Prosperity Partners Blog

Softer Inflation Raises Odds the Fed is Done

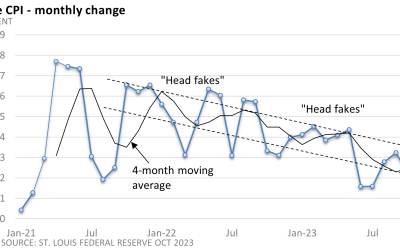

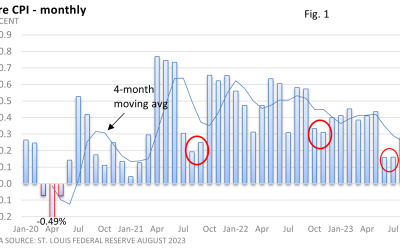

The U.S. Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) was unchanged in October from the prior month. It is up 3.2% from a year ago. Excluding volatile food and energy prices, the core CPI rose 0.2%. The core CPI is up 4% compared to one year ago, which represents the smallest increase since September 2021.

Signs of Softening

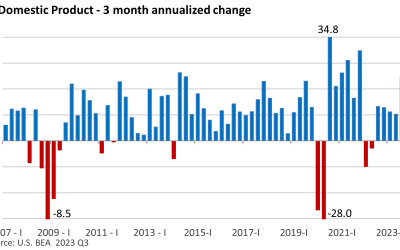

U.S. economic growth in the third quarter accelerated sharply, growing at an annual pace of 4.9%, according to last month’s report by the U.S. Bureau of Economic Analysis. But GDP (Gross Domestic Product) data are backward-looking. It’s a snapshot from July through September. We’re well into November.

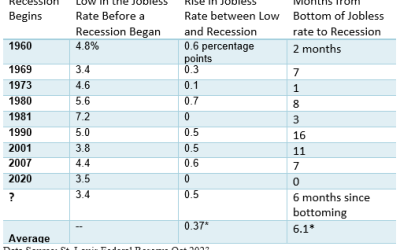

Soft Landing or Recession

So far this year, forecasts for a recession or a soft landing have failed to materialize. What is a soft landing? Economic growth slows, the rate of inflation slows, but the economy stays out of a recession. In other words, the economy is not too hot or too cold.

Breakneck Speed

The U.S. Bureau of Economic Analysis (BEA) reported last week that Gross Domestic Product (GDP), which is the largest measure of goods and services for the economy, expanded at an annual pace of 4.9% in the third quarter.

Disconnect

I recognize we’re getting a bit granular reviewing just one week of market action, but quickly, last week’s volatility was tied primarily to worries about rising bond yields amid a continued stream of strong economic data, not what’s happening in the Middle East.

Quantifying a Short Attack

When political or geopolitical events surface that may influence markets, analysts look at that event or events through a narrow prism—how might it affect investors? These might include an election, a debt-ceiling debate, a government shutdown, or something overseas.

A Hotter-for-Longer Economy

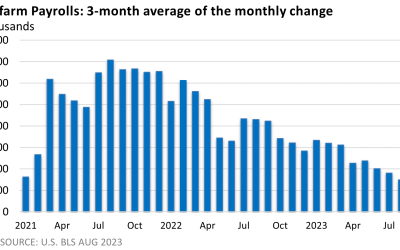

September recorded an increase of 336,000 in payrolls, easily topping the estimate of 170,000, according to Dow Jones Newswires. The unemployment rate held steady at 3.8%. It is the latest economic report that is signaling economic momentum, as the data has defied economists’ forecasts of a slowdown led by rising interest rates and inflation.

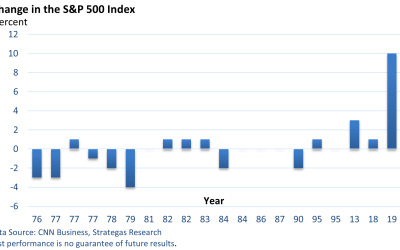

Government Shutdowns and Stock Market Performance

Government shutdowns make for good political drama. Nonessential workers are furloughed, travel plans to national parks could be interrupted, and some services are limited. A shutdown also increases investor anxiety.

But should sentiment take a beating? Historically, the short answer has been no.

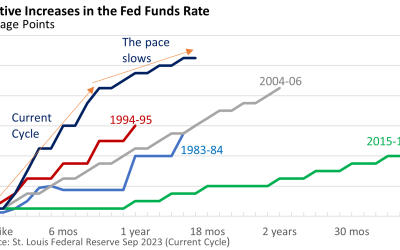

Higher for Longer and Longer… and Maybe Longer

The Federal Reserve surprised virtually no one when Fed officials unanimously voted to keep the fed funds rate unchanged at 5.25 – 5.50% on Wednesday. While it is the second time the Fed has punted on a rate hike this year (the last time was June), official Federal Reserve Economic Projections (released quarterly and updated last week) still suggest we may get one more increase this year, possibly in early November or in December.

A Tricky Inflation Number

Progress on inflation won’t be in a straight line. That’s to be expected. Following two low readings in June and July, the number picked up in August. It wasn’t unusually concerning. But following a 0.2% monthly increase in the Consumer Price Index (CPI) in June and July, the CPI rose 0.6% in August, as gasoline prices surged 10.6%, according to the U.S. Bureau of Labor Statistics.

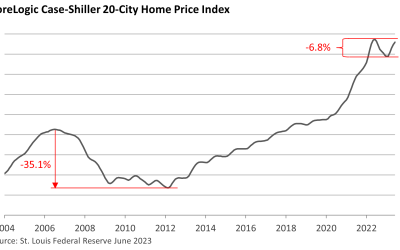

Rebounding Home Prices

Mortgage rates soared last year, rising from nearly 3% for a 30-year fixed-rate mortgage to as high as 7.08%, according to Freddie Mac’s weekly mortgage survey. Predictably, housing sales fell sharply last year, and there were plenty of forecasts predicting a significant drop in home prices.

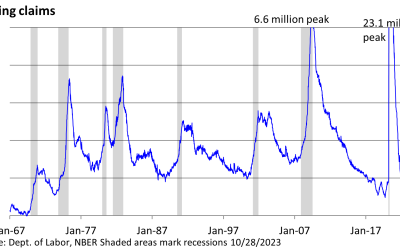

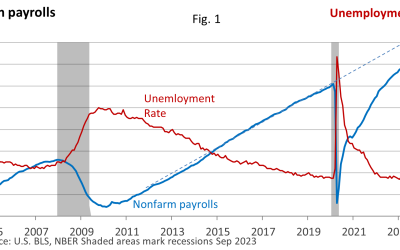

Job Gains, Rising Unemployment Rate

It sounds like a contradiction. Jobs increased last month, but the unemployment rate also rose. What happened? Nonfarm payrolls rose by 187,000 in August, according to the U.S. Bureau of Labor Statistics (BLS), while the unemployment rate rose to a still-low 3.8% in August from 3.5% in July.