer, and slip in the fall. This year is no exception, as prices echo the seasonal pattern.

Rate Cuts Still on the Table, Timing Less Certain

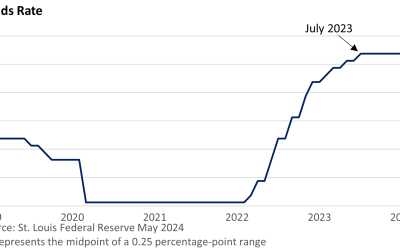

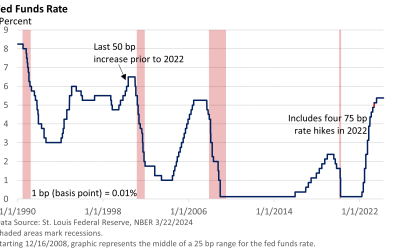

We often discuss the Federal Reserve and interest rates because both greatly impact investors. For starters, changes in interest rates have a significant impact on stock prices and income earned on savings. Sharply higher rates in 2022 pushed equities into a bear market.

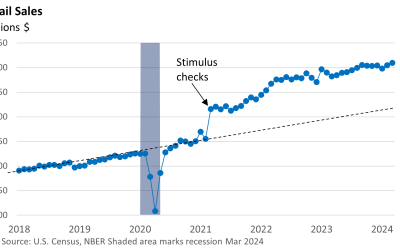

Just Do It

That ubiquitous phrase from one of America’s most extensive athletic footwear and apparel makers seems to have been adopted by most American shoppers. The U.S. Census Bureau reported last week that retail sales jumped 0.7% in March, following a strong 0.9% rise in February.

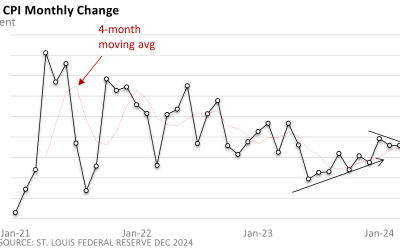

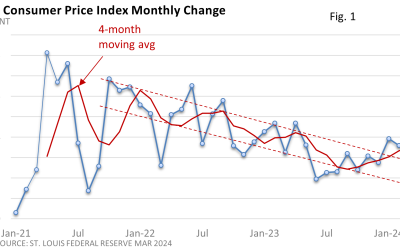

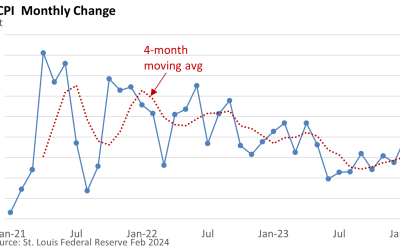

The Road to Lower Inflation Takes a Detour

The rate of inflation is accelerating. That’s not how we hoped to start this week’s Insights. Take a moment and review Figure 1. The 4-month moving average has broken out of its long-term downward trend (red-dashed lines). On a monthly basis, prices bottomed in June and began to gradually turn higher. The upward trajectory picked up in January.

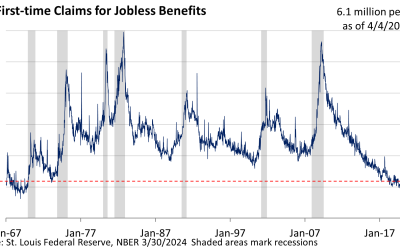

No Matter How You Slice It and Dice It…

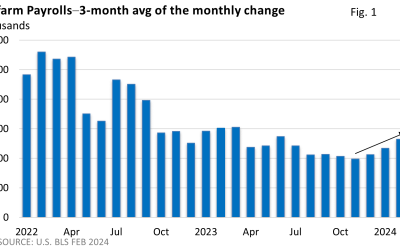

The latest employment numbers from the U.S. Bureau of Labor Statistics (BLS) point to a robust job market. On Friday, the U.S. BLS reported that nonfarm payrolls rose 303,000 in March, well ahead of expectations. It’s not simply March; growth has been above 250,000 for four months running.

Last Year’s Rally Spills into 2024

Stocks turned in a surprisingly strong 2023, and momentum has yet to slow in 2024 as last year’s rally remains in high gear. According to Dow Jones Market Data published by MarketWatch, the S&P 500 Index set 22 all-time closing highs this year. Likewise, the Dow notched 17 closing records, and the Nasdaq Composite recorded four new closing highs.

The Fed – Dovish as She Goes

The Federal Reserve held its benchmark rate, the fed funds rate, at 5.25 – 5.50% last week. That wasn’t a surprise. Let’s look at three important takeaways from the meeting that drove the Dow, the S&P 500 Index, and the Nasdaq to new closing highs on Wednesday and Thursday (MarketWatch data).

Are We There Yet

The road to price stability has been long and arduous. Inflation doesn’t just impact investors. It impacts everyone, from shoppers to travelers to those on a fixed income. February’s Consumer Price Index (CPI) marks the second straight month of stronger-than-expected inflation.

A Clear as Mud Jobs Report

On Friday, the U.S. Bureau of Labor Statistics (BLS) reported that employers added 275,000 net new jobs in February. The hiring boom continues, right? Well, it’s not quite that simple. Let’s dive in. January’s red-hot increase of 353,000 was revised lower to a still-strong 229,000. But that’s an unusually large downward revision.